Do you need help spotting when a stock might bounce? It might be time to learn candlestick reversal patterns.

It’s an indicator that can give you a hint as to when a trend might be reversing direction. The patterns aren’t an exact science, but they can be a useful tool to add to your trading arsenal.

You can use these patterns and indicators to find better entries and exits for your trades.

So, let’s go over what a candlestick reversal pattern is and some examples you can use in your trading. Let’s do this!

Table of Contents

- 1 What’s a Candlestick Reversal Pattern?

- 2 What Does a Candlestick Reversal Pattern Look Like?

- 3 Do Candlestick Patterns Work?

- 4 Types of Candlestick Patterns

- 5 Which Candlestick Pattern Is Most Reliable?

- 6 Candlestick Pattern Indicators

- 7 5 Candlestick Reversal Pattern Examples

- 8 How Can You Predict Candlestick Movement?

- 9 Conclusion: Candlestick Reversal Patterns

What’s a Candlestick Reversal Pattern?

A candlestick reversal pattern is a series of one to three candlesticks in a specific order.

They can indicate that the stock may change — or reverse — direction. You can find candlestick reversal patterns on daily, weekly, monthly, or intraday charts.

What Does a Candlestick Reversal Pattern Look Like?

There are a few different candlestick patterns. They all look slightly different. But they’re all made up of patterns of candlesticks.

The patterns are higher-odds setups when they appear at the top of a longer-term uptrend or at the bottom of a long-term downtrend.

We’ll get into what to look for in each pattern later — read on to learn more.

How Do You Read Stock Reversal Candlestick Patterns?

There’s no shortcut or easy answer for how to read stock charts and candlestick patterns.

It takes time, a lot of studying, and practice watching charts in real time. Then you have to repeat it, over and over. It never ends, either…

The market is always changing, and traders have to constantly adapt.

After you’ve studied enough charts, you’ll have to work on your execution to take advantage of these patterns.

You’ll have an idea of what to look for and how to read the patterns once we go over some examples later on…

Remember, trading’s a marathon, not a sprint. Give yourself time to learn the nuances of the market. There’s not one magical pattern that will make you profitable every trade.

I’ve been trading the market for over 20 years, and I’m still only profitable roughly 76% of the time.* So don’t think there’s a silver bullet pattern that’s gonna make you rich quick.

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade, and individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

You need the right mindset to focus on the process. Trading can be a great career, but you won’t get there overnight. Stop focusing on the money and focus on your education instead.

Kick off your education with my comprehensive DVD guide, “How to Make Millions.” It’s 35 hours of educational content, and all proceeds from the sale of this DVD go to charity.

When you’re ready to take your education to the next level, and if you’re truly dedicated, apply for my Trading Challenge.

Do Candlestick Patterns Work?

It’s believed candlesticks originated in the 1700s, when Japanese rice traders used them to track the rice market.

They’re not as reliable as they used to be. Hedge funds and money managers, with huge amounts of capital, can use algorithms to trade against retail traders trying to take advantage of these predictable patterns.

That’s why I love my penny stock niche. Penny stock patterns repeat because there are no hedge funds or algorithms trading them. I don’t have to compete against the big Wall Street money. Just uneducated “investors” who buy these junk companies because they believe in the products or technology.

There are still some candlestick patterns that can indicate a change in trend. But if the pattern doesn’t work, remember to cut losses quickly. That’s rule #1 for a reason.

Types of Candlestick Patterns

There are continuation patterns that indicate a trend will continue. Then you have consolidation patterns, where a stock trades sideways without a specific direction. And reversal patterns indicate a trend may change direction.

In this post, I’m focusing on candlestick reversal patterns. For a full overview of candlestick charts and patterns, check out this post.

And for more lessons to build your trading knowledge, get in my 30-Day Bootcamp. It’s a month’s worth of lessons with daily videos and homework. And you can work at your own pace and repeat it as many times as you need to. Bonus: It comes with “The Complete Penny Stock Course” book and my “Pennystocking Framework” DVD.

Now, as far as reversal patterns go, they’re either bullish or bearish. Let’s look at the difference…

Bullish Candlestick Patterns

A bullish candlestick reversal pattern is a series of candlesticks that appears at the bottom of a bearish trend. It indicates a shift in momentum, and the stock may change direction.

Ideally, you want to see high volume and a confirmation candle in the direction of the new trend.

More Breaking News

- QuantumScape Takes a Big Leap with New Battery Line

- Ondas Leverages Strategic Gains in Defense Sector Expansion

- Under Armour Faces Data Breach Affecting 72 Million Customers

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

Bearish Candlestick Patterns

A bearish candlestick reversal pattern will appear at the top of a bullish uptrend. It means the uptrend may be over and the stock could reverse to the downside.

With a bearish reversal, you’ll also want to see a second confirmation candle to the downside after the pattern forms.

Which Candlestick Pattern Is Most Reliable?

Students always want to know: what are the best candlestick patterns?

There’s no one right answer to this…

There are countless candlestick patterns in the market. You could ask thousands of successful traders what their favorite patterns are and they’d probably each give you a different answer.

I have my own favorite patterns like the morning panic dip buy. There are also breakouts, supernovas, and the “gap and crap” reversal. These penny stock patterns work for me and many of my students.

But they might not work for you.

That’s why I put out so many educational resources, from no-cost, to low-cost and more, like my Supernova Alerts, the “Volatility Survival Guide,” and my weekly watchlist.

I provide all these tools to help you, but you have to take advantage of them. Learn as much as you can, then determine which patterns make the most sense to you.

Candlestick Pattern Indicators

Candlestick patterns can give traders an indication of when to enter or exit a position. Or they can indicate when a stock might continue its trend or trade sideways until there’s a clear direction.

If you can recognize a reversal pattern at the bottom of a downtrend, you could take an entry after a confirmation candle.

If you see a reversal pattern and confirmation after a long-term uptrend, it could mean it’s time to exit your long position. You could also short sell the stock and take advantage of the downside. But I don’t recommend shorting for new traders. It’s a high-risk strategy.

5 Candlestick Reversal Pattern Examples

Candlestick reversal patterns work best after an extended uptrend or downtrend. In a choppy market, they don’t offer the same odds.

Remember to trade these patterns in the time frame of the chart you’re looking at (daily, intraday, etc.). And if the pattern does create a trend reversal, remember to take profits when you have them. Remember, small gains add up over time.

Let’s look at five of the most common candlestick reversal patterns that can signal a trend change…

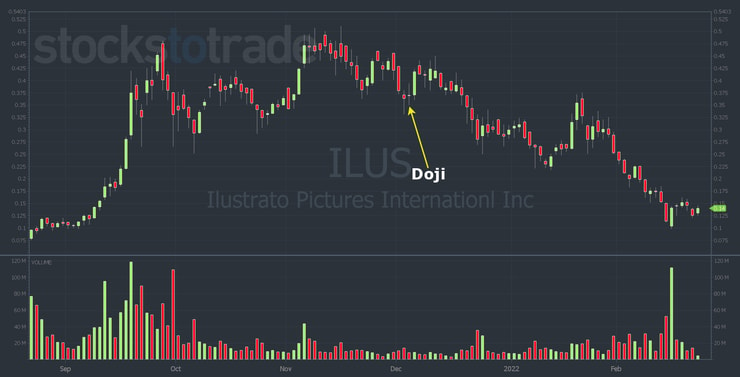

Doji

A Doji candle is a candle with an open and closing price that’s the same or very close, with wicks on the top and bottom of the candle.

Since candlesticks are a depiction of investor sentiment, a Doji candle represents indecision or a battle between buyers and sellers. A Doji candle means that the price fluctuated throughout the day (or timeframe of the candle) and then ended up at the same price where it opened.

Usually, the candle following a Doji signals the direction of the next trend.

Abandoned Baby

An abandoned baby pattern is a series of three candlesticks with a Doji as the second candle. Specifically, there is a gap between the Doji and the other two candles. Hence, the Doji is ‘abandoned.’

An abandoned baby candlestick pattern can be either bullish or bearish. The VTI chart above shows several examples of Doji candles including an abandoned baby bottom, a bullish reversal pattern.

It happens when there’s a downtrend that ends with a gap down. But instead of more sellers and continued downside, the following candle is a Doji. The third candle completes the pattern. It’s a gap back up with a big green candle. It signals the start of the reversal to the upside.

The Doji candle at the bottom of the pattern is the abandoned baby.

Evening Star

An evening star is a bearish reversal pattern. It appears at the top of an uptrend. There are three candlesticks in this pattern.

It appears as one large green candle as part of the uptrend, then a small-bodied candle referred to as the star. The third candle is a large red candle confirming the star was a top. It signals that the uptrend is over and the sellers and short-sellers have taken over.

Engulfing Patterns

An engulfing pattern is a pattern of two candlesticks and can be a bullish or bearish candlestick pattern. If it appears at the top of a trend, it signals the start of a bearish trend. And if it’s at the bottom of a downtrend, it signals a reversal to the upside.

The pattern is made up of one small candle, followed by a taller candle that “engulfs” the smaller candle’s body within the body of the larger candle. The wick length doesn’t matter in this pattern.

At the end of an uptrend, the pattern would look like a small green candle followed by a large red candle that engulfs the previous green candle body within the body of the larger candle.

At the end of a downtrend, you see a smaller red candle followed by a tall green candle that engulfs the body of the previous candle.

Engulfing patterns can happen anywhere in a chart, but they’re more meaningful after an extended uptrend or downtrend.

The Hammer

The hammer candlestick is another bullish reversal pattern and often a good signal that a downtrend is over. The candle is shaped … you guessed it … like a hammer. It’s a candle with a long wick on the bottom and a small body at the top.

The long wick means the price went down, then buyers came in and brought it back up.

After a hammer candle, you’ll want to see another candle as confirmation to the upside with high volume.

For more candlestick chart patterns and information on how to trade them, get a copy of Steve Nison’s book, “Japanese Candlestick Charting Techniques.”

(As an Amazon affiliate, we may profit if you make a purchase.)

How Can You Predict Candlestick Movement?

Candlestick charts are a visual depiction of investor and trader sentiment.

Patterns repeat because the candles are formed by the actions of buyers and sellers. As they say, the market doesn’t change because human nature doesn’t change.

I like to say history doesn’t repeat itself, but it often rhymes. So no pattern will ever play out exactly the same. Each one’s unique based on the stock, the float, the volume, and the buyers and sellers participating in the move.

That said, I never try to predict the market. I always react and wait for confirmation. There’s no pattern that works 100% of the time…

Conclusion: Candlestick Reversal Patterns

Now that you have this information, are you ready to start trading candlestick reversal patterns? Only if you’ve studied…

I never recommend new traders rush into trading. Focus first on your education, and never stop learning.

Develop your process. Find a repeatable pattern that you can build a strategy around. Then work on developing the discipline to stick to your setups and trading plans.

I help new students develop these habits in my Trading Challenge. I don’t give hot stock picks, and I don’t want students following my trade alerts. So if that’s what you’re about, don’t apply.

I don’t have time for lazy students who don’t want to put in the work. But if you’re ready to focus on your education and learn the skills that have helped my students and I find our own way in the market … apply for the Trading Challenge today.

Do you trade candlestick reversal patterns? Let me know in the comments … I love to hear from my readers!

Leave a reply