During the hot market of 2020/2021, Jack Kellogg pushed it harder than any trader I know. Now he’s up to $12 million in career earnings at just 24 years old… But his story has humble beginnings.

Read this Business Insider article to learn about Jack Kellogg’s 4 favorite indicators here.

Jack joined my Trading Challenge in 2017, when he was just out of high school.

When family and friends put him down for dreaming, Jack kept studying. He knew what was possible and was determined to stick with it. Early on he almost gave up after taking a loss when holding overnight to avoid a day trade. To get over the PDT, Jack saved money from his valet job.

This infographic tells Jack’s story…

Table of Contents

Background

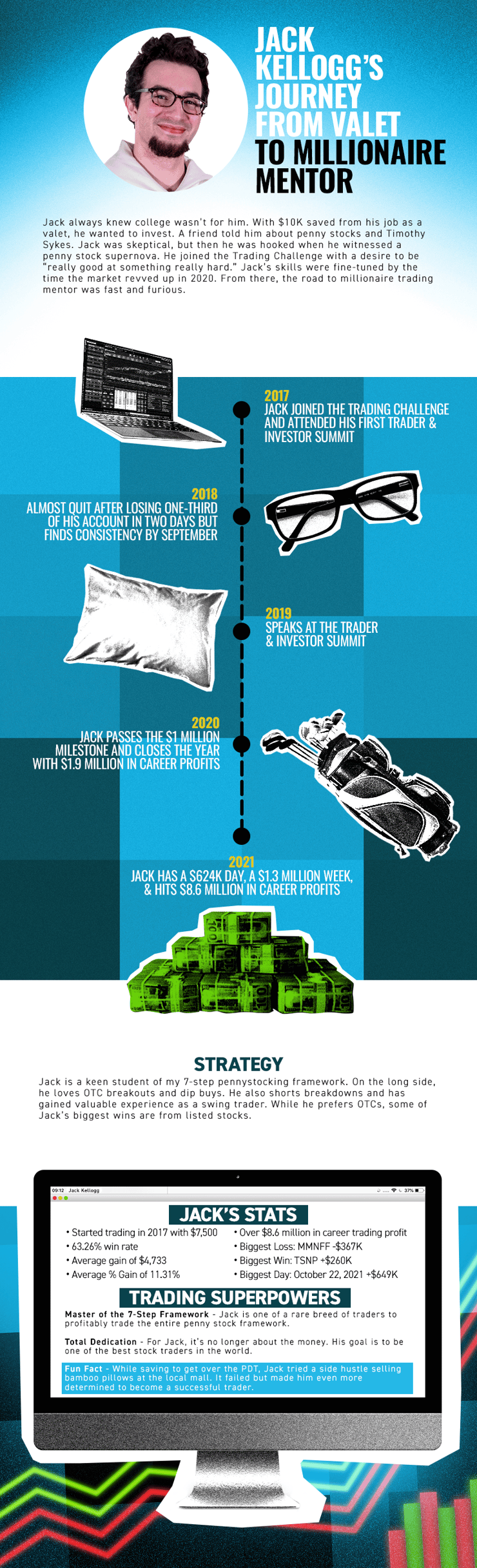

Jack always knew college wasn’t for him. With $10K saved from his job as a valet, he wanted to invest. A friend told him about penny stocks and Timothy Sykes. Jack was skeptical, but then he was hooked when he witnessed a penny stock supernova. He joined the Trading Challenge with a desire to be “really good at something really hard.” Jack’s skills were fine-tuned by the time the market revved up in 2020. From there, the road to millionaire trading mentor was fast and furious.

Timeline

2017: Jack joined the Trading Challenge and attended his first Trader & Investor Summit

2018: Almost quit after losing one-third of his account in two days but finds consistency by September

2019: Speaks at the Trader & Investor Summit after sizing up and hitting $100K

2020: Jack passes the $1 million milestone and closes the year with $1.9 million in career profits

2021: Jack has a $624K day, a $1.3 million week, and hits $8.6 million in career profits

2022: While the overall market was down, Jack added $1.7 million to his overall tally

More Breaking News

- BigBear.ai Expands Partnerships and Strengthens Financial Position

- Vale S.A. Stock Soars as Goldman Sachs Raises Price Target

- Red Cat Holdings Poised for Growth as Drone Orders Surge

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

2023: Through 11 months, Jack has made $1.9 million in 2023 — on track to become my highest earning student ever!

Strategy

Jack is a keen student of my 7-step pennystocking framework. On the long side, he loves OTC breakouts and dip buys. He also shorts breakdowns and has gained valuable experience as a swing trader. While he prefers OTCs, some of Jack’s biggest wins are from listed stocks.

Jack’s Stats

- Started trading in 2017 with $7,500

- 58.68% win rate

- Average gain of $6,747

- Average % Gain of 10.66%

- Over $12.4 million in career trading profit

- Biggest Loss: MMNFF -$367K

- Biggest Win: TSNP +$260K

- Biggest Day: October 22, 2021 +$649K

Trading Superpowers

Master of the 7-Step Framework. Jack is one of a rare breed of traders to profitably trade the entire penny stock framework.

Total Dedication. For Jack, it’s no longer about the money. His goal is to be one of the best stock traders in the world.

Fun Fact: While saving to get over the PDT, Jack tried a side hustle selling bamboo pillows at the local mall. It failed but made him even more determined to become a successful trader.

Learn From Jack

See Jack’s Profit.ly stats here, including his biggest loss (MMNFF -$367K) and his biggest win (TSNP +$260K). Now, check out all the amazing ways you can learn with Jack.

- Tim Sykes’ Trading Challenge — Where Jack learned his trading skills

- Confessions of a Valet Turned Millionaire Day Trader Part 1 of 4 (Also watch Part 2, Part 3, and Part 4)

- T.W.I.S.T. podcast

What do you think of Jack’s journey? Comment below and give Jack the props he deserves!

Leave a reply