In the world of trading, a pump-and-dump stock is like a mirage in the desert. It’s a stock from a small-cap or microcap company that promoters manipulate to create an illusion of value and potential. Promoters “pump” the stock, inflating its price through a flurry of positive publicity and hype. Once the stock price is artificially inflated, they “dump” their shares, selling them off at the elevated prices. When the dust settles, the stock price plummets, leaving unsuspecting investors holding the bag. This practice is not only unethical but also illegal, and it’s a form of securities fraud.

A pump-and-dump stock is a security, typically from a microcap company, that is subject to a large-scale marketing campaign designed to artificially inflate its price and trading volume. The promoters behind the scheme will then sell their shares at the inflated prices and cease all promotion. The stock price inevitably falls, leaving unsuspecting investors and traders with significant losses. This practice is illegal and is a form of securities fraud.

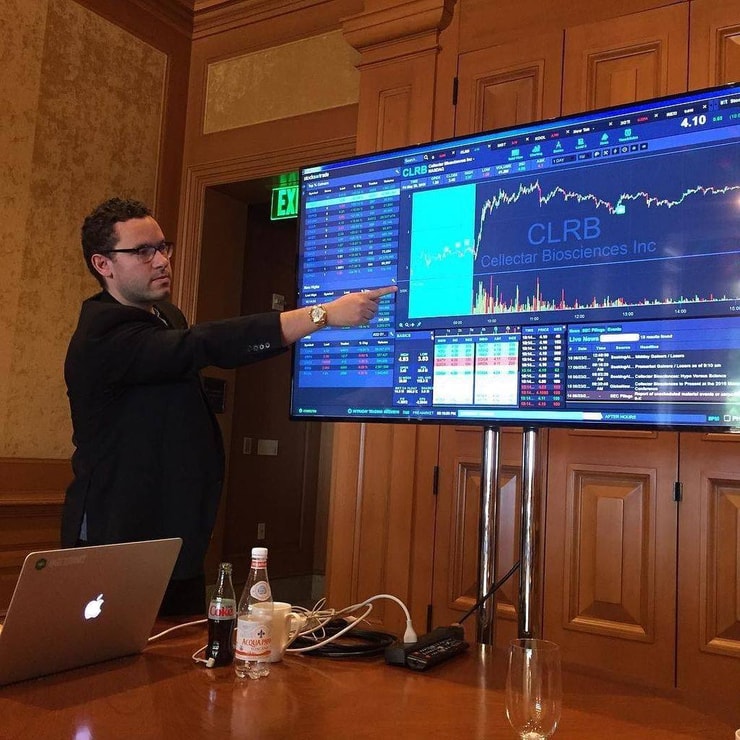

Penny stock pumps are what brought me into trading in the first place! When I started trading, fraudsters used boiler room transactions to get out their messages — the standards of pump-and-dump recommendations were a LOT less advanced than they are today…

So I shorted them on the way to my first million. Now it isn’t so easy — but I still trade pumps for profits.

I'll keep buying these pumps all the way up, the higher the better, just know it'll be ugly when the pumps crash/get halted & newbies will blindly go down with the ship. Don't mention fundamentals with me, no pump has them and if you think so, then you're brainwashed by promoters

— Timothy Sykes (@timothysykes) February 15, 2021

Read on to learn how to spot pumps, and more importantly — trade them!

Table of Contents

Definition of Pump and Dump Stocks

Pump-and-dump stocks are the Wall Street equivalent of a con artist’s sleight of hand. They’re all about illusion, misdirection, and the art of the scam.

The scheme involves inflating the price of a stock (the “pump”) and then selling off shares once the price has risen due to the hype (the “dump”). The result? The promoters make a profit, while the unsuspecting investors are left holding worthless shares.

Stocks with breaking news often experience sudden price movements, which can be a double-edged sword. It’s essential to differentiate between legitimate news and artificially created hype. To understand how news impacts stock prices, read this article.

Overview of the Practice

The practice of pump-and-dump is as old as the stock market itself. It’s a game of smoke and mirrors, where the only winners are the ones pulling the strings. The promoters create a sense of urgency and excitement about a particular stock, causing a surge in demand and a sharp rise in price.

Once the price is inflated, they sell off their shares, causing the price to plummet and leaving the investors in a lurch.

History of Pump and Dump Schemes

Pump-and-dump schemes have been around since the early days of the stock market. In the United States, they gained notoriety during the Roaring Twenties, a time of rampant speculation and loose securities regulations.

Despite numerous crackdowns and sanctions over the years, these schemes continue to persist, evolving with the times and exploiting the latest technologies.

Types of Pump and Dump Stocks

Pump-and-dump schemes can target various types of stocks, but they’re particularly common in the realm of penny stocks, microcap stocks, and small-cap stocks.

Penny Stocks

Penny stocks are a favorite tool of pump-and-dump schemers. These are stocks that trade for less than $5 per share, often on over-the-counter (OTC) markets. Due to their low price and lack of liquidity, they are particularly susceptible to price manipulation.

Microcap Stocks

Microcap stocks, companies with a market capitalization under $300 million, are another common target. These stocks often lack the transparency and regulatory oversight of larger firms, making them an ideal playground for promoters.

Small-Cap Stocks

Small-cap stocks, while less common targets than penny or microcap stocks, can still fall prey to pump-and-dump schemes. These are companies with a market capitalization between $300 million and $2 billion. While they typically have more oversight than microcap stocks, they can still be manipulated under the right circumstances.

Potential Victims of Pump and Dump Schemes

Anyone can fall victim to a pump-and-dump scheme, but certain groups are more susceptible.

Unsuspecting Investors

Unsuspecting investors are the most common victims of pump-and-dump schemes. These buyers are often individuals who are new to investing or who are not familiar with the intricacies of the stock market. They may be lured in by promises of quick profits or “hot tips” from seemingly reliable sources.

Novice Investors

Novice investors, those who are relatively new to the world of investing, are also prime targets. They may lack the experience or knowledge to spot the red flags associated with pump-and-dump schemes, making them easy prey for promoters.

Majority Of Investors

In truth, the majority of investors can fall victim to pump-and-dump schemes. Even seasoned investors can be caught off guard if they let their guard down. The allure of quick profits can be a powerful motivator, causing even the most rational investors to throw caution to the wind.

How The Scheme Works

Pump-and-dump schemes are a masterclass in manipulation. The promoters start by choosing a stock, often from a small-cap or microcap company. They then begin a large-scale promotional campaign, spreading positive news and rumors about the company to generate interest and excitement. This can involve everything from email blasts and social media posts to cold calls. As investors start buying the stock, the increased demand leads to a rise in the stock’s price.

Once the stock price is sufficiently inflated, the promoters sell off their shares at elevated prices. The sudden sell-off leads to a sharp drop in the stock’s price, leaving the other investors with significant losses.

Hot stocks can sometimes result from pump and dump schemes. These are stocks that have gained significant attention and have a high trading volume. However, not all hot stocks are part of a scheme. Some genuinely have strong fundamentals or positive news driving their price. Learn more about hot stocks and how to differentiate them.

Cold Calling Strategies Used By Stock Promoters

Stock promoters play a crucial role in pump-and-dump schemes. They may use cold calling strategies to reach potential investors, spinning tales of a “once-in-a-lifetime” investment opportunity. These promoters are skilled at creating a sense of urgency, pressuring investors to buy before they have a chance to do their due diligence.

Fake News Releases And Social Media Posts

In the digital age, fake news releases and social media posts have become a popular tool for pump-and-dump schemers. They can spread false or misleading information about a company at lightning speed, creating a buzz that can inflate a stock’s price in no time. The anonymity of the internet provides a perfect cover for these promoters.

Investment Pitches To Investors

Investment pitches are another common tactic. These can take many forms, from slick presentations to persuasive emails. The goal is always the same: to convince investors to buy shares, thereby driving up the price. Once the price has been inflated, the promoters sell off their shares, leaving the investors with a worthless investment.

Avoiding Pump-and-Dump Schemes

Avoiding pump-and-dump schemes involves a combination of vigilance, skepticism, and due diligence. Be wary of unsolicited investment offers, especially those that promise quick profits. Look out for red flags, such as a sudden spike in a stock’s price or trading volume. Always do your homework before investing.

Research the company name — even its employees’ Linkedin! Check its financials, reviews, and the services it provides, and understand its business model. Stick to stocks that are listed on major exchanges, as they are subject to more stringent reporting requirements. Consider seeking the advice of a financial advisor or broker, but ensure they are reputable and have a clean record with regulatory bodies.

Penny stocks are often targets for pump and dump schemes due to their low market price and lesser regulatory oversight. However, with the right knowledge and strategy, trading penny stocks can be profitable. It’s crucial to understand the risks and learn how to spot potential red flags.

To get a better understanding of penny stocks, check out this comprehensive guide on penny stocks.

If you suspect a pump-and-dump scheme, report it to the Securities and Exchange Commission (SEC). Your information could help stop a potential scam and protect other investors.

Be Extremely Wary of Unsolicited Investment Offers

One of the best ways to avoid falling victim to a pump-and-dump scheme is to be extremely wary of unsolicited investment offers. If someone you don’t know is pushing a stock on you, take a step back and do your homework before investing.

Look Out for Obvious Red Flags

There are several red flags that can signal a potential pump-and-dump scheme. These include a sudden spike in a stock’s price or trading volume, aggressive promotional tactics, and a lack of reliable information about the company. If something seems too good to be true, it probably is.

Look Out for Affinity Fraud

Affinity fraud is a type of investment scam where the promoters target members of a specific group, such as a religious community or ethnic group. They exploit the trust and camaraderie within these groups to perpetrate their schemes. Be cautious of investment opportunities that come through these channels.

Consider the Source of the Hype

Always consider the source of the hype. If the excitement around a stock is being driven by anonymous internet posts or unsolicited emails, be skeptical. Legitimate investment opportunities are typically based on a company’s underlying business and financial performance, not hype.

Do Your Homework Before You Invest

Before investing in any stock, do your homework. Research the company, check out its financial statements, and understand its business model. Don’t rely on tips or rumors. Make sure you’re making an informed decision based on solid information.

Be Cautious of “Hot Tips”

“Hot tips” are often anything but. They’re a common tool used by promoters to lure in unsuspecting investors. Be cautious of any investment advice that promises quick profits or comes from an unverified source. Remember, if it sounds too good to be true, it probably is.

How Do You Know If It’s a Pump and Dump?

Identifying a pump-and-dump can be tricky, especially for novice investors. However, there are a few telltale signs. A sudden, unexplained surge in a stock’s price or trading volume can be a red flag. So can aggressive promotional tactics or a lack of reliable information about the company. Remember, if something seems too good to be true, it probably is.

How Common are Pumps and Dumps?

Pump-and-dump schemes are more common than you might think. While it’s hard to put a precise number on it, the Securities and Exchange Commission (SEC) regularly issues warnings about these types of scams. They’re particularly prevalent in the world of penny stocks and microcap stocks, where lack of oversight and transparency make it easier for promoters to operate.

Why are Pump and Dump Strategies Bad?

Pump-and-dump strategies are bad for a number of reasons. First and foremost, they’re illegal. They involve manipulating a stock’s price to deceive investors, which is a clear violation of securities law. But beyond that, they’re also bad for the market as a whole. They undermine investor confidence and can lead to significant financial losses for those who fall victim to the scam.

Key Takeaways

Pump-and-dump schemes are a form of stock market fraud that involves inflating a stock’s price through false or misleading statements, then selling off the stock once the price has been pumped up. They’re illegal and can result in significant financial losses for investors. To avoid falling victim to these schemes, be wary of unsolicited investment offers, look out for red flags, and always do your homework before investing.

Pump-and-dumps aren’t the only danger in the market — they’re one of many topics you should learn as part of your trading education!

Trading isn’t rocket science. It’s a skill you build and work on like any other. Trading has changed my life, and I think this way of life should be open to more people…

I’ve built my Trading Challenge to pass on the things I had to learn for myself. It’s the kind of community that I wish I had when I was starting out. It has thousands of people in the same position as you: content to put in hard work in order to make money. This makes it a rare place in a world where instant gratification is the norm.

We don’t accept everyone. If you’re up for the challenge — I want to hear from you.

Apply to the Trading Challenge here.

Trading is a battlefield. The more knowledge you have, the better prepared you’ll be.

How do YOU avoid bad investments? Let me know in the comments — I love hearing from my readers!

Leave a reply