Mariana is a trailblazing Trading Challenge student. Not only is she my first female millionaire student, but also the youngest. She was just 20 years old when she passed seven figures in trading profits.

I’m so inspired by Mariana’s trading journey that I dedicated my 86th Karmagawa school to her:

⚠️NEW KARMAGAWA SCHOOL ALERT!⚠️I’m proud to announce the 86th Karmagawa school in honor of my 1st female millionaire student @mari_trades who has been in my https://t.co/occ8wKmlgm program for 3 years now and she crossed the $1 million trading profit mark just a few weeks ago! pic.twitter.com/RCEkzi2f4A

— Timothy Sykes (@timothysykes) May 28, 2021

She may be young, but Mariana’s success is no accident. Her story is the perfect illustration of ‘preparation meets opportunity’ — and the results are extraordinary.

Table of Contents

Mariana’s Guiding Principles

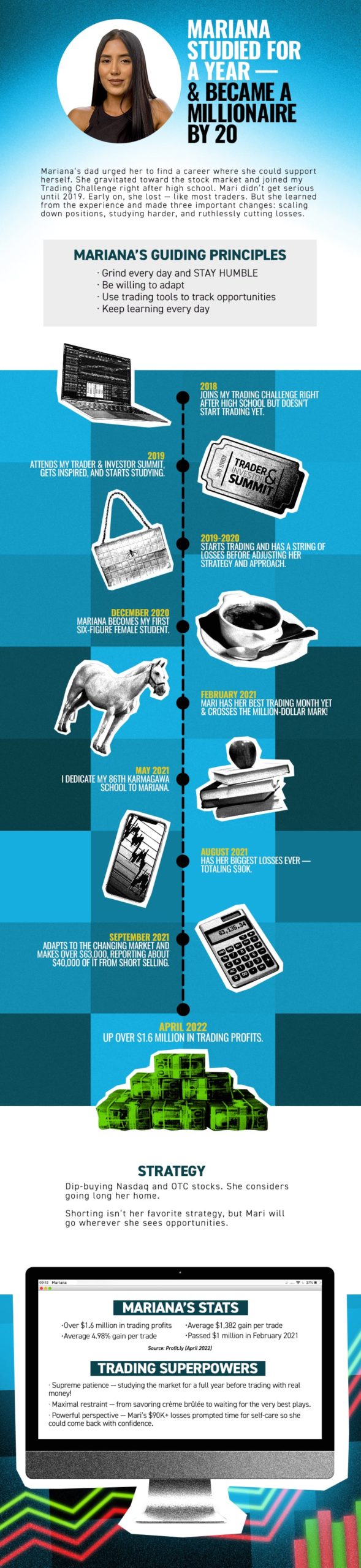

- Grind every day and STAY HUMBLE

- Be willing to adapt

- Use trading tools to track opportunities

- Keep learning every day

Background

Mariana’s dad urged her to find a career where she could support herself. She gravitated toward the stock market and joined my Trading Challenge right after high school. Mari didn’t get serious until 2019. Early on, she lost — like most traders. But she learned from the experience and made three important changes: scaling down positions, studying harder, and ruthlessly cutting losses.

Timeline

2018

Joins my Trading Challenge right after high school but doesn’t start trading yet.

2019

Attends my Trader & Investor Summit, gets inspired, and starts studying.

More Breaking News

- SoFi Technologies Stock Surges: Q4 Wins Spark Analyst Upgrades

- Vale’s Stock Soars Following Significant Price Target Increases

- Vizsla Silver Corp. Sees Stock Flux Amid Strategic Movements

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

2019–2020

Starts trading and has a string of losses before adjusting her strategy and approach.

December 2020

Mariana becomes my first six-figure female student.

February 2021

Mari has her best trading month yet and crosses the million-dollar mark!

May 2021

I dedicate my 86th Karmagawa school to Mariana.

August 2021

Has her biggest losses ever — totaling $90K.

September 2021

Adapts to the changing market and makes over $63,000, reporting about $40,000 of it from short selling.

April 2022

Up over $1.6 million in trading profits.

Go-To Strategies

- Dip-buying Nasdaq and OTC stocks. She considers going long her home.

- Shorting isn’t her favorite strategy, but Mari will go wherever she sees opportunities.

Stats

- Over $1.6 million in trading profits

- Average 4.98% gain per trade

- Average $1,382 gain per trade

- Passed $1 million in February 2021

Source: Profit.ly (April 2022)

Trading Superpowers

- Supreme patience — studying the market for a full year before trading with real money!

- Maximal restraint — from savoring crème brûlée to waiting for the very best plays.

- Powerful perspective — Mari’s $90K+ losses prompted time for self-care so she could come back with confidence.

See Mariana’s Chart + Learn More

- Check out Mariana’s Profit.ly chart

- Read more about Mariana’s trading story: My First 7-Figure Female Student! Mariana’s $1 Million Trading Milestone

- Get some crucial trading lessons: 7 Trading Lessons With Mariana, My Youngest Millionaire Student

- Learn how she bounced back from major losses: What Millionaire Trader Mariana Learned From Her Biggest Losses Ever — $90K!

Take Your Education Further!

- Learn from Mariana’s trades and watchlists in StocksToTrade’s Breakouts & Breakdowns chat room

- Mariana got her start in my Trading Challenge — check it out!

- Just getting started? Check out my 30-Day Bootcamp for new traders

What did you learn from Mariana’s story? What can you take to your own trading? Let me know in the comments!

Leave a reply