A trading journal is where you track your daily progress as a day trader. Typically, trading journal entries include details about your trades (or notes on why you didn’t trade), what you did, and your overall results. Some traders use a note-taking app, others use Excel or Google Docs as their trading journal of preference.

Trading is a battlefield. Are you ready to fight for your account? A trading journal is one of the weapons that can help you stay alive in the trading game — and hopefully, thrive.

We’re not talking “dear diary” here. A trading journal contains data that you can analyze and use to keep improving.

Here’s everything you need to know about trading journals, including what they are, why they matter, and how to create an effective one.

Table of Contents

- 1 What’s a Trading Journal?

- 2 Benefits of a Stock Trading Journal

- 3 4 Top Trading Journal Tools

- 4 How to Create an Efficient Stock Trading Journal

- 5 Example of a Trading Journal Spreadsheet

- 6 Tips for a Successful Trading Journal

- 7 The Bottom Line

What’s a Trading Journal?

2025 Millionaire Media, LLCA trading journal (aka trading diary) is where you track your daily progress as a day trader. Typically, entries will include details about your trades (or notes on why you didn’t trade), what you did, and your overall results.

There’s more than one way to track your trading data. Some traders use a note-taking app, others use Excel or Google Docs. Some use a specific trading-related program.

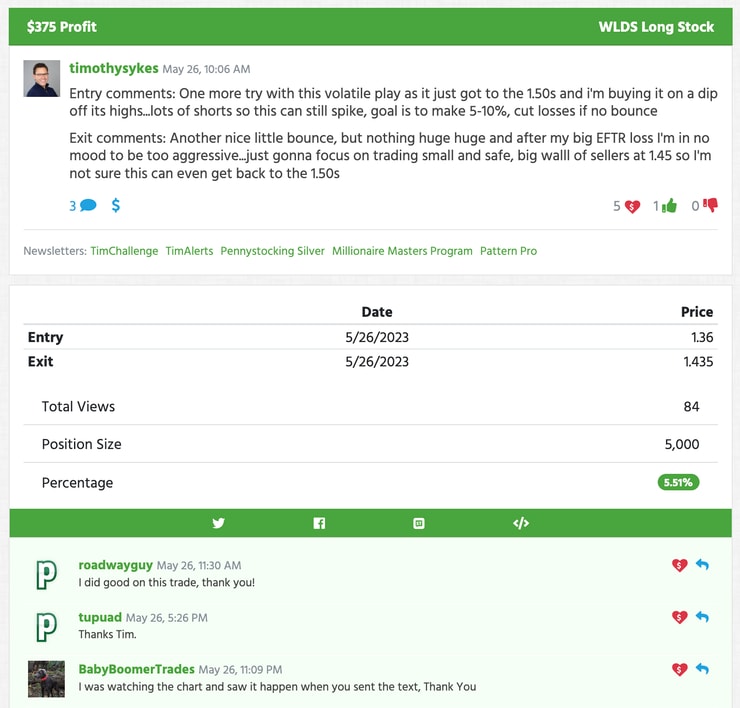

For instance, I keep track of my trading by logging every trade publicly on Profit.ly, complete with the ticker, date/time, entry and exit points, and commentary.

Of course, I also take it further and keep track of my progress by recording videos and posting on social media to offer even more resources for my students.

As a side note … Making video commentary of your trades can be helpful, too. For instance, Trading Challenge student Stephen Johnson started out with a YouTube channel documenting his trades. Documentation can keep you accountable and help you stay motivated.

No matter the format, when it’s maintained meticulously, it can help make you a better trader.

Benefits of a Stock Trading Journal

2025 Millionaire Media, LLCA trading journal can help to improve your trading skills. Here’s how…

A Trading Journal Will Help You Develop Your Strategies

Maybe the most important benefit is that it can help you figure out which strategies work best for you.

Tim Grittani is my most profitable student ever. He used his trading journal to provide insights on his way to $13.5 million in career earnings.

Here’s the crazy thing — before becoming profitable, he actually blew up his account! Check out this SteadyTrade podcast interview, where he talks about how he started using a journal to review his performance after that initial misstep.

Know what he found? The setups that were actually working weren’t necessarily the ones he thought were working.

Crazy how that works … But once he realized which of his trades had the best success rate, he was able to zero in on these strategies and refine them.

Paper trading, testing different strategies, and keeping a trading journal of your progress can help you figure out what strategies work best for you. That’s how you can work to continue to improve over time.

A Trading Journal Will Help You Develop Your Discipline in Trading

Maintaining a journal forces you to face the truth about what you’re doing right — and what you’re doing wrong. When you’re honest about where you could improve, it can give your study time a sense of direction.

It can also help improve discipline by creating a sense of accountability… As long as you update it after each trade!

If you know that you’ll be posting your trades publicly on Profit.ly, you might be more likely to follow the rules…

After all, it’s embarrassing to post trades over and over where you know you could have avoided a loss if you’d just followed the rules.

More Breaking News

- Is Sonnet BioTherapeutics Stock A Hidden Gem?

- AG Shares Rally: Buy, Hold, or Sell?

- D-Wave Quantum Inc. Under Spotlight: What’s Next?

A Trading Journal Will Help You Master Your Emotions

2025 Millionaire Media, LLCIt would be awesome if you could trade without emotions. Unfortunately, it’s not possible.

That’s easy enough to see. Just look at all of the stubborn short-sellers and the bad decisions they make when they get caught in one of the insane short squeezes we’ve seen recently.

Tracking your trades can help you start analyzing your own behavior patterns and figuring out what plays into your personal trading psychology.

For instance, here’s an entry I wrote on Profit.ly about a trade where I had a $7 profit:

Entry comments: “Buying this multi-week breakout that’s been very annoying to trade so only a small position, but this could be the day it finally pops, goal is to make 10-20%, nothing huge as this one isn’t usually very volatile but breakout is solid”

Exit comments: “Tried to be patient but its just going nowhere, so I’m out for small profits, probably better for panic dip buying only as this one has always been frustrating lately”

Notice how I also record my emotional state? I know I can be impatient and make bad decisions when I get frustrated, so I got out fast.

A Trading Journal Will Improve Your Risk Management

Risk management just means considering all of the variables associated with a risk and assessing the level that you’re willing to take.

Any time you trade, you’re taking a risk. You can’t change that. But you can work on how you manage your risk.

Are you, like so many newbies, taking massive positions on trades, hoping you’ll win big? Start logging your trades. You might notice you have the wrong money mindset, and it’s making you lose big. Tracking it all can help you adjust your risk levels to a smarter level.

It’s all about small wins adding up over time!

I like to keep things tight — I cut losses quickly. That’s rule #1. Sometimes I take profits too quickly. But I’d rather make less and stay SAFE than hold and hope.

4 Top Trading Journal Tools

2025 Millionaire Media, LLC#1 Profit.ly

If you’re on Profit.ly, it’s easy to log trades. Just click on the “Post a Trade” button.

From there, you’ll be guided to a form where you fill out basics like the ticker, a chart, entry and exit times and prices, your position size, whether you went long or short, and a ton of other details. You’ll also be given a space to make notes on the trade if you have any.

This is where I publicly post every single trade. It’s great because it’s easy to share my trades and show them during webinars, and it also keeps track of open and closed trades, average profit, and other stats.

#2 Note-Taking Apps

There are a ton of note-taking apps you can use to track trades. A lot of them are supported by mobile devices and the web, making it easy to keep track of your trades.

My friend and former student Tim Bohen — who’s the lead trainer at StocksToTrade — is a big fan of Evernote. But there are a ton of different note-taking apps out there.

They range from free basic versions to more advanced paid versions. So if you want things like email integration, file search, photo scanning, or the ability to add images or audio, you might want to opt for a paid version.

#3 Excel

A lot of traders just keep track of their trades in plain old spreadsheets.

It makes sense — it’s simple, easy to add numbers and keep track of P&L, and it’s fast. The one problem with Excel is that it’s not really easy to take detailed notes and keep it easy to read.

Some traders just deal with that annoyance. Others keep a separate document with more detailed notes and then keep track of the cold, hard numbers in Excel.

#4 Pen and Paper

I mean, you could always do it old school. Personally, I love my laptop too much. Honestly, I don’t even know if I can write with a pen anymore. I have blogger hands. But it works for some traders.

How to Create an Efficient Stock Trading Journal

Structure Your Trading Routine

As I said in this tweet…

… it’s all about boring old habits.

Every trader has a routine that works for them … Waking up early is a good start. That gives you time to run your scans, make a watchlist, and be prepared for the day ahead.

No matter what your personal routine is, make sure that making entries in your journal is part of it.

Analysis of the Market

As a developing trader, you’re like a scientist conducting experiments. Your journal is where you keep your experiment notes.

The more trades you track, the more data you amass. Then the more data you have, the more you have to learn from. And the more you learn, the more informed and prepared you’ll be.

By recording your trades, market observations, and overall thoughts, you’re not just learning from your own mistakes and successes — you’re also learning how the stock market works.

Analyze and Record Your Own Setups in Your Trading Journal

Here’s how you can develop and refine your own setups using your journal…

Find Setups to Trigger Your Entry

You should go into every trade with a trading plan. But how do you figure out entry and exit points?

To a certain degree, this is something you figure out over time. Tracking and analyzing trades can fast-forward your learning curve. By logging your entry and exit points over time, you’ll start to notice when you’re choosing good entry points.

Market Insight

Wanna become a pro at noticing market trends and how they affect your setups? Yep: a trading journal can help with this too.

History repeats itself. For example, early on in the pandemic, we had a ton of spikers related to medical equipment.

For smart traders who’d been logging trades for a while, that trend probably would have been evident. They could look back in their journal and see that the same exact thing happened during prior health scares with SARS and Ebola.

So yeah, you could look at your journal as an easy resource for market insight over time.

Determine Appropriate Lot Size

Lot size is a fancy way of saying how many shares you buy in a single transaction.

You don’t have to be aggressive in trading. And especially if you’re a new trader, it’s smarter to trade safe and small.

Check out this video about when to be aggressive versus conservative in trades:

Bigger isn’t always better with your position size. If you’re not consistent with small positions, you’re not going to magically make huge profits if you start taking massive positions.

Focus on refining your strategy first. Keep track of your position sizes and how the trades work out. This can help you know when it’s time to start scaling up safely.

Long/Short

I used to do a lot of shorting, but I’ve changed my strategy based on the market. Now, I mainly go long. Don’t be loyal to a position — be loyal to what’s working for you.

Whether you’re going long or short, you should have really strict criteria for every trade. I have seven indicators I use for every trade. You can learn about them in my “Trader Checklist Part Deux” DVD.

Stop and Profit Placement

When are you stopping out? And when are you taking profits? Are you doing it too soon, like I often do? Or are you holding on too long?

Make notes in your trading journal and BE HONEST.

Cut Losses Quickly

The most important rule in all of trading: cut losses quickly.

Yeah, I trade like a coward. But I’d rather take profits too quickly than hold too long and lose big.

But I also cut losses quickly, and that keeps my losses small. Over time, I don’t care about not missing the highest highs. I know that by trading scared I minimize losses.

Stop Loss

A stop loss is an order that you place where you sell a stock when it reaches a specific price.

I don’t use stop orders. Instead, I stay in front of my computer during the trade and have a mental stop. But I also have the discipline to stick with it. But if that doesn’t work for you, you might want to have a stop in place.

Read up on the basics of stop losses here and how you can use them to protect your account.

Tracking that data can help you zero in on appropriate positions and find ideal stop losses. It can help you effectively implement mental stops (discussed in this post), too.

Record the Profit or Loss from Each Trade in Your Trading Journal

Every time you make a trade, make a detailed entry in your journal about the specifics, including the profit or loss from each trade.

What Else Do You Need to Record In Your Trading Journal?

2025 Millionaire Media, LLCAs much as you think you’ll remember the details of your trading setup, you probably won’t.

Record these things to make the most of every entry…

Date

Obviously, right? But sometimes traders forget this important detail. You want to be able to go back and look at the stock chart on that date if you need to.

Time Frame

Time-stamp your entry, too. In the world of day trading, minutes matter. It can make a big difference if you traded in the morning hours versus mid or late day. The same setup that spells success in the morning could be a massive midday flop.

Price In

What was your entry point for the trade? Why did you choose this level? Was there volume, volatility, a catalyst?

Price Out

When did you exit? Be sure to note any difficulties in getting out of your positions. It might affect how much you risk next time.

The Amount You’re Risking

Have an idea of your max pain point for any trade. For instance, if you’re in at $4.15 and you intend to cut losses if it goes down to $4.10, know that before you get into the trade.

How much should you risk on a trade? My opinion is that you should always take a more cautious position. Never risk more than you could comfortably lose. You don’t want the stress of potentially blowing up your account on any trade. This might make you act or react in irrational, emotionally driven ways.

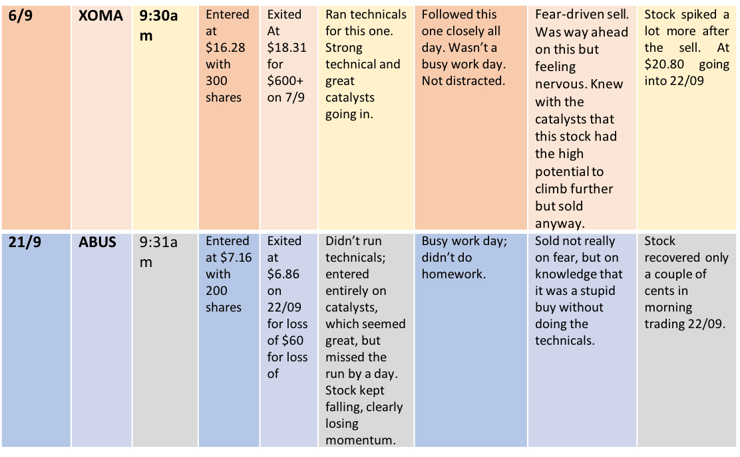

Example of a Trading Journal Spreadsheet

Here’s an example of what a trading journal spreadsheet might look like from a previous post:

And here’s an example of how I might log a trade on Profit.ly:

These are just two examples of how a trading journal could look — but there aren’t specific rules for how you format yours.

Tips for a Successful Trading Journal

2025 Millionaire Media, LLCWant more tips to help you maximize your journal’s potential? Good. I have a few more for you…

Identify Patterns That Lead to Your Losses

Making trading mistakes is inevitable. I don’t win all of the time. My success rate is about 70%. You can see all my trades on Profit.ly — I’m a firm believer in full transparency.

I never aim for slam-dunk trades. And I know that’s unattainable. While I can control my research, I can’t control what the market will do.

What I can control is how I learn from my losses.

If you track your trades well, you’ll eventually see patterns with your losses. It might be the time of day, a sector you can’t nail, or a flaw in your setup. Whatever it is, figure it out. Then work to make it better.

Identify Patterns That Lead to Your Winners

Don’t just focus on what you’re doing wrong — look at what’s going right, too. You can — and should — chart patterns in your trades to help you analyze what’s working.

I call myself a glorified history teacher. Much of my success in trading is based on my ability to identify patterns. Here are some of my favorites:

Once you begin to collect data, you can begin to evaluate what patterns really work for you.

For example: Are you getting good results shorting supernovas? Are you consistently finding winners by keeping up with updates from the StocksToTrade Breaking News add-on? Use this information to trade smarter.

Try StocksToTrade + Breaking News for 14 days — only $17!

Master Your Skills With Professional Assistance

The data in your journal is only as good as what you do with it. That means it’s important to understand the mechanics of the stock market to make sense of your data.

Take the time to learn key setups, trading basics, chart patterns, and how to execute orders. I’ve got a ton of FREE resources for you. Here are just four to start with:

- “An American Hedge Fund” — Read the free autobiography of my journey in trading penny stocks.

- “The Volatility Survival Guide” — Access my no-cost video guide to trading through volatility.

- My interview on the SteadyTrade podcast — The SteadyTrade podcast covers tons of topics for traders of all levels and often features top traders and finance legends.

- My YouTube channel — I post new videos with trading lessons, resources, and more … be sure to subscribe!

If you’re ready to take trading to the next level, consider applying for my…

Trading Challenge

You have to apply. I don’t want losers who just want hot stock picks. That’s not how I roll.

I want to help you do what I did — become a self-sufficient trader with strategies that work over time. I’ve found the best way to do that is to teach students what I’ve learned over the past 20 years … and let the journey unfold.

I’m only training wheels. A lot of my students learn from my strategy then develop their own.

The point isn’t for you to join and just follow everything I do. It’s to learn the market, learn from the community, and speed up your learning curve.

Take, for instance, Latoya Smith. She trades mid-priced stocks now, but she studied penny stock trading with me. In a recent SteadyTrade episode, she talks about how starting with penny stocks ended up leading her to the strategy that works for her now.

Apply for the Trading Challenge here.

The Bottom Line

2025 Millionaire Media, LLCYou do want to keep improving, right? If so, you’ve gotta keep track of your trades in a trading journal.

Whether your journal is a color-coded spreadsheet, logged trades on Profit.ly, or even an old-school composition book, the data you collect over time can be super informative. It can help you figure out what strategies work best for you and so you can refine them over time.

Go ahead, prove me wrong. Keep a journal, analyze the data, and see if it doesn’t improve your results. I dare you!

Do you keep a trading journal? What program and format do you follow? I love to hear what works for traders … and why. Drop a comment below!

Leave a reply