Day trading chart patterns are formations on price charts that signal something about the price trend. While these patterns don’t guarantee future price movement, they can be valuable clues to market sentiment and momentum.

Day trading isn’t about hunches. It’s a series of decisions made from cold, hard facts. Chart patterns are at the core of those facts. Your time, energy, and money are invested in trades.

Dive into the world of chart patterns with me. It’s not just lines and shapes; it’s a detailed picture of market behavior. From trend reversals to continuation patterns, chart patterns are the essence of a trader’s toolkit.

Want to become a self-sufficient day trader? Learn the tools.

Table of Contents

- 1 What Is Day Trading?

- 2 What Are Chart Patterns?

- 3 Understanding the Importance of Chart Patterns in Day Trading

- 4 Most Popular and Common Day Trading Patterns

- 5 How to Read and Recognize Chart Patterns

- 6 Practical Approach to Using Day Trading Patterns

- 6.1 Determine the Market Mood on Different Timeframes

- 6.2 Use Technical Indicators in Conjunction with Price Action Analysis

- 6.3 Wait for Patterns to Fully Form and Identify Profitable Entry Points

- 6.4 Implement Risk Management Strategies

- 6.5 Stay Up-to-Date with News

- 6.6 Beware of Bull and Bear Traps

- 6.7 Keep Calm and Avoid Impulsive Decisions

- 7 Key Takeaways

- 8 FAQs

- 8.1 What Is the Strongest Chart Pattern?

- 8.2 Which Chart Pattern Is Best for Day Trading?

- 8.3 How Do You Find Day Trading Patterns?

- 8.4 What Are the Basic Types of Candlesticks, and How Do They Form Support Levels and Resistance Lines in Day Trading?

- 8.5 How Do Prices, Moves, and Bulls Influence the Understanding of Chart Patterns Like the Wedge Pattern?

- 8.6 How Are Examples, Lists, and Content Organized in a Comprehensive Guide on Day Trading Chart Patterns?

- 8.7 How Do Same, Left, Middle, and Anywhere Relate to User Interaction with Chart Patterns in Day Trading?

- 8.8 How Can Traders Utilize Reviews, Body Patterns, and Categories to Make Informed Trading Decisions?

- 8.9 What Role Do Opposite Trends, Warranty of Tools, and Timing Play in Day Trading?

What Is Day Trading?

Day trading is buying and selling assets within a single day. It’s not investing; it’s trading.

Want to make quick profits? Get ready to analyze stock chart patterns and act swiftly. Open, close, and profit or loss. That’s the rhythm of day trading.

Every tick of the clock is a new opportunity or a potential mistake. It’s a world that demands attention to detail, an understanding of trends, and the ability to act decisively. The stock market, forex, and other instruments can all be day trading fodder.

What Are Chart Patterns?

Chart patterns provide valuable information that helps traders make decisions — and potentially profits.

Chart patterns are the heartbeat of the market. They’re a visual representation of buyers and sellers battling over price. You see a candlestick pattern? That’s the market talking to you.

Understanding the peaks, troughs, support and resistance levels is like reading a map. It leads you to trading opportunities. Chart patterns include various shapes like double bottom, ascending triangle, and even the popular head and shoulders. Recognize them, and you’ll see the market’s picture.

Understanding the Importance of Chart Patterns in Day Trading

Chart patterns are essential for day trading. Why? Read on.

Why Are Chart Patterns Important?

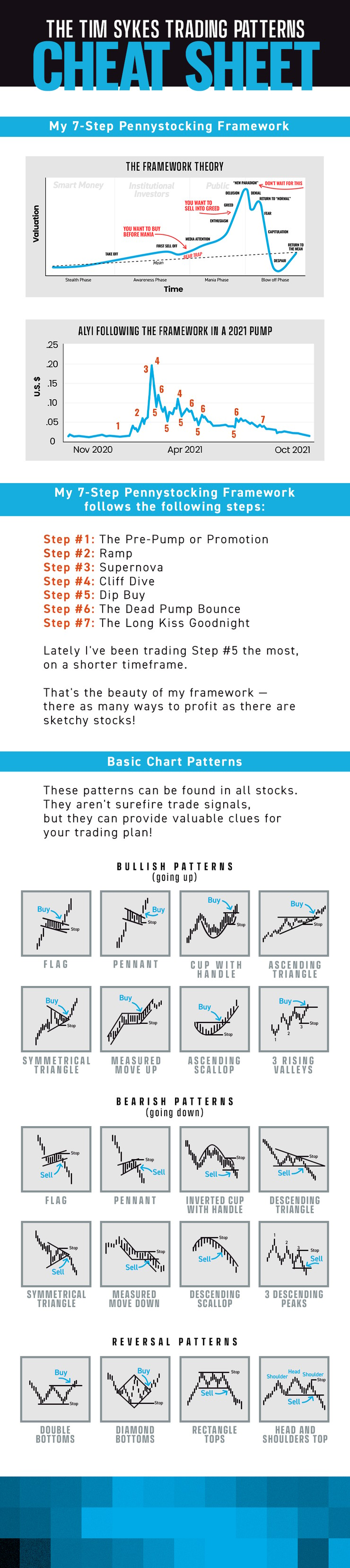

The patterns tell a story. They show you trends, reversals, continuation patterns. Bullish flag or descending triangle — each pattern has a significance. It’s an image of market psychology, a representation of collective decisions. It’s not a guarantee, but a chance. A chance to gauge the market, make an informed decision, and potentially profit.

Do Day Trading Patterns Really Work?

You bet, but it’s not a magical tool. Patterns like head and shoulders or the double bottom are there to guide, not guarantee profits. Understanding the context, the volume, the swing highs, and the lows, all in accordance with the market mood, is what makes them work. Some patterns signal a breakout; others, a retracement. Learn to read them right, and they’ll serve you well.

Most Popular and Common Day Trading Patterns

Day trading is a battlefield. The right strategies make a difference. Let’s dig in.

More Breaking News

- Bitmine Immersion Technologies Secures Strategic Edge with $14 Billion Crypto Holdings

- Entegris Faces CFO Transition Amid Price Target Boosts from Analysts

- Bitcoin Crash Sparks Sharp Decline in Cryptocurrency Stocks

- Huntington Bancshares Misses Q4 Earnings Estimate Amid Turbulent Market Conditions

Cup and Handle

Look at the chart. See a ‘U’ followed by a little dip? That’s your cup and handle. It’s a sign of bullish continuation, an indication that it’s time to act. Know the pattern, spot the entry point, set your target and stop loss. You’re in control.

If you’re interested in diving deeper into this particular pattern, you might find this guide on the cup and handle pattern helpful. It provides detailed insights and strategies to make the most of this unique trading opportunity.

Triangles

Triangles come in various forms: ascending, descending, symmetrical. Each triangle pattern tells a different tale. Ascending triangle pushing against a resistance level? Expect a potential upward breakout. A descending triangle with a strong support line? Watch for a drop. It’s geometry with benefits.

Flag and Pennant

The market’s on the move. A sharp price movement followed by a consolidation? You’ve got a flag or a pennant. Bullish or bearish, these patterns signal continuation. See the trendline, plot your entry, and let the market do its thing.

Wedge

Wedges are like slow-cooking opportunities. Falling wedge during a downtrend? The reversal might be coming. Spot the breakout, decide your entry point, and ride the change. Experience the patterns; the wedge is a trader’s friend.

The ascending wedge, in particular, often appears during an uptrend and can indicate a potential reversal. Understanding how to spot and trade this pattern can be a valuable skill for any day trader. If you want to explore the ascending wedge pattern further, consider reading this comprehensive guide on the ascending wedge. It offers a detailed analysis and practical tips to leverage this pattern for potential profits.

Double Top and Bottom

A double top screams resistance; a double bottom whispers support. It’s a tale of two peaks and troughs. Recognize the trend reversal and act. It’s a simple shape, but with complex opportunities.

Bullish Hammer and Bearish Hammer

The market’s a series of battles. The bullish hammer is a sign the buyers are fighting back. The bearish hammer? The sellers are in control.

It’s not just a candlestick pattern; it’s a signal.

Head and Shoulders

Three peaks. Two shoulders, one head. It’s not art; it’s a classic reversal pattern. Recognize the head and shoulders, and you’ve found a potential market turnaround.

How to Read and Recognize Chart Patterns

Reading chart patterns is a skill. It’s your tool for success in the world of day trading.

Diamond patterns are unique formations that can signal significant market reversals. They are formed by a combination of trend lines that create a diamond shape on the chart. Recognizing and interpreting this pattern requires a keen eye and understanding of market dynamics. If you’re intrigued by the potential of diamond pattern trading and want to learn how to apply it in your trading strategy, this guide on diamond pattern trading might be just what you need. It offers in-depth insights and practical advice to help you navigate this complex pattern.

How to Easily Recognize Chart Patterns

Recognizing chart patterns is a process. It’s about understanding trend lines, support, and resistance, and interpreting what they mean. Tools like trading software and practice on historical data make the difference. Spend time with the charts, and they’ll start talking to you.

What Time is Best for Day Trading

The best time for day trading can vary depending on the market and the trader’s strategy. For stocks, the first few hours after the market opens often see high volatility and price movements. It’s a time when trends might emerge, and support and resistance levels are tested. Understanding the timeframes, market mood, and individual risk tolerance can guide traders to the right moment for entry and exit. As always, analysis, education, and proper risk control are vital.

Practical Approach to Using Day Trading Patterns

Using day trading patterns requires a combination of skills, tools, and a disciplined approach.

Determine the Market Mood on Different Timeframes

Look at the price chart; what do you see? Is the market in an uptrend or a decline? Identifying swing lows and highs can give insights into the market’s mood. Your analysis needs to consider different timeframes, from short term to longer frames, to get the full picture.

Use Technical Indicators in Conjunction with Price Action Analysis

Technical indicators like moving averages or RSI are not standalone signals. Use them in combination with price action, candlestick patterns, and trendlines. The right mix of indicators helps you read the market better, identify potential trends, and set profit targets.

Wait for Patterns to Fully Form and Identify Profitable Entry Points

Spotting a double bottom pattern or a symmetrical triangle? Wait for confirmation. Entry points must be calculated based on fully formed patterns, not on an attempt or assumption. This reduces mistakes and aligns with your trading strategies.

Implement Risk Management Strategies

Investors and day traders need proper risk management. Setting stop-loss levels, calculating position sizes, and considering the overall volatility are vital for controlling potential downside. It’s about protecting capital and achieving consistent performance.

Stay Up-to-Date with News

World events, company news, and economic data can lead to sudden price movements. Staying updated with relevant news helps you anticipate potential gaps or sudden shifts in price, aligning your strategies with market realities.

Beware of Bull and Bear Traps

The market is full of traps, from bull flag breakdowns to deceptive price chart movements. Awareness and education are your defenses. Recognizing false signals and avoiding impulsive decisions protect your account from unnecessary losses.

Keep Calm and Avoid Impulsive Decisions

Emotions have no place in day trading. Impulsive decisions often lead to mistakes. Stick to the analysis, follow the plan, and use tools like webinars, community insights, and brokers’ advice to stay disciplined.

Key Takeaways

Day trading is an exciting and potentially profitable world, but it requires discipline, knowledge, and a practical approach. From understanding trendlines and candlestick charts to applying proper risk management and staying informed through research and education, the right combination of tools and strategies can lead to success. Whether beginners or seasoned traders, ongoing learning and community engagement make the difference.

They aren’t a silver bullet for your trading plan — but day trading chart patterns are some of the many topics you should learn as part of your trading education!

Trading isn’t rocket science. It’s a skill you build and work on like any other. Trading has changed my life, and I think this way of life should be open to more people…

I’ve built my Trading Challenge to pass on the things I had to learn for myself. It’s the kind of community that I wish I had when I was starting out.

We don’t accept everyone. If you’re up for the challenge — I want to hear from you.

Apply to the Trading Challenge here.

Trading is a battlefield. The more knowledge you have, the better prepared you’ll be.

Do you use day trading chart patterns in your trading strategy? Let me know in the comments — I love hearing from my readers!

FAQs

What Is the Strongest Chart Pattern?

There’s no one-size-fits-all answer here. Different chart patterns serve different purposes and depend on context. Patterns like the double bottom, triple top, and symmetrical triangle are widely used, but their strength needs confirmation, research, and alignment with overall trading strategies.

Which Chart Pattern Is Best for Day Trading?

Again, the ‘best’ chart pattern depends on the situation, market mood, and the trader’s style. Patterns like pennants, wedges, and candlestick formations may be highly effective in short-term trading. Choosing the right pattern requires experience, education, and careful analysis.

How Do You Find Day Trading Patterns?

Finding day trading patterns requires practice, the right tools, and education. Utilizing trading software, attending webinars, engaging with a trading community, and consistent review of price charts will reveal patterns. It’s about knowing what to look for, understanding the context, and applying the right combination of indicators and analysis.

The trading world offers resources, but the trader must invest in learning and perfecting the skill. Every chart, every bar, every figure adds to the trader’s arsenal, helping to move from novice to expert. Websites, articles, and products dedicated to trading education are valuable resources that can shape the trader’s journey. It’s a continuous process that unlocks new ways to interpret the market, set profit targets, avoid common mistakes, and thrive in the investment world. Whether it’s a single gap or complex patterns like triple bottom or triple top, understanding each aspect of the market leads to informed decisions, and the right choices lead to success.

What Are the Basic Types of Candlesticks, and How Do They Form Support Levels and Resistance Lines in Day Trading?

In day trading, candlesticks are one of the most common types of chart patterns. They help identify support levels and resistance lines, contributing to the formation of triangle forms, channels, rectangles, and wedge patterns. The height of the candlesticks and the distance between tops and bottoms can indicate price movements and trends.

How Do Prices, Moves, and Bulls Influence the Understanding of Chart Patterns Like the Wedge Pattern?

Understanding prices, moves, and bullish trends is vital in interpreting various day trading chart patterns, such as the wedge pattern. Analyzing these factors can provide insight into potential future price movements and help traders determine the optimal entry and exit points.

How Are Examples, Lists, and Content Organized in a Comprehensive Guide on Day Trading Chart Patterns?

A comprehensive guide on day trading chart patterns will include numerous examples and categorize them into different types and sections. This organization helps traders access specific patterns, such as support levels or the wedge pattern, and understand how they function within the broader context of trading strategies.

How Do Same, Left, Middle, and Anywhere Relate to User Interaction with Chart Patterns in Day Trading?

In day trading, concepts like “same,” “left,” “middle,” and “anywhere” may refer to user interactions with chart patterns or trading platforms. These terms may describe the positioning of chart elements, alignment of support and resistance lines, or flexibility in accessing different parts of a trading platform.

How Can Traders Utilize Reviews, Body Patterns, and Categories to Make Informed Trading Decisions?

Traders often look at reviews from experienced investors and analysts to gauge the effectiveness of various trading strategies. In addition to reviews, they also examine the body of candlestick patterns, which reveals the relationship between the opening and closing prices. These patterns can be categorized into different types, such as bullish or bearish, and understanding these categories can help traders make informed decisions.

What Role Do Opposite Trends, Warranty of Tools, and Timing Play in Day Trading?

In day trading, recognizing opposite trends is essential, as it helps traders identify potential reversals in the market. Warranty of tools refers to the reliability and support provided by trading platforms and software, which is crucial for executing trades efficiently. Trading at the right times is vital in making entry and exit decisions, as even slight changes in timing can lead to significantly different outcomes in both profits and losses. By understanding these things and how they interact with each other, traders can optimize their strategies and reduce risk.

Leave a reply