Think you wanna invest in penny stocks? Not so fast. Before you start throwing money at the market, get smart about how penny stocks work.

Many traders fail because they want to invest in penny stocks, but they don’t invest in their education first. So many of these losses are avoidable … You need the right mindset and approach.

The typical investing mindset is typically all wrong for penny stocks — most of the small companies behind them eventually fail. Weirdly enough, that’s actually part of my strategy. A lot about this niche is counterintuitive.

I’m a trader — not an investor.

For me, short-term trading versus long-term investing has proven the best approach to penny stocks. I’ve been trading penny stocks for 20+ years and made over $7.6 million.

In this guide, I’ll give you a crash course on some of the most important penny stock basics.

You’ll learn what it means to invest in penny stocks versus trade them. I’ll talk about the basics of my strategy and how I’ve used it to find consistency in trading — and how my top students have, too.

My goal isn’t to tell you “do this and you’ll get rich.” Trading definitely doesn’t work like that.

Instead, I want to be more like training wheels — teaching you my strategies so you can adapt them and become a self-sufficient trader. Ready to learn?

Table of Contents

- 1 What Are Penny Stocks?

- 2 Advantages and Disadvantages of Investing in Penny Stocks

- 3 The Potential Payoff of Penny Stocks

- 4 How Do You Buy Penny Stocks?

- 5 What Are the Top Brokers to Buy From?

- 6 What Are the SEC’s Rules for Penny Stocks?

- 7 What Techniques Do I Need to Learn to Be Successful?

- 8 How Do I Find Penny Stocks to Invest In?

- 9 What Are Good Stocks to Invest in Right Now?

- 10 Day Trading Penny Stocks

- 11 Learn How to Trade Penny Stocks: Lessons From My Top Students

- 12 FAQs about Investing in Penny Stocks

- 12.1 Are Penny Stocks Worth the Risk?

- 12.2 Does Anyone Successfully Invest in Penny Stocks

- 12.3 Do People Get Rich Trading Penny Stocks? Can You Make Money in Penny Stocks?

- 12.4 How Much Money Do You Need to Invest in Penny Stocks?

- 12.5 What Is the PDT Rule for Penny Stocks?

- 12.6 When Is a Penny Stock Not a Penny Stock Anymore?

- 13 Ready to Get Trading?

What Are Penny Stocks?

According to the SEC, penny stocks are stocks that trade for $5 or less per share. Some are sold for fractions of a penny. Others are a few dollars per share.

Penny Stocks Definition

Let’s dig deeper … What are some key characteristics of penny stocks?

- Highly speculative: Penny stocks have a high-risk, high-reward balance. If the stock does well, you could potentially make excellent returns. The flip side is also true: if it does poorly, you could lose your money fast.

- Small-cap companies: Penny stocks have a small market capitalization or stock valuation — in most cases, under $2 billion. Learn more about market cap here.

- Large bid-ask spread: This means that there’s a big difference between the asking price and the bid price. In other words, the amount someone’s willing to pay is much higher than the price at which someone else is willing to sell.

Advantages and Disadvantages of Investing in Penny Stocks

The press and most Wall Streeters are quick to tell you that investing in penny stocks is dangerous, risky, and a total waste of your time.

As a long-term investment strategy, I agree. However, I think that penny stocks can be worth your time if you adjust your mindset and take a short-term approach.

Investing vs. Trading in Penny Stocks

First, let’s get clear on the difference between investing and trading penny stocks. The key differences? Your mindset and your approach.

Investing refers to putting your money into a venture and hoping for a profit or return. But to invest in a penny stock implies that you believe in the company’s products or technology.

I don’t do that. Not with penny stocks.

I don’t believe in these companies. But this doesn’t mean I can’t potentially profit from the rapid price movement of their stocks.

What Is Penny Stock Trading?

I’ll tell you a secret: most companies offering penny stocks eventually fail.

Why am I telling you this?

Because it doesn’t actually matter that they’ll probably fail. Before they do, they can experience huge price spikes. A ton of them follow what I call a ‘supernova’ pattern — they suddenly explode then fizzle out, just like supernovas in space.

Smart traders can take advantage of these brief spikes, riding the momentum before the stock eventually fails.

Sound interesting? I created a Supernova Alerts service specifically for traders who might have limited time but want confirmation on hot potential supernovas.

My strategy isn’t about believing or investing in a company’s future. It’s about recognizing the patterns their stocks follow and taking advantage of them.

More Breaking News

- Bitfarms to Rebrand as Keel Infrastructure Amid Major Financial Moves

- Bitmine Immersion Technologies Stock Plummets Amid Bitcoin Decline

- TransMedics Stock Surges as Analysts Raise Price Targets Amid Strong Earnings

- D-Wave Quantum Sees Stock Uplift Amid Earnings Disappointment

The Benefits of Investing in Penny Stocks

OK, maybe you’re finding it hard to get outside of the “buy low, sell high” mentality of believing in a company before you buy a stock.

It’s possible that you could find the diamond in the rough penny stock that actually does turn into a success story. For example, True Religion Jeans started out as a penny stock.

But more often than not, these junk companies will disappoint you.

The Benefits of Trading Penny Stocks

Trading penny stocks, on the other hand, has so much to offer — especially for traders with small accounts. Here are some of the big draws of trading penny stocks…

Low Capital Investment

You don’t need to be a millionaire to get into the penny stock game. Just about anyone can afford to take a position.

I started trading with $12,415 of bar mitzvah money. My parents figured it was my money to lose. But I didn’t lose it. I became a millionaire while I was still in college.*

Wanna know the full story? You can read about it in my book ( for FREE at the following link), “An American Hedge Fund.”

You might not have $12K to start. That’s OK. I have students who have started with much less.

My top student, Tim Grittani, started with just $1,500. He started small and scaled up over time. Now, he’s made over $12 million.

Yep: my student surpassed me! And it’s a win for Trading Challenge students: Grittani’s an active participant in the chat room community and even offers webinars.

Diversification

Penny stocks can be part of rounding out your portfolio with more speculative, short-term trades.

Most wealthy people have more than one stream of income. Even though I’ve made millions* trading penny stocks, I don’t rely on trading alone to generate income.

In fact, I primarily trade to teach, and I donate the proceeds to charity. This year I’ve donated to Direct Relief, a fundraiser for Yemen, and more.

Don’t look to penny stocks as a get-rich-quick scheme to get out of debt or try to make rent. Instead, look at them as a piece of the puzzle and a way to diversify your sources of potential income.

Fast Movement

Patience is a virtue … It’s just not one of mine. Waiting to make money from a stock like Amazon or Google? Boring.

Penny stocks are different. If you look at penny stock charts, you’ll see they often experience rapid price fluctuations.

In many cases, the price of a stock can double or more in a very short period of time — a matter of hours or overnight. If you’re quick to react and understand how these patterns play out, you could benefit from these fast movements.

Potential to Grow Your Account Quickly

In my experience, there’s no other type of trading or investing that offers the potential to grow your account as quickly as penny stocks.

That’s especially true right now as we’re experiencing the most volatile market I’ve ever seen. It’s so crazy that I made a no-cost resource, “The Volatility Survival Guide.” Watch it to learn how to adapt and stay safe!

Lately, it’s become normal for stocks to experience huge growth in short periods of time. A lot of it is due to insane short squeezes …

The potential for growth is there — it’s about understanding the patterns that play out over and over and being ready when they come along next time.

The Potential Payoff of Penny Stocks

I’ve made millions of dollars trading penny stocks. I have several confirmed millionaire students. I have even more six-figure profit students. It’s all thanks to penny stocks.*

So yeah, the potential payoff is good. But remember: we’ve taken the time to learn the rules. We know key penny stock patterns.

We’re not just throwing money at the market.

A ton of the horror stories I hear about epic trading fails involve new traders going ‘all in’ on a penny stock. They get a hot tip from a penny stock promoter, put everything they have into this so-called amazing opportunity. Then they sit back and wait for their windfall.

But it doesn’t usually come. Once the price is pumped up, the promoters are out. The price deflates, and that trader is left holding the bag.

Don’t be a cautionary tale. Instead, have a strategy so that you can benefit from the crazy spikes that penny stocks can experience … And be prepared to take profits or cut losses quickly.

The Risks of Investing in Penny Stocks

It’s impossible to entirely avoid risk when trading penny stocks. You will make mistakes and lose money at some point.

Look at my trades, which I post publicly. I’m only right about 75% of the time. That’s right: even with 20+ years’ experience, I still get it wrong sometimes.

But I’m profitable overall because I trade scared and don’t let my losses outweigh my gains.

I’m not afraid to take profits too soon. But I’m also not scared to cut losses if the trade goes against me. If you take nothing else from this guide, take this one rule: CUT LOSSES QUICKLY!

Understanding the Risks

Most new traders invest in penny stocks with a total lack of information. They’re investing with no minimum standards, a lack of history, and without considering basics like liquidity. And then they’re surprised that they lose.

Losses are part of the process, but I don’t want you to lose more than you have to. So educate yourself and understand the risks of penny stocks.

If you’re ready to get serious, apply for my Trading Challenge. Not there yet? I offer many resources for FREE. You can start here:

How Do You Buy Penny Stocks?

Here’s what you need to know about how to get your hands on those hot little shares…

How to Invest in Penny Stocks

Again, I’m a penny stock trader. For me, trading is faster — and easier!

How to Trade Penny Stocks

First, you need a brokerage account. But before you open one, you need to know which exchange offer penny stocks — not every broker offers access to every exchange.

Where to Buy Penny Stocks

You’ll find some penny stocks on the major market exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq. But more often, they’re on the OTCBB and the pink sheets.

What Is the OTCBB?

This is the exchange for electronic trading for companies not listed on a major exchange. Shares rarely trade over $5 per share.

What Are Pink Sheets?

You could think of pink sheets as the OTC’s equivalent of the big exchanges. Each day, the National Quotation Bureau publishes a pink sheet (that’s where the name comes from) featuring the bid and ask prices for penny stocks, as well as other OTC stocks.

Some brokers can access bid and ask prices for pink sheets in real time, and transactions can be made online.

What Are Blue-Chip Stocks?

The term “blue chip” is said to come from the game of poker, where blue chips have a high value. In the stock market, blue-chip companies and stocks are considered highly prized, stable companies.

I think companies like this are a snoozefest — they just don’t have the volatility necessary to grow an account fast. That’s why I like to stick with lower-priced penny stocks.

What Are the Top Brokers to Buy From?

A broker is an agent that actually facilitates buy and sell orders.

There’s no such thing as a perfect broker. Every broker will have its pros and cons. Wanna learn more? I go into it in great detail in this post and this video:

Offshore Brokers

I strongly caution you to avoid offshore brokers — they’re usually sketchy.

There have been schemes involving selling stocks to foreign brokers at discounted prices, then selling them back to the U.S.-based investors for a handsome profit.

The SEC doesn’t require offshore brokers to register stocks, so it’s easy to get taken in by scams like this … especially with under-the-radar penny stocks.

What Are the SEC’s Rules for Penny Stocks?

To stay safe, be sure your broker abides by the SEC’s rules and provides you with appropriate disclosure, documentation, and statements.

Also, familiarize yourself with the SEC’s rules with regard to trading penny stocks — here are some of the most important ones.

1. Sales Practice Requirements §240.15g-9

The SEC wants to make sure that brokers and dealers won’t manipulate customers. Brokers have to abide by sales practice requirements, including “approving” the customer.

This basically means that the broker has to assess whether the customer’s financial goals and account size are suitable for penny stocks.

The SEC doesn’t want brokers to work with people who might game the system or create a financially dangerous situation for other investors.

2. Disclosure Document §240.15g-2

I mentioned before that penny stocks are considered relatively high risk due to their volatility. However, for traders like me, that risk is countered by the opportunity for financial rewards.

Still, the SEC wants consumers to understand that risk. So brokers must provide customers with a standardized disclosure document. It fully explains the risks of trading penny stocks and potential pitfalls.

3. Bid-Offer Quotations Disclosure §240.15g-3

Like in any transaction, you want to know what you’re paying for. In this section of the SEC’s rules, people who broker sales in penny stocks have to provide traders and investors with bid-offer quotations.

4. Compensation Disclosure §240.15g-4

Under SEC rules, brokers also must provide customers with his or her compensation schedule — in writing.

Some brokers charge a flat fee, while others charge by the transaction or even the share. Take this into consideration when choosing a broker.

5. Monthly Accounts Statements §240.15g-6

Every month, your broker is obligated to send account statements that detail each transaction and the status of your positions.

This is a smart way to stay updated on your transactions, but you should also keep a trading journal.

What Techniques Do I Need to Learn to Be Successful?

Just because the entry to day trading is simple doesn’t mean you should just dive in.

Overall, your goal is to find a strategy that works for you. It takes time and practice to do that. However, there are certain techniques that a ton of successful traders have in common…

Focus on Specific Sectors

Stock sectors represent different sectors of the economy — energy, tech, healthcare, financials, and so on.

In penny stocks, sectors can get subdivided into any portion of the economy or stock market that might be trending. For instance, coronavirus-related stocks or marijuana stocks can be sectors.

Don’t spread yourself too thin. By focusing on one or two hot sectors, you can better zero in and hone your methods. Then you can adapt when the sector starts to fade or shift.

Penny Stock Patterns

I love patterns because history repeats.

It might not always play out the same way, but usually, a penny stock’s past can tell you how it might react in the future.

Penny stock charts are the gateway to finding patterns and scoping out when a penny stock might be following one. There are lots of different types of charts. You’ll find what suits you as you gain experience.

I mainly stick with candlestick charts. They can be extremely complex or simple. You can learn to recognize candlestick shapes and wicks. Learn more about charts and patterns here.

Technical Analysis

In trading, there are two basic types of analysis: technical and fundamental.

Technical analysis largely involves studying charts, finding patterns, and making trades based on them.

Since penny stocks move fast, I usually don’t care about the company’s long-term prospects. I mainly rely on technical analysis.

Technical analysts believe all the information they need is in the charts. In some ways, they’re right. But it’s not an exact science.

It’s possible for a stock to bottom out suddenly with no warning.

Fundamental Analysis

Fundamental analysis relies more on a company’s finances and operations.

It’s about the inner workings of the company behind a stock. Here, you’re looking at balance sheets, sales, and a company’s general health.

Smaller companies are behind penny stocks. They have low liquidity, high volatility, and limited products or services. If you want to invest in penny stocks versus trade them, you need fundamental analysis. But it’s helpful for traders, too.

For example, a company that just got a massive influx of venture capital might be a better bet than one that just took on a huge amount of debt.

How Do I Find Penny Stocks to Invest In?

Unless you just started reading halfway through the post, you probably already know what I’m gonna say…

Adjust Your Mindset

Investing in penny stocks can be a dangerous approach. So if you’re still thinking about how to get in on the ground floor with a small company, my penny stock trading strategy isn’t for you. If you want to get smart about playing penny stock patterns and benefitting from short-lived spikes, let’s talk.

Use a Scanner

If you want to find the hottest stocks, it’s all about having a great stock scanner.

There are thousands of stocks out there. You’ve gotta narrow down the choices. A stock scanner can help you filter down the many choices to the tickers that fit your specific criteria.

I live and die by StocksToTrade. Full disclosure: I helped develop this platform. It’s got everything I need! You can scan for things like the top percent gainers, volume, and even look at news and social media mentions.

Now, it has a Breaking News Chat feature where I’ve been finding SO many great trades lately. Trading is a battlefield … suit up with the right armor!

What Are Good Stocks to Invest in Right Now?

A lot of traders who fail have this in common: They just want hot stock picks.

They don’t want to do research, run scans, or look at charts. That’s boring. They want me to tell them what to trade.

It doesn’t work like that. There are way too many factors at play for that to be a successful strategy. I show my trades and my watchlist so that you can learn from my process.

Ready to learn from my trades?

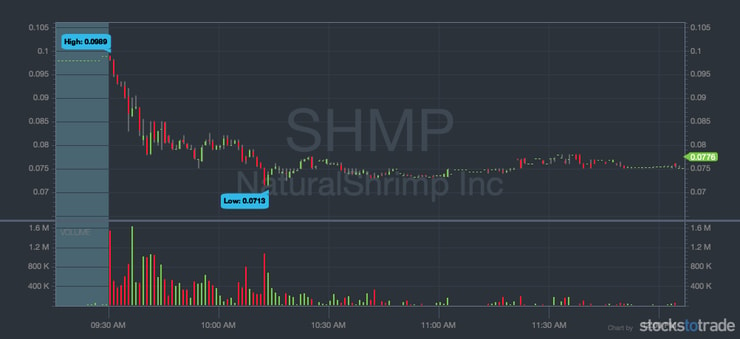

Here’s a recent example. Natural Shrimp, Inc. (OTCQB: SHMP) is a former runner that I bought on a morning panic. I bought 175K shares at $0.079 at about 9:41 a.m. Eastern, then added to my position with another 145K at $0.076 about 15 minutes later.

About 10 minutes after that I sold all my shares at $0.081, netting a $1,088 profit.* Not bad for about 30 minutes of work!

Trending tickers change fast. I love my Trading Challenge chat room community because traders talk about market action … Not in the chat room yet? you can still join my watchlist for free and see which stocks I’m watching.

Are Penny Stocks Under $1 Worth Trading?

When a company is small, the right news catalyst can mean big moves. Even a crappy newswire story can make the stock jump.

In recent months, we’ve seen stocks experience crazy gains.

That isn’t to say that stocks under $1 will experience huge gains or always worth your time. There are higher-priced stocks that I’d argue aren’t worth your time either.

It all goes back to your mindset — penny stock success isn’t about home runs or striking gold.

It’s about small wins that add up over time.

So the real question is whether you can trade stocks — at any dollar amount — and find consistency.

How to Calculate Penny Stock Trading Costs

How much does it cost to trade penny stocks? It’s not just about the stock price.

There can be fees. Most brokers are commission-free now, but you might have to deal with things like borrow fees for short selling or other surcharges.

Another thing you should consider? Investing in your education. It might cost a little money to take day trading classes, but it could actually reduce your losses over time. That’s a smart investment.

Day Trading Penny Stocks

Day trading refers to buying and selling stock shares within the same trading day.

Since my strategy with penny stocks is pretty much always short term, I often day trade or hold overnight.

Keep in mind that if you’re new to trading and have a small account, you can’t necessarily trade all day every day. There’s a little something called the PDT rule that limits your day trades.

Learn more about the PDT rule here.

If you break the rule, you could find yourself in hot water. Some brokers will just give you a warning the first time. But if you do it again, your broker can freeze your account for as long as 90 days or until you bring your balance to $25K or more.

Tips for Trading Penny Stocks Right Now

Ultimately, my goal is to help you become a smart, self-sufficient trader. I try to help my students do that by teaching them what I’ve learned in my past 20+ years in the stock market.

If you really want to get a head start, consider applying for my Trading Challenge. If that’s too big or serious for you now, at least do yourself a favor and heed these hard-earned tips.

Start Small

I’ll keep on saying this over and over and hopefully annoy you enough to remember: small wins add up over time.

Trading is NOT about hitting home runs. It’s about singles! Focus on your strategy first, then scale up your position later.

I don’t care if you’re making $2 profits. If you can find a strategy where you can consistently do that, you can start to scale up over time.

I didn’t become a millionaire with a single trade. Now, my average gain is $1,741.* That’s nothing to hedge fund bros in New York. But it keeps the 9-to-5 away.

Be VERY Careful With Short-Selling

There have been times in my trading career where I focused on short selling.

When you short, you borrow shares from your broker, then sell them, then buy them back, hopefully at a lower price. In a bear market where stock prices are falling, you can potentially generate huge profits by using this strategy.

But it can go very wrong.

When you go short, you run the risk of not just wiping out your initial position, but going into debt.

In a typical transaction, your return on an investment can range from $0 (loss of the amount you put into the trade) to any amount of profit.

With margin account. Specifically for short selling, your profit can go negative. That means that you could owe more than the amount of your initial position. Plus, you’ll still have to pay a borrow fee.

If you’re new to trading, avoid Huddie, is one of my top students. To date, he reports profiting approximately a quarter of a million dollars primarily from short selling at first. The risks are just too heavy in a short squeeze-prone market like we’re in now.

Start by Paper Trading

Paper trading is simulated trading. It works just like actual trading on a platform in terms of execution, but you’re not putting real money on the line.

It can help you get up to speed with the actual process of executing orders and figuring out how to use a trading platform.

It can also help you time your entries and exits and test strategies before you put real money into the game. Read more about paper trading here.

Trade Only Penny Stocks with Volume

When it comes to trading penny stocks, volume is super important. Volume is the number of shares changing hands during a trading day. You need decent volume to ensure you can buy and sell with ease. If not, you could be stuck and unable to buy or sell!

A fast and furious upswing in volume could also be a clue that something’s going on with a stock. Learn more here:

Enforce Mental Stops

You’ve gotta have standards in place for loss control. Even though you’re putting up relatively little money per share in a penny stock, you don’t want to lose any more than you need to.

That’s where mental stops come in. A mental stop (aka a soft stop) refers to the level where you decide you’ll sell. You don’t set up an actual stop order, but you mentally know where you’ll get out.

Of course, a mental stop requires a TON of discipline. I talk more about why I don’t use stop orders in this post … Learn why it matters!

Don’t Fall For Penny Stock Pumps

A penny stock pump is when an investor buys up lots of shares of a penny stock, then has a promoter pump up the price through hype. Then that initial investor sells as soon as activity begins to grow. Shifty!

Promoters use emails, tweets, Facebook posts, and blog posts to encourage people (read: newbies) to BUY.

Yep: promoters receive payments for that service. It’s completely self-serving. Don’t get suckered! Don’t trust anyone else’s stock picks — always do your own research.

Look For Penny Stock Success Stories

Don’t copy other traders. Instead, learn from their successes.

Always be sure to consider the source. Don’t blindly follow someone’s advice EVER. Look for people who publish every trade publicly — NOT screenshots of month-end profits with no details — and provide insight into their strategies.

Learn How to Trade Penny Stocks: Lessons From My Top Students

My top students are all pretty public about their strategies and trades. Learn from them in videos like this:

If you’re interested in learning how to trade penny stocks, consider joining my top students in my Trading Challenge. It’s a great way to motivate you to learn as quickly as you can.

You can also learn from me in other ways. Check out my DVD collection, watch the videos available for free on YouTube, and follow my blog. I constantly share content!

Keep a Trading Journal

A trading journal or log of all of your trades is one of the best ways to learn from your successes and failures.

I track my trades on Profit.ly. It’s an easy way to track trades, and you can see things like your win rate, profit chart, and more.

The important thing is to document your progress and learn from what you’ve done in the past. Yesterday’s mistake can become tomorrow’s streamlined strategy! Read more about trading journals here.

Keep it Real

One great trade won’t make you, but one bad one could break you.

In trading, it’s SO important to keep a level head. I’ve seen it time and again — traders have a winning streak, start to feel invincible … and inevitably, that’s when they start losing.

Say humble and keep it real.

Consider my student Jack Kellogg, who made an incredible $184K in June 2020.* That’s a major accomplishment. But he’s not letting it get to his head.

Right after announcing his record month, he posted a tweet about how his profits looked a year ago at the same time. Not quite as impressive…

One year ago today.

You never know when it is coming.

All you can do is show up everyday and always stay learning. 😤 pic.twitter.com/OXtQD1VrOV

— Jack Kellogg (@Jackaroo_Trades) July 1, 2020

This is the right mindset for trading … Always remember how far you’ve come and how much work there still is to do.

Be Willing to Adapt

Nothing lasts forever in the stock market. Hot sectors fade, patterns shift … things change. You’ve got to be willing to change, too.

For example, for many years I was primarily a short seller. These days, I see better opportunities going long with patterns like the morning panic.

I like the path of least resistance and sticking with the strategies that work for me! I’m loyal to adapting and doing what works as dictated by the market.

Do Your Research

Research is boring. It would be so much easier to trade based on someone’s hot stock picks, right?

Resist the temptation. Following someone else’s trades is not a strategy that works in the long run. You’ve gotta learn how to find your own list of stocks to watch, and to trade using your own strategies. That’s how you figure out what works and gain the ability to adapt and grow.

Get used to devoting time to daily stock research and creating a watchlist now … These habits are vital if you want to be in this game for the long run.

FAQs about Investing in Penny Stocks

Are Penny Stocks Worth the Risk?

Penny stocks are volatile, which means that there’s a relatively high level of risk associated with trading them. However, if you learn how penny stocks work, learn strategies, use proper risk management, and gain experience over time, I think penny stocks can be worth the risk.

Does Anyone Successfully Invest in Penny Stocks

I don’t approach penny stocks as a long-term investor. I don’t even believe in the companies I trade. My strategy involves following patterns and riding short-lived price spikes to potentially generate profits. Using this strategy, I’ve made over $5.8 million trading penny stocks.*

Do People Get Rich Trading Penny Stocks? Can You Make Money in Penny Stocks?

I’ve millions trading penny stocks and so have several of my top students. Many more have made hundreds of thousands of dollars trading penny stocks.* Yes, it’s possible to make money in penny stocks, but it requires dedication, hard work, experience, and the ability to develop a strategy that works for you. Even then, there are no guarantees.

How Much Money Do You Need to Invest in Penny Stocks?

Since penny stocks are less than $5 per share, you don’t need a ton of money to get started. I personally started with $12,415, but some students of mine have started with less than $1,000. You’ll need a brokerage account to trade — minimum opening balances vary depending on the broker.

What Is the PDT Rule for Penny Stocks?

The pattern day trader (PDT) rule is a regulation enforced by the Financial Industry Regulatory Authority (FINRA.) It limits traders with less than $25K in their accounts to four day trades per rolling five-day period.

When Is a Penny Stock Not a Penny Stock Anymore?

A penny stock stops being a penny stock when its share price rises above $5. Sometimes this happens permanently. In other cases, it’s a temporary increase, and the stock will dip back into penny stock territory.

Ready to Get Trading?

Penny stocks aren’t just low-priced stocks. They’re a whole different niche.

They’re not subject to as much regulation as bigger stocks listed on the major stock exchanges, and they tend to have high volatility.

That means that they require a whole different strategy than trading higher-priced stocks.

Reading this post was a great first step — but your education is just beginning. To really get smart about penny stocks and to speed up your learning curve, consider joining a supportive community of like-minded and hard-working traders in my Trading Challenge.

Are you ready to work hard, study, and develop your own penny stock trading strategy?

Leave a reply