Recently, a student asked how to maintain trading discipline when you’re trading well. In this edition of the update, I’ll explore that subject.

Recently, I got cocky on a trade and broke all my rules. It’s a classic lesson of what happens when one near-perfect trade makes you feel unbeatable. And it emphasizes the dangerous consequences.

While writing this update I heard the tragic news of Kobe Bryant’s passing along with his daughter and seven others. Kobe was one of the all-time greats. He was also an inspiration to anyone with a desire to be the best they can be…

With that in mind, I wrote another post dedicated to Kobe. It focuses on the lessons we can learn from him and his legendary work ethic. Read the post here: What We Can Learn From Kobe Bryant.

Before we get to the trading lessons of the week…

Table of Contents

When Giving to Charity, It Takes Time

I was in Los Angeles last week working on some new video projects — we filmed a lot. I also met with a few LA-based charities. Nothing’s finalized yet — these things take time.

Some people think it’s “Oh, just donate to anything.” But this is my hard-earned money. So while I meet with a lot of charities, only a few make the cut. I’ll have more on new charities we’re supporting in a coming update.

Also, I’ll be heading to Australia soon. Karmagawa’s getting closer to our Save Australia charity merch goal. We have about a dozen charities in Australia and we’re donating roughly $100,000.

On to trading…

Trading Questions from Students

Let’s get right to questions from students. To set up the first question…

My winning percentage to start the year has been pretty good — roughly 84%.* One student noticed and asked a well-timed question about trading discipline…

“When your winning percentage is high, how do you keep it in perspective? How do you stay focused and not get cocky?”

Funny thing is, on January 24 I had my worst loss after my biggest gain of the year.*

How? I got cocky. The first trade was my biggest gain. The trade was a speculative midday pattern — one I don’t often trade. It worked out. So…

… I got cocky. I tried another midday pattern and got my butt handed to me. You can never get too cocky. Don’t push your luck. I’ll go into more detail about both trades in the Trade of the Week section of this post.

Remember, $500 a day … $1,000 a day … keeps the real job away. (I love to say that but keep it in perspective. The level of consistency required to average $500 a day takes both study and experience. Work on your process and develop trading discipline.)

Next question…

“Tim, I’m new to your Trading Challenge. How would you compare the current market to the tech bubble when you got started? What lessons should I learn from studying the past tech bubble?”

First, understand there’s usually always a bubble of some kind. When I first started it was biotech and then the internet. More recently we’ve had bitcoin and marijuana stocks.

New to penny stocks? Get access to my FREE penny stock guide here.

Now, with the coronavirus scare, a lot of these virus-related stocks are running. I’m watching NanoViricides (AMEX: NNVC), Novavax (NASDAQ: NVAX), and Alpha Pro Tech Ltd (AMEX: APT). These are the same exact stocks as when Ebola was spreading a few years ago.

Note: I’m doing a dedicated post on coronavirus stocks to watch in the coming weeks. There are several more worth watching. It’ll be up in the next day or so. Also, follow me on Instagram as I’ve been documenting this crazy coronavirus outbreak the past couple of days.

The lesson: be prepared. Wait for the hot sectors and wait for the predictable patterns. And if there’s no hot sector … you should consider yourself lucky. You should be happy because it gives you more time to catch up.

Finally, let’s get to the trades of the week and the lessons to be learned…

Trades of the Week

Again, on Friday I had my biggest gain* of the past few weeks … and also my biggest loss. On the exact same day. Very close to each other.

And the two are not random. A breakdown of trading discipline led to the loss.

Let’s briefly check out both trades…

Ocean Bio-Chem Inc. (NASDAQ: OBCI)

Ocean Bio-Chem makes sanitizing products. During the Ebola outbreak in 2014, the stock spiked when the company donated its disinfectant/virucide to Liberia and Sierra Leone.

On January 24, the stock spiked nearly $1 a share in about 30 minutes. So I took a small speculative position on this virus play as this is the hottest sector right now.

Take a look at the OBCI intraday chart from January 24…

It was a near-perfect play. But here’s the problem…

Wins Are Dangerous Without Trading Discipline

I usually don’t trade midday. But I took this trade midday and did well. I nailed it. It’s one of my best plays — not in terms of money — but on execution. I nailed the dip buy on the entry and actually sold near the top for once. My whole thesis played out.

Students were even giving me some love in the Trading Challenge chat room…

01:40 PM the_tipsy_nomad → timothysykes: Way to sell into strength near the top. Well done.

01:43 PM KarolaCrawford → timothysykes: Nice job Tim!

01:44 PM Sky_Hi_Trading → timothysykes: great way to demonstrate selling into strength!!! thank you!!!

01:44 PM gardner56 → timothysykes: that was perfect Tim, nice play.

But it’s a very slippery slope when you start being undisciplined. It’s crazy how with one trade … when your thesis plays out … you start to think “Ah … I can do anything.”

From that win — mea culpa — I lost big. See if you can figure out all the mistakes I made (I’ll explain them after.)

(*Please note: my results are not typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

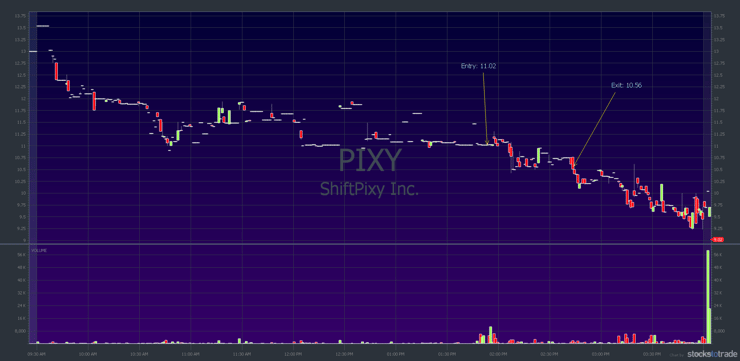

ShiftPixy Inc. (NASDAQ: PIXY)

I dip bought this recent spiker more than 50% off its highs. First, take a look at the chart…

I bought at $11.02 with a risk of $10.80. My entry comments mentioned I would have gone for a bigger position size if there was higher volume. My thesis was it could bounce 40–80 cents a share. I was wrong.

Some of my students recognized I’d lost my normal trading discipline. (And that makes me happy — because they’re studying and paying attention.) Check it out…

01:58 PM therealmcdougal → timothysykes: I don’t get this play at all: low volume, don’t see the support you’re referring to at 10.8 more like 11, mid-day, choppy.

02:01 PM Ramesh_Kumar → timothysykes: Tim, PIXY after earnings release on jan 21st, it didn’t gapped up/spiked whatsoever and is pretty much down after that. Isn’t it a failed earnings?

02:08 PM therealmcdougal → timothysykes: hope you got out of PIXY this looks like [expletive deleted].

02:08 PM Kriminator → timothysykes: is this new pattern? did you man short? are you drunk?

02:17 PM calvinw → timothysykes: You did clearly say it was at key support and risky. Hope it works out if you didn’t sell.

The reality is … I got cocky after OBCI.

Now let’s look at some of the more obvious mistakes I made.

Breaking Rules Is a Very Slippery Slope

First, these are the rules I broke with this trade…

Avoid trading midday: I don’t often trade midday because of lower volume. It’s much more difficult. Sometimes there’s a play — as was the case with OBCI. But even that one broke my rule and led me to break it again. Read this to understand when to dip buy vs. not dip buy.

Avoid trading low volume stocks: In hindsight … it’s so obvious. In my entry comments alerted to students I even mentioned it being low volume. Focus on trading high-volume stocks.

Avoid trading illiquid stocks: My intention was to take half the position size that got executed. It got executed twice because I was trading with sketchy Wi-Fi. With twice the number of shares I wanted, in an illiquid stock, it was even more difficult to get out. This post explains how to find liquid stocks.

Avoid trading without a solid plan: This trade was more of an “I can do anything” moment. Instead of having a solid plan that made sense. Be meticulous when you develop your trading plan.

Avoid trading when you’re not clear headed: I was still on a buzz from the OBCI trade. The fact that I alerted the wrong newsletter and got the wrong position size on a low-volume, illiquid stock…

… that pretty much says it all. Be sure to develop a growth mindset and follow your rules. Read “The Complete Penny Stock Course” by my student Jamil. (See pg. 51 for tips on trading psychology.)

More Breaking News

- Coca-Cola’s CEO Sells Shares: Market Reactions and Financial Insights

- TRX Gold Shines with Strong Q1 Earnings and Raised Price Targets

- Microbot Medical Eyes Expansion with Key Milestones in 2026

- Coty Faces Uncertainties with Earnings Miss and Strategy Revisions

When You Win Big, Focus MORE On Rules

As you can see, my trading discipline broke down — especially on the PIXY trade. One of the things that keeps me humble is that I usually sell way too soon. Most of the time I’m thinking “Oh, I can do better.” So if I ever catch the exact top or near the top, I have to remember this…

“Don’t push it. You nailed that one play.”

And then I need to step back and remember my rules. Because that’s when you stick MORE to the rules. Not less. Most of the time I’m very good about following these trading rules.

You have to be more aggressive in terms of your discipline. I wasn’t. I traded an illiquid stock, with little or no catalyst, midday. Plus, I was going against the overall market.

Midday … you should just say “no.” Low volume … just say “no.” I screwed up.

Be Humble and Accept Your Mistakes

No matter how long you’re in this … you’re still gonna screw up. On OBCI, I nailed the bottom and had patience for the top. I traded it so perfectly that my self-talk was, “I know this market, I know I have rules, but I can do this.”

You really can’t throw out rules about volume, liquidity, pattern, and time of day. And I was clearly breaking my own rules.

That said, it’s good I lost. Why? Because if I’d somehow lucked out and won it would’ve reinforced my lack of discipline. And taught students all the wrong lessons. So in that respect, I’m glad it happened. It’s a reminder to maintain trading discipline.

Watch this video for more tips on trading discipline:

Be a Transparent Trader

I take pride in full transparency. And I encourage all my students to be transparent. Share your wins and your losses. Every detail. It will make you a better trader in the long run.

Thankfully, students recognized there are lessons in every trade. Some even expressed thanks for me being real. I don’t expect or need students to tell me … for better or worse, I’m real. And I make stupid mistakes sometimes. So while I appreciate the comments, I need to do better.

02:50 PM wallride5194 → timothysykes: Love the candor – a real teacher not a poser.

02:50 PM Jcarriere → timothysykes: even if you mess up on a trade it’s still a good lesson for us all. sucks you mess up but still good to learn off of!

02:53 PM RouxBourbon → timothysykes: Yeah man, much love Tim.

Millionaire Mentor Market Wrap

Please bookmark this post and come back to it any time you start to lose trading discipline. Remember the lessons.

Stay safe out there. The coronavirus outbreak and Kobe’s loss are both reminders that life is fragile. So strive to be your best every day because we don’t know what tomorrow will bring.

What do you think of this post? Comment below, I love to hear from all my readers! If the part about trading with discipline makes sense, comment with “I will be disciplined.”

Leave a reply