How to Use a Trading Journal

If you’re a trader, you’re a student of the markets and you’ll need to know how to use a trading journal.

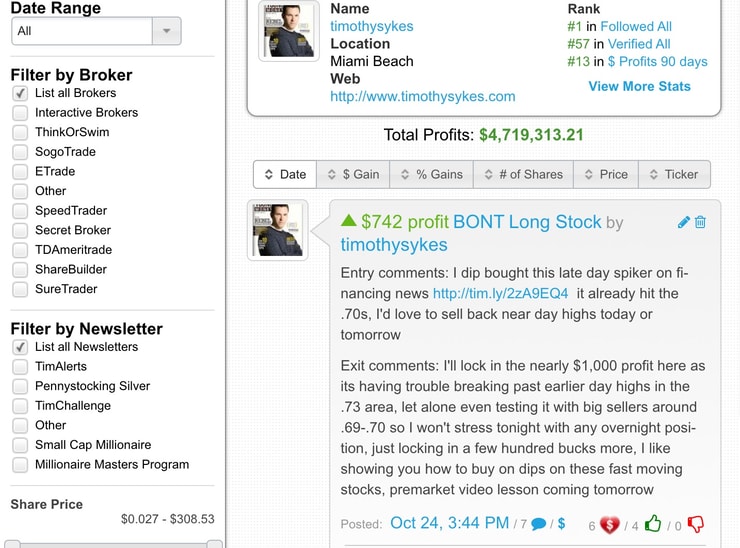

My best students and I take detailed notes, as you can see I do on every trade HERE, as we’re always adapting to the markets trying out various strategies and patterns and for traders, this process involves keeping a detailed trading journal. Never forget that successful traders track all of their moves and then optimize, optimize, optimize over time and while perfection is truly impossible, practice does make close to perfect in this industry and the one common element that all my top millionaire trading challenge students and I have in common is that we are meticulous in testing and refining our strategies to better adapt various market environments and our own strengths and weaknesses too.

This educational process is critical to your success and this is why we created Profitly and now have a section where you can even make your own blog posts and/or video lessons and watchlists too at https://profit.ly/contribute

If you think it sounds boring and cumbersome, maybe it is, but it’s your best shot at becoming successful so you’ll thank me later. There’s a psychology to every move you make, and there’s a pattern to every trade you enter and exit so as part of your education you must being to understand your own best and worst patterns, how they change, when they are successful and when they aren’t. And the only way to do this is to keep a detailed record of every move you make and then review your journal often.

This has been a CRUCIAL PART OF MY EDUCATION — not just as a trader, but as a teacher, too.

Need more proof about how important it is to document and learn from ALL of your trades? Watch this video with my top Trading Challenge student who just surpassed me in total trading profits:**

He’s a BIG believer in keeping track of various strategies and patterns and documenting everything, just like this great trader and this one too…it’s a trend!

What Should I Put In My Journal?

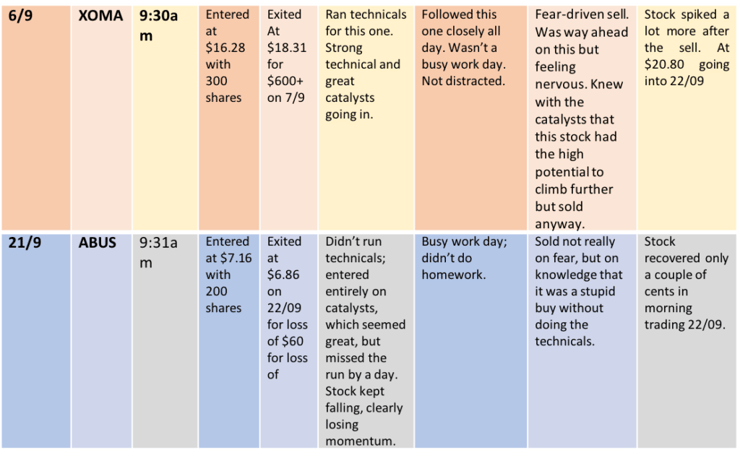

So, what are the key elements of a trading journal? Action and emotion. It should note when you entered a trade, and when you exited; your short or long position; what the stock did during that time; what technical indicators or catalysts made you enter this trade; and—importantly—what you were thinking when you entered it. Your emotional state on that day can give you insight into success or failure—so keep track. You’ve got moods, and a journal helps to establish patterns so you can better assess which days are good days to trade, and when it might be better to take a break.

Here’s a hypothetical example for someone who is a total newbie:

So, basically, if you keep a journal like this, you won’t have to ask yourself how you lost money on a trade and how you might have repeated that mistake a week later, or a month later.

Trading is a skill you learn—and keep learning—every day, even if you’ve been at it for years. There’s always something new to learn about patterns, about stocks, about the market—and about yourself.

The best way to see yourself growing as a trader is to keep a journal of your progress. And the best way to actually progress is to build on each move, which means recording each move. Otherwise you really only have a general recollection of your trades. Filling in the journal for each trade also helps you to better understand yourself in the process. It makes you dig a bit deeper into your psyche to figure out what you were thinking and why you were thinking it. It makes you examine and analyze your thoughts, not just record them for future use. So it’s useful in the present and the future.

It’s a great way to learn from mistakes; and mistakes are necessary in order to learn.

It’s also important to start the journal immediately—from your first trade. It doesn’t matter if it’s old school, with pen and paper, or digital, but digital makes it easier for you to update your journal. For instance, you might watch a stock you sold for a while and see what it did and how much you could have won or lost. A digital journal gives you that flexibility, while also allowing you to easily search it for symbols or key words.

If you’re not sold yet on the journal idea, I’ll sum up 5 benefits to having one:

#1 Easy Trade Tracking

Sure, you can see your trading history and all your moves on your broker app or website, but this isn’t enough. Your journal should have every relevant detail of a trade, and something your broker history won’t give you: The reasons you entered in the first place, and what made you exit. This is where you record your thought process, and it’s vital to your trading future.

#2 Easy Method for Reviewing Trades

The main reason for having a trading journal is ease of reviewing a fuller trading history. You can compare all your entries and develop a new strategy. If you enter all the details in your trading journal, it will help you track your profit goals and evaluate long-term risks and earnings. Are you making progress toward the goals you had when you set out? Your journal tells all.

#3 Learning From Your Trades

Every time you review your trades, you will find out what you were doing wrong, and you will learn from your mistakes. And when you learn from your mistakes, you will know how to avoid repeating the same mistake at the next trade. Also, the journal record of a good trade will help you to focus on advancing your strategy and achieving your goals. Good or bad, there’s something to learn from every trade.

#4 See the Big Picture

Not only will your trading journal give you better insight into who you are and what you’re capable of, but it will also give you a bigger picture of the market and how it works. Writing and reviewing your journal will tell what kind of trader you are, and what kind of trader you should be. It tells you what kind of stocks work for you.

#5 Score a Mental Victory over Loss

Your trading journal will help you to recognize your losses and turn them into a mental victory. If you don’t write down your losses, you leave them unresolved. A journal gives your closure, and lets you sleep.

Keeping a trading journal with all these details might seem exhausting. I know, you’re thinking that everything you need to learn to be a successful trader already seems overwhelming. But a journal will actually make your overall workload lighter. Remember, we’re all students, and students without notes are lost—and lost money.

So, if you understand what I’m saying in this post, then please leave a comment and promise me that you’ll follow these instructions and start using Profitly to keep track of ALL your trades…trust me, it’ll help you SO much in the long run!

Leave a reply