If you’re learning how to day trade, you gotta have a solid trading plan.

The markets went crazy in 2020. Opportunities were everywhere. If you weren’t prepared, it was easy to feel overwhelmed. It reminded me of how important it is to have a solid trading plan.

They say success is where preparation meets opportunity. I think this applies to trading! Create a good plan and be strict — it’s a great way to prepare for the next hot market.

Every day trader should have and stick to a plan. Goals, risk/reward, experience … consider all of these important. Your plan should represent who you are as a trader and how you’ll approach the market each day.

In day trading, It’s easy to feel discouraged. That’s one of the best times to build a more solid trading plan. For example, if you find the discipline to stick to a maximum daily loss, you could learn to avoid trading on your emotions and FOMO.

Trust the process … it could save your butt.

Now let’s talk about how to create a trading plan…

Table of Contents

What Is a Trading Plan?

A trading plan is a blueprint for becoming self-sufficient. It takes into account your trading style, account size, and risk tolerance, among other things.

In the markets, my plan is to stick with penny stocks. It’s the niche I know best. Most of the time, I only go long. My plan might not suit every trader. Someone like a Nasdaq short seller might have completely different patterns and criteria.

A good trading plan narrows down your trades and cuts out the noise. Don’t overwhelm yourself with random stocks. Be picky — focus on stocks that fit your plan.

Making a plan can be simple. While it depends on your style, I think beginners should trade penny stocks. You can study several fundamental patterns. Learn about the indicators and use them to prepare.

Don’t be lazy with your plan. But don’t overcomplicate it either. It should be easy to understand. The hard part is having the discipline to stick to it.

New to trading penny stocks? Get my free online guide here.

Why Do You Need a Trading Plan?

You need one for many reasons. If you’re lazy, you should look for a different activity. This takes a lot of work and it’s never really over. But trading without a plan can be very risky.

So to keep things simple, stick to a handful of useful strategies for you.

For example, risk/reward. You need the right formula for taking trades. You risk a certain amount of money on each trade but only look for good setups. You want better odds and your wins to cover your losses.

If you don’t use a trading plan, it could hurt your progress. You might overtrade without realizing it. A solid plan can help you stick to high-quality setups with more potential.

Losing is a part of trading. It happens to everyone. But good planning can help reduce risk and, potentially, losses. Set a maximum amount you’re comfortable losing in a day. That can teach you to walk away before you start trading emotionally.

Without a plan, how would you become self-sufficient? Some traders hold and hope or chase overextended stocks. That can be like throwing money out the window.

Put yourself in a position to grow over time. Stick to good setups, cut losses quickly, and be strict. Don’t break your rules!

Let’s take a closer look…

What Should You Include in Your Trading Plan?

- Trading goals: What’s your trading goal? As the year comes to an end, a lot of traders are considering this. Start with goals you can manage, then increase them as you get better. Where do you see yourself in a year? Your plan can help you reach that goal. Keep track of your trades, then study your strengths and weaknesses.

- Patterns: Patterns usually reappear over time. I trade a handful of penny stock patterns. Breakouts, first green day, and dip buys are all good examples. Find out what patterns work best for you, then study and practice.

- Cut losses quickly: It’s my #1 rule. Learn to accept small losses — they’re part of trading. Some traders get nervous and sell too quickly. It’s not the end of the world. If you focus on the best setups, you can potentially get back into a trade and still profit.

How Do You Make a Trading Plan? (Step by Step)

Set Your Risk Level

Using a risk level is pretty common in day trading. But what is it?

It’s the amount you’re willing to lose on a trade before cutting the loss. Let’s say you buy a penny stock breakout at $1. If the pattern shows support at 91 cents, set a stop-loss order at 90 cents. Your area of risk is 10 cents per share.

Remember to set the order below the support level, so it can test that price. If the price shows strength, it can mean it’s a good risk level.

How much do you wanna risk per trade? If it’s $10 a trade, you should buy 100 shares at the breakout. At $1 per share, that’s a $100 position. If your stop-loss order gets executed around 90 cents, you’ll lose about 10 cents per share, or $10.

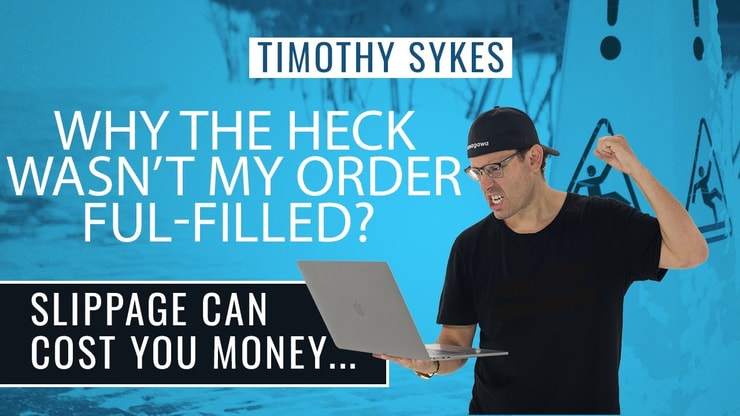

But keep in mind, there could be slippage. This can happen when your order gets filled below your stop-loss price. It can indicate there weren’t enough buyers at that price. Slippage is more likely to happen when there’s a lot of selling.

And don’t just focus on risk. Make sure the risk is worth the reward. You can’t just buy any stock that’s near a support level. Only take a trade if there’s room for it to run higher. If you’re unsure, keep studying. Focus on the best patterns, where you can potentially make three to four times your risk.

After you’ve had some experience trading your plan, consider increasing your risk. But don’t size up too quickly … this could lead to a big loss. Only increase risk when you’re comfortable and experienced.

Set Goals

Many self-sufficient day traders set goals. Here’s a common goal: “I want to make x amount of money.” Technically, there’s nothing wrong with that. But that’s not all trading is about.

Forget about the money. Instead, think long term. What are your weaknesses? How can you improve your education? Consider questions like these throughout your journey. Write them down and put them somewhere you’ll see them.

For example, maybe you aren’t that good at trading breakouts. You sell too quickly and miss the move. Your goal should be to work on patience with that pattern. Buy the breakout, set your stop-loss, and force yourself to wait longer than usual.

Achieving goals like this can improve your trading psychology. In my opinion, that’s important if you want to become a better trader.

Make your goals realistic. Don’t expect to get rich overnight. It can take a long time to become self-sufficient. If you’re just starting out, don’t try for home runs. Learn how to take singles and be consistent.

Day traders should think of themselves as students for life. We can never be too educated. The market can change fast. So evaluate your weaknesses and take steps to improve.

Ideally, you’ll be setting goals forever. Never stop grinding to achieve them!

Create a Watchlist

A watchlist is exactly what it sounds like … a list of stocks you watch. With most software, watchlists can show you data like percent change, bid and ask prices, open prices, and more. It might seem straightforward, but there’s a lot involved.

Always try to keep your watchlist updated. If you’re new to day trading, figuring out what to watch can be stressful. I think it’s important to focus on sector momentum. Fall 2020 is a great example.

That was a crazy market for trading penny stocks. The electric vehicle sector was on fire! Companies like Nio (NASDAQ: NIO) and Electra Meccanica (NASDAQ: SOLO) made huge moves.

These massive runners created a lot of sympathy plays — even OTC stocks ran on the sector hype. It can be easy to get distracted by other stocks.

Let’s say you found a good pattern, but the sector wasn’t hot. You gotta remember, most traders were watching the EV stocks. A hot sector can offer setups with higher odds. Big moves usually require big volume, which is most likely found in a hot sector.

Anyone can throw random stocks on a watchlist. But creating a relevant watchlist requires effort and knowledge. Avoid irrelevant stocks. Put the work in and create a watchlist that keeps you focused on the best setups.

Want to know what stocks I’m watching? Sign up for my weekly watchlist! There’s no cost…

Keep a Trading Journal

The earlier you start this, the better. A trading journal is where you keep track of all your trades. You can use a computer or a notebook. I recommend this for all day traders, but especially beginners.

If you don’t track your trades, how do you know what you’re doing wrong? Trading without a journal can be a huge disadvantage. You can try to remember everything, but it’s too difficult.

Document all the lessons you learn, especially from losses. These lessons are valuable for getting better. Don’t just write down the numbers … talk about your thought process.

Over time, you’ll get a better idea of your strengths and weaknesses. You can see your success rates with different patterns. There are also stats like average winner/loser and biggest gain/loss.

Some traders go to extremes with their trading journal data. That’s great, but it doesn’t have to be complex. Write down simple things like the stock name, your entry, and your exit. Include a few sentences about each trade. Then, categorize them by the type of pattern.

Keeping a journal is a simple, low-budget way to improve your trading. It’s pretty lazy not to keep one.

Start using a trading journal. It’ll be worth it down the road.

Apply to the Trading Challenge

I created my Trading Challenge so that I could become a hands-on mentor. I teach my students how to day trade penny stocks.

The Challenge is for traders who are determined to learn self-sufficiency. Not everyone can join — I only want the hardest workers. If you think you meet the standard, consider applying.

If you’re accepted, you’ll have instant access to tons of educational material. There are hundreds of video lessons, webinars, and more.

You’ll also have access to my Challenge chat room. It’s a community of traders working toward the same goal: becoming self-sufficient.

I’m a completely transparent trader and teacher. That’s pretty rare in this industry. I post all my trades on Profit.ly and discuss my trading plans. You can study my good trades and learn from my mistakes.

This year, I passed $6 million in profits using the same patterns I teach my Challenge students.* Some of my top students have achieved six- and seven-figure profits by using my lessons.*

If you have the dedication, this community could be a great opportunity to become a better trader.

Apply today and start your journey!

(*These results are not typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Example of a Trading Plan

This is how you make a good trading plan…

- Set goals: Goals are the backbone of every well-crafted plan. Challenge yourself to grow. Make sure the goal is reasonable, but also make sure you’ll be proud when you achieve it. As you start to gain experience and knowledge, adjust your goals. Keep working toward getting better.

- Determine your risk management: Based on your trading goals and account size, find a risk amount that works for you. Start small and never risk more than your plan calls for. For example, a small account could risk around $10 on a good setup, looking to make $30 or more. If you stay strict, one win should cover at least three losses.

- Know your patterns: Breakout, dip buy, and first green day are all good examples. But regardless of your style, stick to a handful of good patterns. I recommend writing them down and putting them somewhere easily visible. Study them constantly. Focus on what makes them work. Don’t trade patterns outside of your trading plan. Wait for only your patterns. Patience is part of the process and it can keep you safe.

- Keep a trading journal: Record all your trades. You’ll thank yourself in the future. You can learn so much from studying your mistakes. Your journal should include no less than the name of the stock, entry, exit, profit/loss, and the setup. Don’t slack. Putting the work in now can serve you well throughout your career.

The Trading Plan Conclusion

Read this post whenever you need a refresher on making your trading plan. You gotta remember these lessons.

It’s impossible to be a perfect trader. But many of the best traders have something in common — they plan every trade. They don’t deviate from their process. Learning to be disciplined is one of the hardest parts of day trading, but it’s a must.

Choose your risk level. Remember … It’s a marathon, not a sprint. Get some experience under your belt before you try sizing up.

Create realistic goals. As you become a better trader, adjust them accordingly. Never get complacent. Improvement is a constant battle.

And keep a trading journal throughout your journey. It can help you learn from your mistakes. In the future, you can look back at the progress you’ve made.

This journey isn’t easy, but it can be done. Study hard and never give up!

For less than $100, you can make a smart investment in your trading education … Get in my 30-Day Bootcamp today and start building your trading foundation!

Do you have a solid trading plan? Let me know in the comments!

Leave a reply