This is a special edition of the Millionaire Mentor Update … it’s a lesson on goals!

Yes, I’ll share a few trades with you. But instead of answering student questions this time, I want to get you thinking. What I want to share with you may sound a little counter-intuitive. But it’s extremely important if you want to be both rich AND happy. So read on…

As always, I need to acknowledge that trading makes my life possible — my travels, charity work, and all I do as a teacher. My first job is still trading. It’s no longer my primary job — but it’s my first job. I want to teach you, but only if you’re willing to work hard. If that’s you, apply for the Trading Challenge today.

Table of Contents

Santorini Is Awesome … Except for the Wi-Fi

So I’m in Santorini. I’m here talking with local animal shelters, trying to trade, and trying to keep up with my teaching duties.

I was supposed to do a special four-hour live Q&A webinar with one of my top students, Huddie, on July 9. But the Wi-Fi is so bad where I’m staying, we had to cancel the live session and record it. Luckily we had well over 100 student questions lined up in advance.

If you’ve never been to Santorini, it’s beautiful. The whitewashed buildings, the view of the Aegean Sea from the clifftops — it’s all stunning. The other side of the island slopes down to sea level where you can find great beaches and resorts. If you like to travel as much as I do, add it to your bucket list.

Also, in keeping with my travel tradition … I’m eating way too much Greek food.

As always, I’m ready to trade if the right opportunity presents itself. But with sketchy Wi-Fi, you have to be careful. So I really only took a few trades in the early part of the week. I finally found a place with a good connection — I’ll talk about one of those trades next time.

For now, here are my sketchy Wi-Fi trades…

Lessons from Recent Trades

Kraig Biocraft Laboratories, Inc. (OTCQB: KBLB)

The first trade is our good friend Kraig Biocraft Labs. You might remember KBLB from earlier this year. After a positive press release, it was the strongest stock in the market for most of May.

After losing roughly 50% of its early-May gains over a four-day period, KBLB slowly climbed right back to its highs.

Take a look at the 1-year chart for an idea of why KBLB keeps finding its way onto my watchlist this year:

KBLB ended up on my watchlist again on July 8. As I considered the trade, it had three things going for it:

- It was a recent runner.

- It was testing multi-week highs.

- It was gapping up on news of an upcoming shareholder meeting.

So I took a small position with a goal of selling into a breakout in the low 50-cent range. I took profits into a little spike — not as much as I wanted, but I was happy to take the single.

Here’s the chart:

By the way, if you’re new to reading stock charts, check out this post on how to read stock charts. I bring up that particular post because it featured KBLB, and it can help you get up to speed on the basics. Also, reading charts is an essential part of trading.

As you can see from the chart above, it didn’t spike like I expected. Instead, it dropped hard. That’s exactly why you can’t hold and hope. When a breakout fails, you have to exit quickly.

Rule #1: Cut losses quickly. In this case, I cut for a small profit before it tanked. When a trade doesn’t go the way you want, get out. Especially if you’re new or trading with a small account.

On to the second trade…

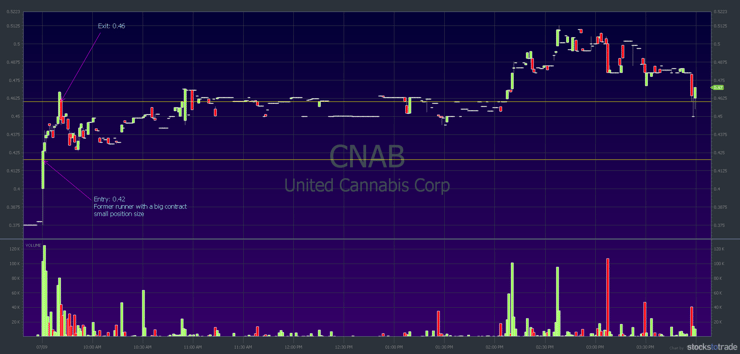

United Cannabis Corporation (OTCQB: CNAB)

United Cannabis announced a big contract roughly an hour before the market opened on July 9. As a result, the stock was gapping up. I figured it was worth a shot for a big spike. But I took a small position size because those types of moves can be quick.

Let’s take a look at a 1-year chart first:

Notice that CNAB is a former runner with a history of overnight gap ups. Also, notice the huge volume bar on the far right. There was only one day with higher volume in the past year. That kind of volume spike tells you there’s a lot of interest in the stock.

Now take a look at the chart from July 9 — the day of the trade:

As you can see, it did spike and it was quick. I had a nice 9.52% gain in just over 10 minutes without getting greedy. This is why I love penny stocks!

With CNAB holding near its highs in the late morning, I alerted a potential re-buy into the market close. As it turns out, it was more of an afternoon breakout that dropped back to midday support. Some students reported successfully trading the breakout.

Now, before I get to the big lesson for this edition of the update…

I want to reiterate that I find stocks using StocksToTrade. Both KBLB and CNAB popped up on one of the built-in scans. Plus, the news catalysts I shared with you were right there in the software.

And now…

An Important and Counter-Intuitive Lesson on Goals

I recently posted this tweet and it got some interesting responses:

Never do anything just for the money alone, instead you must prioritize FREEDOM first!

— Timothy Sykes (@timothysykes) June 12, 2019

I got to thinking about it after reading the responses. It made me realize how important that idea is: to prioritize freedom over making money. In the end, I made a video lesson about it for my Trading Challenge and PennyStocking Silver students.

Because it’s so important I want to share the general idea here on the blog. Bear with me for a minute…

More Breaking News

- European Wax Center Signals Confidence with Financial Projections Boost

- Huntington Bancshares Misses Q4 Earnings Estimate Amid Turbulent Market Conditions

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

How to Prioritize the Freedom to Live Your Dream Life

I want you to prioritize freedom, but let me clarify…

I used the word freedom in my tweet because I know a lot of people want to make a lot of money. And money is part of it. But I don’t think money should be your focus. Money won’t make you happy.

What I want you to do is prioritize your dream life. For you to live your dream life, it will require money.

So, what gives?

The reason I say to focus on your dream life over just making money is because I know a lot of miserable rich people.

That may sound counter-intuitive to some of you. But it’s true.

Check this out…

On one hand, you have those who are miserable because they have next to nothing and struggle to make ends meet. It’s scary and stressful. Then you have some rich people who have anything and everything they want … and they’re also miserable. Maybe it’s not as scary or stressful, but they’re still miserable.

A lot of those rich folks are bored. They’re shocked that they focused everything on making money, and the money didn’t buy happiness.

I can’t tell you how many rich people I know who are like this. It blows my mind that they won’t talk about it publicly. Also, our society values ‘getting rich’ above pretty much anything else.

So here’s my point…

Money can give you the freedom to do what you want — but you need to have a purpose. Otherwise, you can end up just another miserable rich person.

In Search of My Next HAPPY Millionaire Student

Look, I’ve been there. I was one of those unhappy millionaires without a purpose. It sucks.

I know. You’re probably thinking, “Oh, you poor millionaire … that’s so sad.” Cue the eye-roll, right?

I realize it sounds bad. Believe me when I say I want you to get rich. But I don’t want you to be in a position where you’ve sacrificed everything for that one goal while your life has no purpose or meaning.

For me, I found a purpose when I started doing charity work. Suddenly, my whole life made sense. It was like the circle was complete.

Yes, I still get to enjoy beautiful hot tubs like the one in that tweet. (By the way, that’s Villa Honegg in Switzerland if you want to add it to your vision board.) Yes, I still get to help change the lives of my students. And yes, I still get to trade. But my purpose and my passion is charity.

If I focused only on making money, I could probably be a lot richer. I could even give more to charity. But I wouldn’t be happier. I spend time and energy on the things that make me happy. My accountant thinks I’m crazy.

Thing is, I’m a better teacher when I’m happy. I’m better all around when I’m happy. So freedom in the form of my dream life is my priority.

Anyway, when I talk about the search for my next millionaire student…

I’m NOT looking for somebody whose only focus in life is money. I’m looking for someone who understands that money can make your dream life possible.

Your dream life. Not mine. YOURS.

I’m so proud of my top students because they seem to all have their heads in a good place. And that’s what I’m looking for in all my students.

I don’t want you to just be my next millionaire student … I want you to be my next HAPPY millionaire student. Yes, that means you have to do the work to make the money. But what happens if and when you succeed?

That’s why my teaching focus is NOT on how can I get more students. It’s not even how I can get more rich students. My focus is on how we can do this the right way so you can be mentally prepared for your dream life.

So I want you to think a little bit more about what you want in life instead of just money. I’ve seen a lot of millionaires with nasty habits. And a lot of them developed those bad habits to try to cope with their utter disappointment at being rich.

Ready to think outside the box?

Think counter-intuitively or it will catch up with you. Be prepared to overthink it a little. Most people don’t think about it enough.

Just like I tell my Trading Challenge students: preparation is key. Overprepare for the stock market battlefield. Overprepare for your dream life. I want you to live your best life — even after you get rich.

Look, I’m not saying you should be living paycheck to paycheck or month to month…

… that’s no way to live.

I’m saying prioritize your dream life and think about it. A lot. Make the money so you can have your dream life. Then the money can fuel your purpose instead of being a drag.

I want you to be happy. So please, again, spend time thinking about what that means to you. You can be so much happier in the long run if you make your money the right way and have a purpose in your life.

Trader or not, please comment below. I want to know what your purpose is. Even if it’s not 100% clear yet, what’s your passion? Not mine. Yours. What’s YOUR dream life?

Leave a reply