Your trading chat room is key … The right chat room can help you learn to trade smarter.

There’s no denying the coronavirus pandemic is scary. But it’s also creating massive opportunities in penny stocks.

For example…

I’d just finished my Trading Challenge webinar on March 16 when a student alert in the chat room caught my eye.

I’d already had a decent trade that morning on Waitr Holdings Inc. (NASDAQ: WTRH). I wasn’t looking to trade again … Just as I was exiting the webinar, my student schultzy sent out an alert about No Borders (OTCPK: NBDR)…

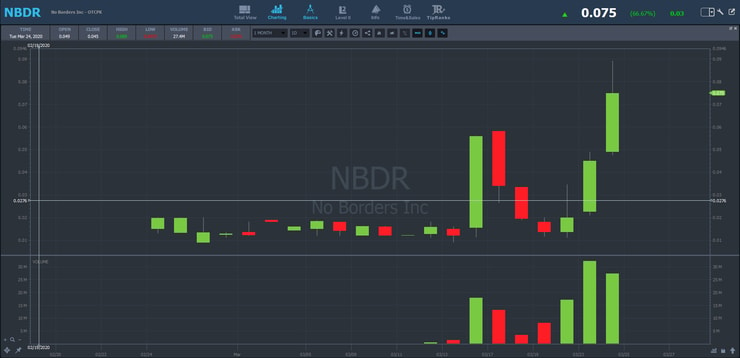

This stock had coronavirus news about an at-home test and was spiking. I acted fast. At 1:38 p.m. schultzy commented, and I entered the position minutes later.

I put in a little over $1,000 and made over $1,000 in minutes.*

(*Please note: my results are not typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

I’ll break this all down in more detail in a bit. First, let me say…

Table of Contents

The uncertainty and fear around the coronavirus pandemic have created a level of opportunity I haven’t seen in several years.

The sector momentum of coronavirus plays has lasted far longer than people expected. The closest comparison, in recent memory, is the bitcoin run in 2017.

Several of my top students capitalized on that crazy run … but plenty missed it. They weren’t prepared.

But my most dedicated students — those in my Trading Challenge — have learned from previous sector momentum. Many of them are nailing the wild coronavirus run.

If you’re new, you may not nail your first sector run. Most of my top students missed the first few sector runs they encountered. Don’t be discouraged. Study the charts and learn from them. There will always be another hot sector.

Use this opportunity to learn…

How to Find and Trade Hot Sector Stocks

At the beginning of 2020, I thought biotech stocks would be explosive. Many were beaten down from years of neglect and disappointing drug results.

I’ll be honest … I didn’t think they’d be this HOT. And nobody could have predicted a worldwide pandemic.

I tend to underestimate the spikeabilty of stocks. I like to take a conservative approach and lock in small, predictable gains. But many of my students are more aggressive and report making more money than me the past several weeks.*

My top student, Tim Grittani, recently passed $10 million in total trading profits.* That’s nearly double what I’ve made trading the last 20 years. His dedication and generosity to the community is a gift. If you’re in my Trading Challenge, make sure you check out the special GRITTANI ticker. (Check it out here.)

[*Students’ results are NOT typical. Roughly 90% of traders lose. Always remember trading is risky, and never risk more than you can afford.]

More Than a Chat Room

Get in the right trading chat room. It’s not just traders sharing hot stocks or talking smack. My chat rooms are communities. They’re about traders supporting traders — answering questions, celebrating wins, commiserating over losses, and sharing key tools. Just make sure you follow the rules when you get there.

Here’s an example of how great this community can be…

Lately my students are finding 100%+ runners because of coronavirus press releases. These press releases can be hard to spot if you don’t use the right tools. On March 16, in the wake of the coronavirus market crash, one of my students found a BIG winner in the market, NBDR.

So how did schultzy spot the NBDR spike?

By using StocksToTrade’s news scanner. The company released coronavirus news, which caused the stock to spike 367%.

When’s the last time you saw a large-cap, ‘real’ company spike that much in a day? I never have. Wall Street loves to scoff at these plays. Let ‘em ignore these opportunities. My students and I will keep nailing them.

Because we use the chat rooms to share the key tools that help us find these big runners…

That’s how you can learn to make money in penny stocks in ANY market. While the big traders on Wall Street are panicking because of the historic decline, penny stocks are on fire.

But you gotta be careful and watch for…

I have to give props for the hot stock pick on NBDR.

I would’ve missed this play if it wasn’t for my student schultzy (I hope you’re reading this!). Now, schultzy isn’t one of my top students … But you don’t need to be to take advantage of these plays. Here’s his simple alert from the TimChallenge chat room:

schultzy: “NBDR CV [coronavirus] news.”

I know a lot of people think trading chat rooms are full of noise. But when you have so many people watching stocks and looking for news, it can be a huge edge.

I have two chat rooms — TimAlerts and TimChallenge. All of my top students are in the Challenge. The Challenge chat room is a little different. These students have access to all my DVDs, video lessons, and webinars. They also have access to Grittani’s DVD and webinars.

The Challenge chat is a beautiful community. TimAlerts is awesome too — don’t get me wrong. But the Challenge students have access to all my educational materials, plus there’s a meatier upfront investment. So students tend to be more committed.

PSA to Challenge Students: Appreciate how good the chat room is every day. It’s one reason I think everyone should be a Challenge student. Especially now when we must self-isolate until the pandemic fades away. This is a great time to learn and get ahead in the world.

I understand it’s difficult for everyone to be that dedicated. People have other commitments that can make it difficult to dedicate time every day to study. Ask yourself how bad you want it … What are you willing to sacrifice?

The best rewards are earned over time, but most quit too early because the journey is hard and then they miss out…what will you do?

— Timothy Sykes (@timothysykes) March 14, 2020

Back to NBDR. Like I said before, I made a little over $1,000 on the play with a small position. It’s crazy how fast these stocks can spike. Within minutes I was up over 100% on my money. I bought NBDR in the $0.02s and sold into the $0.05s. (See my verified trade here.)

And for those of you wondering, here’s…

When I’ll Trade Midday

I don’t usually trade midday. The patterns are riskier. There’s less volume than the morning and afternoon sessions.

I scheduled my weekly webinar with Challenge students midday because of the slower action. My plan was to take time to answer all the Challenge student questions. That way, I’d be focused on the webinar and less tempted to trade.

During the Trading Challenge webinar, one of the most frequent questions was…

When do I trade midday?

When there’s breaking news. I wouldn’t trade anything with news from the morning. There can be so many fake breakouts midday. It’s harder to trade the patterns I talk about in my library of 6,300+ video lessons.

The webinar was great. I love spending time answering all of my student’s questions. And as I was signing off the webinar, I glanced through the thank-you messages coming in from the TimChallenge chat room.

That’s when I noticed schultzy’s comment on NBDR.

Why I Love My Trading Chat Room

My student schultzy reports being up $772 — but he’s a dedicated student. We don’t discriminate based on profits in my chat rooms.

I wish I’d seen the message before I closed the webinar so people could see me trade NBDR live. Watching people trade live is one of the best ways to learn. That’s why being in the Challenge is so important to your trading education.

When I first saw the message I thought…

… NBDR? I’ve never heard of this stock…

Then I pulled the stock up on StocksToTrade. StocksToTrade has awesome news and SEC filters to help traders find the most relevant news. Sure enough … six minutes earlier, NBDR released news about an at-home coronavirus test.

I took a smaller position than I normally would’ve on this trade. I don’t like chasing stocks and I was about six minutes late seeing the news. But the sector is red hot so I thought it was worth the risk.

Watch this video lesson to understand my entire trading thesis on NBDR:

Wall Street mocks these types of trades. I made a little over $1,000 on it. I don’t know about you, but I’ll take that trade any day. Small gains add up over time.

The best part? Anyone can take this trade if they’re prepared. And those who really understand the past know that…

More Breaking News

- TeraWulf’s Strategic Expansion Ignites Market Interest

- Exponent Stock Boosted by Strong Q4 Performance and Dividend Hike

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

- Credo Technology’s Blue Heron Surge: What It Means for Investors

NBDR has been on my radar every day since the company’s first coronavirus press release. As long as this sector stays hot, I’ll keep my eye on any stock with coronavirus news. To date, I’ve taken three additional trades on NBDR.

Stocks in a hot market aren’t one-day wonders.

People thought NBDR was done once it faded off for a few days with no additional news. I kept the stock on my watchlist and waited for the company to release more news. I’d never buy a stock anticipating the news. I wait until the news is released and the stock starts spiking.

How many times have you seen a company release news only for the stock to dump?

It happens all the time. It’s called “buying the rumor, selling the news.” Too many people fail to understand this basic pattern … study it here.

My patience paid with NBDR. The three additional trades added $1,577 to my profits* and NBDR isn’t done yet…

Again, the first trade I picked up from a student in the chat room, but the following three were a result of my preparation. Check out all my NBDR trades and thoughts here.

Wall Street’s Wrong About Penny Stocks

Let Wall Street and the big funds laugh about making $1,000 on a trade. My students and I would love more 100%+ trades — especially when they take less than 10 minutes.

I remember one time I was sitting on a stage with big hedge fund managers and traders at a conference. I have a big mouth, so I end up on these stages a lot.

On that specific day of the conference, I made $350. I was satisfied. $350 a day won’t make you rich, but it’s enough money to make a difference in people’s lives. So there I was … on stage talking about my awesome $350 trade … and the other people on the stage started laughing.

They were making fun of me, thinking I only made $350,000 that day. That’s right, 350 THOUSAND. So I had to emphasize that I made just $350. These big Wall Street players were visibly shocked. Some were completely stunned.

These traders and investors will never understand. To them, penny stocks are a waste of their time. This gives us an advantage.

If Wall Street doesn’t want to touch penny stocks, there are fewer big traders playing these stocks. And if you’re one of my students, you can learn how to ride the momentum of these moves.

Penny stocks offer the best opportunities in the entire stock market. Interested in learning how to take advantage of penny stocks? Apply to my Trading Challenge Today.

Props to My Students

NBDR wasn’t the easiest trade — you had to be fast. Executions were tough and the spread got crazy once it was up over 300%. But plenty of my students report nailing it. Huge congrats to everyone listed below.

From the Trading Challenge Chat Room

March 16

1:38 PM schultzy: “$NBDR CV news.”

3:56 PM nbn707: “sold some $NBDR at 0.0526 from 0.0436.”

3:59 PM nbn707: “$NBDR sold 3/5 at 0.053 avg from 0.0436, holding remaining o/n.”

4:03 PM Fiona1015: “$NBDR: Holding 7.5K at 0.041 overnight since it is a first green day OTC with great news.”

4:06 PM malquist: “out $nbdr .052 from .0476. nice little 26 dollar gain for my second trade ever.”

March 20

2:23 PM schultzy: “$NBDR news.”

2:30 PM schultzy: “in $NBDR $0.015. Out at $0.0278. wanted to get greedy but forced myself to sell.”

3:03 PM Luke_Fenwick: “also dip bought $NBDR at .022 out at .0231 for small win. bad execution.”

Think you can cut it in my Trading Challenge? Apply today and find out.

More Comments From the TimAlerts Chat Room

March 20

2:30 PM MichaelGoode: “definitely don’t chase $NBDR — poor r/r up here — good sell point.”

2:31 PM Mcisek13: “$NBDR in @.0128 out at .027.”

2:33 PM Mcisek13 → Noncha1ant: “I dip bought it before the PR thinking they’d update something on a Friday. Yikes early sell there for $NBDR but i’ll take my $1400.”

[Students’ results aren’t typical. These students put in the time and dedication and have exceptional skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

Conclusion

NBDR is only the latest example of a news-based play. The coronavirus sector is hot right now. There will be more plays — study up and get in my chat rooms.

I would’ve missed this opportunity if it wasn’t for my trading chat room and my student alerting the news. It’s a key lesson that you don’t have to be the fastest or first to a play. As a trader, you simply need to understand the patterns and know when it’s time to place a trade.

Not every news release is worthy of a trade. If you want to find the best plays, you have to be using smart tools like StocksToTrade.

Keep up the great work, everyone. 2020 is turning out to be an incredible year for the penny stock market. Please, stay safe and study up as we ride out this pandemic.

What are you doing to prepare for your next trade? Comment below — I love to hear from my dedicated students!

Leave a reply