The 2020–2021 hot market has been EPIC for OTC stocks.

I’ll be the first to admit that OTC stocks are sketchy. Many of these companies are complete crap. But if you can learn to trade carefully, OTC stocks can offer insane opportunities.

We’ve seen OTCs run hot before, but I’ve never seen a run like this recent one. It wasn’t just one single sector like the 2018 weed run … Energy, electric vehicles, and other sectors ran too!

If you’d studied and prepared, you likely found tons of great setups to nail. But you also know that OTC momentum can fade fast.

It’s all part of the cycle. So while it’s slow, study up. Grind hard and prepare for the next hot OTC market. Remember…

Table of Contents

Many Top Traders Crush OTC Stocks

I know several top traders who started their trading careers in my Trading Challenge with OTC stocks. Why OTCs?

I think they’re easier to understand. Trading them relies more on technical analysis rather than deep dives into financials. Making a trading plan can be easier with OTC stocks.

One of my first millionaire students, Tim Grittani, grew $1,500 into over $13 million.* His explosive start in the OTC market is a big part of his success.

And over the past year, there’s been a flurry of Challenge traders hitting the millionaire milestone.* Jack Kellogg, Kyle Williams, and Matthew Monaco NAILED recent OTC runs.* And they each credit OTC stocks with helping kickstart their journeys.

(*Trading results are not typical. Individual results will vary. Most traders lose money. These top traders and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

OTC stocks will always be some of my favorite plays. They can run for multiple days — spiking hundreds of percent in the process.

But as soon as these stocks slow down, I adjust my approach. I stick with A+ setups. And I always cut losses quickly — it’s rule #1 for a reason.

A slow market is a great time to study. Use it wisely to learn…

How to Play It Safe With OTC Stocks

It’s important to understand that 99% of OTC companies are crap. That’s why I don’t invest in them. If I swing them, it’s rarely for more than one night. I mainly stick with day trading them.

Only trade OTC stocks if you have a plan. I only use a handful of trading patterns because I like to keep it simple. No need to overcomplicate trading with unreliable patterns.

The trading patterns I prefer tend to repeat over time. If you study and practice for long enough, you can learn to spot the indicators.

But like I said, I never invest in OTC stocks. They get suspended and halted left and right … It’s like the Wild West. But if you can learn to nail and bail, these stocks can be lots of fun.

Start by learning a few basic patterns like a breakout, first green day, or panic dip buy.

This is a great time to study up and prepare to trade through any kind of market. Get my no-cost “Volatility Survival Guide” and get to work!

And one more thing…

Learn to Take Singles and Lock in Profits

I aim to lock in profits fast — sometimes too quickly. I rarely time the top perfectly. And I don’t try to sell at the top. When I make a trading plan and alert my students, I always emphasize my price targets. Most of the time, I’m looking for a predictable 10%–20% move.

If the stock follows my plan, I lock in a single. If the stock doesn’t behave as I expect, I cut losses quickly. That keeps my losses small compared to my wins. And it can help prevent newbie traders or those with small accounts from blowing up their accounts.

Now, let’s get to the 5 Ps of OTC stocks…

More Breaking News

- QuantumScape’s Stunning Stock Surge: What’s Next?

- Is SoundHound AI Stock Ready for Takeoff?

- APLD Shares Skyrocket: What’s Driving the Surge?

#1. Keep Things in Perspective

Again, the majority of the time I exit positions too soon. Then haters always say…

“Tim, what’s wrong with you? Why don’t you have diamond hands?”

Sure, OTC stocks can keep going. But I’d rather lock in singles. These crap companies have terrible fundamentals and are usually worthless. They typically only run on a press release.

Here’s a great recent example with World Series of Golf, Inc. (OTCPK: WSGF).

WSGF was a textbook OTC breakout in the making. But you must be aware of the overall markets. When it looks like they’re on the verge of crashing, people aren’t as confident in holding.

It’s all fun and games until the stock you’re in dumps over 50%.

This is why I lock in profits quickly. You never know what can happen. Singles add up — don’t underestimate them.

My best tip for aspiring day traders? Pay close attention to the market as it transitions from hot to cold. It’s one thing to read about it, but experiencing it can be far more valuable.

You’ll probably see some OTC stocks try to run higher. But just because a stock is a former runner doesn’t mean it’s a smart trade in this market. Stay safe out there. Here’s another example of why perspective matters…

Brewbilt Manufacturing Inc. (OTCPK: BBRW)

First, check out the one-year chart:

BBRW was a strong runner last year, hitting a high of around 9 cents. Since then, it consolidated in the sub-penny range and set up for a breakout above 1 cent.

It looked like a good opportunity in the making, but the play fizzled out quickly. BBRW couldn’t even make it past 2 cents, let alone push toward previous price levels.

I’ll say it again: 99% of OTC stocks are trash. They can offer great trading opportunities but are terrible investments. Keep things in perspective.

One way to do that is to…

#2. Learn From the Past

OTC stocks are hit and miss. They’re usually great the first few months of the year because of the January effect … Then they die off. Since the market’s cyclical, you must learn from historical examples to prepare for future OTC runners.

Nobody said this job was easy … you must constantly educate yourself and adapt.

Let’s look at a killer breakout chart from early February…

After BRLL broke out over 1 cent, it rocketed to almost 90 cents. That’s the kind of madness you can see with OTC stocks. Traders buy them up like crazy, which can sometimes lead to INSANE multi-day runs.

Here’s a breakout chart from early March, as the madness fades.

As you can see, the breakout failed before it got going. WSGF had a strong first green day out of consolidation. It looked like the next hot pick…

But if you’d been trading for long enough, you know that OTC stocks lose momentum. The question isn’t if they’ll drop — that’s inevitable. It’s when they’ll drop.

Want to better understand my trading mindset? Get “The Complete Penny Stock Course” by my student Jamil to learn my approach.

These moves don’t surprise me. And because I’ve seen it so many times, I often play it too safe. That’s why #3 of the 5 Ps is key too…

#3. Know the Patterns

These examples are making their way through my “PennyStocking Framework” DVD. It may be a few years old, but the patterns still work.

It blows my mind that some students complain about not understanding the patterns. But they don’t study the most basic lessons. This DVD lays it all out. Study it. (It’s also one of the bonus features of my ridiculously low-priced 30-Day Bootcamp.)

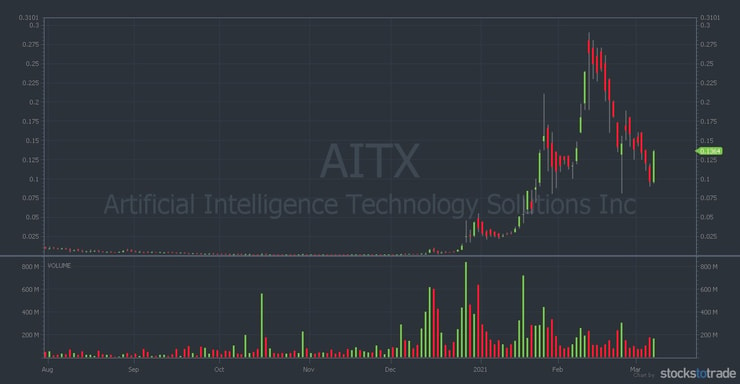

Here’s an example … Artificial Intelligence Technology Solutions Inc. (OTCPK: AITX) recently had a run-up from a 5-cent breakout to almost 30 cents. Then it went red for about a week straight, with several dip buys along the way.

It hadn’t really bounced (yet). But this was a strong runner … I had a hunch that it would try, even though the markets felt dead.

AITX was entering the sixth stage in my PennyStocking Framework.

The stock released contract news on the morning of February 5, which gave even more confidence for the bounce. But after stuffing the 11.5-cent level, AITX faded the rest of the morning. I made a small gain on it.*

I forgot about AITX. Then, this breakout happened. Check out the chart…

So I was right about the bounce … But I made a rookie mistake and forgot about the chart.

This is why it’s important to know the patterns. I’ve seen this happen again and again — a stock finds a new bottom and bounces. But I lacked patience that day.

Learn some of my top trading patterns in my FREE guide to penny stocks.

When you’re ready for more, you can study all my lessons on morning panics. When you make your education your top priority, you can…

#4. Be Prepared

Preparation is everything in OTC stocks. Case in point: Bayport International Holdings Inc. (OTCPK: BAYP). This stock ran from $10 to $14, then had a strong gap up. Check out the monster run on the chart…

After it went parabolic to almost $29 in the morning, I was hoping for a dip buy opportunity.

I recognized it was overextended. But the sell-off was so rapid, I had to give it a shot. This is what I look for in a panic dip buy.

Some might look at this chart and think, “Tim, you missed the big move.” But it was choppy, pretty illiquid, and the overall markets were slow.

And since I was prepared, I had two profitable trades — one in the morning, and one on the afternoon dip.* I didn’t need to overstay my welcome to lock in these singles.

Remember: preparation is key. Spend more time studying the past. Immerse yourself in the patterns. Don’t stop after learning the basics … focus on the details.

Doing this can help you learn to…

#5. Adapt to the Present

I’ve been trading the same patterns for over two decades. But that doesn’t mean they play out exactly the same every time. It doesn’t work that way. You have to learn to adapt to the present, especially when the market shifts.

Some traders lose morale when their patterns and setups change. But if you want to become self-sufficient, you need patience. If you expect the market to always be red-hot, you’ll probably get crushed.

The moment you stop learning is the moment you start losing.

Too many inexperienced newbies fail to adapt and start giving back profits. I’ve seen it happen so many times.

Learn to trade what the market gives you now. If things are slow, STUDY and tweak your setups.

Don’t overcomplicate things. Stick to the rules and guidelines, learn the material, and break the cycle of the losing majority.

Bonus: Panics — Don’t Be Desperate for Dip Buys

I want to make something very clear about dip-buying … It’s not about buying the first dip.

Too many people make this newbie assumption after watching one or two video lessons. It’s not that simple.

There’s a reason I have over 7,000 video lessons. My top students study them all. Mark Croock watched each of them three times. If you want success, you have to work hard for it and study. It’s that simple.

Sadly, a lot of people don’t prepare. Dip buying doesn’t work every time. But if you study more, you can better understand how to adapt to the market.

When a dip fails, people freeze, “Um … why isn’t this bouncing?”

OTCs don’t have to bounce! Look at those charts again. You think you’re guaranteed a bounce? Please. That’s not how it works.

Don’t be desperate. These stocks can be up BIG. And then people try to dip buy them when they’re only 10%–20% off their highs … They think they’ll go right back to the highs.

Does that happen? It can. But stop trying to predict and start learning how to react to patterns. Newbies learn the wrong lessons when they dip buy a speculative OTC and it bounces back to highs. They start to think…

“Oh, this is easy. I can do it every time.”

Then they’re unprepared when a stock doesn’t bounce.

Play it safe. Conserve your mental capital and your real capital. It’s impossible to trade when you don’t have any capital.

The Trading Challenge

Here’s the reality … most traders lose money.

I want to help change that. So I can teach you everything I’ve learned in 20+ years of trading to help you become a self-sufficient trader. That’s what my Trading Challenge is all about. But you have to apply — I don’t want lazy traders.

I teach my students how to think for themselves. It’s how they find the strategies that work for them and adapt them to trade in any kind of market. I’ve made over $6.8 million in profits.* And now multiple traders have gone through the Challenge and made six and seven figures in trading profits.*

These traders make the most of every resource in the Challenge — DVDs, webinars, video lessons. They learn from my process, wins, and mistakes as I share every trade in the Challenge chat room. I’m proud to be transparent. It’s rare in this industry.

The Challenge is your opportunity to learn from me, multiple top traders, and an amazing group of peers. Ready to work your butt off?

Apply for the Trading Challenge today and start your journey!

(*Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Conclusion

Keep OTC stocks in perspective. You can’t expect all bounces to work perfectly. Nor should you expect these sketchy stocks to go back to their highs.

These are newbie mistakes. You set yourself up for failure when you aren’t prepared or you have the wrong expectations.

I want to keep you safe and see you succeed.

It sucks if you get stuck in a stock that completely collapses. Especially if you have no idea of what’s happening because you’re underprepared.

Overprepare like all the traders who are now Challenge chat room moderators — Tim Lento, Tim Grittani, Matt Monaco, Mariana, Jack S., and so many others.

Be obsessed with studying. Know these charts inside and out. Study up.

What do you think of OTC stocks? Leave a comment below. I love hearing from dedicated students!

Leave a reply