Covered call, puts, options straddle, strike price — I’m not speaking in code. These are terms options traders use every day.

The terms I use are ‘buy’ and ‘sell.’ Those probably make more sense to you, right? I’ll bet you already know what both those words mean … But your education is important to me. And options trading may be your bag…

My millionaire student Mark Croock found success with options — he even started teaching it.* I’ll share more on that later…

Today, I’ll cover (pun intended, sorry) what is a covered call and an uncovered call? And I’ll give you the covered call formula and an example.

Let’s break it down…

Table of Contents

- 1 What’s a Covered Call?

- 2 Covered Call Examples

- 3 Covered Call Strategies and Tips

- 4 How to Place a Covered Call

- 5 Can You Profit From Covered Calls?

- 6 Frequently Asked Questions About Covered Call

- 7 Advantages of Covered Calls

- 8 What Are the Risks of Covered Calls?

- 9 How Does a Covered Call Work?

- 10 Apply for the Millionaire Challenge

- 11 Conclusion: Is It Possible to Make Money From Covered Calls?

What’s a Covered Call?

A covered call requires two separate transactions. First, you gotta buy a stock … Then you sell someone else the right to buy them from you. For a premium, of course.

Here’s how it works…

Typically, you buy a stock because you expect its price to go up. But some stocks move sideways more than they move up or down. Especially the higher-priced large-cap stocks…

So you buy the stock now to hold it as a long-term investment strategy. You think it has the potential to go up in the future, but you want to make some money off it in the meantime.

You can sell call options while the stock is consolidating. If it moves sideways in the short term, you can profit as you wait for the price to rise in the long run.

Basically, you’re selling someone else the rights to your shares, at a future price, and they pay a premium for that right.

If the price stays flat, you keep the premium. If the option expires before it hits the strike price, you also keep the premium the buyer paid.

Let’s look at this a little more in-depth … How does it compare to other strategies? And what are the risks?

Covered Call vs. Protective Put

A protective put is kinda like an insurance policy. If you buy a stock but then worry the price might drop, you can buy a put option.

It gives you the option to sell a stock at a strike price lower than the current price. A protective put can help limit your losses, not eliminate them.

Both strategies are more complex. It’s one of the downsides of options trading. Plus, you often have to allocate and tie up some of your capital for long periods of time.

Personally, I don’t go for super complex trading strategies. My preferred stocks are penny stocks. There’s less competition and you can start with a small account. Don’t get me wrong — there’s no such thing as easy trading…

But I think there are a lot of advantages to low-priced stocks. You don’t need to hold a position for a long time to make a profit. I’m typically in and out of a trade in a matter of minutes or hours. Sometimes I’ll hold a position overnight but never for multiple days.

Looking for more information on how to trade penny stocks? Start with my FREE penny stock guide here.

Covered Call Examples

Let’s say that you hypothetically bought Walmart Inc. (NYSE: WMT) at $150 per share. To place a covered call, you’d sell a call option for a later date at a strike price above the current price.

Here’s an example of a relatively short trade, with a small profit potential…

Let’s say you sell a call option with a strike price of $155. The expiration is about two weeks out with a premium of 99 cents. Remember … in options trading, the premium is always multiplied by 100. So you’d actually receive a premium of $99.

As long as the stock price stays below the strike price you get to keep the entire premium from the contract you sell.

Now let’s look at a longer trade with higher profit potential:

This time, you sell a call option with a strike price of $160 with an expiration about six months away. That premium is currently at $3.25.

In this example, you keep the entire premium of $325 — as long as the stock price stays below the $160 strike price.

But what if the stock goes up? I’ll get to that…

Covered Call Strategies and Tips

Position sizing can make or break you in this strategy. Don’t trade too big relative to the size of your account.

Only trade a portion of the underlying position. Options contracts trade in lots of 100 shares. You can limit your exposure to the risks by keeping your call sale smaller than your overall position. If your WMT position is 500 shares, only sell one or two options contracts. That’s equal to 100 or 200 shares.

If the price climbs above the strike price, you can still profit with the portion of your position that you didn’t sell calls against.

Practice these trades with paper trading first. (On StocksToTrade, of course.) There’s no reason to put money on the line until you fully grasp the concept.

Study the charts and get real screen time. There’s no substitute for experience, but the markets are only open so many hours per day. Learn in real time when you can. Learn from others when the markets are closed.

Only take the best setups. As a trader, one of your jobs is to learn to not overtrade. Trade like a retired trader … Only come out of retirement for the best plays.

How to Place a Covered Call

Before you can place a covered call, you should own shares of the company. Then you can enter the call option through your broker.

When placing covered calls, it’s best practice to hold all the positions at the same brokerages. That can allow you to balance out the profit or loss no matter which way the trade goes.

Placing the orders at separate brokerages can make the process more complicated. But you should get the same result at the end of the day.

There are plenty of choices out there when it comes to brokers and trading. Find what works for you and your trading style. These are the brokers I use.

Be wary of newer commission-free brokerages. There’s no such thing as a free lunch. There’s always a catch. I lay it all out in my review of Robinhood trading … Read it to learn the potential pitfalls of choosing the wrong broker and why I’m happy to pay commissions.

When to Sell a Covered Call

The best-case scenario for executing a covered call is when you hold a winning position but expect it to go higher after a time of consolidation.

You can sell calls when the price moves sideways and take some extra profits out of the move. Or in this case the lack of movement.

Selling a covered call can cause you to miss out on a larger move. So only use this on stocks with a long history of not making big moves … even at earnings.

Can You Profit From Covered Calls?

Profits from the covered call can come when you make multiple predictions correctly.

First, you find a stock that’s going up and buy it before it does. Then you expect sideways movement for a period … but move upward movement later on.

If you time all this right, you can profit modestly from a covered call.

Looking for a strategy with the potential for larger rewards and more action? Selling covered calls may not be right for you…

Trading penny stocks with the right discipline and strategies can bring you larger profits in a shorter time frame. But you must be willing to live and trade by a very strict set of rules.

I think it’s easier to learn to trade penny stocks. Your trades play out in shorter time frames.

But you need knowledge and experience to improve as a trader. Learn the rules of the game first. You can start with this book by my student Jamil: “The Complete Penny Stock Course.”

More Breaking News

- Oracle’s Surge: Decoding its Stock Movement

- Soligenix Excels: Unveiling Stock Surge

- Growth or Bubble? Decoding SOUN’s Rapid Rise

Covered Call Formula

Ideally, you want your stock to stay sideways and not trigger the strike price. But what happens if the stock price goes up? Here’s a formula to calculate your profit if you sell a call option and the price climbs above the strike price before the expiration.

Expiration Above Strike Price per 100 shares…

= { [Strike Price] – [Purchase Price] + [Premium] } x 100

So our first example with WMT shares purchased at $150 with a strike price of $155 would look like this:

[155 – 150 + .99] x 100 = $599If your call option expires below the strike price, you keep the entire premium you received and your entire position. No complex formula for this one — you keep everything.

Frequently Asked Questions About Covered Call

How Do You Lose Money on a Covered Call?

With covered calls your losses and profits are limited. You’re basically hoping to make money on the premium you sell.

Is a Covered Call Bullish or Bearish?

Selling a covered call option isn’t bullish or bearish. It’s a way for an investor to generate income while the stock they’re holding is consolidating or less volatile.

What’s Buying a Covered Call?

If you’re buying a call option, you’re hoping the stock will go up so you can buy it lower and sell it higher.

What’s Uncovered Call?

An uncovered call, or naked call, is when you sell a call option without owning the underlying shares you're selling the right to.

What’s a Covered Call ETF?

A covered call ETF is an ETF that sells call options on a portion of the shares it holds as investments.

What Happens When a Covered Call Is Exercised?

When a covered call is exercised, it means the purchaser of the call option has opted to exercise their right to buy the shares. This usually happens when the strike price is hit.

Advantages of Covered Calls

Covered calls offer some advantages for those looking to trade more passively. So this strategy might work for traders with larger accounts or those looking for small returns.

It’s a strategy geared more towards long-term investors.

Every trading strategy has advantages and disadvantages. Find what works for you. I’ve made over $6 million day trading low-priced stocks.* It suits my lifestyle — and I LOVE my life. I teach, travel, and give back through charity.

You have to find the trading style that fits your lifestyle.

Maybe you’re starting with a smaller account. Or maybe you’re looking for bigger opportunities. Covered calls may not be the strategy for you.

(*Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Max Profit

Holding shares is only a part of a covered call. There’s no limit to how high a stock price might go.

That’s why I love penny stocks! While any stock could go to the moon, penny stocks can actually go supernova on a fairly regular basis.

More expensive stocks don’t do this nearly as often. I’m not saying it never happens — but it’s few and far between. The real profit potential in covered calls is in the premiums for the calls you sell.

The maximum profit of the option is the premium. The max profit on the hedged stock is the strike price. In other words, when you sell covered calls it limits the potential profit on the underlying stock.

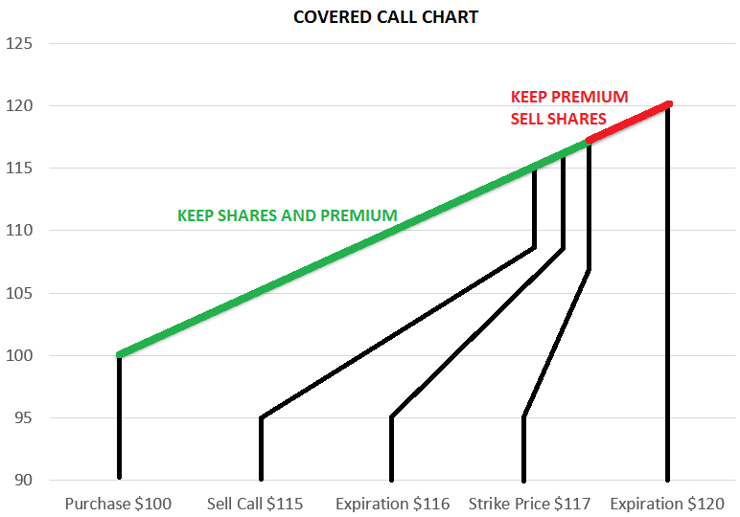

Payoff Chart

When executing a covered call, you always keep the premium from selling the option. The stock price at expiration determines whether you keep the shares you bought in the first place. You must give up your shares above the strike price.

Take note: the keys to options trading are the strike price and the expiration date.

As an options seller, you want the call to expire without meeting the strike price for maximum profits.

What Are the Risks of Covered Calls?

The risk is mostly in the call portion of the covered call. All stocks have some inherent risk, but you can always sell the stock when the stock hits your stop.

My #1 rule is to cut losses quickly. It’s a smart rule to follow if you want a chance at a long-term career in the market.

When you sell a call without holding a position in the underlying stock, your risks are technically unlimited. So you gotta be careful and calculated. But when you sell a covered call, you can balance out your risk.

When you sell a call, you’re selling the buyer the option to buy a stock at the strike price. You’re responsible for purchasing that stock in order to sell it. If the price of the stock moves above the strike price you must make up the difference.

With a covered call, you already own the stock that you purchased at a lower price. So you can sell your stock to the options contract buyer … But you’re giving up the profits you would’ve made if you just held the stock.

You keep the difference from the purchase price to the strike price. You also keep the premium from selling the option.

How Does a Covered Call Work?

We’ve covered the basics … But this just scratches the surface of the strategy. There’s so much you have to consider such as cash, time, and volatility. Actually executing this strategy can be really complicated.

Let’s tackle these one by one. Here are some of the details to consider…

Capital Requirements

I get this question a lot: “How much money do I need to start trading?”

With low-priced penny stocks, you can start with a small account. I recommend about $2,000, but I have students (like Tim Grittani) who started with less. You need to invest in your education. You need the right mindset and work ethic. If you have all that, the amount you start with doesn’t really matter.

That’s not the case with trading options. Just look at our WMT example. You’re dealing in 100 share lots with options.

Even if you bought at $150, that still costs $15,000. Sure you can make $99 here or $325 there. But those gains are minimal compared to how much capital you put in. And it can take weeks or months for this strategy to play out.

Most traders want to be able to make more than one trade at a time. So with complicated options strategies like a straddle or a covered call, you probably want to keep some cash on hand. That way you can take on new positions and withstand some losses.

$40,000 might be a starting point for an options account. But you have to assess your finances, your risks, and your overall strategy. And definitely don’t take my word for it.**

**I’m not an investor and I’m in no way giving you financial advice. All trading and investing is risky. Never risk more than you can afford. Do your due diligence.

Early Assignment

Now let’s imagine you played your cards right. The option you sold is about to expire worthlessly. You’re ready to add the premium from the sale to your bankroll when something happens…

The buyer executes the option contract you sold — even though it’s at a loss.

It’s rare, but it does happen from time to time. Your profit can take a hit.

Just be aware that even if the stock doesn’t hit the strike price, there’s an off chance you may still have to uphold your end of the options contract and sell at the strike price.

The Impact of a Stock Price Change

While the goal of a covered call is to make some easy money while a stock price moves sideways. The reality is that a big price move can invalidate your entire process.

It’s smarter to use this on relatively stable stocks, but you never know when a stock’s price will move up or down.

A big move up will limit your profits. Everything above the strike price is profit for the contract buyer. Your profit is limited to the difference between your entry and the strike price.

A big move down allows you to keep your premium from selling options. But you still have to decide whether to hold or sell your underlying stock.

Volatility

When selling a covered call, your bet is on low volatility. You expect the price to rise but not quickly. Volatility can throw this entire position out of whack.

Volatility can cause the price to swing up and down very quickly. In a worst-case scenario, your entire position can turn into a loss.

If the price drops rapidly, your initial long position can get stopped out for a loss. And you’re still obligated to sell to the contract buyer at the strike price.

After you get stopped out, what if the price rockets to new highs? The buyer of the contract would likely exercise the option to buy at the lower strike price. Since you no longer have any shares, you gotta buy them on the open market at the higher price and sell them for the lower strike price.

Of course, this is a worst-case scenario, but anything can happen at any time in the stock market. I always expect the worst out of every trade, then I’m never disappointed.

Once again, as long as everything stays stable until the expiration, you should be good to go. You can make 1%–3% extra profit on your money, in a stock that’s going sideways.

What’s the Impact of Time on Contracts?

The premium or price of options contracts goes down as the expiration approaches … as long as the strike price stays at a distance. The odds improve the longer you hold when executing a covered call.

But that means your capital is tied up while you hold these positions. So it can seem like an easy 2%. But the cost of lost potential can outpace the expected profit.

The standard investment advice is to buy and hold an S&P 500 index fund and get an average of 7%–9% return per year. Holding call positions for six months with a maximum gain of 3% doesn’t seem that great in comparison to me.

I’ve always been a trader. I’m not great at investing in the traditional sense.

But even I can see the potential pitfalls of trading complicated options strategies. I love the simplicity of buying and selling. I like knowing my profits and losses as they happen.

Making bets one, three, or even six months out doesn’t make sense to me. Especially if you’re looking to build your account quickly.

Expiration

Every option has three critical components: the strike price, the premium, and the expiration.

The premium is the most an options contract seller can expect to make and the most a buyer can expect to lose. The expiration locks everyone in at a certain point.

If the contract expires outside of the strike price, the seller is the winner. If the strike price is met, the buyer is the winner. I’m oversimplifying a bit, but that’s all you need to understand about the expiration right now.

Apply for the Millionaire Challenge

Option trading can be complicated and risky, but they can make sense to some people. Find what works best for you.

I prefer to stick to my penny stock niche. Trading penny stocks is how I’ve been able to grow my account to over $6 million.* And I’m happy to donate all my profits to charity.

I teach simple patterns and strategies. You don’t have to be a math wiz or super smart to trade penny stocks.

There’s less competition since hedge funds, algorithms, and other Wall Street talking heads don’t trade them.

I have six millionaire students now from my Trading Challenge. It’s where all my millionaire students have come from. They get access to all my educational resources like my DVDs, video lessons, live trading, and Q&A webinars (all of them are archived so you can go back and study). Plus, you get access to my amazing Challenge chat room.

My students Jack Kellogg, Mark Croock, Tim Grittani, Mike “Huddie” Hudson, and Micheal Goode are moderators in the chat, sharing ideas and answering questions.

If you’re dedicated to your education and ready to study your butt off, apply for my Trading Challenge. But don’t do it if you’re lazy! I don’t have time for lazy students looking for hot stock picks…

Conclusion: Is It Possible to Make Money From Covered Calls?

There are so many ways to make money in the market — and lose it. Make sure you find what works best for you.

A lot of people love to trade options. They feel like they’re limiting their risk. But they can also limit potential rewards. And the barriers to entry can be high.

No matter which market you decide to trade, make sure you stay disciplined. Only learn one setup at a time. It’s one more way to find what works for you.

Write out and follow a trading plan for every trade. A losing trade is only a failure if you fail to follow your plan. Trade with an edge.

Trading in the stock market is highly personal. What works for one trader won’t necessarily work for another. Find a strategy that plays to your strengths and master it.

What do you think about options trading and covered calls? Let me know your thoughts. Leave a comment below!

Leave a reply