June 2020 has been full of learning and success for my students, including trader Jack Kellogg, who’s officially passed $500K in trading profits.*

Jack Kellogg is one of the fastest learners I’ve taught in a long time.

But more importantly is how fast he applies those lessons to his trading. I think that’s the real reason he’s risen to this trading milestone so fast.

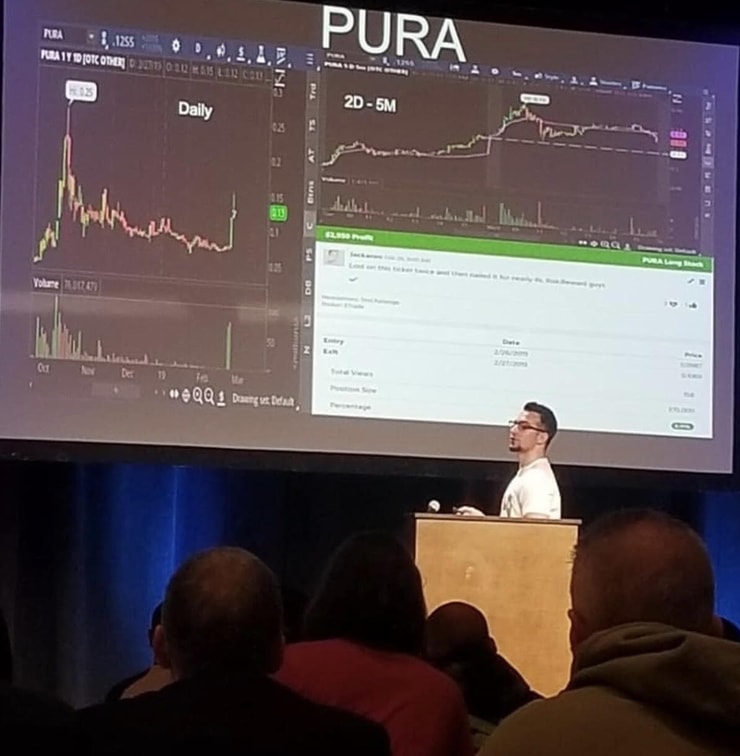

In fact, just about a year ago I published an article about Jack — aka Jackaroo on Twitter and Profit.ly — as he began to find initial success in trading. By that point in his trading career, he had passed $100K in trading profits.

Only a year later, he’s grown his trading profits by four times that…

Let that sink in…

This is the kind of trading consistency I hope all my dedicated students strive for. At the very least, I want my students to know that with enough studying and dedication to trading, this is possible.

I think the best thing about Jackaroo is that his mindset hasn’t changed much since my feature on him last year.

What has changed? He’s expanding into new strategies and attacking with bigger size — something that becomes possible with consistency, experience, and confidence.

Jackaroo’s profits are awesome — but anyone can flash around big numbers. Jack’s story goes so much deeper than that. So I want to share with you what Jack Kellogg does to be a growing, self-sufficient trader.

Get ready for some serious trading motivation as I dig into what led to Jack’s $500K milestone in only about three short years of his trading career.

(*Please note these results are not typical. Jack has exceptional knowledge and skills developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.)

Table of Contents

What Trader Jack Kellogg First Did to Pass $100K

I’ve said this a lot, especially to newbie traders who think trading is a way to get rich quick — don’t expect to make $1,000 consistently before you can make $100 consistently.

I’ve never had a student come in and instantly be profitable and stay profitable … It’s just not realistic or feasible.

Trading is a craft. It takes time to really learn it, just like with any other skill. And your education never ends. My top student Tim Grittani studied for nine months every day before he became a consistent trader … And that’s faster than most.

Many of my top students, like Jackaroo, need a few years before it really clicks for them. Trading is not a means to get rich quick. I don’t have time for students who don’t want to buckle down and learn to trade.

2025 Millionaire Media, LLCAnyway, Jack studied as much as he could for months on end … sometimes for over 10 hours a day.

Remember, most traders fail in the stock market. They don’t prepare and they don’t stick with it. It takes discipline and studying every day to get to Jack’s level.

With all this talk about the studying Jack did, that actually leads me to another important topic — one that helped Jack so much.

Building Your Knowledge Account FIRST

Sure, this is similar to studying … but it goes way deeper than that in my opinion.

When Jack first began trading, he knew he wasn’t in the right space to put his hard-earned money on the line. Here are some valuable lessons from Grittani on what it takes to learn to trade and stick with it:

Jack was only about 19 when he started trading.

He didn’t have a ton of money to start. And he knew that if he went right into trading with his savings, he’d probably lose most of it.

So instead of using real money and making real trades, he learned from all my DVDs, webinars, and countless other video lessons that I’ve built up over the years.

Not many of my students watch the 6,300+ video lessons I have … But Jack and many of my other top students have … Notice a trend?

Jack studied everything from my videos that he could — he soaked it all up like a sponge.

He built his knowledge account first. And as I always say, that’s so much more important than making money in the beginning. Why go into trading with no experience when you can take the time to learn first and minimize your losses? You risk blowing up and taking yourself out of the game.

Use Jack’s journey as inspiration to build your knowledge account first.

Trader Jack Kellogg Takes Networking to Another Level

Jack also did something that a lot of traders forget about — or at least don’t talk about much. He networked with and learned from other traders … primarily successful students in my Trading Challenge.

One of my favorite Jack Kellogg trader stories is when he reached out to Grittani mid-trade to ask for advice. Yeah, it was a while back.

What happened? Jack was facing his biggest loss on Turtle Beach Corp. (NASDAQ: HEAR) back in May 2018.

I teach my students to cut losses quickly, but Jack had missed his opportunity for a small loss. That’s why he turned to Grittani, who’s evolved past the point of cutting losses quickly. Grittani cuts losses intelligently.

That’s what Jack needed — a way to intelligently cut his losses. Of course, Grittani helped him out. And while Jack still took a loss on HEAR, he reports that helped reduce his losses by about 40%.

But Jack’s networking went far beyond reaching out to my successful students in the chat room. And this might be the most extreme case of trader networking I’ve ever seen from any of my students.

He began talking to another top student — Dom Mastromatteo. They hit it off, and soon he moved so he could learn how to trade right beside Dom.

I commend Dom, another six-figure student,* for helping out an aspiring trader like Jack. With Dom’s help, Jack passed $100K in trading profits, playing primarily OTC breakouts.*

(*These traders’ results are not typical. It takes time to build and hone exceptional trading skills. Please remember all trading is risky. Always do your due diligence, and never risk more than you can afford to lose.)

Jack’s Next Steps To $500K Profits

Why settle for $100K when you could make $500K in trading profits … right?

That’s what Jack thought. He knew that $100K was just the beginning for him. So once he hit that first milestone, over the course of the next year, Jack worked his butt off. Now he reports surpassing $500K in career trading profits.*

It was around this time that Jack started learning how to short sell, which has helped him a lot. But don’t get too excited thinking that just because Jackaroo is a great short seller that it’s the right strategy for you.

I too used to be a short seller back in my early trading career. It can be a great strategy with a lot of great patterns. But…

It’s also a more advanced strategy. I don’t think newbies should short. It’s risky. It’s a lot easier to lose bigger when shorting and get too aggressive.

And Jack worked hard on his long strategies in the beginning to find his footing. Then when he was ready to grow and adapt, he found his niche in short selling.

Interestingly enough, his shorting success was much due to the networking he did with another one of my successful students — Kyle Williams. The two of them have grown a lot together as traders … I love it!

Now Jack and Kyle have teamed up with another one of my up-and-coming Challenge students, Matthew Monaco. They’ve revived the TWIST podcast. Check that out. It’s free and every week they cover trading tips and stocks.

And recently, I sat down to talk with them about what’s been working for them in this market. I’m so proud of all of them.

This video is a great way to find out more about trader Jack Kellogg and how he’s grown over the past year.

Cutting Losses

Another one of Jack’s keys to leveling up has been understanding how to manage his losses extremely well.

In fact, I’ll go out on a limb and say he’s one of the best students I’ve seen in years when it comes to keeping his losses small, given the account size he trades with.

Wanna see what I mean? Check this out this tweet.

The stats in Jack’s tweets may be a little confusing if you’re new to trading, so I’ll walk you through them.

In May 2020, Jackaroo reports $70K in profits — his biggest month ever at the time. But honestly, that’s not what I care about…

To me, his losses are more impressive than his gains. Yep, you heard me right.

My haters rag on me for this all the time. They make it seem like I encourage traders to lose. But that’s not at all what I’m saying.

What I want every trader to understand is that managing losses is critical, and Jack’s living proof of that.

In May, when he reports $70K in profits … Jack’s biggest losing day was under $500. His average losing trade was only $244. But Jack’s average winning trade was $906 — almost four times his average loser.

This is cutting losses quickly — but to a whole new extreme. These are the types of lessons that top traders value most, and I’m glad Jack can show everyone how he does it.

Trader Jack Kellogg on Being Diverse

I know I’ve mentioned it already, but Jack is now a better short seller than he is at going long. But that doesn’t mean he only shorts.

If you go back to this tweet, the second picture shows his trading data broken even more. If you look closely, you’ll see his profits from his long trades versus his short trades.

In May, Jack reports about $60K short and another $10K long. The bulk of his monthly profits came from options. For trading purposes, especially short selling, but he still did a great job at longing as well.

Being diverse in trading is important, and Jack is a great example of this. Just because he’s a short-biased trader doesn’t mean he’s oblivious to other strategies. He’s able to attack long setups that he’s comfortable with — primarily OTCs — and perform well.

And in reality, most traders have one setup that works best for them — just like Jack. So what’s Jack’s favorite setup now?

The first red day, which he’s now playing on both listed stocks and OTCs. Even within his primary setup, Jackaroo’s being diverse.

But that comes with experience. You gotta study first and build your knowledge account. Then, you need to focus on the process and discipline. That’s all part of finding what works for you.

You can do that paper trading on StocksToTrade. You have access to live market data and learn to trade your patterns without losing any real money to start. When you’re ready to go live, you can start with small trades.

More Breaking News

- BTC Digital Celebrates Green Mining Milestone in Georgia

- Capricor Therapeutics: Is the Slide a Tactical Chance?

- Will GAUZ Reach New Heights?

How You Can Trade Alongside Trader Jack Kellogg and My Top Students

2025 Millionaire Media, LLCAll my top students come from my Trading Challenge.

This is the course I designed to help everyday traders learn to be self-sufficient in the markets. It’s not about following hot stocks picks, and every one of my top Challenge students can tell you that.

You have to work your butt off, but you get to do that with access to the best trading chat room, access to all my DVDs, lessons, and webinars. Plus, you get live trading sessions with me and my top students. If you’re ready to commit to learning the process, this is the best place you can start.

And know that you’re in this for the marathon, not the sprint. You also have the opportunity to learn from my 20+ years of experience, as well as other dedicated traders. Think you’re up to it? Apply today.

Conclusion

It’s kinda crazy to say this, but not a whole lot has changed for Jack since his $100K trading milestone. Yes, he’s made adjustments in his trading style. But what’s really helped him is cutting his losses quicker than ever and letting his winners run.

Jack’s networking with other traders also seems to be one of the most important steps he’s taken to grow. That’s just one benefit he got from being a Challenge student.

Be sure to check out the TWIST podcast with Matt and Kyle.

Also check out the SteadyTrade podcast — there’s a lot to learn there. Both SteadyTrade and TWIST are free resources. And another way for you to learn more about trading.

Maybe you all can tell Jack that he needs to cool it with his recent spending habits … rumor has it he just spent $20K on a new gold chain. He tried telling me it was an investment, but I’m not buying it…

I’m kidding, of course! But I’m dead serious about how proud I am of Jack. This is no easy feat.

I can’t wait to see where Jack goes from here — especially if he stays disciplined and continues to grow.

I’m curious — do you think you have what it takes to be one of my top students like young trader Jack Kellogg? Leave a comment below and tell me why.

Leave a reply