This is the final post of my 4 Things to Watch in 2020 series … today I’ll cover hot OTCs.

If you missed the first three sections, be sure to check them out…

I explain the growing trend of MASSIVE short squeezes, break down the hottest sector of 2020, and discuss why you should pay attention to former runners.

To wrap up this series, I want to discuss a pattern I talk about all the time in my 6,000+ video lessons.

Before I dive in, let me make something crystal clear … This four-part series shouldn’t be your entire market education. 2020 is still young, and there’s no better time to start your trading education…

So make 2020 your year. Invest in your education and start your journey to financial freedom. I look forward to seeing you in my chat room.

Now — let’s explore the mysterious, sometimes sketchy world of OTC runners.

Table of Contents

- 1 What Are OTCs?

- 2 Hot OTC Examples

- 2.1 CytoDyn Inc. (OTC: CYDY)

- 2.2 Cannabix Technologies Inc. (OTC: BLOZF)

- 2.3 BioRestorative Therapies, Inc. (OTC: BRTX)

- 2.4 Tautachrome, Inc. (OTC: TTCM)

- 2.5 GRN Holding Corporation (GRNF) — Formally Discovery Gold Corp (OTC: DCGD)

- 2.6 Kraig Biocraft Laboratories, Inc. (OTC: KBLB)

- 2.7 NaturalShrimp Incorporated (OTC: SHMP)

- 2.8 Kona Gold Solutions, Inc. (OTC: KGKG)

- 2.9 IntelliPharmaCeutics International Inc. (OTC: IPCIF)

- 2.10 Rivex Technology Corp. (OTC: RIVX)

- 3 These Students Understand the Power of OTC Spikers

- 4 What to Watch Going Forward

What Are OTCs?

OTC stands for over the counter. If you hear OTC in relation to the stock market, it means the OTC market.

Unlike Nasdaq or the NYSE, the OTC market still mostly operates without computers. Individuals have to manually execute trades. That slows down executions and can create huge trading opportunities — if you know how to spot a hot play.

I love the OTC market the most. The plays fit my patterns better. It’s easier for me to find trades. But just because I like OTCs doesn’t mean they’re for everyone. Plenty of my students won’t touch these stocks. It’s just not where they excel or trade well consistently.

Since the movie “The Wolf of Wall Street” came out, the OTC market has gotten a bad reputation. It was the notorious stomping ground for promoters. And many companies that trade on the OTC markets are scams.

That’s OK — I’m not looking to invest in these companies long term. Hold and hope isn’t my strategy. I hold these stocks for a few minutes or hours … maybe a day at the most. I try to take advantage of the massive moves OTCs can make when they gain momentum.

Need a crash course in low-priced stocks? Start with the book by my student Jamil, “The Complete Penny Stock Course.” It combines all my lessons into one book. It’s a great way to learn the rules I follow when I trade.

Let’s look at a couple of the insane runs in OTC stocks in the past year…

Hot OTC Examples

Right now, the stock market is at all-time highs. There are a lot of hot sectors. But low-priced OTC runners have had some huge gains — 50%, 100%, or even 200% in a day.

CytoDyn Inc. (OTC: CYDY)

Here’s the daily chart for CYDY. If you zoom out two or three years, it doesn’t look that great. But if you look at the last 60 days, it’s amazing!

The stock quadrupled. It spiked from a low of around 26 cents to a high of $1.18. OTCs move differently than listed stocks. They can make these large moves over a short period. That’s why I love playing them when they’re hot and have solid trading volume.

Let’s take a look at another recent hot OTC…

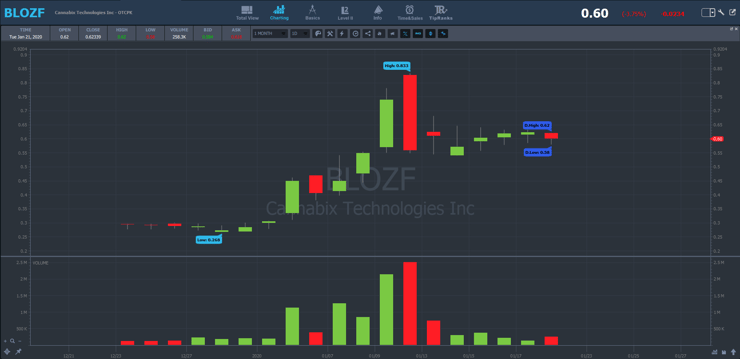

Cannabix Technologies Inc. (OTC: BLOZF)

BLOZF is another OTC that’s gone from a low of roughly 27 cents to 83 cents in only a month. That’s a sweet triple on this play in only a few days.

BLOZF is probably the best example so far in 2020. This chart’s a very typical OTC setup. There’s a nice day-one run, followed by a rest day. Then it had a breakout that continued for multiple days.

After its third green day, it pulled back hard. That’s where I tried to dip buy it but was a little off. I had trouble getting filled.

Thankfully, I nailed the breakout into the close the day before its final green day. I bought toward the end of the day. But I knew it was overextended so I didn’t want to be too aggressive or patient.

Once these stocks put in two to four green days in a row, they become a lot riskier. So I try to be extra careful with my trades.

More Breaking News

- Strategic Acquisition Expands Momentus Inc.’s Horizons

- GTM Stock Experiences Notable Fluctuations Amid Recent Financial Developments

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Datadog Sees Price Target Shifts Amid Market Changes

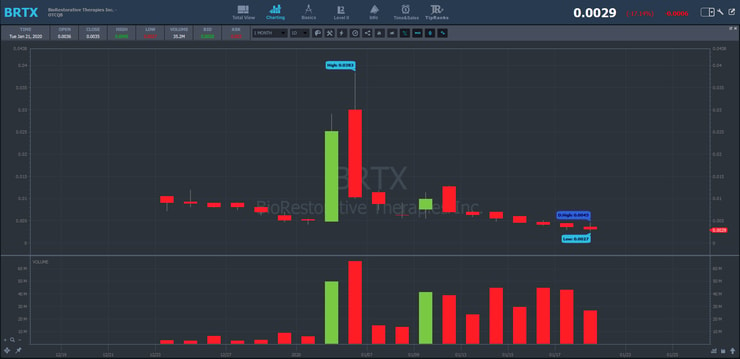

BioRestorative Therapies, Inc. (OTC: BRTX)

BRTX didn’t hold up for multiple days like some of the others. But it still spiked 300% off its lows. It’s since failed, but that was a nice two-day spike.

I want to show you BRTX because not every OTC will run for multiple days. It’s important to notice when these stocks start to fail.

Tautachrome, Inc. (OTC: TTCM)

TTCM has been uptrending and actually is a nice triple over the last month. But if you go back a little further it had a HUGE spike in 2019.

It spiked from under a penny ($0.006) to over 3 cents in only eight trading days! That’s a 500% spike.

Hot OTCs are insane, but sadly there aren’t that many of them anymore. A lot of the promoters behind some of the best OTC plays are in jail. Sometimes we’ll go months without a good OTC supernova. But you should still prepare. Study these charts and be ready for the next one.

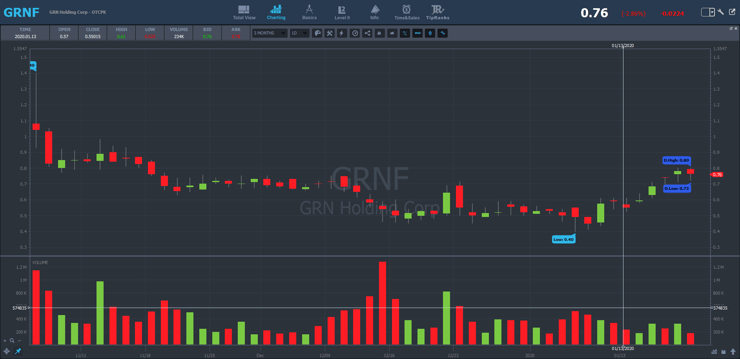

GRN Holding Corporation (GRNF) — Formally Discovery Gold Corp (OTC: DCGD)

DCGD spiked from under 1 cent to well over $2 a share over three months! It eventually got halted and the company changed its name…

So DCGD is now GRNF, which has gone straight down. It opened around $1 a share and now trades around 50 cents. These plays can be sketchy … don’t overstay your welcome. Nail the meat of the move. Take your single and move on.

The people who fall in love with these stocks almost always lose money. Again, I’m not looking to invest in any of these companies.

Date the stock, don’t marry it.

At the end of the day, most of these companies are crap. My goal is to take advantage of the volatility. The key to these OTCs is recognizing they have big spike potential — but they don’t usually hold their gains.

And always remember rule #1: cut losses quickly.

Kraig Biocraft Laboratories, Inc. (OTC: KBLB)

KBLB was a big runner in 2019 from 8 cents to 50 cents. It had a perfect double top at 50 cents and has since been dead. When an OTC dies … it dies hard.

NaturalShrimp Incorporated (OTC: SHMP)

If we go back to early 2019, SHMP was the best supernova I’ve seen in a long time. It spiked from around 4 cents to over 90 cents.

A lot of my top students nailed SHMP.* And here’s the thing … these students played SHMP their way based on the PennyStocking Framework. There’s no ‘right’ way to trade these supernovas…

You can buy the breakout, short the first red day, or dip buy a morning panic. There are plenty of plays. You need to focus on the strategy that works best for you and your schedule.

Kona Gold Solutions, Inc. (OTC: KGKG)

In 2018, KGKG ran from 1 cent to 14 cents. Then it dropped back to 4 cents, and now it’s trying to bounce.

I’m keeping an eye on it … Traders tend to remember former runners, but KGKG’s long-term chart is terrible.

👉🏼Get my FREE weekly stock watchlist here.

IntelliPharmaCeutics International Inc. (OTC: IPCIF)

IPCIF had a huge run-up from 14 cents to a high of roughly 95 cents.

I want to emphasize this one … it ended up gapping down HUGE. This is why you must lock in your gains and move on.

I’ll say it again: these stocks are usually crap. That’s why they’re on the OTC market and not on a listed exchange. Burn the IPCIF chart into your memory. Let it haunt you into taking small gains.

Rivex Technology Corp. (OTC: RIVX)

There are still a few stock promotions out there. They suck compared to the promotions from five or 10 years ago. Most of those promoters are in jail or shut down. Personally, I’d love to see more promoters. They can create more opportunities for me and my students.

The best pump I’ve seen in a long time is RIVX. The promoters hyped this from the $2.80s to the mid $10s. Guess what happened then? It dropped all the way back to the $2.80s.

I mean, look at this chart. They pumped it for nearly two full months, then let it die in only one day. The SEC ended up halting it. When RIVX was halted on January 8, the stock closed at $4.27. It re-opened on January 24 at $2.50 … and tanked to 27 cents a share by the end of the day.

One of my top young students, Jack Kellogg, absolutely NAILED this play.

01/06 2:26 PM Jackaroo → timothysykes: $RIVX next stop .50c

01/09 9:30 AM Jackaroo: $rivx HALTED gg

Now check out Jack’s comments from the Trading Challenge chat room on January 24…

01/24 10:15 AM Jackaroo: filled RIVX cover .25 cents.

01/24 10:15 AM Jackaroo: +$13k roughly.

01/24 10:16 AM wildwes → Jackaroo: holy sh*t man. Where did you short it from?

01/24 10:16 AM Jackaroo → wildwes: 5.41.

[*Note that these results aren’t typical. It takes time, dedication, exceptional skills, and knowledge to trade well. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

Jack played the short on this pump like I would’ve in the past. But now I’m long biased since short selling is so overcrowded. I wrote a special blog post about RIVX and how I long these promotion stocks. These stocks are sketchy, but you can still find an edge … if you prepare and are smart about your entry.

These Students Understand the Power of OTC Spikers

From the Trading Challenge Chat Room

12/26 4:02 PM Androo: $CYDY what a close, defs an o/n I didn’t want to chase

12/27 9:36 AM scottsaylor11: out 4 of 7k swing $cydy. looking for .90s push for last piece

12/27 9:41 AM ThePennySqueeze: Woohhooo! ONe of my biggest days to date! $1,162.15 From $FCEL and $CYDY! Thanks Gurus!

12/27 9:45 AM WinstonSmith: Sold $CYDY at 0.84 for 122 in profit

12/27 10:38 AM tbohen: 12/26/2019 $CYDY is a “OTC breakout” gapper play, but I’m still so gun shy on these, its been FOREVER since we had one work

12/27 1:09 PM SkuLL_KiD: OTC Multiday Breakout hands down the most PDT friendly strategy

ive ever come across, 2 profits in 2 accounts and didn’t even use a daytrade $CYDY

01/09 3:34 PM CrazyWillows: $BRTX I feel comes with experience, even with small size I was not sure on a good entry level, glad I could watch and learn.

01/16 9:34 AM Tommy_D: Wow, $IPCIF down 77% on news. Not a dip buy

Think you can cut it in my Trading Challenge? Apply today and find out.

More Comments From the TimAlerts Chat Room

12/27 10:02 AM Ems_trader: Papertrade $CYDY in .77 out .89 2000 shares

01/06 9:37 AM Thenunzzz: Good man! Wish I was with you on that one, used all my trades last week before $BRTX! EPIC!

01/06 10:20 AM Meeshka_Z123: $IPCIF in at 0.73 out at 0.77

01/06 2:24 PM Tessa: $RIVX has a 60% crash today! From $11 down to $4.28

01/10 12:23 PM Lpena1214: correction: $BLOZF in .722 overnight sell to .7843 this morn

01/10 12:37 PM Jackaroo: I sold $BLOZF just not bouncing, zzzz, going to take off midday here, likely no trades into close

Although these students all took advantage of different hot OTC runners, they had a lot of similarities in their trades. And they had the right mindset. They were prepared for the stocks when they started running. They used the past to prepare themselves for these awesome plays.

I can’t wait to see the awesome hot OTC runners 2020 will bring.

Do you want to learn how to think for yourself in the markets? Or learn how to be prepared for the next OTC runner? Apply for my Trading Challenge today.

Interested in hearing from one of my newest six-figure students* and his OTC strategy? Check out Jack Kellogg on the SteadyTrade podcast.

[*Note that these results aren’t typical. It takes time, dedication, exceptional skills, and knowledge to trade well. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

What to Watch Going Forward

Long story short, you’re looking for low-priced stocks with huge volume in the OTC market.

OTCs are super sketchy. A lot of people say…

“I’ll never touch an OTC.”

But for me, I think they’re easier. They fit my patterns better and there are fewer players in the market. Would you rather trade against professional traders and hedge funds or people who don’t know what they’re doing?

Moral of the story — focus on OTCs when they’re hot. I don’t care about an OTC that spikes and fails the next day. I’m interested in seeing how far they can go over several days or weeks. I don’t like to chase, but I’m willing to dip buy on morning panics or in the afternoon off highs.

When I look for an OTC, I want to see good volume. If it’s not there, that means there’s not enough interest. For an OTC to run multiple days it needs a story to really interest lots of traders. And ideally, a catalyst causes the stock to spike.

How do I find these plays? I use this revolutionary trading software and scan for the top percent gainers in the OTC market trading with above-average volume.

OTCs can be hit and miss — don’t try to force it. In 2019, there was a stretch of three or four months with very little OTC activity. That’s OK…

Prepare yourself today to be ready for the hot OTCs of tomorrow.

What do you think about hot OTCs? I love to hear from you!

Leave a reply