It was Friday, October 11. I’d mentioned in my chat rooms there was a good chance of a Friday short-squeeze supernova. Too many shorts were trying to make back losses. And they’d all chosen Synthesis Energy Systems, Inc. (NASDAQ: SES).

By 2:30 p.m. Eastern, I was getting messages galore from those who follow this flawed strategy. Very sad. But then I had to catch a flight … so I missed what happened next.

Table of Contents

- 1 A Lesson on Why Shorting Sucks Right Now

- 2 RIP Newbie Shorts

- 3 Rules Prevent Disasters

- 4 Slaves to Their Computers and They STILL Got It Wrong

- 5 Ignore My Rules and Get Crushed

- 6 Bad to Worse OR … SES Short Squeeze Goes Full Supernova

- 7 “But Tim, They Were Right — SES Tanked!”

- 8 Knowing the End of the Story

- 9 Short Selling: Cottage Industry of Fakes and Liars

- 10 A Moment of Silence for the Newbie Shorts

- 11 Congrats to All Students Who Played These Stocks Well

32,000 Feet Above Europe

As I sat in my seat aboard the flight, SES was about to become the latest short-squeeze supernova. I couldn’t trade it because I was flying. But a lot of my students did…

Like Justin @justin3615:

@timothysykes dip bought $SES in the higher low @ 3.10 2.5k shares, out at 3.50 shaken by the double top and back trend, so took the profits nice lil 1k on my now 8.5k account

— Justin (@justin3615) October 11, 2019

And Jerad @Jerad11187501:

$SES what a play! I took this in the morning $3.31-$3.55 just under 10%. Even tho I sold way to early I stuck to my plan and this was a good trade. On to the next! @timothysykes @TheStockSnipers pic.twitter.com/tIBRvaJKNc

— Jerad leon (@Jerad11187501) October 11, 2019

Jared, Justin, and many other students benefited from the squeeze. It was amazing for longs. But for many newbie shorts, it was a complete disaster…

Classic Friday Short Squeeze

SES was a classic Friday short squeeze. Look at the chart from Friday. It only tells part of the story. By itself, it’s scary enough for shorts. (Great for longs…) But keep reading, because for shorts it gets worse. (Keep reading, there’s a twist…)

SES chart, October 11, 2019:

A lot of shorts were shorting into the first little run up into the $3s. (Click on the chart to open a full-size view in a new tab.) And they were doing so because it’s a fundamentally/financially flawed company.

A Lesson on Why Shorting Sucks Right Now

October 11 offered us a great lesson in why shorting sucks so bad right now. One of the seemingly best setups in a long time for shorts turned out to be the perfect trap. The stock went from the $1s to $3s on news it was acquiring Australian Future Energy.

In came the shorts. They gave all the same reasons short sellers give… “Hey, this company should be trading at zero, it’s already up from the $1s to the $3s. I’m gonna short it.”

And if you look at the chart, you can see where a lot of chat rooms attempted bear raids. This is a kind of groupthink, where everyone shorts at the same time in an attempt to drive down the price.

Every time the stock cracked a little, more shorts got excited. And with each little bounce, they piled in, shorting more shares, trying to get their average as high as possible. But what many of them failed to realize is that they were setting themselves up for disaster.

I’m not the most popular with short sellers because I rip on them nonstop. SES is an example of why they deserve it. Because there were several newbie-led chat rooms (I won’t name them) shorting in the $3–$4 range.

These chat rooms … they make fun of how many video lessons I have. They say, “You don’t need to study all that much. Sykes overcomplicates things.”

So all those shorts who averaged up on every bounce — maybe they got their average to around $3.35 thinking when it cracked to $3 they’d take 10%. But here’s the problem: what happens if it doesn’t crack?

When you risk disaster to make a little bit, you’re picking up pennies in front of a bulldozer.

RIP Newbie Shorts

So, while I was enjoying my flight, the newbie short seller’s nightmare happened. SES took roughly 45 minutes to go from the $3s to $9.

Wow $SES up to $8/share afterhiurs, congrats to soooo many https://t.co/fljCJN8USq students who made $1-4/share, remember to sell into strength and RIP to far too many newbie shorts stuck since shorting at $3-4, shorting a low float on a Friday FGD play is naivety at its finest

— Timothy Sykes (@timothysykes) October 11, 2019

This is the risk. I don’t know everything. I’m not right 100% of the time. But I do have rules in place to prevent disasters. (I trade using these rules.)

Rules Prevent Disasters

A lot of people rip on me — I have doubters and haters. But, again, the rules I teach I’ve learned over 20+ years.

And this one didn’t break just one rule. It broke four rules.

You’ll never see me short a low float, first green day runner, with news, on a Friday afternoon.

You Don’t Know What You Don’t Know

The float on SES is so small. According to Yahoo Finance, it’s 1.38 million shares. So even at $5 a share, the market cap was only $7 million. At $9 it was only roughly $12 million. Some people say, “It doesn’t deserve to be a $12 million company.”

You. Have. No. Idea.

The news released on Thursday night said they were buying another company. You don’t know how much the new company is worth. Is it worth $7 million? How about $12 million? Or is it worth $30 million?

With these nano cap stocks, $5–$20 million is nothing. So all the shorts thought it was gonna crash.

“Look, it started fading… and the volume is fading…”

When a company is trading so low in price and valuation … and when there are so many shares trading … and so many shares being shorted…

… it becomes a perfect demand versus supply vortex. There’s too much demand for the shares and not enough supply. The price has to rise.

Slaves to Their Computers and They STILL Got It Wrong

Most traders need to find an edge to get news before other traders. They’re slaves to their computers. They have 30 monitors, and they can’t miss anything. With SES, the news came out Thursday night.

So even though the news on this stock was already out, it was lost — or misjudged — by all these short sellers. This is another benefit of penny stocks. (Read this important post about how penny stocks are different.)

So the biggest move happened in the last hour or two of trading and after-hours trading on Friday. And that’s because it was all the short sellers trying to buy their way out of the mess. There wasn’t good news that tripled this company from $3 to $9.

It wasn’t like “Oh my god, something just happened and this company tripled.” It was purely a short squeeze. Too many short sellers. I’m sure there were naked short sellers.

And as my flight continued, the messages kept coming in…

Ignore My Rules and Get Crushed

I got messages from people who lost $5K … $10K … $20K … even some who’d lost $30K! Wanna know what they were all saying?

“I wish I’d never left the Tim Challenge and the Tim chat room…”

Shorting SES…

… a low float, first green day runner, with news, on a Friday…

… breaks all my rules.

Again, if you’re stubborn, feel free to break my rules. Learn the hard way.

More Breaking News

- AZI Stock Slips as Investors Eye Key Developments

- Vizsla Silver Corp. Sees Stock Flux Amid Strategic Movements

- GTM Stock Experiences Notable Fluctuations Amid Recent Financial Developments

- GGB Stock Hovers as Market Reactions Vary Amid Market Speculation

It Sickens Me to Get These Messages

I hate getting messages from people who lose big trading stocks like $SES but you ignore my rules you get crushed so either learn from me or let the market teach you in a far more expensive/painful way, which do you choose? Either way you gotta learn as newbies risk FAR too much!

— Timothy Sykes (@timothysykes) October 11, 2019

Look, I don’t wanna mention the names of the short sellers. Because, frankly, we need them.

I’m Conflicted

I wanna show you what’s happening with this niche, where too many newbie short sellers think it’s easy. They don’t study my videos. And they don’t respect my lessons. So they keep losing. (Study my FREE penny stock guide here.)

I feel for them. But at the same time, for those of you who are long biased…

… this is an amazing time to be a trader IF you recognize how many newbie shorts there are.

There’s more…

Bad to Worse OR … SES Short Squeeze Goes Full Supernova

Over the weekend I made a video lesson about SES. I uploaded it for my students on Monday morning. (You can watch it when you join the Profit.ly community here.) I said this one could continue on Monday … to the $12s, $15s … or even the $20s.

Here’s the chart. If you’re considering a career as a short seller, get scared. Get very, very scared…

SES chart October 11 and 14:

Wisely, I didn’t get sucked into shorting SES. Too many unprepared shorts were shorting in the $3–$4 range on Friday. On Monday, the squeeze went all the way to $26+. It left many people in short-biased chat rooms not only broke but in debt to their brokers. (I use these brokers.)

Incredible short squeezes as tons of shorts trapped on $SES from the $3-4 range Friday, noe $23+, some people down 7x their investment and $BIMI I Bought at $2.55 today now it’s $9+, to anyone who still hates on penny stocks you’re dumb as fuck lol

— Timothy Sykes (@timothysykes) October 14, 2019

“But Tim, They Were Right — SES Tanked!”

It’s true. On October 15, SES crashed back to the $10s. And, yes, the fundamentals on SES are terrible. Once the newbie/early shorts got annihilated by the squeeze, the stock dropped 60% off its highs in under 24 hours.

So if you’re shorting based on fundamentals, guess what? You’re right. But does that mean all short sellers were right? Be very careful with your answer. The early shorts — all those shorting in the $3s and $4s — they were wrong.

Anyone shorting at $10 or $11 on the way up … wrong. Unless they had the stomach and a big enough account to ride it out. Even then, they’re basically at break even now.

This SES chart shows the full picture from October 11 to 17:

What about someone who managed to borrow shares and get short at $22 or even $26? People say “Oh, you can make so much money if you just get the top right and ride it down.” But you don’t know where a stock like SES is gonna top. You. Have. No. Idea.

I often call myself a glorified history teacher. It’s time for a recent history lesson…

Learn From the Past or Pay the Price

Do you remember BPTH? Back in late February/early March, Bio-Path Holdings, Inc (NASDAQ: BPTH) went from $2 to $73 in six days. Here’s the chart…

Again, BPTH was great for traders who followed the right strategies at the right time. Like SES this week, some of my students made CRAZY profits on BPTH.

CRAZY https://t.co/fljCJMRjtQ student profits today: kjc9trader Up $9870 on 3 $BPTH trades – so far! singhanz:I made $3775 today on BPTH Jimmy_Graves: Damn I made $5k on BPTH just this morning aristi0523: sold $SWRM locked in 1700 joshcrivers: all out $SWRM for 20%, $1300 profit

— Timothy Sykes (@timothysykes) March 1, 2019

Sadly, just like SES this week, the BPTH squeeze blew up early shorts.

Hearing horror stories galore on $BPTH from newbie short sellers and their followers…ignore my warnings guys and learn the hard way, it’s so stupid, but that’s what happens when you learn from non-self-made millionaires and those without decades of experience #goodtobereal

— Timothy Sykes (@timothysykes) March 7, 2019

BPTH is one example — extreme but not unique. Literally dozens of penny stocks have squeezed early shorts the last few years. WGBS, CANF, and CRK back in 2015 … REN in 2016 … IDXG in 2017 … TLRY last year … those are just a few examples off the top of my head.

And it’s getting more common. Because of people like Tim Grittani having so much success, there are WAY too many short sellers. As more newbie shorts pile into newbie-led chat rooms, they crowd each other out. The niche is so crowded it’s crazy.

Short Selling Still Works IF You Learn the Right Way

I became long biased when short selling got too crowded.

Thing is, I’m still trading the same basic patterns that made me my first million 20 years ago. I’m just playing different time periods. With all the newbie shorts piling in too soon it creates more and more short squeezes. For me, I prefer big morning panics. But that’s not to say that options. For trading purposes, especially short selling doesn’t still work.

Kyle Williams, my latest six-figure student who I wrote about in this blog post, is short-biased. Tim Grittani, arguably the best penny stock trader in the world, is short-biased. One of my top young students, Huddie, has now made nearly $250K. Huddie is short-biased.

Let’s get back to SES for a minute. Just because newbie shorts led by other newbie shorts got crushed … it doesn’t mean all shorts got crushed. Again, it’s about knowing the patterns, following the rules, and being patient. Huddie absolutely banked on SES…

This is from the Trading Challenge chat room on October 15:

09:54 AM Huddie: Locked in 4 grand on Ses

See Huddie’s Profit.ly page here.

So even though I rip on newbie shorts all the time … and even though I say shorting sucks right now…

… the problem is shorting early and risking too much.

Huddie is successful because he put in the time. Even though shorting is overcrowded he’s profitable because he learned the rules. And he does NOT have the idiotic newbie mentality of “Short anything that’s up … sell, sell, sell!”

I love Huddie’s pinned tweet…

Put the 10,000 hours in and get here! Not a sprint, it’s a marathon. Long term goals are key!!! I was not profitable for 2 1/2 years. It takes a massive amount of focus, maturity, and responsibility. This is not some “get rich fast” scheme. This is hard work and dedication. https://t.co/7p2HJDKlSq

— H𝙪𝙙𝙙𝙞𝙚 (@MikeHuddie) July 17, 2019

That’s keepin’ it real.

Knowing the End of the Story

Trading penny stocks is like knowing the end of the story and working backward. If you know they’re gonna eventually fail, it’s a matter of looking at predictable patterns. I’ve always said you can profit on the way up … and the way down. But you gotta know the patterns. You MUST study history and be prepared.

Full-On Supernova Season

This entire blog post has been focused on SES. But SES isn’t the only game in town this week. We’re in a full-on supernova season. It’s crazy. This is a GREAT time to be a trader IF YOU ARE PREPARED.

How Penny Stock Supernovas Are Like Crocodiles

Have you ever seen crocodiles being fed? It’s pretty crazy. When one crocodile snaps its jaws shut, several more ferocious jaws go … SNAP … SNAP, SNAP, SNAP!

Penny stock supernovas happen a lot like that. And with the increasing number of short squeezes, you can almost predict it. Some of the most fundamentally flawed companies become the single hottest stocks in the market. Briefly. And before you have time to catch your breath, there’s another.

Which is why we haven’t seen just one supernova in the last week. We’ve seen six!

Like Huddie said in chat on October 14:

12:27PM Huddie: Always remember, when you get 1 great runner, usually more follow. $SES was Friday. $YUMA, $BIMI followed suit. Sympathy plays!

First, it was SES. Then it was BIMI, WWR, DTSS, BNGO, and VIVE.

Study the charts below. I really want you to get this because once you see the patterns, then you can start working on all the other things you have to know. (It’s more than just memorizing patterns. Otherwise, people who shorted SES at $3 wouldn’t still be crying. And they’re ALL still crying.)

For each of the stocks below, I’ve included a 10-day chart/one-minute candlestick and a three-month chart/daily candlestick. It’s too much for this blog post to go into detail about every stock. But it’s important you see what’s possible.

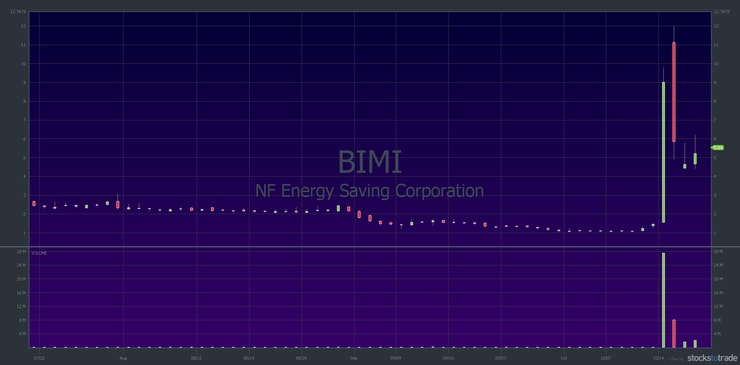

NF Energy Saving Corporation (NASDAQ: BIMI)

BIMI ran from roughly $1.50 to $13 in a little over 24 hours starting on October 14.

First the 10-day chart:

As you can see, many students made solid profits on the front side of BIMI…

Challenge Chat October 14 BIMI:

10:32AM GOO: in $BIMI 600 shares @$3.00 out $3.30 safe profits blew past my sell order lol.

10:34AM RBI: alright, out now $SES from 8.60 to 11.60. $450 before breakfast, not bad.

10:46AM Jackaroo: $BIMI took 500 from low 3s to high 4s for +$400.

10:49AM Popcheez: $BIMI in @ 3 out at 4.20 !!! so glad I got annoyed with $SES thanks Tim!!

10:50AM FrostyFro: I took my $480 profit on $BIMI – but my lord – could have been 2k+++.

11:25AM Marioa145: bought the dip on $BIMI at 3.65 out at 3.99. one second later 4.60 haha.

11:28AM keeyongtn → timothysykes: Best trade of the day $1500 $BIMI.

11:52AM the_tipsy_nomad: All out of $BIMI 1500 shares in @4.1 and out @5.6. Taking my $2250 and running for the hills.

11:57AM the_tipsy_nomad: As Tim keeps preaching, newbie shorts are great for us buyers who anticipate these short squeezes. Just like $SES did on Friday. The market is very unforgiving.

And the three-month chart:

Then there was WWR…

Westwater Resources, Inc. (NASDAQ: WWR)

WWR spiked from roughly $3 to $9.25 in a few hours on October 15.

Here’s the 10-day chart:

Check out some of my students’ WWR trades…

Challenge Chat October 15 WWR:

9:49AM MoonShot: $WWR in 7.28 out 7.61 500sh.

10:02AM HunterrBradley: sold $WWR from 7.14 to 8.12, feels good.

10:04AM therealmcdougal: $WWR paper trade – dip bought – long 2k shares at 7.27 average, sold at 8.27 average, got in and out quickly and made 13%.

10:04AM SatelliteIncomeUnlimited: just made 849.00 $WWR I got spooked and figured I could get back in, it’s going up and down.

10:17AM Popcheez: Bought $WWR @ 7 out at 8.3.

And the three-month chart:

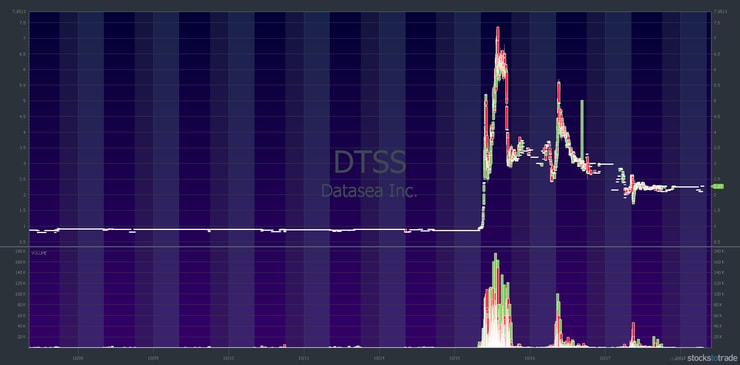

Datasea Inc. (NASDAQ: DTSS)

DTSS ran from 90 cents to $7.39 on October 15.

Check out the DTSS 10-day chart:

TimAlerts Chat October 15 DTSS:

10/15 12:15PM LUNCHB0X: out of $DTSS 4.70 from 4.07 entry.

10/15 12:17PM sgriever3: bought $dtss 4.39 sold 5.00 small position.

10/15 12:17PM gobeavs2015: $DTSS in @ 4.05 out @5. looks like sold too soon but I’ll gladly take my 20% and run.

10/15 4:44PM Knesevitch: 631+ DTSS middayperk

And the three-month chart:

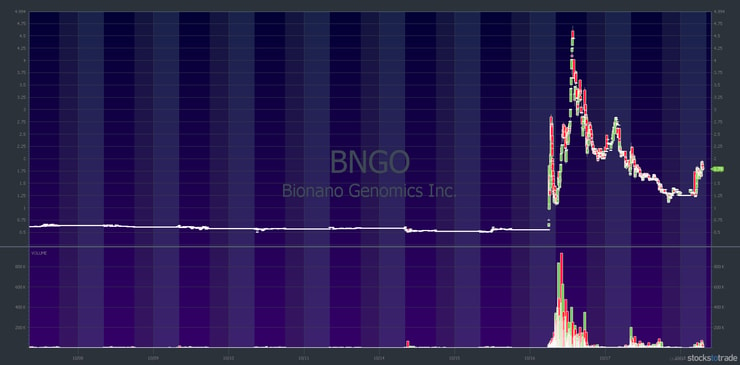

Bianano Genomics, Inc. (NASDAQ: BNGO)

BNGO spiked from less than $1 to $4.70 on October 16.

Here’s the BNGO 10-day chart:

Here are some of the comments from the Challenge Chat…

Challenge Chat October 16 BNGO:

10:25AM Ogletine: paper trade on $BNGO for $1,580. things are starting to click.

10:35AM TraderRick: wublubudubdub!!! $BNGO in at 1.25 out at 1.47.

10:44AM jobeauthement: entered another position on bngo at $1.53 for 1000 shares, out at $2.1643. Total gains of $1,104.59.

11:01AM Peachtart: OK, I’m out at 2.50 from 1.48. Holy Crap!! I made $500 today! $BNGO.

11:42AM pebblestexas: $BNGO bought at 1.27 out at 1.50 for profit of $900…wished i stayed in. $VIVE bought at 7.27 and out at 9.50 for a profit of $1065. Joined Tim’s Challenge a little over a month ago. Couldn’t have done this without the mentoring and training of Tim and his team.

12:06PM JMad: all out $BNGO 500 shares from 1.40 to $2.45 woohoo! love these low float runners.

And the three-month chart:

On every one of these stocks, students made solid profits on the front side. But I also want to give props to my short-biased students who trade with meticulous discipline. Huddie nailed the back side of BNGO just like he did SES…

#Playoftheday$Bngo – #Overextendedgapdown pic.twitter.com/VrZK6oNlrn

— H𝙪𝙙𝙙𝙞𝙚 (@MikeHuddie) October 17, 2019

And finally…

Viveve Medical, Inc. (NASDAQ: VIVE)

VIVE ran from the $3s to the $11s during extra hours trading on October 15 and 16.

Take a look at the VIVE 10-day chart:

Here are a few of the VIVE trades from the TimAlerts chat…

TimAlerts Chat October 16 VIVE:

7:38AM RBI: sold 1/3 $VIVE at 7.94, looking to sell another 1/3 in the 8.20’s if it can get there again. I bought 550 shares at 5.50. sold another 1/3 at 8.35, holding the last 200 shares till I gotta leave for work haha.

7:51AM RBI: Thanks. Made 1700 on that…glad I’m out of day trades too so I can’t give it back today LOL.

08:55AM Survivor007: $ViVE in at 1.90 out 2.55 @ 500 shares.

10:17AM usmarine2daytrader: I bought $VIVE at $6.65 out at $6.94 was bouncing now almost my original exit price $8 I lacked patience but still green.

10:20AM phong84: first couple trades in a couple weeks, small loss on $IPWR in 3.88 out 3.82 and a bigger win on $VIVE in 6.88 out 7.52.

10:51AM LKScientist: In $VIVE at 7.5.. out at 8.99. 500 shares.

And the three-month chart:

I hope you can see why I love penny stocks. There’s just so much opportunity. Again, you can profit on the way up and the way down. But if you’re short biased, please, please, please beware of this…

Short Selling: Cottage Industry of Fakes and Liars

There’s a whole cottage industry around short selling. And, frankly, I’m one of the ones who inspired it because I’ve made millions shorting.

But it’s gone WAY over to the dark side…

Secret chat rooms … secret brokers … secret high net worth brokers … naked or illegal shorts … sketchy offshore brokers … sketchy hedge funds… the list goes on. And they suck newbies into a vortex.

But again, I think you’re an idiot if you’re shorting stocks like SES on the first green day. Low float. With News. On a Friday.

Our Little Secret … Don’t Tell Except for Good Friends

If you know a newbie short … don’t tell them to change. If they’re your good friend, you might want to show them this blog post. Try to help them. But, fair warning: newbie shorts are very stubborn. They think they know everything. They bring up fundamentals. But it just doesn’t matter…

A Moment of Silence for the Newbie Shorts

This is the beauty of being real. I’m not always right. I don’t know everything. But I have rules.

Shorting first green day, low float runners, on a Friday … that’s the dumbest of all strategies. Piling in on Monday because surely the stock has had its run … nope. Bad idea. Anybody who would follow these strategies has some major, major studying to do.

The risk they take is unfathomable.

So, a moment of silence for the newbie shorts. Many ripped their hair out last weekend as they battled on social media. They tried to make people see the bad fundamentals of SES. Then … well … you saw the chart.

I feel for them. But if you follow a flawed methodology and inaccurate strategies, you get wrecked. It’s your choice. You can still win as a short seller. But you gotta follow the rules and learn from someone with experience and success. I choose experience and success over naive newbies and losses.

Where do you get access to experience and success?

Trading Challenge and Pennystocking Silver

Pennystocking Silver is a monthly subscription that gives you access to video lessons, daily watchlists, and the TimAlerts chat room. You benefit from my 20+ years of experience and guidance.

Look at it this way — the SES short squeeze is not the first time I’ve seen this. And all the sympathy plays … same thing. So you can learn the rules and nuances of trading … or learn from the market. And the market is ruthless.

The Trading Challenge is my full-immersion course. Webinars, DVDs, video lessons, archived webinars. But not everyone gets accepted. There’s an interview process because my goal is to work with dedicated students. Is that you? Apply here.

Now for some serious congratulations to all SES longs from Friday and Monday. Oh, and before I forget, Monday’s move created sympathy plays. (Read about sympathy plays in “The Complete Penny Stock Course” pg. 186). So there were other stocks in the same sector, moving almost in sync with SES. I’ve included some of the sympathy play comments below, as well.

Congrats to All Students Who Played These Stocks Well

I included some of the trades above in between charts. There are so many I can’t include them all. But I want to give props to as many students as possible, so…

So first, from the Challenge chat room…

October 11, Challenge Chat:

9:48AM Popcheez: Awesome! $SES in at 3.19 out at 3.70

9:50AM GOO: in $SES 3.28 out 3.60 just 500 shares quick $155 small profits but better than a loss.

10:02AM Tommy_D: What a load of crap on $SES. In at 3.19 and out at 3.31 after watching it hit 3.90, watching 3.60 hold, seeing VWAP hold and bouncing, then big red candle. Cut bait as it crossed below VWAP.

2:30PM benhook: Officially got scared out of $SES. sold @ 4.49 from 3.60, 300 shares.

3:46PM arturoil710: This trading thing is Hard!!! I was in at $4.19 $SES panic sold at $4.30 cus i lost patience, and now its making the move i was looking for.

3:52PM JRF: Bought $SES at 4.20, sold at 5.10. profit of 179.94.

3:57PM CharlieTango: Long $SES 1100 shares at 4.33 out at 5.38. I’d say that was a dAM good trade.

5:38PM Griff: $SES chuffed to high hell with my 14.8K gain today. Bought around 1.45 initially when it confirmed. Ended up making multiple trades. I gave some profits back through over trading. Room for much improvement but happy with the patience in recent weeks coming to this nice little gainer.

October 14, Challenge Chat:

Remember, there were sympathy plays on Monday. So I’ve included trades from the best one, NF Energy Saving Corporation (NASDAQ: BIMI). And also one or two from YUMA.

9:42AM LegalPimp: i already longed $SES once at open…..bought the dip at 9.55 and sold at 10.15.

10:37AM oskbmb: made $55 on $SES.

12:33PM Trade4us: $BIMI in at 4.25 out at 5.75 small position.

12:41PM alexbricker: 500 $BIMI – in at $4.10 out at $6.10.

1:18PM RD52: In $YUMA @ 4.28 out at 5.52. A small win.

1:53PM PapaD → timothysykes: $SES, $BIMI, and $YUMA have been great mental wins for me, and small actual profits too. But the lessons I’ve been able to capture since last Thursday, have been so valuable… more than the missed profits. My level of confidence has been elevated. Thanks Tim. Just what I needed after the TI summit.

2:01PM SatelliteIncomeUnlimited: made 769.00 on BIMI.

2:07PM Jackaroo: $YUMA 1k 4.80 (see 3:37 time stamp for exit).

2:12PM arturoil710: all out $BIMI $761 profit in at $7.50 out at $9.00 avg.

2:20PM the_tipsy_nomad: Traded $BIMI for the second time today, 1000 shares in @7.25 and out @9.29 adding another $2000 to my days gains. Incredible Monday.

2:28PM arturoil710: Congrats to all Longs on $SES and $BIMI and if you didnt make money today, just remember there are shorts who are stuck on $SES from $5 and below.

2:51PM JMad: All out BIMI from 2.99 to 8.3! Woot!

2:54PM RD52: Not easy to trade $BIMI for a gain now. Scalped it. In at 8.45, out at 8.65.

3:25PM EHodge: $BIMI in at 5.30 out at 8.30 after it fell from nine i was anxious to get out and take profits was hoping for a break of day high when in doubt get out.

3:37PM Jackaroo: flat on everything energy for +$750 – except holding $GBR overnight if it closes above my entry of 1.70.

4:22PM keeyongtn: $BIMI in at 2:12 PM at $9 out at 4:10 PM $11 500 shares, scared to hold overnight.

October 15, Challenge Chat

9:40AM RBI: out last third of $BIMI at 10.60….crazy what you can make when you wait for the market to come to you. Doubled my money yesterday and today on 3 trades (small positions but still!)

10:35AM ejroyce: Very first profit ever, thanks Sykes, Grittani, others here, I’ve learned quite a bit. I caught a falling knife and didn’t bleed.

3:04PM greenking49: out $SES about +200 i am ok with that.

3:48PM tfife: was able to grab me a small piece of $DTSS . in at 3.10 out at 3.40.. one of my first trades as a new Challenge student.

October 11, TimAlerts Chat

8:50AM RouxBourbon: OUts $SES at 3.50 for a $50 gain, I will take it on a 100.

9:47AM Gettingrich91: $SES in @ 3.10 Out @ 3.55.. Keeping it safe.

9:49AM BigDreDay26: $SES in at $3.24 out at $ 3.78.

9:50AM carlosmezagomez: $SES in @3.23 out at 3.70, before everyone started sell.

9:51AM TinCup72: $SES in @ 3.16 out @ 3.63. I know I’m going to leave some on the table but I took my profit and ran.

10:06AM joeylowe: 3 trades (2 premarket) on $SES. +2700. Enjoy your weekend traders and remember don’t force your trades. It’s a whole lot easier to make money when you let the trade come to you.

11:39AM jaromau: $SES in at 3.19 out at 3.25 should have taken the 10% when i had the chance. oh well live and learn. will not be so greedy next time.

October 14, TimAlerts Chat

9:36AM hAM 159: in $SES at 10 out at 10.5 lol wtf this thing is crazy.

9:36AM Big482: I got scared and sold $SES for $48 profit.

9:38AM InternationalLegend: $SES SOLD AT 10.19. $40 profit.

10:13AM EAdapon: in $BIMI at 2.74 out at 3.15. 1500 shares.

10:14AM slettebak: $BIMI bad entry 2.67 sold 3.13.

10:14AM sgoodall31: $SES bought at $8.50 out at $9.83.

10:23AM keeyongtn: Just sold $SES at $11 in at $10 heart was pumping so fast had to take deep breaths.

10:23AM J_Freedom: $BIMI in @ $3 out at $3.25 +8%.

10:32AM Survivor007: $BIMI in at 3.05 out 3.55 / 150 shares

10:40AM schultzy: was in $BIMI at $3.00, out at 3.75. 200 shares.

10:44AM CAPOmg: BIMI in at 2.98, out at 3.22.

10:47AM Yoshling: $SES at $13.6 was my goal for the day lol but sold long time ago… oh well still up $3000 on $2400 since friday afternoon.

10:48AM vnickn: $SES in at 8.30, sold half at 13.3.

10:56AM vnickn: $SES in 1000 at 8.30, out avg 13.35 +5062 on the day.

11:01AM charan: In $BIMI at 370 sold at 4.25.

11:24AM Yoshling: I just made $50 on my locked in $200 $BIMI gamble lol… no day trades left so tiny position.

11:26AM Slayertrade: dip bought $BIMI at 3.79 out at 4.40.

11:37AM stevenpalomino: made 5.52% on $BIMI & $GNUS trading with super small account so only $9.43 but wanted above 3% and it was my very first LIVE trade.

11:40AM Survivor007: $BIMI in at 4.70 out 5.50 / 150 shares.

11:43AM Duffle_duff: almost sold $BIMI for a loss at $3.83, held and got out at $5.00, in at $4.23, solid %12 gain.

11:43AM Gobucks: $BIMI bought 200 at 3.8 sold 100 at 4.6 and 100 at 5.3.

11:45AM womda: $BIMI 3.90-5.36.

11:48AM jadiez: $BIMI @ 3.85 out @ 5.49.

11:59AM matthewwhitell: Made 400$ off bimi so far.

12:10PM matthewwhitell → zzaznhan626zz: I got in $bimii at 3.80 with 200 shares. But I also got in at 2.60 the first time. And broke even when I tried trading in a second time. I’d say I traded it 4 times today. But I’m done now took my profit and run.

1:23PM AnsiCartman: $BIMI in at 5.8 out at 5.85, $SES in at 10.15 out at 10.22, wow im really bad at this.

1:24PM sgriever3: bought $bimi at 6.36 500 shares out 6.80.

2:06PM sgriever3: bought $bimi 8.25 out 8.62 small position.

2:10 PM GooniesTrader81: Trading is frustrating. $BIMI 150s at $6.16 out at $6.46. 3 minute trade. Sold WAY TOO SOON! I keep telling myself to let me winners run longer but I don’t. $BIMI now at $9. I’m glad I was on the right track again and again.

2:11 PM Hardybrian1: Sold BIMI – in at $4.00 and out at $9.46 with 2,000 shares… hoping for a nice pull back to enter an overnight play.

2:17 PM nburton20: went in at 8.5 this morning for $SES… I now AM in shock! Sold at 10.10 before the spikes because i had stuff to do today😂.

3:16 PM Yoshling → CKP111: I had $2400 friday morning dipped to $2000 and now I AM at $6100 lol… I literally could have made so much more.

3:20 PM FutureKin_g: Caught that $BIMI dip WOW so SCARY in @8.29 and out @9.14 for small gains.

4:03 PMcharan: sold and bought $BIMI 4 times today roughly made around $500 happy about it.

4:10PM Androo: $BIMI in at $10.08, out at $10.89 solid a/h b/o trade, just like $SES Friday.

4:21PM vnickn → charan: im holding from 5.60…. cuz no day trade…. stupid decision on my part but as of now im up +8400. Got lucky. I would to take profits lol.

October 15, TimAlerts Chat:

7:15AM Moavran: jeeeeeez – what a monster. Held 600 $BIMI @ 8.75 and just sold @ 12.65 #meatofthemove … Nice $2k gain.

9:34AM vnickn: $BIMI in 1500 at 5.60, out 10.2 +6900. Between yesterday $SES and today +12,000.

9:47AM HammsKC: in $SES 12.95 out 13.17 tried for that bounce when it looked like it was staying around 13 but just wasn’t going strong enough to $110.

9:50AM Normunds95: dip bought (paper trade) $WWR at 7.04 out at 7.62, 5 seconds later it spiked $1/share, but ok, I was right on my thesis and it reached my goal had I have been holding a bit longer …Thank you Tim! Things finally start to align for me.

10/15 12:57PM Neverhood2019: Fuf… $WWR. Dip buy In – 5.76 out – 6.69. So nervous for me. I still buy too early.. 500 shares and $465 profit.

10/15 3:22PM BlackWolfTradingCo: Done for today gang. +250 or so on the day. Until tomorrow.

11:15 AM Bobbemornee: second order of BNGO SOLD, IN 1.45, OUT 2.43, 100 share! thanks all!

12:47 PM GooniesTrader8: Studying breakouts for months is now paying off. BNGO 300s $2.67 out at $3.30 $190. A good win after beating myself up for selling SES and BIMI wayyyy tooo soon earlier this week. Now back to work. 🙂

October 16, TimAlerts Chat:

10:05 AM GoldengirlDTSS: in at 4.13, out at 4.45 for a quick $220. It seemed like it halted for so long that I got out BUT now it’s up to $5.06. Still learning…

10:24 AM AnigaiMyB: DTSS +24% trade has me too happy with myself right now. I may be influenced by some misplaced overconfidence were I to continue. No more for me today, time to step back, watch and reevaluate.

Tweets

Again, there are so many. I’ll include several here, but you can see more by going to Twitter and searching “@timothysykes $SES.” If you want to check any of the other stocks mentioned in this piece, do the same search like this: “@timothysykes $TICKER.”

It’s pretty crazy…

@stevenshatton:

Made $1200 on $SES. Studying really pays off! @timothysykes

— Steven Hatton (@stevenshatton) October 11, 2019

@BarryWixson

$SES in @ 3.90 out at 7.98 with 73 still riding. @timothysykes FINALLY!!!!!! $1300 profit locked…. couldn’t have done this without you buddy!!!!! pic.twitter.com/XBFFXaLQKU

— Pump-N-DumpChump (@BarryWixson) October 11, 2019

Sold my remaining 73 of $SES.$598.98. Total trade profit of over $1898. Time to Educate and Replicate. @timothysykes Maybe the 6 years in Minneapolis rubbed off lol. I’ll take singles all day…study time. #ThankYou pic.twitter.com/ADxgl2KMvk

— Pump-N-DumpChump (@BarryWixson) October 14, 2019

@EwenLaing

Patience pays off!

Super happy I saved some trades for $SES today. $3.67-$4.55 & $5.15-$7.85 AH.

Cheers @tbohen @timothysykes @StocksToTradePro.— Ewen Laing (@EwenLaing) October 12, 2019

@INceNY1:

I’m so happy & upset in the same time. Finally market getting back $SES was amagzing.But I got message from 2 friends they blow up their accounts. One more time KNOWLEDGE Is EVERYTHING. STUDY HARD & FOLLOW @timothysykes rule about shorting on #Friday to low float stock.@profitly

— ERIC INCE (@InceNY1) October 12, 2019

@TessaLamping

Credit… I only did 10 shares.. BUT after losing my discipline yesterday I had to scale back a bit. I studied @timothysykes dip buys last night, waited for the 3rd dip to buy $SES. Trusted myself. Bought at 12.80 and sold at $13.40. Happy with my plan 👌😊👩💻 pic.twitter.com/WyNIbf3MLu

— Tessa (@TessaLamping) October 15, 2019

@Kitembadas:

Made $141 on $SES on a $289 account making 49% profit

Made roughly $102 on $SES on my $450 account making 23% profit.

Bought $BIMI twice but came out even..Thanks for the small account incentive. Great for learning process @timothysykes pic.twitter.com/yjXhFg50vQ

— José Kitembo (@Kitembadas) October 14, 2019

@DanteBenton2:

Bought $SES Friday into the close at 5.42 out at market open at 10.15 almost a 100% return on my money!!Thank you! @timothysykes @timbohen This is how you grow a small account!! ✊🏾

— Redtrader01 (@DanteBenton2) October 14, 2019

@Jonk87:

Caught a tiny part of $SES for $650 but not chasing anything just take meat of move as @timothysykes teaches – not risking shit with this lil float

— Stephen Johnson (@Jonk87) October 15, 2019

@nawkker:

$SES $BIMI I used to look at charts like these (with lines all over the place) and squirm. Now, I will never go back.

thx @timothysykes @madaznfootballr @rolandwolf86 @Steven1_994 🙏🙏

only 1 of 4 longs worked for me today lol, but initially lost $400, & yet came back +$400. pic.twitter.com/sAyjm7RFST

— nawkk (@nawkker) October 14, 2019

@BeckyBr3198000

Made my first profit today $55 in 5 minutes on $SES… thanks @timothysykes for teaching me!!! I put into practice your teachings and disciplined myself! Yay

— Becky Brandt (@BeckyBr33198000) October 14, 2019

[Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

What do you think about the SES short squeeze and full-on Supernova Season? Comment below, I love to hear from all my readers!

Leave a reply