Table of Contents

The Wrong Brokers

I still get TONS of daily questions about the best/worst brokers so I am writing this blog post to settle everything once and for all! TO help you avoid using the wrong brokers!

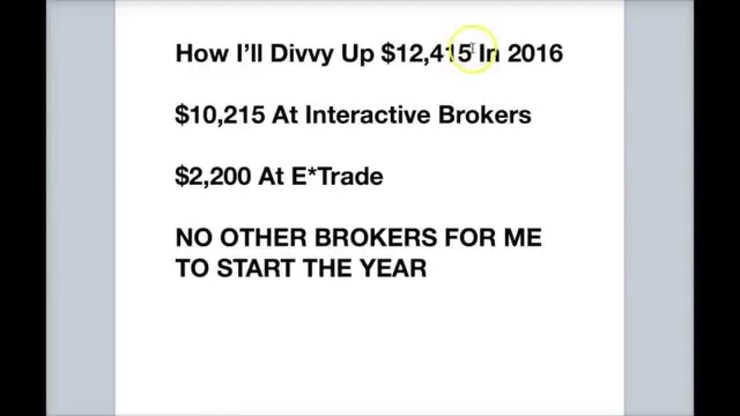

Despite my posting this video last year of the ONLY 2 brokers I’m using in 2016:

Sadly, choosing the right broker is NOT just about finding one with good commissions, software, executions, customer service, borrows, low minimums like too many people believe…unfortunately for all of us, the path to choosing the best broker is a bit more complicated so pay close attention.

Questions, Questions & More Questions!

The other day I answered 20 FAQs here and you can see a common theme among questions I get asked such as

- “What is the least amount of money I can put into a brokerage account?”

- “What’s the least amount of time I can study and still be successful?”

- “Do you guarantee profits if I study your lessons?”

- “What’s the least amount of intelligence needed to be a millionaire?”

OK, OK, that last question was made up, but it’s utterly pathetic that SO many people want to earn money and “become my next millionaire student” putting in the bare minimum in terms of money and time spent when in fact your outlook should be the opposite.

Read that full article here, it’s worth your time.

EVERYONE wants to become successful, but do you know what so few actually do?

Because it’s damn hard work and even if you put in a ton of hard work, you’re STILL not guaranteed seven-figure profits and great success.

Sure, sure, I have several millionaire trading challenge students who now help mentor other trading challenge students too, and dozens of students earning five and six figures/year** in this industry where 90%+ continually lose, but before worrying about the right broker and how “little” money you will risk in that account, you NEED to have the right mindset going in or else the whole journey is worthless and you waste my time which I will not allow.

Sadly, too many people only want hot stock picks and not put in the incredible amount of time required to study and actually invest in their own education/knowledge…that’s a surefire way to becoming part of the 90% of losers out there.

I don’t want that and hopefully, you don’t want that either.

On top of having the right mindset, you should be aware of the risks — my rule #1 out of 100+ rules listed HERE is to cut losses quickly, a rule my top millionaire challenge students and I have gotten better and better at following/being disciplined, as even on the day of the scariest short squeeze in the past decade on KBIO which went from $2 to $10+ in one after-hours session both my first millionaire trading challenge student and I were short big and we each lost only a few thousand dollars** as most others who did not follow this rule lost six and seven figures), but sometimes, these crazy stocks we trade move faster than we can execute our orders, no matter what broker, prop firm or hedge fund we use, so if you get into this game, be prepared to lose EVERYTHING!

That’s the risk so you must be aware of it…but then again, life is risky, even mutual funds which were thought to be so safe, lost 40-60% of their value just a few years ago. So deal with it and accept it.

Also, some brokers, especially off-shore brokers and prop firms and hedge funds and all the sketchy, small firms out there, sometimes have terrible executions so even if you put in an order to try to “cut losses quickly”, you might get screwed by your broker, prop firm, hedge fund and guess what?

It’s not a coincidence…that’s how a lot of sketchy/small firms make their money, by screwing over their customers!

Welcome to Wall Street where I remind you 90%+ of traders lose, and even in bull markets, 70% of stocks go down every year…it’s best you be aware of these stats BEFORE risking your hard earned money.

And let’s say there is a good broker, prop firm, hedge fund out there that wants to do right by its customers, companies with big hearts…well, big hearts often die ugly deaths on Wall Street, often times these do-gooders go bust and no matter the size of their hearts or quality of their service, your money can be tied up for months, or even years, and it’s just a messy situation, although if the startup is US based, if it’s offshore you’re pretty much screwed….all the while you’re missing out on potential solid plays every damn day.

More Breaking News

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

- Spotify’s Royalty Growth and Stock Upgrade Create Buzz

- Ondas Leverages Strategic Gains in Defense Sector Expansion

- Vale’s Stock Soars Following Significant Price Target Increases

Did I scare you away yet?

If so, it’s for the best as one of the main benefits of my being real in an industry full of snake oil salesmen is that I get to choose my students and I don’t need to BS you like so many others will. If you have any doubts or you’re not sure about trading my strategy, don’t waste my time or yours, just close my website now and go back to your safe, but boring 9-5 job and likely say goodbye to any big dreams you’ve ever had…that’s fine…for a lot of people.

Some people say if I was nicer, I could have a lot more students, but I don’t want a lot more students, I’m already overwhelmed…and I’m not here to be your friend, I’m here to be your mentor and to help you learn and profit, those who are overly nice usually don’t prepare their students for the ugliness of trading and Wall Street and their “friends” get crushed as a result…not on my watch…you can call me a jerk all you want, that’s fine, I can take it, I’m here to see my students succeed, not win a contest on how to be the most polite/politically correct.

I’ve been trading for nearly 20 years so I’ve seen all kinds of scams, shams, along with quality brokers, good people, and everything in between and I’ll tell you right now with this market just 4 days ago turning into the second longest bull market in history, winter is coming…so you had better be prepared.

I’m not saying we’re definitely heading into a bear market, if it happens, that’s cool, my strategy actually does better in bear market, but I’m prepared either way.

Most importantly, I’m secure with where the money I trade stocks with is being held.

It’s time to buckle down, look at where your money is and think about how safe that place is and find ways to trade safely, above all else right now I think it’s GOOD to be OVERLY conservative and put yourself in a position to ride out all the potential dangers on the horizon.

Who I Use as my Brokers

I’m not going to get into all those dangers or all the brokers I think likely to close or collapse; I could write a whole book and probably still not be accurate as to what actually does vs doesn’t play out, and it might take years for all the risks to become reality little different from the upcoming war in Game Of Thrones, but I’ll tell you it’s not random that I went with E*Trade and Interactive Brokers as my brokers this year as both are multi-billion dollar companies and in a brokerage industry filled with potential risks, these are safe choices at least for me and my money.

No off-shore accounts, no hedge fund brokers, no prop firms, no startup brokers, no small brokers with very little cash on hand, as little danger and risk as possible is my motto for 2016 and the next few years too…and Interactive Brokers while having some of the worst customer service I’ve ever experienced is best for shorting stocks under $2/share and I use E*trade for stocks over $2/share despite them sadly limiting themselves to only accepting people from certain countries and not others.

I’m sorry for all the negatives associated with each, I don’t work for them, I don’t get paid by them, I’m not an affiliate, I just use them as my safety brokers in this dangerous environment because when the shit hits the fan, I still want to be able to trade as that’s when the best trading opportunities show themselves…when everyone else is panicking.

You probably don’t remember when this scumbag took a lot of his customers’ money when his prop firm shut down without warning, and from what I hear, many STILL haven’t gotten their money back, but I do and I don’t want to see that happening to ANYONE again…I lost several students that day due to no fault of their own, only because they were too trusting of a sketchy prop firm.

I don’t trust ANY prop firms, off-shore brokers, hedge fund brokers, startup brokers or even on-shore brokers that are just small and don’t have a lot of excess capital…I’ve tried pretty much every broker in existence on my search for finding shares to short of penny stock pumps and I’ve come to the realization that putting my money into and trusting ANY questionable firm just isn’t worth the risk.

(Besides shorting hasn’t been as amazing as buying some of these Supernovas like PRGN, GLBS, ULTR lately!)

I know, I know, all this talk about risk and safety coming from a seemingly risky penny stock day-trader/short seller who has already turned $12,000 into $40,000 in 2016** in a basically flat/unchanged overall must sound crazy, but as I often say in DVDs, video lessons and webinars, I’m the safest, most cowardly trader out there and somehow I still have made millions from trading and now you can see in real-time as I exponentially grow my account thanks to incredible days like this below so ignore me and my warning about dangerous brokers at your own risk…

You can do whatever you like with your money, that’s the beauty of my educational business, I’m not a financial advisor, I’m not a broker, I don’t want to touch your trading account at all…I’m just here for some hopefully helpful guidance and to share my experience so if you’ve read this whole blog post, please consider yourself warned and I’ve done my job for today.

Leave a reply