Given that literally today is the day that all of the major US stock market indices are breaking below key multi-month support levels, now is a good time to brush up on your short selling skills and also understand the risks involved, as you don’t need to fear crashes or bear markets if you learn to profit from them!

The legendary man who netted $1 billion** in windfall profits betting against the British Pound in 1992 is again back to trading at the ripe age of 86. The last time Mr. George Soros was involved in trading was in 2007, when he is rumored to have earned more than $1 billion** by betting on lower prices.

In June of this year, The Wall Street Journal reported that the legendary investor was back from hiatus, because he believed that there is profit to be made from the economic troubles in the world using bearish bets.

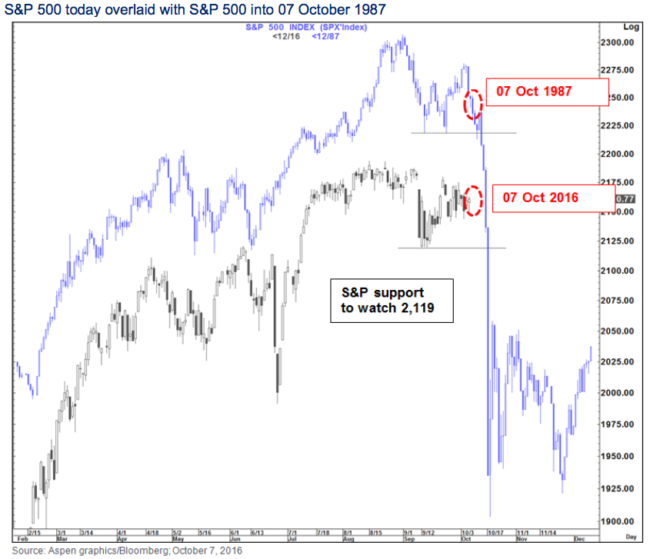

Recently, Murray Gunn, the head of technical analysis for HSBC, issued a warning on the possibility of a severe fall, should the S&P 500 fall below 2016 levels, reports the Business Insider. He is not the only one—Citi’s Tom Fitzpatrick and his team also warned of the similarities between the charts of 1987 and now, as seen in the chart above.

Though I not suggesting that the market will fall immediately, it is always better to have an extra weapon in your arsenal for profiting from every type of market situation. Though most are well aware of the mainstream strategy of buying low and selling high, very few are aware of the nitty gritty of short selling.

By remaining unaware of the ins and outs of this method, they forgo an excellent opportunity to earn profits in falling markets. By the time you finish reading this post, you will no longer be a short selling novice, although you should also study this 6-hour DVD guide that helps dramatically.

- Basics of Check out my verified trade here. I sold 1,000 shares at .10 and covered at .53. People asked me why I covered so quickly. Frankly, I’m scared of short selling

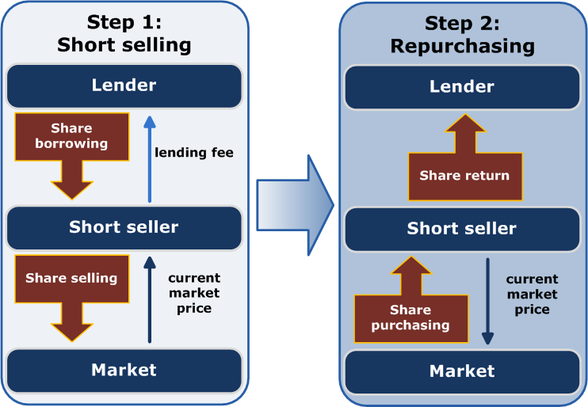

What is short selling, anyway? Investopedia describes a short sale as “the sale of a security that isn’t owned by the seller, but that is promised to be delivered.” The short seller borrows the shares—mostly from the broker—to place the trade. It might sound confusing now, but don’t worry, in just a minute, it will seem less so.

Source: – Wikipedia

Why should I short sell? Markets either go up, down or remain in a range. Short selling is an opportunity to profit from a falling market. In a bear market, short sellers can earn huge profits through this method.

What is the risk? Though all trading is a risky business, purchasing stocks of a company limits the risk to 100% of the money paid to purchase the stock. Your investment can go to zero, as many stocks have, but your profit potential is unlimited, if you have chosen to buy the right stock at the right moment. Unlike traditional buying and selling, in short selling, your profit potential is limited and unfortunately, your risk, in theory, is unlimited— so you really should understand what you’re doing before employing this method.

(hence why my rule #1 about cutting losses quickly is SO important!)

- Open a margin account with the broker : In order to trade on the short side of the market, you will have to open a margin account, not a cash or IRA account. Margin is different from leverage, though, as I NEVER recommend going “all in,” let alone borrowing money from your broker and using leverage. Be sure to know your terminology, as I see too many confused people these days.When you utilize margin, your broker will charge you fees for lending the shares that you want to sell short. The shares for lending will be made available through the broker or, at times, the broker loans it from a custody bank or a fund management company.Depending on the demand of shares, the free float of the stock and the market condition, these firms may demand a fee of anywhere between a fraction of a percent to a high double-digit percentage of the total value of the shares. This fee will have to be borne by the short seller, although since I only hold my shorts for a few hours or days, the fees are negligible. But, that’s not all—there are other liabilities that you should be aware of.

You can’t use the money that you earn from the short selling of shares right away: Though the money will be “deposited” in your account, you will not be able to use it until your liability to return the borrowed shares is complied with, usually a few days later.

The broker might demand excess margin: The broker might ask you to deposit additional money or collateral stocks, depending on the market conditions, especially if the volatility is high and they’re scared you could lose more money than you have in your account.

More Breaking News

- Allegiant Travel Boosts Market Confidence with Strong Financial Projections

- Nvidia’s $2B Investment Supercharges CoreWeave’s AI Expansion

- GTM Stock Gains: Strategic Moves Pave Way for Future Growth

- HP Inc. Sets Sights on Strong Performance: Fiscal 2026 Outlook Unveiled

This is not all. There are a few more things to understand about risk…I want to scare you before I show you the rewards, like these great short selling setups 🙂

- Risk of margin call: A margin call is initiated when the broker finds that the short position is going against you, i.e., the price of the stock has risen from the level where you sold it and/or they can no longer lend you the shares.

The broker will require you to cough up the difference between the price at which you sold short and the current price of the stock, as collateral in your account. That is to ensure that you have enough money in your account to be able to purchase the shares back at the current rate, if required.

If you are unable to arrange the money or collateral via other securities, minus the haircut, the broker usually asks you to cover the position. If you fail to do it, they will do it for you at whatever price is prevailing in the market. Hence, the rule, ‘Never put good money behind bad money.’ It is always better to close out the position when it goes against you, instead of pouring money on margin calls. You can put your short back on at a later date, if required.

- “Called out” or “Buy in”: In the event that there is a huge short interest in a stock or if a large player wants to sell his investment position, the broker might be unable to arrange to lend you stocks. Under such circumstances, the broker might ask you to close the position at the current price. If you don’t close the position, the broker will do it for you at the prevailing price and return the shares to the owner. Hence, just by selling short, one cannot be certain that the trade can be carried indefinitely, even if adequate funds are maintained in the account.

- Liability to fulfill corporate actions: Keep informed on whether the company whose shares you have sold short announces a dividend. The date when the company identifies the shareholders for paying a dividend is known as the record date. Two days before the record date, is the “ex-dividend date.” Hence, if you are holding shorts on the ex-dividend date, you will be liable to pay money to the broker, who will then deposit it in the share owner’s account.

- Rules to sell short and higher taxation charges: If a security falls 10% over the previous day’s close, it cannot be sold short. This is to avoid speculators piling on the stock and forcing its prices down. On top of that, short sellers are taxed at higher rates of short-term capital gains tax, irrespective of the duration of the short position.

- Why sell short, if there are so many hassles and risks? Though the stock markets go up more than they fall, bear markets can be gut-wrenching. Fear of losing can lead to many wrong decisions during a bear market. With knowledge of short selling, you can either hedge your portfolio, use a long-short strategy or use short selling to profit from a falling market.

Though, in theory, the profit potential is limited, the loss potential is unlimited. Hence, expert short sellers protect their positions with suitable stop losses and mental stop losses, unless you’re willing to watch your stock minute by minute, 24/7 which is not only time consuming, but also gut-wrenching. I’ve held short for days or even weeks, only to be bought in by my broker days or even hours before the big expected drop! Successful short sellers plan the money they are willing to risk while entering the shorts and diligently follow it.

- A few examples of famous successful short trades**:

SOURCE: ACTIVIST SHORTS RESEARCH and Bloomberg

- Short sellers use both technical analysis and fundamental analysis to find stocks to short: While a few investors short stocks when they find wrongdoings by the company on scrutinizing their balance sheets closely, others short if the company’s fundamentals point to a dismal future.

Others use the chart patterns to place short positions. A few can use a combination of both. Short sellers also use a short interest ratio(SIR) and short open interest. The short interest is the percentage of the outstanding shares of the company sold short. The short interest ratio is the total outstanding shorts divided by the stock’s average trading volume.

Whatever your technique, active money and risk management of the short position is of prime importance.

- Be careful of shorting the stocks in a bull market: “The market can remain irrational longer than you can remain solvent,” is an important saying in the stock markets. Hence, short selling a stock, just because it has a high p/e is not a good strategy. During bull markets, an overpriced stock can get more overpriced. For this reason, it is best to always wait for the trend to change from up to down in any stock before attempting a short trade.

Leave a reply