Last week was another solid week of trading for me. I finished up over $20,000, trading conservatively and following my rules.** My April profits were roughly $80,000.** That’s my lowest profit month of 2021 — by far. But I won’t complain.

The beautiful thing is, it’s the same pattern. And whether real news (see my trade review below) or promoters drive the price action, I’m prepared. Keep reading for more about preparation and why I teach.

First…

I donate 100% of my trading profits to charity. $80,000 will go a long way toward funding three new school projects like these…*

Table of Contents

Karmagawa and Bali Children’s Project

Whenever we open a new school or library in Bali, I’m super excited to share it. But Karmagawa’s partnership with Bali Children’s Project goes even further.

We’ve been working with Bali Children’s Project since 2016. We’ve now funded a total of 44 projects. That includes schools, learning centers, school transport, and school sponsorships. And during the pandemic, we funded 250 emergency food packages, too.

To date, Karmagawa has donated $665,000. The children, whose lives get changed by education, are far more important than the money.

Karmagawa is incredibly proud of our work in Bali. Visit the Karmagawa page on the Bali Children’s Project website to see all our completed projects.

Remember, we can ALL do better to help those in need. Even if it’s just sharing the story on social media.

And now, I’m proud to announce…

Karmagawa’s 78th School Project

We live in such a crazy world. Here in America, we take education for granted. But in many parts of the world, it’s a struggle. Conflict and a lack of money mean too many children never get the education they deserve.

That’s why this one is extra special…

Here are some more photos from the newest @karmagawa school in Iraq that will serve 600+ students, our 78th school worldwide with my goal still being to build 1,000+. This one is extra-special since many of the girl students were sold to ISIS fighters as slaves, but are now free! pic.twitter.com/KLaYuXGXat

— Timothy Sykes (@timothysykes) April 29, 2021

I’m proud to announce the school in Sinjar, Iraq, is now open — 600 children are back in school!

My goal is to build/renovate 1,000 schools around the world. One school at a time it WILL happen. And when we reach 1,000 schools, we’ll just keep going.

Want to help? Support Karmagawa’s mission by wearing our sustainable merch. Tag me on Instagram with a picture of you wearing it. Help spread the word. Together we CAN make the world a better place.

Trading Mentor

Huge congratulations to my newest seven-figure student, Dan I.* Dan started in November 2016. But he wasn’t profitable until March 2019. He reckons he’s put in 12,500 hours learning and trading. Let that sink in. See Dan’s profit chart here.

More Student Milestones

Also, congratulations to two new $500,000 students, Bryce Tuohey and Evan S.*

Evan passed $500,000 in profits after three years and 16 days.* Again, let that sink in. I say it all the time … this is a marathon, not a sprint.

Everyone please retweet this snd congratulate @eschunk8 on hitting the big $500,000 profit milestone today, my latest https://t.co/occ8wKDW7U student to do so. He deserves all this success & more as he’s worked his ass for years study hardcore & putting the lessons into action! https://t.co/h0JLAjbBtM

— Timothy Sykes (@timothysykes) April 29, 2021

Finally, congratulations to Bryce. We all know and love Bryce as the co-founder of Beyond the PDT with Matt Monaco. Now Bryce works with me to help build my education business. For one, you can catch him on StocksToTrade with SteadyTrade Treats.

Please congratulate @TraderBryce on hitting $500,000+ in trading profits! Whiles he’s my latest https://t.co/occ8wKDW7U student to hit this important milestone, he won’t be the last one…who’s next?! Retweet/favorite this if you promise to study your ass off and BE DEDICATED! https://t.co/oJHKNJgJdj

— Timothy Sykes (@timothysykes) April 27, 2021

See Bryce’s profit chart here.

Notice the similarities in those profit charts? None of these guys made any money for months, if not years!

So how did Dan, Bryce, and Evan do it? They’re all members of my…

More Breaking News

- Under Armour Battles Data Breach Amid Revenue Challenges

- GGB Stock Hovers as Market Reactions Vary Amid Market Speculation

- DealFlow Discovery Conference Unveils Corporate Opportunities

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

Trading Challenge

All three took part in the Trading Challenge program. All my top students are members. More importantly, they work at it every single day. Over time, knowledge and experience add up.

So how does the Trading Challenge help dedicated students? They get two to four live webinars every week and access to all archived webinars. Plus, they have their own special chat room, video lessons, and mentoring. It’s for my most dedicated students only.

If you’re not truly dedicated, it’s OK. Don’t feel bad. I have a lot of part-time students, too. You choose your dedication level. If you’re truly dedicated, apply for the Trading Challenge here.

Whatever your level of dedication, there are obstacles to face with penny stocks.

New to penny stocks? Get started with my FREE penny stock guide.

Fighting BS, Lies, and Misconceptions

I love teaching, but many people don’t know why I got into it. Why would anyone teach if they can trade well enough to live a good life?

Because my blood boils with the misinformation in this niche.

It started when I was on the reality TV show “Wall Street Warriors.” People would message me and say “You can’t short sell penny stocks. You’re a criminal.”

Yes, you can short sell penny stocks. I don’t think it’s a good idea right now. But back when I first started teaching, I was primarily short selling.

But it wasn’t only people calling me a liar that made me want to teach. It was the stock promoters…

Promoters say, “Why learn? Why go through the struggle? Just invest in…” And then they name whatever stock they’re pumping this week. Then they accuse me of short selling their pump when I haven’t done any short selling for months.

A great example is HUMBL Inc. (OTCPK: HMBL), which was TSNPD and TSNP before that. I’ve NEVER shorted it. It’s my single biggest winning stock in the last year. Every trade I took was long. See my HMBL, TSNP, and TSNPD trades.** (They’re all the same company, but on Profit.ly the trades show up under the ticker at the time of the trade.)

One of the reasons I teach is to save newbies from getting decimated by unethical scumbags. Don’t listen to the promoters! Again, I don’t want them to stop promoting. We need them — their pumps help to create volatility and predictable patterns.

But it’s the height of ignorance, laziness, and naivete to listen to promoters and ‘invest.’ You can’t invest in pumps. It’s important to take profits or cut losses quickly.

Are OTCs Back?

The OTC market still isn’t as hot as it was in January and February. But last week there were some solid plays. And all my trades were OTCs.

One stock was exceptional because it had real news. Check it out…

Trade Review

The COVID-19 crisis in India is very scary. It’s the hardest-hit country in the world right now. It’s worrying, too. India is second only to China in the number of COVID-19 doses manufactured. But it’s the number-one exporter of COVID-19 doses worldwide.

What does that have to do with my trade? Let’s review…

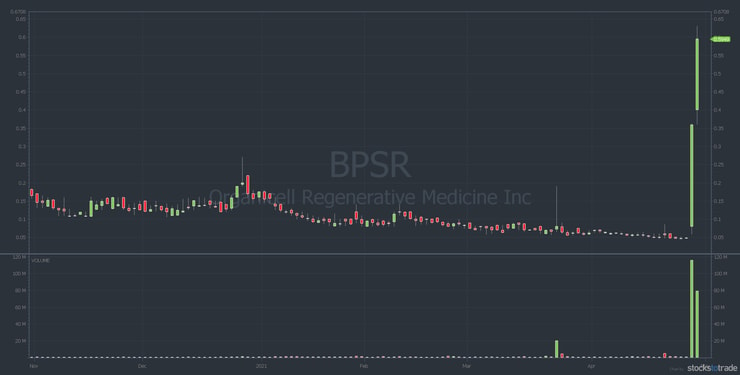

Organicelle Regenerative Medicine Inc. (OTCPK: BPSR)

Organicelle Regenerative recently announced positive results for COVID-19 patients treated with ZofinTM. The test group was small, only 10 patients, but it was in India.

When a company has success with a product that could help the hardest-hit country, it’s no surprise the stock gets attention. And BPSR did get attention.

First, check out the BPSR six-month chart…

As you can see, the news catalyst spiked BPSR big time. Then the social media chatter picked up and it kept going. Here’s the BPSR chart from April 28–29 with my trade entries and exits…

The first trade I didn’t want to chase. Instead, I bought the dip after the first big spike. It hit a wall of sellers, so I was happy to take a $1,908 win.** BPSR consolidated during the slower afternoon hours. Heading into power hour the volume picked up and it was closing very strong.

I bought just below the breakout over the previous high-of-day. It had a little breakout but wasn’t convincing. Again, instead of being aggressive, I played it safe and took the $2,464 win.**

The final trade on the chart was a morning panic followed by a beautiful morning spike. This play is a great example of why I prefer not to hold overnight right now. Yes, it gapped up, but I would’ve sold into the open and missed the bigger play. This trade was a solid $5,453 win.**

Trading Mastery: BPSR Live Trade

Finally, I had a very fast dip buy on BPSR right at the market open on Friday. It was during my Trading Mastery webinar. I only just made the market open due to my cab being late, but it was another $1,637 in profits.**

Register today for 12-months of Trading Mastery webinars.

Millionaire Mentor Market Wrap

That’s another update in the books. I hope you realize how much hard work and studying it takes to get this niche. The trade review this week was a stock with real news rather than fluff. Would you have known the difference?

At the same time, promoters are everywhere in this niche. Don’t let them fool you. They want as many buyers as possible to prop up their pumps. They have zero interest in you becoming a self-sufficient trader. I’m not trying to rip on promoters. Thank you promoters for creating such predictable patterns.

I just want you to learn the pattern so you can react. So if you’re an average retail trader, watch out. Learn how this niche works.

Trading Education Resources

What do you need to learn? A lot. It’s gonna take time and a HUGE effort. Are you ready? If you haven’t yet decided to apply for the Trading Challenge, start with…

“The Complete Penny Stock Course”

Written by my student Jamil, this book covers the basics of my entire penny stock strategy. Want to know about catalysts? See page 183. Need more information on creating a watchlist? See page 205.

30-Day Bootcamp

Ready to take a deeper dive into the basics? The 30-Day Bootcamp takes it to another level. You get video lessons, workbooks, quizzes, and “The Complete Penny Stock Course.”

To learn the framework I use, watch “Pennystocking Framework” and “Pennystocking Framework Part Deux.”

(Hint: “Pennystocking Framework” is included as a BONUS with the 30-Day Bootcamp. And you don’t have to finish in 30 days. You get access for life.)

As always, my goal is to be the mentor to you that I never had. But YOU have to put in the time and effort. YOU have to focus on the process. It’s up to you to test, tweak, and refine over time. You got this?

Please congratulate Dan, Bryce, and Evan in the comments below. I love to hear from all my readers!

*Bryce’s, Evan’s and Dan’s trading results are not typical and do not reflect the experience of the majority of individuals in the Trading Challenge program and reporting on Profit.ly. This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. Timothy Sykes has a minority shareholder interest in the platform. The typical success rate of users was based on the following methodology:

- From January 1, 2020, to December 31, 2020, 849,078 trades were uploaded to Profit.ly. 633,891 trades were “verified” (corroborated with trade account data).

- Instructor trades are ignored.

- Average P&L / trades is obtained by calculating total P&L and dividing by the total number of trades

- Average trades per account is obtained by counting the total number of trades and dividing by the number of accounts (mean function)

*While Tim Sykes has enjoyed remarkable success trading stocks over the years, his primary income derives from the sale of financial education products and subscription services offered by various businesses and websites in which he has an ownership stake.

Leave a reply