URGENT MEMORIAL DAY SALE HERE and another SALE HERE with coupon code: save100

Below you’ll find my 5 Step Process that I feel everyone should utilize to get the best results and put you on track for success.

If you’ve watched my DVD guides (which are on sale here for 48 hours ONLY), seen my recent trades HERE of what kinds of trades are working best right now and read my recent blog posts like “Try This Every Morning And You’ll Make Money” and “The Best Play That’s Working Well Right Now” you know it’s VERY important for me to look for hot stocks near the market open.

And even though I was traveling today, I still nailed one of the hottest penny stocks today as I detailed in this video lesson and as you can see from my solid $1,000+ profit trade on it:**

And while making $1,000 doesn’t seem like big money, that’s how my top millionaire trading challenge students and I grew our accounts at the beginning** and remember that’s more than enough to keep the real job away…so leave a comment below this post saying “I will make $1,000/day” if you understand and watch this video for further proof:

…and I even emphasized this specific point in yesterday’s blog post “My Thoughts On The Coming Week” and sure enough that mentality and strategy paid off nicely today.

So, here’s a simple 5-step process you can do EVERY single morning before the market open at 9:30am EST…ideally by 9:15am EST or even 9am EST so you’re not rushing right at the opening bell at 9:30am:

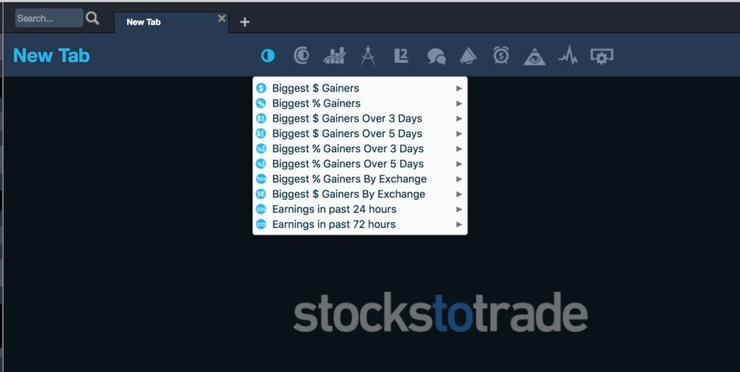

1. Check the biggest % gainers and other top scans that are built into this key tool since it’s built specifically for scanning the hottest low priced stocks which no other platform is built for…and it’s on sale for 48 hours HERE using coupon code save100

More Breaking News

- Datadog’s Market Surge: What’s Driving the Momentum?

- HIVE Stock Surges: What’s Driving It?

- Datadog Soars on Wolfe Upgrade and S&P 500 Inclusion

2. Out of whatever big % gainers you find, look at the news that cause the big % gain…is it an earnings winner that has the potential to be like this solid long pattern? Is it a pump that is better for shorting like this pattern? Or is it a pump on the verge of a big collapse that might make it a great dip buy like this pattern…or is it something else?

Study and get to know the most common and your favorite patterns ahead of time (researching these video categories meticulously helps a lot), see which patterns you’re best at capturing some of the big move on and ignore patterns you suck at…we’re all different so just because one pattern works for one trader does not mean that it’ll work for you, some of my top upcoming millionaire trading challenge students just have a few key patterns they’re good at:

…and also understand that just because a pattern has worked in the past does not mean it’ll keep working so you must adapt to changing patterns too, as my most successful Trading Challenge student has done well:

3. Stay out of the big % gainers without news — I usually ignore big % gainers without news as you have NO idea what’s causing the big run up so it could literally be a good long or short and you have no idea, it’s a coin flip and I would not be a successful trader if I liked 50/50 odds…that would make me a typical gunslinging gambler and I know too many traders who have fallen victim to trades with crappy odds just because they’re such degenerates that they need “action” all the time…it’s kind of sad that I have the most Millionaire Trading Challenge students and it’s 100% because most other teachers don’t emphasize the importance of being extra-picky and extra-safe when trading these volatile stocks, I’m a full-on coward in trading and teaching and I’m proud of it since it gives students the right mentality, even if brokers and gunslingers tell you to trade a lot more than my top students and I do…welcome to the industry that’s full of shit, where most brokers and “teachers” are on the verge of a very dangerous reckoning as I warned here.

4. Use my https://traderchecklist.com guide parameters to plan your trade BEFORE the market opens…we even have this handy free tool so you can plug in values like float, market environment and past performance of spiking as ALL of that matters when I make a trade…see today’s video lesson to see how I have internalized all of this over the years and am able to find the best stocks before most others put it all together.

5. Don’t be looking to trade ALL THE TIME, but be open to trading IF a play fits enough of the indicators I go over and over and over…then it’s just rinse and repeat, practicing your trading, even if you have no money using paper-trading here to get used to the volatility that these penny stocks have and trying to take trades with solid risk/reward…knowing that you won’t win 100% of the time — my top Millionaire Trading Challenge students and I “only” win 65-75% of the time, simply cutting losses quickly when we’re wrong and trying to capture “the meat of the move” on all the best plays of the day, understanding that the majority of volatility happens right near the market open and the market close and that’s why I have so many part-time students and traders too!

Leave a reply