I often say “Learn it, love it, live it…” It’s an old adage with a ton of variations. It applies really well to the process of learning to trade.

To become a self-sufficient trader, you have to do two things…

- See the patterns play out in real time.

- Try different setups until you find what works best for you.

Nobody goes in and nails every trade from the beginning. Nobody nails every trade at any time in their career. Learning to take losses is part of the game.

What I love about teaching is that my students, trade by trade, confirm everything I teach. From patterns to catalysts, their dedication shows that what I teach is real.

Wanna know something?

Table of Contents

I Love It When Students Prove Me Right

When students share their trading journeys and learning experiences, it proves me right. It’s fantastic to see students — from newbies to new millionaires — sharing. And it’s not only my strategies they prove right.

They also help expose…

The Truth About Penny Stocks

A lot of people doubt penny stocks. And if you look at penny stocks as investments, the doubt is justified. (New to penny stocks? Start with this FREE guide.)

But for trading…

It’s a completely different story as long as you don’t buy the hype. Never hold and hope. Lock in profits along the way. Penny stocks are an outstanding trading vehicle … when they’re in play.

That’s one of the reasons…

I Love It When Doubters Call Me Out

The funny thing is, the haters and doubters think they’re exposing something. What they expose are potentially bad or lazy students. So they’re doing me a favor.

They also make it easier for me to highlight the fact that I’m 100% transparent. I share every trade here.

But the doubters are also right about some things…

You’re Right to Recognize the Scams

This is a sketchy industry and it’s easy to get sucked into a scam. It’s human nature to look for the best in people. If you want to survive in this industry, expect the worst and you’ll never be disappointed.

It starts with understanding…

More Breaking News

- Bitcoin Crash Sparks Sharp Decline in Cryptocurrency Stocks

- QuantumScape Takes a Big Leap with New Battery Line

- GTM Stock Experiences Notable Fluctuations Amid Recent Financial Developments

- Huntington Bancshares Faces Earnings Miss, Market Considers Impacts

Most Penny Stocks Are Scams

Most penny stock companies fail in the long run. Or they do financing after toxic financing to keep the lights on. But they almost never turn into profitable companies worth your investment.

That’s why I trade like a sniper. Watch this video to see…

How I Cut Through the BS in Penny Stocks

This is part of the reason I got into teaching 12+ years ago. I was on the TV show “Wall Street Warriors” and people saw that I turned a few thousand dollars into several million. I was living a pretty good life as documented by the series.

People were contacting me and asking to learn. But at the same time, a lot of people thought I was a scam. Which is understandable because…

Most Teachers on the Internet Are Frauds

Some would actually say, “I want to learn but I think you’re a scam.” They experienced inner conflict. Again, it’s just a beautiful thing to be real in an industry full of frauds…

The Proof Is Seeing It Play Out

It’s easy to check. I’ll explain more, but you can watch all this with your own eyes before trading a single share. Also, I have students who literally just want to give it a try. Like this guy…

Some stats. I joined @timothysykes SuperNova alerts 2 months ago. Mainly for the training but also to give it a try. Total newbie. On the alerts I’ve acted on (4), average win is 16.8%. I’ve averaged $1046 positions. Made $703. Legit. I plan to scale up as I get more experience

— HeavyMetalMillionaire (@HeavyMetalMill1) October 10, 2020

Here’s a guy who joined my Supernova Alerts. (Keep reading for more information about Supernova Alerts.) He joined a few months ago and started trading because he wanted to give it a try. He’s a total newbie. (Although he’s already a successful entrepreneur.)

So he’d taken action on four alerts and his plan is to scale up as he gains experience. That’s fantastic.

What are Supernova Alerts? They’re alerts for people with less time for trading and learning the nuances. Only members get alerts for potential Supernovas. It can work better for people who want to focus on one simple strategy. They confirm the action. Then they can get in, get out, and move on with their day.

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

How to Grow a Small Account

If you’re interested in this strategy, watch the no-cost Supernova Alerts presentation. Keep in mind that you still need to study and not every alert is a winner. There’s no easy button.

I’ve had several recent Supernova Alerts winners. Let’s look at a few…

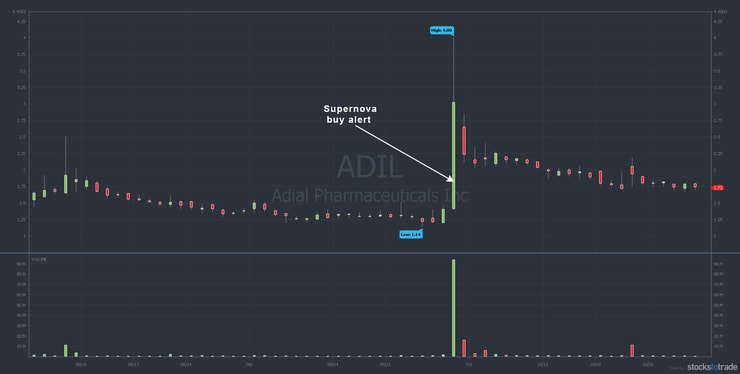

Adial Pharmaceuticals, Inc. (NASDAQ: ADIL)

Congrats to all my https://t.co/e6fMS4JVqW subscribers on $ADIL with my buy alert in the $1.80s this morning, i was out in Tulum all day and came back to see it hit $4/share in the afternoon, wohooooo!!! Soooo awesome https://t.co/upbH5YNf4H

— Timothy Sykes (@timothysykes) September 29, 2020

Here’s the ADIL three-month chart showing how far these stocks can go…

The awesome thing is, I picked it in the $1.80s and it hit $4 around five or six hours later. Traders had plenty of time to confirm the trade.

Here’s another recent Supernova Alerts winner I picked…

Ocean Power Technologies, Inc. (NASDAQ: OPTT)

Check out the OPTT three-month chart with my alert…

I picked OPTT at $1.17 and it hit the $3.60s the same week — a triple. Again, there was plenty of time with this one.

This is a strategy that can work for some people. The plays have a potential of 50% to 200% upside — that’s the beautiful thing.

And you choose how aggressive you want to be.

It’s so cool to see students doing well. And that gets back to the whole purpose of this post. I love it when students share their wins — big or small. And I also love it when they’re transparent with their losses because it helps everyone learn.

With that in mind…

How to Get My ‘Love It’ Attention

A lot of people ask, “How can I get your attention?”

First, if you want direct Q&A, get in the Trading Challenge for the chat room and webinars. But if you just want me to see what you’re doing, post on Twitter and tag me. I’m always looking at Twitter.

Here’s another way to get my attention.

Write a blog post on Profit.ly. We have that option now, and I’ll look at it. I love it when my top students write posts about their journey. Here’s a GREAT example…

Expand and Optimize Your Mind for Success

Jack Kellogg (Jackaroo on Profit.ly) wrote this post on October 10. It’s a great post and I want to share some thoughts about it. (Jack kept his eye on the prize and passed $1 million in trading profits on November 5.*)

An ‘I Love It!’ Success Story

Jack is one of the top young traders in the Trading Challenge. He’s a moderator in the chat room. He also co-hosts the TWIST podcast with Matthew Monaco and Kyle Williams. But it’s been a journey, and it wasn’t always easy.

When Jack started learning to trade, his family and friends told him he was wasting his time and gambling. Instead of supporting his dream, they told him it wouldn’t last. They were even disappointed when they found him studying. They were so negative that he went from extrovert to introvert.

I’m used to this. But remember, most of the time…

Your Doubters Want the Best for You

The thing about Jack’s family is that they wanted the best for him. Friends and family aren’t bad people. They’re concerned you’ll get scammed or not have the dedication to follow through.

Jack’s family didn’t know me from anyone else on the internet. I doubt they know that most traders lose. But I bet they’ve heard horror stories galore of get-rich-quick scammers. Maybe they visualize snake-oil salesmen pitching to people in the 1800s.

So if someone in your circle of family and friends is doubting or hating, remember they don’t mean harm. They don’t mean bad for you. They’re trying to protect you.

Again, I’m proud to be real in an industry full of scams. But this is exactly why I show all my trades. It’s why I encourage my students to show all their trades, too.

The cool thing is that Jack had one family member who believed in him…

Uncle Larry’s Wise Words of Success

In his post, Jack said he was studying while babysitting his cousin when his aunt and uncle came home early. And while his aunt appeared disappointed, his uncle was interested.

Jack’s uncle Larry told him, “Stick with it long enough, and you’ll be a consistently profitable trader.”

Jack stuck with it. That was in 2017. In 2018 Jack started to gain some momentum and his uncle was pleased. But in late 2019, Jack found himself updating his uncle while shorting a pump that kept going up. He was in a position where he could potentially blow up his account.

His uncle, ever the wise advisor, told him two things…

First, if he was confident in his plan, stick with it. Second, even if he lost, he was learning, so stick with it. As a former short-biased trader, I would have advised Jack to follow rule #1: cut losses quickly. But Jack knew it was a pump and was able to sit through the pain.

It turned out to be his first five-figure win for $13,391 in profits.*

Because of the pandemic, Jack hasn’t seen much of his family and hasn’t been able to update his uncle. But I bet Uncle Larry will be proud when he hears Jack passed $1 million in trading profits!*

One more thing about Jack’s post that I need to emphasize…

The More You See, the Better You’ll Be

When Jack was feeling pressure from his family, he focused on learning. And he was able to do that because, in his words…

“I knew what was possible because I saw the opportunity day in and day out.”

His family didn’t. Again, they were relying on the stats. If you start seeing these plays day by day, if you see 50%, 100% … even 200% gainers … it’s pretty crazy. And the more you see them, the better you’ll be. Just don’t expect it to happen overnight.

And don’t expect it to be an exact science. My sell alerts on ADIL and OPTT were both way too soon.

Confessions of a Penny Stock Lover

I’m 20+ years into my journey, and I still love it. And I still underestimate the potential of a lot of trades. But don’t take my word for it. See it with your own eyes over several months or years. Give the patterns a chance, see how predictable these plays are, and stick with it.

You can doubt all you want — like my first hater Michael Goode. He wrote a blog post called “Timothy Sykes is full of bullship.” But then he gave my strategies a try and became my first millionaire student.*

So be skeptical and have doubts. But at least watch and try. Here’s how…

Love It and Stick With It: Tools for Success

Use these tools to get started — and stick with — your journey.

My YouTube channel has over 1,550 videos (and growing.) There’s SO MUCH solid information there. It blows my mind that more people don’t watch every video and take notes.

“The Complete Penny Stock Course” by my student Jamil gives you all the basics in one book.

The 30-Day Bootcamp I recorded with Matt Monaco this year condenses three years of learning into 30 days. (You don’t have to finish it in 30 days. You can work at your own pace.)

Profit.ly has thousands of video lessons (and growing) dating back to March 2010. Again, it blows my mind that more people don’t watch every video. Yes, video lessons from 10 years ago are still relevant. The patterns are the same!

Mark Croock watched every video lesson three times — and organized them. Maybe that’s why he’s a multi-millionaire.*

And … if you’re a Trading Challenge student, there are 1,025 archived webinars (and growing). Add that to the list of tools you can use to help you become self-sufficient.

Now go study! After you comment below…

Don’t you love it when students share their trading journeys? Comment below — give Jackaroo and @HeavyMetalMill1 some love!

Leave a reply