Today I want to talk about what some of my top students do to help them make consistent gains in the stock market.

How are some of my students able to make six- and seven-figure profits? Are they really just getting lucky?

People love to bash success stories. I’m not sure why — maybe they’re jealous. Success stories like those of my top students should be an inspiration. They should show you what’s really possible thanks to the internet.

Need a little motivation? Check out these hard-working traders!

[Before we go any further, I gotta please the lawyers with a quick disclaimer. These students’ results aren’t typical. It takes time and dedication to develop exceptional skills and knowledge. Most traders — around 90% — lose money. Trading is risky. Never risk more than you can afford.]

Table of Contents

My “Lucky” Success Story

Every day, people on social media attack me saying…

“Sykes — you just got lucky back in the 2000 tech bubble, and you haven’t made any money since.”

Maybe I did get a little lucky in the beginning. I was in the right place at the right time. But my trading consistency has allowed me to make money every year.

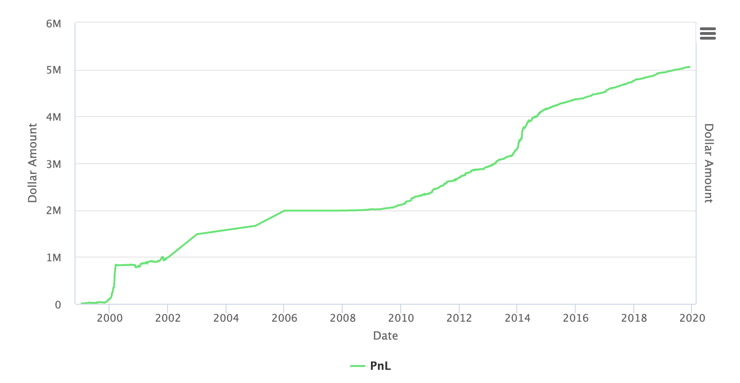

For the haters, here’s my profit chart:

You can see I made my first million at the end of the dot-com boom. But my profits didn’t abruptly stop when the bubble burst. In fact, my largest trading profit year didn’t even happen during the tech bubble.

2014 was my largest trading profit year. That’s when I made $844,813.

Since then, I’ve reduced the size of my trading account to help my students. I find students in my Trading Challenge learn better when I trade with a small account that’s a similar size to their own.

Even with my smaller account, I consistently make six figures a year — all of which I donate to charity.

My trading isn’t lucky and it’s not a fluke. My top students all follow my rules, and they’ve also gone on to make six to seven figures every year.

I want to thank my students for being fully transparent and showing every single trade so new traders can learn.

Millionaire Mentor — Mark Croock

Mark Croock didn’t make nearly $1.38 million on one or two large trades. His journey, along with all my top students, is a marathon. He studied for almost a decade to reach this level of profitability.

Look through his trades and see why following my rules is so essential…

Check out Mark’s profit chart here and you can look through his trades here.

Mark says his average gain is only $1,110, but he’s still managed to make $1.3 million.

Becoming a six- or seven-figure trader won’t happen overnight. It took Mark over 4,000 trades to make it to $1.3 million in profits. The key to his success was following my #1 rule — cutting losses quickly. His small losses allowed him to find consistent profits … even while only winning 53% of the time.

If you want to find your own consistency in the market, take note from Mark’s journey.

I’m not saying you’ll be the next Mark Croock, but if you want to replicate someone successful — it’s vital to understand all the ingredients.

Let me expand this analogy…

If you’re a cook and you want to replicate a recipe by one of your favorite chefs … and the chef is willing to show you every last ingredient in the recipe … Guess what?

You can LEARN the recipe.

Once you understand the process, you can make that recipe anytime you want. Trading is no different. Understand the ingredients, the process, and work your butt off to replicate it.

You don’t have to reinvent the wheel. Use the vast resources at Profit.ly to your advantage.

Obviously, trading isn’t an exact science…

But Mark wins 53% of the time, profits an average of $1,100 per trade, and is up over $1.3 million … So what valuable knowledge can you learn from this millionaire mentor?

More Breaking News

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- QuantumScape Takes a Big Leap with New Battery Line

- BigBear.ai Expands Partnerships and Strengthens Financial Position

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

My Newest Six-Figure Student — Kyle Williams

My Trading Challenge student — Kyle Williams — reports that he’s up over $114,000.

Look at Kyle’s profit chart here.

[Hint: get to know your way around the Profit.ly website. After you read this entire post, spend some time checking out these traders. Click on their name (above their avatar/picture). You’ll find everything from their profit chart to individual trades. Some even record video lessons and monthly recaps. They know what it takes to be successful … so learn from their example.]

His chart is very gradual. His profits aren’t based on any single trade. Like Mark, he’s slow and steady — locking in small gains over and over again.

He wins 56% of the time with an average gain of only $356!

If you look closely at Kyle’s chart, he was negative for nearly a year while he was learning. Many of my top students take several months or even years to learn the necessary skills to become consistently profitable.

After putting in the study hours, Kyle’s profit chart just keeps grinding higher. I’m excited to see where he’ll be in a year.

My First Successful Student — Tim Grittani

The OG student Tim Grittani says he’s now up nearly $8.7 million after passing me last year in total trading profits.

Grittani trades with a much larger account now, which skews his statistics a bit, but the same lessons apply.

See Tim Grittani’s profit chart here.

Because he trades with millions of dollars, his average gain is $3,200. But early on in his career, he was making an average of $1,000–$2,000 per trade.

Over the years, he’s become more selective with his setups, and his win percentage is the highest out of any of my students. Currently, he wins 67% of the time.

Even though Grittani’s profits are MASSIVE, they happened slowly — one trade at a time.

The Dynamic Duo — Dominic Mastromatteo & Jack Kellogg

These two young students trade together in an office in Michigan. I managed to find time in my busy schedule to fly out and meet them for this great interview:

Both of these students have dedicated their lives to trading, and their journeys are impressive.

Let’s look at Dom (MichealGScott) first. Based on his Profit.ly stats, his average gain is just $544, and he wins less than 50% of the time — 48.6%, to be exact. But look at Dom’s profit chart … it’s straight up!

Again we aren’t talking about any single trade. Dom has taken thousands of trades, allowing him to amass $233,000 in trading profits.

For good measure … here’s Jack’s profit chart.

Jack reports being up $150,000 with a 56% winning percentage and $457 average profit.

So when people say…

“Sykes — you and your students just got lucky.”

… or “You have to win 100% of the time to be a profitable trader…”

Don’t listen! If you look at any of my top students, it’s clear you don’t need to win 100% of the time.

Time to Summarize

We only looked at a few of my top students. I could literally go into dozens of students who make six or seven figures from trading.

These students, on average, win 55%–70% of the time and $500–$2,000 per trade. That’s a recipe for success.

Too many traders only post how they made $30,000 today or only post their monthly statements.

That’s meaningless! Especially when so many people fake success with photoshop. It’s not hard for someone to create fake account statements and counterfeit profits. There are fake gurus and completely bogus services out there.

So I encourage you — if you’re ready to learn from someone — check every single trade they make first. Don’t just look at their profit chart or end-of-month statements. Look at the details. What’s their average dollar gain? What’s their average percent gain?

Plenty of people can make $20K–$30K in a day. But they trade with $2–$3 million dollar accounts. If you trade their strategies with a small account, you will NOT do well.

So, you must understand how REAL my students are and why I take so much pride in calling out the BS.

There will always be another scammer or another faker — there’s just no way to stop the BS. And there’s no point in trying to change people.

Those who fake do so because they aren’t real. But for my students and me, we are real. We show every trade. I’m so proud to be authentic in an industry full of fakes.

Want to be my next top student? Apply for my Trading Challenge today. This is your chance to learn from my top students and use that as a base for your trading. Turn their process and strategy into your own, and just maybe you’ll be in an article just like this one some day.

[Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

Which of my top students do you want to learn from? There’s no wrong choice! Comment below … I love to hear from my dedicated readers!

Leave a reply