The Beauty of Small Accounts and Big Percent Gainers: Key Takeaways

- There’s an untapped opportunity for small accounts IF you focus on big percent gainers.

- Wall Street doesn’t care about you. Keep reading to find out why.

- There’s more than one way to trade big percent gainers … that’s the beauty!

Could You Be Roland Wolf’s Next Millionaire Student?

This is a very important lesson for anyone with a small account…

Table of Contents

The Truth About Your Small Account

©

Brokers and analysts don’t want to deal with you. Newsletters don’t want to deal with you. Nobody wants to deal with you because you don’t have a lot of money, and you ask too many questions.

It seems ridiculous, right? How are you supposed to become a self-sufficient trader if you can’t ask questions?

That’s exactly why I started teaching — to shine a light on the most ignored segment of the financial world. Everyone thought I was crazy.

They told me…

- You can’t teach penny stocks.

- You can’t teach people with small accounts.

- Day trading is a scam.

- Penny stocks are a scam.

Of course, they were wrong. I’d already made millions day trading penny stocks.* I even started over with a small account to prove to myself that it wasn’t a fluke.

Brand New to Penny Stocks? Start Here.

What of those who said it couldn’t, or shouldn’t, be done? They were…

Blinded By Big Money and Assumptions

Everyone with big money and assumptions ignores small accounts. They ignore small gains and penny stocks. They’re looking elsewhere. For me, penny stocks are SO much easier. It’s astounding.

Be Careful What You Wish For

If you have a small account, understand this — you have an advantage. Most people with small accounts hate it…

“I can’t wait until I have a big account so I can take big size and make big money.”

Be careful what you wish for. Many traders get over the PDT only to start overtrading. They churn and burn their way under the PDT and have to do it all again. Or, worse, they focus on the wrong stocks.

So far in September, I’m up $20,731 trading stocks that Wall Street couldn’t care less about.* People with small accounts should focus entirely on these stocks.

The big lesson is…

Focus on Big Percent Gainers

At the end of this post, comment with “I will focus on big percent gainers.” Don’t worry, I’ll remind you.

It’s crazy how many people with small accounts are trading the wrong stocks…a BIG reason why 90%+ of traders lose, so stop this BS ASAP! Ignore what promoters and newbies say on social media, focus on big % gainers and learn the https://t.co/aICa7zhCLS & https://t.co/bzjI5mhQlG

— Timothy Sykes (@timothysykes) September 7, 2021

What stocks are the biggest percent gainers on any given day? Penny stocks. But most people say…

“Penny Stocks Are Scary”

Yes, I know penny stocks are scary. I’m not saying it’s going to be easy. They’re not all gimmes. But … you have to utilize your small account the right way so that you can grow it.

More Breaking News

- Vertiv’s Stock Surge: Expectations Soar with Updated Price Targets and Cooling Solutions

- Upstream Bio Faces New Strategic Challenges Amid Latest Developments

- Credo Technology Stock Skyrockets After Impressive Fiscal Performance

- Hims & Hers Health Faces Legal Storm Amid FDA and Novo Nordisk Scrutiny

Top Tip for Traders With Small Accounts

Never forget what it was like in the beginning. The market shifts. You could make a lot one year and nothing the next. So you need to remember what it was like trading with a small account — focused on the process.

There will come a time when you have to get back to focusing on the process. Ask Kyle, Jack, or Roland. They’re all millionaires now.* But they remember what it was like. When the market shifts, they adapt.

Speaking of Roland, did you see this?

Roland Wolf’s Brand New Project

I often say, “Study the past to prepare for the future.” Let’s review three recent runners so you can see it with your own eyes…

3 Recent Examples of Big Percent Gainers

As you study these charts, focus on similarities. Do your homework. Pull them up on StocksToTrade.** Save them and keep coming back to them.

Why You Should Study These Charts

These plays were there for the taking — they were there for anybody. StocksToTrade Breaking News alerted them.* They’re all slightly different, but each was a big percent gainer that provided opportunities.

Note: I didn’t trade every stock below. When I did trade, it wasn’t perfect. Trading isn’t about perfection. It’s about understanding patterns and price action. It’s about risk management and knowing what catalysts move stocks.

Health Revenue Assurance Holdings Inc. (OTCPK: HRAA)

First, take a look at the HRAA one-year chart…

HRAA was on my watchlist for a potential morning panic dip buy on September 14. Here’s the chart…

I got the panic I was looking for and I bought the dip for a $648 win.* Notice HRAA ended the day red. I didn’t hold and hope. Instead, I played the pattern for a single and moved on.

Here’s another recent big percent gainer…

Metal Arts Co., Inc. (OTCPK: MTRT)

MTRT was pretty insane…

On the morning of August 30, it was trading at roughly 7 cents per share. Later that day it hit 73 cents per share.

On September 7, it hit a 52-week high of $6.25 per share. That’s an 8,828% spike in six trading days. That’s crazy. Here’s the one-year chart…

I traded MTRT several times, taking both wins and losses. Overall, I’m up $4,162 on the stock due to a simple formula.* I have more wins (seven) than losses (four). And my average win ($700) was bigger than my average loss ($185).

Again, I traded my patterns and didn’t get attached. Here’s another example…

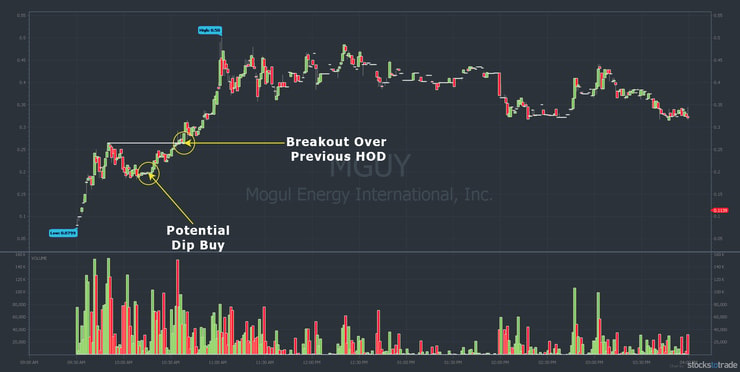

Mogul Energy International, Inc. (OTCPK: MGUY)

I didn’t even trade MGUY. But it was another big percent gainer on September 7.

Here’s the one-year chart…

There was more than one opportunity to trade MGUY for solid gains. Check out the intraday chart from September 7…

If you missed the initial spike there was a 50% bounce in 30 minutes from about 10:15 a.m. Eastern. Or you could have waited for the breakout for an 80% move in 25 minutes. If you bought the dip and held it to the high of day, it was a whopping 151% move in under an hour.

For what it’s worth, I wouldn’t have held through the entire move. Whether I bought the dip or the breakout, I would have been happy to lock in 10%–20% gains. Singles add up.

The takeaway is…

You can trade stocks like this with the potential to double, or even triple, your money if you catch it right. But you can grow a small account even if you trade conservatively.

The Beauty of Big Percent Gainers and Volatile Plays

There’s SO MUCH opportunity! It astounds me there are still people not taking advantage of these big percent runners.

Again, this is what I can do with a small account and small positions.* Don’t go big on these kinds of stocks, especially when chasing. But if you have a small account and you can afford to take a little speculative runner then, by all means, do it.

At the same time, pay attention to all seven indicators in my “Trader Checklist Part Deux” guide. This isn’t about being a gunslinger. It’s about maximizing your small account.

Learn to…

Play the Angles

There are so many angles…

Maybe you prefer holding over the weekend to buying dips or breakouts. Check out my Weekend Profits play on Clean Vision Corp. (OTCPK: CLNV). It’s another example of a big percent gainer. You could have played it differently to me and still crushed it.

Once you learn my 7-step framework and the basic strategies, the angles will open up.

An Untapped Market Opportunity

You can’t do this with tens of millions of shares or tens of millions of dollars in a position. But it is possible to make a few hundred or a few thousand trading the meat of the move. Even if you sell too soon and miss plays like I do. That’s the game.

Too many small account traders have a…

Mind-Blowing Focus on the Wrong Stocks

You MUST focus on big percent winners with catalysts. It blows my mind when I see people commenting on a stock down 7% on the day. Yes, it could be a solid uptrending chart. And I get it … If it’s slower moving, it’s less stressful.

But you’re wasting your time. You’re wasting your capital when you focus on boring stocks. Every day that you have these opportunities you should focus on big percent gainers.

I see people talking about stocks long after they’ve made a run. Maybe it’s something I traded when it was a big percent gainer. But now it’s choppy. It’s irrelevant to me, OK?

Why Trade Hot Stocks?

Some stocks you have to trade when they’re hot. That’s when there’s more opportunity and lessons.

Yes, there’s more stress. It’s scarier. But the more you practice, the less stressful and less scary it becomes. I get that you’re new and scared to lose your small account. But you’re not utilizing and maximizing your small account like you should.

Again, focus on big percent gainers. Take advantage of big runners. Even if you miss it, there’s usually a dip buy opportunity after the spike.

It’s not like there’s only one time to trade these. You can trade them on the way up, and you can trade them on the way down. That’s the beauty of these volatile plays.

Learn the 7-Step Pennystocking Framework

Most of my trades come from the 7-step pennystocking framework. Study it. Learn to see the patterns — both intraday and over days, weeks, and months.

If you want to go deeper, I highly recommend the…

30-Day Bootcamp

Matt Monaco interviewed me every day for four weeks. We talked about the 7-step framework, my favorite patterns, and how to find big percent gainers. It includes a workbook and fun quizzes. If you haven’t been through it, do yourself a favor.

Start Your 30-Day Bootcamp Today

Pennystocking Framework Part Deux

The 30-Day Bootcamp includes access to my original “Pennystocking Framework” guide. Part Deux shows how I’ve adapted the way I trade the framework. (I was mostly short biased when I made the original.)

If you’re ready to go all in and dedicate yourself to becoming a total penny stock trader…

Trading Challenge

All my top students honed their skills in the Trading Challenge. Many of them are now teachers in their own right — with their own chat rooms and alerts. There’s no other program like the Trading Challenge.

Check it out…

- 2–4 live webinars every week

- Thousands of video lessons

- Alerts

- Daily watchlist

- Trading Challenge chat room

- And much, much, more…

It requires dedication and determination. Are you in?

Apply for the Trading Challenge Here

Leave a comment below saying “I will focus on big percent gainers” I love to hear from all my readers!

Disclaimers

*Results are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable.

Timothy Sykes has a minority shareholder interest in the platform. I’ve also hired Kyle Williams, Jack Kellogg, Roland Wolf, and Matt Monaco to help in my education business.

**Tim Sykes has a minority ownership stake in StocksToTrade.com.

Leave a reply