Here’s another birthday gift for you in honor of my 36th birthday this past week and I HIGHLY suggest you take advantage of it ASAP

I get this question every single day and I’m sick of it. If you read my blog post “Answering 20 Penny Stock Trading FAQs” you’d know the answer is:

You need $2,000 in order to short sell, but my most famous student HERE started with just $1,500 and had to borrow $ from his parents to open up several brokerage accounts…I’m not a fan of borrowing money to trade, and since then, E*Trade has become a solid broker with a minimum of just $500 I believe to open an account, although you still need $2,000 to short sell.

Also, the vast majority of my students are over the age of 18, but if you’re under that age and are truly determined, get parental permission and my team will work with you…I started with a custodial account in my parent’s name, it’s not fun or easy, but it is possible.

Stop thinking in terms of minimums, if you’re serious about becoming a successful trader, you can’t cheat your way to success, my Trading Challenge students aren’t created at Costco, coupon clipping doesn’t grow your wealth exponentially and selling shit on Ebay takes forever to build true wealth!

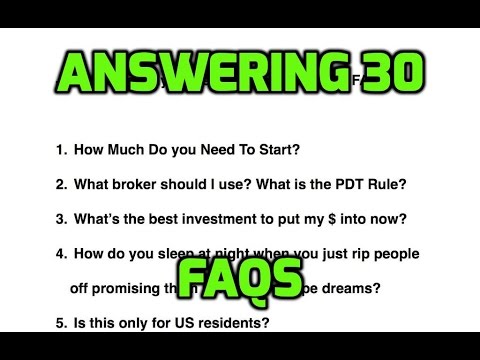

Here’s a video answering 30 FAQs not just 20:

But, more important than all of the stuff about having the proper mindset, let’s get into the nitty gritty details of actual account minimums because there’s so many assumptions and BS floating around out there, it really disturbs me.

First off, you don’t need ANY money to start studying and you should focus on studying FIRST before trading as you must picture trading as being like a doctor and your account is your patient…and without the proper medical training AHEAD OF TIME, your patient will suffer and die.

Now you don’t need to go through a decade of medical training and rack up six-figure in student loan debt, but you do need to know how to plan a trade ahead of time for if you just throw your hard-earned money into the market, or into penny stocks, I guarantee you it’ll be a waste and a loss in no time at all.

My Top FREE Resources on Penny Stock Trading

- Watch these video lessons FIRST

- Watch this 11-hour guide FIRST

- Watch these free video lessons FIRST

- Read this book FIRST

- Watch all 800+ free videos here FIRST.

Yes, you have A LOT of studying to do FIRST before you begin trading…

And yes, I know some people like trading and studying simultaneously so let’s talk brokers and minimums too.

More Breaking News

- Netflix Markets Reacts as Bidding War for Warner Bros. Discovery Ends

- Pinterest Faces Legal and Financial Turbulence as Stock Plunges

- Redwire Corporation Stock Surges Amid Strategic Expansion Moves

- Intuitive Machines CFO’s Stock Sale Draws Attention Amid Market Fluctuations

Recommended Brokers & Their Minimums

Out of the brokers I use, E*Trade has a minimum of $500 to open account, but they’re not open to a lot of countries and I’m sorry I don’t work for them, I don’t even talk with them as most brokers hate me since I encourage people to have more patience than over-trade like brokers prefer in order to rack up big commissions.

There are new sleazy brokers that try to lure you in with no minimums and cheap or even no commissions, but as I warned here, they make money off you in other ways all the while providing you a disservice with unlimited trading, terrible executions and flawed lessons from trading that will cost you far more in the long run…and you don’t realize it until it’s too late…but they’ve become very popular by taking advantage of poor people’s naivety and cheapness.

Long story short, nobody didn’t get rich just by saving on commissions alone… I don’t mind spending a shitload on commissions if the broker can give me good service and solid borrows on penny stocks I want to short since shorting a lot of these pump and dumps is such a great strategy.

As I said in “Warning About Using These Wrong Brokers“, I wouldn’t use an off-shore broker or any of these questionable hedge funds or prop firms as the risk of you losing your entire account without any insurance is too great.

Interactive Brokers, another broker I do use, is likely the best choice broker for most people all around the world, but their minimum is $10,000, although there’s a loophole – if you’re under 26 the minimum is just $3,000.

I literally have thousands of emails from broke or near-broke people whining and complaining about these minimums and the truth of the matter is that broke or near-broke people suck to work with, they blame everything on everyone but themselves, and they’re almost all incompetent in one or several ways (hence why they’re broke or near-broke)…

Sorry to be brutally honest, but that’s the truth…and broke or near-broke people shouldn’t even be trading, you need to get your lives together and learn how to make a steady income in order to pay rent and for groceries etc….even the best traders know that the stock market cannot be relied upon for every day expenses and you don’t want to have to force trades in order to try to make enough money to afford next month’s rent!

So, it’s really no surprise IB has these minimums and I’m surprised they’re even willing to take on their current minimums, if I owned a broker, I’d have the minimum set at at least $30,000 like my high-net-worth broker (hit us up here if you want an intro, I don’t mention publicly because I don’t want them being overwhelmed like some small brokers have been in the past thanks to my hyena-like students) does just to not have to deal with the people who shouldn’t be trading anyway.

And no, you do not need $25,000 in order to trade stocks, that’s just the amount required by the Pattern Day Trader Rule regarding US accounts under $25,000 if you want to make more than 3 day trades per week, which you shouldn’t be doing anyway since there aren’t that many truly great plays for you if you have a small account…watch this video on ideal setups:

And, today’s video lesson I just posted HERE outlines the single most reliable intraday pattern right now which does not pop up more than 1-2x/week MAX.

If you have under $25,000 you can still hold a stock long or short every single night and even though there are added risks holding overnight, if you have the proper take on a stock like shorting the first red day on penny stock pumps like this, it can be very rewarding AND you don’t even waste one of your 3 day trades allowed per week.

Also, if you’re not based in the US the Pattern Day Trader Rule regarding accounts under $25,000 doesn’t even apply to you so don’t sweat it! I know many US people who think they should be free to trade as much as they like, and when I first started teaching I was against it too, but now after 10 years of seeing countless newbies screw up again and again and again and again and overtrade again and again and again, I’ve come to respect the the Pattern Day Trader Rule and agree with it…sorry to say.

If you want to trade a ton then go sign up here and utilize the new paper-trading feature until your heart’s content, it’s not real money, but you’ll learn a ton and hopefully get the degenerate trading trait out of you with this fake money so that you can begin your journey of controlled and disciplined trading.

And, it’s not just me who think this way, my new most popular trading challenge student also believe in patient, meticulous trading on EVERY trade:

**

…so 3 day trades and unlimited overnight trades per week is MORE than enough for you newbies.

So, there you have it, if you can’t meet the minimums of these brokers, save up…if you can, open an account and beware that most traders lose so it’s your mission to study, study, study, study and study some more to up your odds of success and increase your knowledge BEFORE you risk your hard-earned money.

I’m not going to lie to you and say it’s easy to be my next successful student, but as more and more of my Trading Challenge students are showing, it is possible and the secret to our success is obsession and over-preparation.

It doesn’t matter if you start with ZERO, $1,000 or $5,000 or even $50,000, it matters far more how much you’ve learned after 6 months, 1 year, and 2 years…no matter what you start with you won’t make much in the beginning until you learn all the rules and practice good trading habits like these over and over and over and over and over again.

Practice makes perfect and remember even this now-famous penny stock trader wasn’t consistently profitable for his first 9-months** so get any thoughts of immediate success out of your head entirely and commit to this as a marathon, not a sprint.

So, instead of worrying so much about account minimums, worry more about studying minimums and then think about how you can flip the scale and get to studying maximums so much so that the scale gets flipped upside down and you know so damn much, you’re not worried on ANY trade whether you’re risking $500 or $5,000 or $50,000 or $500,000.

This young man doesn’t even know how many hours/day he studies anymore, it’s become his obsession and now after a year his obsession is really beginning to pay off.

How many hours are you willing to study to be successful? How many nights out are you willing to sacrifice to become knowledgeable? How much money can you make AFTER you absorb all the knowledge there is to absorb and become truly masterful in this niche?

Leave a reply