I trade fast, but I’m not high-frequency trading fast. That’s on a completely different level.

High-frequency trading is a game of speed. I don’t run into it much in penny stocks.

But even if penny stock land is your go-to niche, don’t let that fool you into thinking you don’t need to know about high-frequency trading. It’s smart to know about this strategy to grow your overall market knowledge.

This trading style could change how you think about and view the market.

At the very least, you should know how it’s shaped the current market structure. The history goes back to before I started trading 20+ years ago. It’s crazy to think that we only just started realizing its influence on price action in the last decade or so.

Today, you can learn the basics of high-frequency trading right here. Expand your knowledge account, then decide what you think of fast strategies.

Table of Contents

- 1 What Is High-Frequency Trading (HFT)?

- 2 High-Frequency Trading vs. Algorithmic Trading

- 3 How Do You Make Money From HFT?

- 4 Pros and Cons of High-Frequency Trading

- 5 High-Frequency Trading Rules and Regulations

- 6 How Does High-Frequency Trading Affect the Market?

- 7 High-Frequency Trading Strategies for Beginners

- 8 How to Pick the Right High-Frequency Trading Software

- 9 Does High-Frequency Trading Really Work?

- 10 Can I Do High-Frequency Trading?

- 11 Bonus: Books to Better Understand High-Frequency Trading

- 12 Frequently Asked Questions About High-Frequency Trading

- 13 The Bottom Line on High-Frequency Trading

What Is High-Frequency Trading (HFT)?

I’m only human, so there’s no way I can be microseconds fast.

That’s where computers come into the market…

Investment banks and trading firms use advanced algorithms and software. They analyze multiple markets at a time. Once a computer detects a trend, it enters thousands of trades in the blink of an eye.

These are ultra-short-term positions. Did you think holding for a few minutes was short? Computers enter and exit positions faster than you can say … pretty much anything.

High-Frequency Trading vs. Algorithmic Trading

2025 Millionaire Media, LLCThis can be a little confusing. Let me clear it up.

High-frequency trading uses algorithms to find stock picks. But it’s different from algorithmic trading.

Algorithm traders let computers decide which positions to enter and exit. These trades focus on bigger profits. The software calculates when to buy, how many shares, and how long to hold the position.

HFT is different because it doesn’t calculate how long to hold a position or how many shares to buy or sell. The goal is to get in and out as fast as possible and with as many orders as possible.

It may seem like a bogus strategy, but hedge funds and trading firms have been using it for decades.

How Do You Make Money From HFT?

There are two main ways. The main idea is a huge volume of trades…

Scalped Profits

The computers enter trades for less than a second. So their profits on each position are usually a fraction of a percentage. If that doesn’t sound like a lot, you’re right.

I’m no stranger to small profits. Once a trade no longer fits my pattern I get out of the trade. I’m not ashamed of small gains or losses. That just means I followed my rules and traded safe.

My patterns can offer the opportunity for big percent returns. But I aim for singles. Greed won’t help you in the markets. And if a stock starts to look weak I don’t hold and hope. That’s a losing strategy.

Firms and hedge funds look for a small percentage of the profits. They get in and out quickly to minimize risk. There’s a name for traders like that: scalpers.

Scalped profits are tiny, but remember that computers open thousands of positions. With that many trades, profits can add up.

Liquidity Provision

There’s another way to potentially make money from this strategy.

In the early 2000s, liquidity was a big concern for the market. It was difficult for traders to get orders filled at the price they wanted.

Exchanges started offering incentives for companies to increase market liquidity. That means exchanges reward firms that buy and sell a lot of shares. They’re helping fill orders.

For example, the New York Stock Exchange (NYSE) pays supplemental liquidity providers — or SLPs — $0.0012 per share.

That’s not a lot … but remember that there’s a ton of shares in each order. Over time that adds up.

Pros and Cons of High-Frequency Trading

There’s no such thing as a perfect strategy. HFT was originally introduced to help loosen up the markets, but some people say it does more harm than good now. Let’s break it down…

More Breaking News

- Is CNH Industrial Set for a Comeback?

- IREN’s Remarkable Rise: Stock Soars on Convertible Notes Success and AI Expansion

- Webull Corporation’s Stock Skyrockets: What’s Driving the Surge?

Pros

The two biggest pros are that HFT adds liquidity to the market and gets rid of big bid-ask spreads.

“Who buys the stocks I sell?” That’s a common question I hear from newbies. The logical answer? It’s whoever wants to buy what you’re selling at the price for which you’re selling it.

But … what if no one wants to buy?

Then your order doesn’t get filled. That’s an example of illiquidity.

I can’t sell shares at $2.57 if the highest buyer will only pay $2.52. The difference between those two numbers is called the spread.

The result is a stalemate. Either I lower my sell price to meet the buyer or vice versa. A third option is for someone else to come in and fill orders between our prices to reduce the spread.

Reducing the spread can allow for smoother trading as buyers and sellers meet in the middle.

Cons

Market liquidity used to be a big problem. Exchanges needed help filling orders and defining stock prices so traders could enter and exit positions more easily.

But HFT critics say that the market is liquid enough by now. It’s never been easier to buy and sell stocks. You can make trades on your phone with the push of a button and brokers typically fill orders in seconds.

More people are investing than ever before. Is the market liquid enough? Maybe. I don’t have that answer.

Another critique is that HFT creates dangerous volatility.

Computers don’t trade with human judgment. A good decision for a computer program could be disastrous for the market.

The flash crash of May 6, 2010, is a perfect example. It started at 2:32 p.m. Eastern and lasted 36 minutes. Stock prices plummeted, seemingly for no reason, then rebounded just as quickly.

The SEC found that the reason for the crash was a hedge fund selling millions of dollars of stock. Algorithms saw the directional pressure and started selling off shares as well. The result was a landslide of selling.

It’s estimated that 50% of all market activity is computer trades these days. If enough computers make the wrong decision, the effects could be catastrophic.

For help surviving a volatile market, check out my no-cost “Volatility Survival Guide.” Use it to learn how to make volatility your best trading friend.

High-Frequency Trading Rules and Regulations

There have been efforts to decrease volatility and make it safer for the market. But money is king.

Traders will always try to find an edge.

Firms have spent millions of dollars laying fiber optic cable to the nearest exchanges. All to shave microseconds off of order completion.

Firms may also pay exchanges to fill their orders first and pay for early access to public data.

Trading in the stock market is like going to war. Those with the best weapons usually win.

I’ve been profitable for over 20+ years of trading because I have experience and the best tools for my niche.*

So I don’t have to shave nanoseconds off my order speed. It’s all about the patterns that play out again and again. That’s the beauty of penny stock trading.

How Does High-Frequency Trading Affect the Market?

2025 Millionaire Media, LLCIt all comes down to liquidity. Exactly how much is a bit of a mystery.

Some studies show that after introducing high-frequency trading, bid-ask spreads decreased. And again, smaller spreads make it easier to fill orders.

But making trades is easiest when market liquidity is high … So with today’s liquidity, maybe we can do without it.

Also, computers aren’t perfect. We’ve seen algorithms cause market volatility in the past. Who’s to say we won’t see it in the future?

Does High-Frequency Trading Affect Forex Traders?

Recently we’re seeing more activity in the foreign exchange markets. That’s probably because of the increased competition.

Forex markets are big enough to allow large trading volume. Also, fluctuating currencies provide opportunities to profit off price inefficiencies.

But it means competing against the big guns. I don’t trade with algorithms or complex statistical software. That’s an expensive game to play.

High-Frequency Trading Strategies for Beginners

I’ve been teaching newbies to trade for over 10 years. The first thing to know is…

Trading is never easy.

I’ve excelled because I picked a niche. I learned the rules and focus on staying disciplined. In the stock market, competition is important.

Things happen fast, and the fastest to react wins.

If you’re looking to get into high-frequency trading, my advice is to do your research. See if you could join a firm that already does it. It’s an expensive business. Getting started is not easy.

High-speed computers interpret market information and make trades faster than any human.

I could never compete with trading firms. But most importantly, I don’t want to.

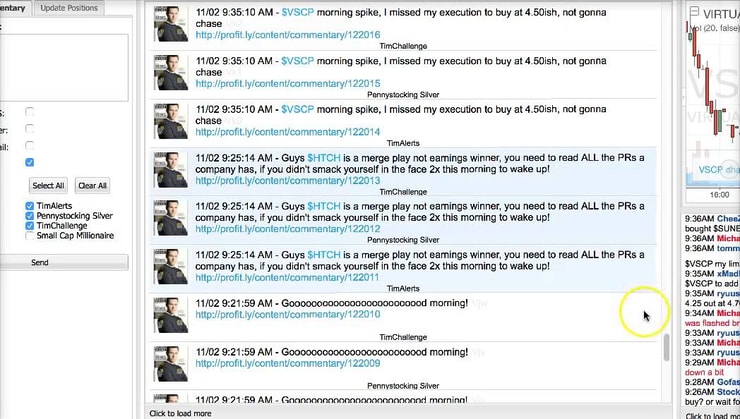

I’ve made over $7 million trading penny stocks.* (Follow me on Profitly where I share all my trades.) Big Wall Street traders laugh at my gains. Let them. My Trading Challenge students and I understand that small gains add up. I have 10+ millionaire students and the list keeps growing.*

No, this niche isn’t about fancy tech and it’s not rocket science. But it does take years to perfect. Even after two decades, I still make mistakes.

How to Pick the Right High-Frequency Trading Software

The most sophisticated software should help traders make the most money. But top software is expensive. Plus, after you buy the software you’ll have to write an algorithmic code to pick stocks.

If you’re not a math whiz, an algorithm will cost a pretty penny too.

I’m not a math whiz, but I know how to follow the rules and patterns in penny stocks. Every day, I use StocksToTrade as my trading software.** It has all the charts and statistical analysis tools I need to be a successful trader.

There’s a ton of software out there to pick from. Look around to find what might fit your needs.

Does High-Frequency Trading Really Work?

For those with enough resources, this could be a way to potentially profit in the stock market.

Some say these traders don’t profit off of any real value. They argue they’re just taking advantage of market inefficiencies that only exist for a fraction of a second.

Regardless of the existence of value, firms have been making enough every year to spend millions more on increased order speeds. They must be doing something right.

Can I Do High-Frequency Trading?

The stock market is not a place for the faint of heart. 90% of traders lose. Being prepared is the only way to stay safe.

This strategy is difficult due to its high barriers to entry and steep competition.

I’m not here to crush dreams. If your goal in life is to be a high-frequency trader, go for it.

But make sure you know what you’re getting into.

Bonus: Books to Better Understand High-Frequency Trading

I say this often … You have to fill your knowledge account before you can fill your bank account. These books are great for understanding HFT and the rest of the market as a whole.

“Flash Boys” by Michael Lewis is one of the better-known books on HFT. It follows a group dedicated to exposing the crooked ways Wall Street makes money. It’s a great way to learn about the basics and also see real-world examples in history.

I have to include “Reminiscences of a Stock Operator” by Edwin Lefèvre. I recommend this book to anyone looking to learn more about the stock market. It’s a great inside look at the mechanics of the market and crowd psychology.

A lot of trading is trying to understand how your competition thinks. Learn the psychological pressures involved. It can help you react to what the market’s doing.

(As an Amazon Associate, we earn from qualifying purchases.)

And if you haven’t already, pick up a copy of “The Complete Penny Stock Course” by my student Jamil. (I wrote the foreword.) To me, trading penny stocks is a great way to build a small account.

I think HFT has too much complexity and competition. Grab “The Complete Penny Stock Course” to take your first step in your day trading education.

Frequently Asked Questions About High-Frequency Trading

Who Uses High-Frequency Trading?

Investment banks, hedge funds, and institutional investors use HFT strategies. Improved technology has allowed more individual traders to compete. But it’s not easy or cheap.

How Fast Is High-Frequency Trading?

In the early 2000s, brokers filled orders in a couple of seconds. That was considered pretty quick back then. By 2010 the speed increased significantly. Today, computer programs execute orders in microseconds. Traders are still looking for ways to make it faster.

What Is a High-Frequency Trading Algorithm?

Some traders use algorithms to make orders based on market conditions. Computers analyze multiple markets at a time, reading data and placing trades. Algorithms take human error out of trades. They also allow for lightning-fast execution speeds. Speed is everything when it comes to HFT.

How Much Do High-Frequency Traders Make?

That all depends on a number of factors. Don’t go into the markets assuming you can make a set amount of money. That’s a fast track to blowing up your account. Focus on your education first.

Is High-Frequency Trading Fair?

Things are rarely fair in the stock market. That’s just the way it works. Some aspects of HFT might seem unfair. Like big-time traders paying for market data before the general public gets it. That should encourage you to study up. The odds are stacked against you, so do everything you can to prepare.

Will High-Frequency Trading Be Banned?

There are arguments on both sides ... Many believe it provides necessary market liquidity. However, some criticize it as an unstable strategy that can cause volatility. There are no current plans to ban HFT.

The Bottom Line on High-Frequency Trading

2025 Millionaire Media, LLCI’m a fast trader. Most people hold long positions for an average of five days. Sometimes I hold trades for less than five minutes.

But high-frequency trading is a different kind of speed.

I don’t want to compete with microsecond executions or high-tech software. I’ll lose every time.

It’s a good thing I don’t have to.

Trading firms stay away from the OTC markets. They’re too illiquid. That works to my advantage. Now I teach others to do the same following my established rules. Ready to learn?

Apply to join my Trading Challenge. You’ll have the opportunity to learn how I follow rules and manage risk while trading sketchy stocks.* It’s not easy. All my millionaire students had to study for years to become self-sufficient.*

Hard work and studying are the keys to success.

What do you think about high-frequency trading? Does it help add liquidity or do you think it does more harm than good? Comment below, I love to hear from all my readers!

Disclaimer

*Please note that these kinds of trading results are not typical and do not reflect the experience of the majority of individuals using our products. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.

**Tim Sykes has a minority ownership stake in StockstoTrade.com.

Leave a reply