Most people can learn the day trading setups I teach within a couple of years. But what many newbies don’t know is that the stock market is a moving target. Which means the setups sometimes shift. Things change a little.

I was lucky enough to experience it during the dot-com boom back in 1999 and 2000. The shift was subtle at first. But it taught me one of the most important lessons any trader needs to know…

You MUST adapt to the market.

That’s exactly what my students featured in this recent New York Post article do. They’ve learned to modulate everything from position size to trading setups. Please be sure to read the NY Post article and share it.

Keep reading for more on adapting, but first…

Table of Contents

- 1 Yemen Fundraiser Crunch Time — Help Us Get It Done!

- 2 Trading Questions From Students

- 2.1 “The market seems to be shifting. You’ve had small wins and losses, but you’re also testing. What day trading setups are working best for you right now?”

- 2.2 Trading Is More Than Memorizing Patterns

- 2.3 “How do you overcome the frustration of a lot of plays but not the best plays for you?”

- 2.4 “How do you balance being patient with not overstaying your welcome in a trade?”

- 3 Millionaire Mentor Market Wrap

Yemen Fundraiser Crunch Time — Help Us Get It Done!

Karmagawa’s fundraiser for Yemen closes at the end of July — in less than two weeks. As I write, we’ve raised $417,083. That’s awesome … but our goal is $500,000.

Please read this important post about children suffering in Yemen and what we’re doing to help.

Donate to the Yemen fundraiser here.

As promised, I’m donating all $297,000 of my trading profits from June to the cause. But I’ve also decided to add my July profits. The total for June plus July so far is $342,372. I can’t guess what it will be at the end of the month, but I’m doing my best to trade lights out and raise more.

If we can get the FB fundraiser to the goal of $500,000, I might top up the total so we donate an even $1 million. What do you think? Leave a comment below this blog post. Tell me if I should top up the total amount we raise from the fundraiser and my trading.

But I need your help to get the FB fundraiser over the top. Please, if you haven’t donated yet, do it today. Every small donation adds up. As I write, the average donation is $27.83. Help us get over the top — for the children of Yemen.

Regardless of whether you donated today, please share the fundraiser on social media. Tag everyone you know. Donate and share here. Let’s get this done!

Now it’s time for…

Trading Questions From Students

This week’s questions focus on trading setups that are working now. Before I answer the questions, you need to understand something.

Trading is like a moving target. Keep reading and it will make sense.

First question…

“The market seems to be shifting. You’ve had small wins and losses, but you’re also testing. What day trading setups are working best for you right now?”

As I’ve said in recent video lessons, some trading setups are shifting a little. The OTC first green day trading setup is normally fantastic to hold overnight and sell into the morning gap up. Technically it’s a swing trading strategy.

Quick note about day trading versus swing trading…

I do both. But I tend to be impatient, so I lean toward day trading setups. I’ll include the first green day setup here because it’s one of my favorites. And it’s working a little different right now.

Back to the setup…

Buying late in the day on a first green day has shifted. It’s a little better selling into the close. Not all the time, but a lot of the time. I think it’s because so many traders are doing it.

It happened back in 99 and 2000, too. First I was buying with five minutes to go before the close and selling the next morning. Then it was 10 minutes, 20 minutes, or longer. Toward the end, I wasn’t even holding overnight. As more and more traders started to see the pattern, you had to be earlier and earlier.

Read about my early trading journey in “An American Hedge Fund.” Download it at no cost here.

The lesson here is…

You have to adapt. Check out this video. I recorded it in May but it’s very relevant to answer your question.

What Is and Is Not Working in the Current Market

While that video focuses on the recent barrage of Twitter pumps, it emphasizes why you MUST adapt.

Trading Is More Than Memorizing Patterns

Trading has never been just about memorizing patterns. It’s understanding why the patterns are working, then adapting. Read “The Complete Penny Stock Course” to learn the basic patterns I teach.

You have to adapt constantly. Even as I’m saying first green days aren’t working well as overnight holds…

… I just closed a first green day overnight trade. Check it out…

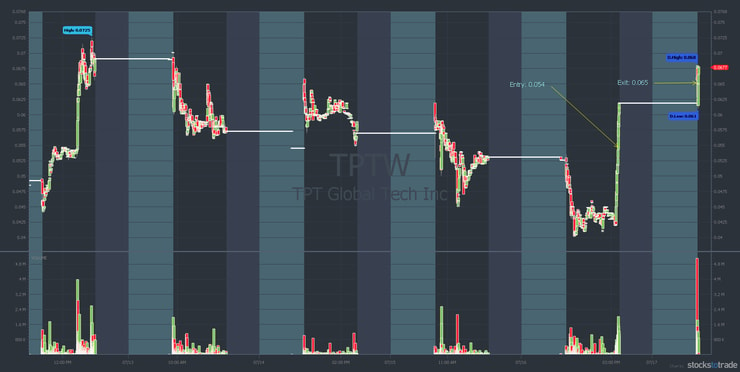

TPT Global Tech, Inc (OTCQB: TPTW)

My trade is a classic example of recognizing informational inefficiencies in penny stocks.

The company started delivering its QuikLab mobile COVID-19 testing stations in June. On July 16 at 3:35 p.m. Eastern, the company issued a press release. The stock started spiking, so I bought it for the first green day setup.

Remember, trading is a moving target. So while the first green day trading setup hasn’t been working the same most of the time…

In this case, I was willing to give it a shot. It had the following going for it:

- The press release was late in the day so a lot of traders wouldn’t have seen it.

- It was a recent runner still off its highs that also went red to green on the day during the spike. That’s a very good sign.

- It wasn’t overextended — which made it worth the risk for me.

Check out the TPTW chart from July 12–17:

As you can see it had a nice gap up. I was able to sell at the open on July 17 for a 20.37% win and $2,123 in profit.**

(**My results are not typical. I have developed exceptional knowledge and skills over time. Individual results will vary. Most traders lose money and trading is inherently risky. Do your due diligence and never risk more than you can afford to comfortably lose.)

Again, most of the time I won’t hold OTC stocks overnight right now. With TPTW everything lined up so it was worth it for me.

Next question…

More Breaking News

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

- BigBear.ai Partners with Maqta Technologies, Enhancing AI Solutions in Port Operations

- Prosperity of Tokyo’s Finance Hub: UOKA Shines

- AZI Stock Slips as Investors Eye Key Developments

“How do you overcome the frustration of a lot of plays but not the best plays for you?”

First, you have to know which plays are best for you. Most newbies have no idea. So most newbies should try a bunch of day trading setups.

- Test overnight hold trades. See how it works for you.

- Try NOT holding overnight.

- Try dip-buying morning panics. (This is my favorite pattern. But as you’ll see, this day trading setup has shifted, too.)

More experienced traders can try shorting first red days. (I don’t recommend shorting for newbies or small accounts.)

This doesn’t mean you should just randomly buy and sell stocks. If anything, THIS is the reason why trading is difficult at first. You need to study each of these trading setups to understand how they work. It’s the only way to go into every trade with a trading plan while you test.

When I say study hard & prepare, that means know these charts/patterns/setups inside & out, you should never just buy a random stock with a random pattern & listen to conflicted promoters on $TWTR who as $HMHC had to take out a PR last night to warn against spreading false rumors

— Timothy Sykes (@timothysykes) July 17, 2020

To really know what works you need a sample set of at least 100 trades. Too many people make 20 trades and then say, “Oh, this is my favorite.”

You don’t have enough trades under your belt. Try a whole bunch of trading setups. Look at your results. Track them in your trading journal. Find what you’re most comfortable with and what works best for you statistically.

Many of my top students and I use Profit.ly to journal trades. Learn how to use a trading journal here. And become a fully transparent trader when you join Profit.ly today.

Hone in on Your Best Trading Setups Without Getting Stubborn

When you know what’s working best for you, try to hone in on that. If you’re doing well on a bunch of plays or a bunch of trading setups, try taking bigger position sizes.

If you’re not doing well, then you should take smaller position sizes. I haven’t been doing that well in the last week, so I’ve sized down. Now I’m getting better at trading smaller. I’m adapting to the market.

So far in July, I’m averaging roughly $3,477 in profits per trading day. Whereas in June I averaged $13,527. There were days where I made $20,000 or even $30,000 in June.* So my dollar gains have come down. Why? Because I’m not as confident in a lot of these plays.

That’s OK. Rule #1 is to cut losses quickly. That helps me to protect my capital so I can stay in the game. Adapting your day trading setups to the moving target is a good thing. Stubborn traders blow up accounts.

(*Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Final question…

“How do you balance being patient with not overstaying your welcome in a trade?”

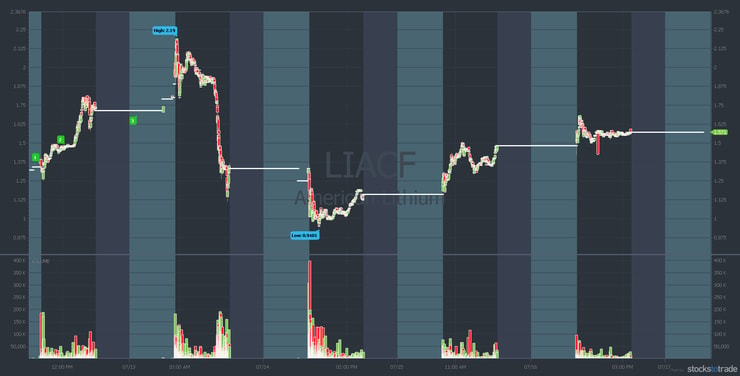

This brings up another variation we’re seeing the past week or so. My all-time favorite pattern is to dip buy morning panics. Until recently, with bounce plays we were seeing a big bounce in under an hour. You might see 20%–50% in 10, 20, or 30 minutes.

Now the bounces are taking days…

Like American Lithium Corporation (OTCQB: LIACF). Recently it had a big panic. It bounced 70%, but it took three days. Check out the chart…

So my favorite day trading setup has almost become a swing setup. For now.

None of this is an exact science. You have to learn from every example and try to adapt. Always look for the classic version of these patterns. But also notice what’s working.

And…

You have to balance it with yourself, too. It’s kinda like there are two moving targets…

The market is moving, and you have to find what you’re best at, too.

Trading Is Like Dogfighting in Jets

A good example is a dogfight in a movie where the pilot is in a moving jet and the other jet is also moving. She’s trying to get the other jet in the bullseye. It’s not easy. That’s trading.

In a perfect world you line up in harmony with the market and then everything is easier. But the world isn’t perfect. That’s why I trade with these rules and try to take the meat of the move.

Millionaire Mentor Market Wrap

That’s another edition in the books. Stay safe out there. Not only in trading but out in the world. We have a ways to go before the pandemic is over.

As for what’s working now…

With OTC first green days, you have to sell sooner and/or not hold overnight. With bounce plays, you have to be more patient. The day trading setups my top students and I teach aren’t overly complicated. But because the market is a moving target, it requires study and experience. The best way I know to help is for you to join the Trading Challenge.

That’s where you’ll get access to a game-changer…

Trading Challenge Webinars

The 950 archived webinars plus two to four live weekly webinars are game-changers. Why?

Reason #1: history. I’m a glorified history teacher. The archived webinars document a decade of teaching while I trade. Studying history is one of the keys to a long-term career as a penny stock trader. If you’re new to penny stocks, start here with my 100% FREE guide.

Reason #2: Q&A. Get answers to your questions in real time from Trading Challenge mentors. Which means you study the DVDs and video lessons and keep track of questions that come up. They’ll get answered by some of the best traders I know, if not by me.

Apply for the Trading Challenge here.

Let me know in the comments below whether I should top up our Yemen fundraising efforts to $1 million. Do you think it’s a good idea? Comment below, I love to hear from you!

Leave a reply