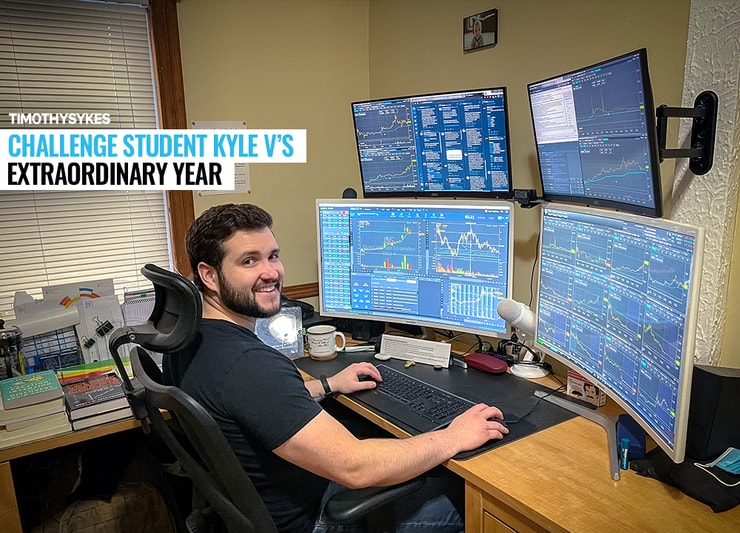

What a difference a year makes. In December 2019, my student Kyle signed up for my Trading Challenge. He didn’t have a brokerage account or know much about trading at all.

As of December 2020, Kyle is up over $74K in overall profits — with over $30K in profits in December alone.*

It might be tempting to say he got lucky … That he got in at the right time during the height of 2020’s market volatility. But Kyle’s trading success has nothing to do with luck. He’s meticulous, dedicated, and just as serious about studying as he is about maintaining his epic beard.

Kidding! The beard in his Profit.ly picture is fake. His actual facial hair is much tamer. But it almost makes me wish I’d never cut off my crazy hair. Could day trader Chia Pets be a thing?

But I digress. I want you to know how Kyle made this impressive account growth happen.

Every trader’s journey is unique, but I want you to see what’s possible in the stock market with dedication and hard work.* How bad do you want it?

(*These results are not typical. Individual results will vary. Most traders lose money. My top students have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Table of Contents

Trading Challenge Student Kyle’s Journey

You could say that Kyle’s a student of life. Every few years, he makes an effort to develop a new skill or learn something that will enrich his life.

When he sets his mind to a goal, he doesn’t quit. For instance, a few years ago he took up photography. He found a mentor, learned as much as he could, established himself, and soon enough, even became a photography teacher.

At the end of 2019, he was considering going into video editing as a natural progression from photography … But it wasn’t clicking.

So he decided to try something else that might work with his sleep schedule. Kyle sleeps from 8:40 p.m. till 4:40 a.m. Eastern every day…

He also knew he wanted to learn something that could potentially make a difference in his family’s life in the long run. At the time, he’d been dabbling with a Robinhood account, “buying random stocks and mostly losing money.”

Choosing Trading

Kyle came across one of my ads and was interested … but not convinced. Not at first.

Initially, he thought I might be a fake. But he did some research and found four things he liked about me:

- Longevity: Kyle liked that I’d been in the game for 20+ years.

- Transparency: I’m always totally transparent.

- Student success stories: Kyle saw I had a variety of students who found success in the market — and that they tend to stay involved in the community.

- Charity focus: Kyle’s into charitable giving too (I love when my students do this!) and appreciates my dedication to giving back.

These four things made him feel like the Trading Challenge might be worth it for him. He had a conversation with his family, and they agreed.

Kyle was ready to go at it hard.

Starting With the Basics

I’m always saying “it’s a marathon, not a sprint.” Well, before you can start long-distance running, you need to learn to crawl and walk.

When Kyle started as a Trading Challenge student, he had very little experience. He tells me, “I had lost some money on bitcoin in 2017 and traded a few random hyped-up tickers with Robinhood with a very small account.”

So he started at the very beginning — with the Trading Challenge orientation videos. He had his work cut out for him. Early on, he didn’t even know basic trading terms.

But he put in the time, watched videos, and took notes. Then internalized and re-watched when needed. Slowly, he started to learn.

Favorite Trading Resources

When Kyle first started out, he made the most of the resources available to him.

He watched my Trading Challenge videos and live webinars — and augmented them with my vast library of YouTube videos. And he started watching the Trading Challenge chat room for resource suggestions from fellow students…

Kyle saw that many traders talked about my student Jamil’s book based on my teachings, “The Complete Penny Stock Course.” So he bought a copy.

And he checked out the teachings of Challenge mentors, too. He says he loves Tim Grittani’s “Trading Tickers” DVD along with live webinars by me and Challenge mentors.

“Seeing them watching the market in real time and talking about what they are seeing … as you do it again and again and hear their commentary, you start to see what they’re seeing.”

He’s inspired by millionaire trader Mark Croock’s “single-minded approach” to options trading that evolved from my penny stock trading strategy.* He loves how my first millionaire student (and O.G. hater) Michael Goode teaches him “about stuff you didn’t know you didn’t know!”*

More Breaking News

- Archer Aviation Faces Legal Drama Amid Stock Fluctuations

- Fabrinet’s Market Potential Soars After Research Upgrade and Strong Earnings

- Battalion Oil Surges Amid New Gas-Treating Agreement

- Money Woes for Tesla as Legal Battles and Price Targets Impact Shares

The Importance of Tracking Your Trades

Data is super important to Kyle … But as he says, early on that wasn’t about specific tickers or dollar amounts. He had to learn who he is as a trader.

Kyle understood that “you cannot control the market, but you can control yourself. So pay attention to your emotions, trading habits, the places you feel stuck or confused, the types of plays you consistently enter at the right time, the reasons you sell too soon or too late…”

Every trader’s unique. They have their own strengths and weaknesses. When you get to know yours, you can begin to refine your process and focus on the strategies and tools that work for you.

That doesn’t end, BTW. I’m always looking for new resources and ways to refine my process…

If you don’t take the time to study yourself and put practices in place to protect yourself from your own bad habits and emotional decisions, you’ll never really understand how or why things are working (or not.) When traders do this, they tend to keep sizing up — until disaster strikes.

As Kyle puts it, “Good traders lose a lot of money when they cannot manage themselves — you get caught in the trap of being right: ‘this should work, so I am going to double or triple down’ instead of ‘I will trade my plan, accept this loss, and move on.’ The market owes you nothing.”

Trading isn’t always necessarily fun. It can be an arduous process. You’ve gotta be willing to put in the work.

The process behind successful trading is NOT fun, it's frustrating, maddening & time-consuming and by Friday, especially lately in this truly crazy bubble market, all the top traders I know are exhausted. So, learn what it takes to succeed…for me it's worthwhile, how about you?

— Timothy Sykes (@timothysykes) January 4, 2021

Trading Small

Kyle really gets the benefit of starting with small positions. “It is up to you if you want to lose a lot of money at the beginning or just a little bit because you control your position size and you control your overtrading.”

He knew that the most challenging time in his trading career was the first six months or so when he was trading without knowing a lot. But he also knew that losing a lot early on would be demoralizing.

In knowing that, he says “I kept my size small and overall the most I was ever down on my account was $250.”

He was also disciplined about knowing when to trade vs. fighting FOMO. “I knew that the days when I really wanted to make a trade or felt like I had to trade were good days to spend more time studying and less time watching the market. Until you really internalize ‘I don’t have to trade’ you will be likely to overtrade while watching the market.”

Focus on Just a Few Patterns

There are so many stocks in play right now and so many day trading strategies. It can be tempting to go for everything at once. Avoid the temptation.

As Kyle notes, “It can be overwhelming at the beginning feeling like you are constantly missing all the plays, but you are better off to pick just a couple of tickers and watch them closely, and then work on really nailing entering plays at the right time.”

It’s all about getting a deeper understanding by watching the patterns.

For Kyle, the goal is to see “how patterns develop and set up, not just what they look like at the exact moment everyone is buying them in chat. In hindsight, it is easy to see the patterns, but to learn what they look like in real time takes practice that you can only do by watching real-time market moves.”

Knowing you should focus on just a few stocks and strategies at a time is one thing. But internalizing it is another thing completely. It took Kyle months to actually start living by this rule … But when he did, everything changed for him.

Kyle’s Aha Moment: June 2020

If you want to be a self-sufficient trader, you MUST develop your own strategy.

ALL of my top students are self-sufficient, they learned early on NEVER to follow alerts from anyone else, just speeding up their learning curve by utilizing bits & pieces from MANY traders to optimize their own trading process & reap the rewards of all that knowledge over time!

— Timothy Sykes (@timothysykes) December 11, 2020

Kyle learned from my teachings. But eventually, he adapted and developed his own method of trading. That’s when things started to click for him.

He says, “I resolved to trade less and wait for the very best setups. And I switched from trading multiple patterns to only trading OTC panic dip buys for that month and the profits started to come in.”*

Kyle continues, “I looked for the patterns that 1) seem to have been around a very long time, and 2) work again and again and again without a ton of extra variables.”

He turned to resources that informed his strategy. That meant daily scans on StocksToTrade and watching Jack Kellogg, who has a similar strategy, in the Challenge chat room. And he watched Challenge mentor Tim Lento’s webinars for replays of these types of moves.

By zeroing in on this strategy and focusing on honing it, he began to see consistency in his trading.

Small Trades Add Up

Kyle made nearly nothing for his first six months. He spent that time investing in his ‘knowledge account.’ But when he doubled down on a specific strategy, he started to see monetary results.*

“Up until June there was this huge sense of FOMO … People were talking about how much opportunity there was, and I was struggling to make like $30 a day.”

While he was inspired by traders like Kyle Williams and Matthew Monaco, he also realized, “they’ve been doing this for a few years. They were ready for this market.”

While this helped keep FOMO in check, Kyle wasn’t perfect. He admits that FOMO led to one of his biggest losses — a $1,660 loss.

It was frustrating. To him, it seemed like “Everyone was making tens of thousands of dollars on it and I had my biggest loss to date.”

Adding to the frustration? If he’d sold later, he would have had a win.

But ultimately, it was a humbling learning experience. He reviewed it, learned from it, and was ready for the next one.

I’m glad Kyle was able to learn from his mistake. I had to lose $500K to learn my lesson so I’d say he’s ahead of the game! You can read about that crazy story in my autobiography, “An American Hedge Fund.”

But for the most part, Kyle shoots for singles. His percent gain is only about 4%. And his average gain is about $99.*

But small gains add up!

Continuing to Grow

Kyle’s had an incredible trading journey so far … But he knows it’s just the beginning.

Now that Kyle’s become more consistent with a trading strategy, he tells me he’s beginning to branch out.

“Because I was consistently profiting on OTC dip buys, I could try out other plays with a small size and accept the losses at my risk levels because I knew I had other profitable trades and the losses didn’t hurt as much.”

Now, he wants to get better at OTC green day plays … and is experimenting with other patterns like the dip and rip pattern that my friend, 30-Day Trading Bootcamp special guest, and StocksToTrade lead trainer Tim Bohen loves so much.

He’s making use of the many resources available — StocksToTrade, STT’s Breaking News Chat, and Small Cap Rockets.

He admits, “I didn’t want to pay for it in the beginning …” But he listened when I said you need to bring the best tools to battle. Now, he can’t imagine his trading life without all of these great tools. “I love it … it’s super helpful software.”

It's the 1st week of 2021 so it's only natural to want to start the year off strong & hit home runs, but please try to resist the urge by recognizing that it's just your human bias in a market that rewards meticulous planning & conservatism the the most over time NOT aggression!

— Timothy Sykes (@timothysykes) January 4, 2021

I can’t wait to see what the future holds for this dedicated trader. I hope you read everything he had to say … He’s a great example of the type of student I want.

Are you ready to work as hard as Kyle and see what a difference a year can make in your trading career? Consider applying for my Trading Challenge.

How does Kyle’s trading story inspire you? Leave a comment and tell me if you’re ready to study hard!

Leave a reply