Big things have small beginnings.

Both my hair and the stock market prove that. They’re both out of control right now…

True, there may not be enough product in the world to tame my mane. But there are still opportunities…

Maybe they’ll make a Chia Pet that looks like me. Or even better, I’ll keep growing it till it’s long enough to donate, so I can bring attention to the illegal hair trade…

There are always opportunities out there — it’s all about having the right mindset.

As for the stock market, there are SO many penny stocks in play right now. I’m ready for them. That’s how I made over $136K* in September 2020…

2 small wins on $GTXMQ and $OZSC to end the month for me, +$136,210 in September with 100% being donated to charity as I adapted well to the changing market, pushing my trading well on hot EV/battery plays like $SUNW $PECK $DSGT $NETE $ABML retweet this if you learned a lot too! pic.twitter.com/t0sokNrYz8

— Timothy Sykes (@timothysykes) September 30, 2020

You can’t control what will happen next in the market. But you can control how prepared you are when the right plays come along.

Wanna get ready to take advantage of the current market volatility?

(*Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Table of Contents

So Many Opportunities

The opportunities in the stock market right now are as plentiful as my hair.

Consider Spi Energy Co Ltd (NASDAQ: SPI), one of the craziest movers in recent memory. There’s a lot you can learn from this 4,000% gainer…

I dip bought this crazy short squeeze when it came off of its tops with a goal of making 50–75 cents on the bounce.

Bounce it did — it was a total rush. I got out of the trade fast and made a quick $1,040 profit.*

Big things have small beginnings! I could have made a lot more … but I like to play it safe. I couldn’t know at the time how high this stock would go. Plays like this aren’t for the timid.

Things can change fast, so you can’t get greedy.

Wanna be ready for plays like this? I’ve got two resources.

First, you’ve gotta check out “The Volatility Survival Guide.” This no-cost resource offers a thorough education on the insane volatility we’ve been experiencing. If you want to understand how to approach rockets like SPI, it’s a must-watch.

Second, I can’t recommend StocksToTrade’s Breaking News Chat Room enough. You need to be a subscriber to STT to get access — I say it’s well worth it. I’ve found countless trades using this tool.

(Please note I’m an investor in StocksToTrade and I proudly helped develop it.)

Adapting Your Strategy

I’ve been using the same basic trading strategy for the past 20+ years.

I’ve had to adapt, though. I used to be a short seller. Now I mostly go long, with very few exceptions…

But my strategy still relies on the same basic patterns. They repeat over and over. I just adapt as needed.

When the market shifts, I shift. I’m loyal to what makes me profits so that I can donate more to charity.* And I’m loyal to the trades that offer the best lessons for my students.

My top students get it. They all started out in my Trading Challenge. They learned my strategy … Then over time, they adapted it into their own respective strategies.

For example, Mark Croock was among my first millionaire students.* These days, he’s an options trader.

I didn’t teach him how to trade options. I’m just training wheels for my students. He used the basic rules I taught him and applied them to options trading.

Now, he’s up over $2 million in total profits.*

That’s what I’m talking about when I say that I want you to become self-sufficient.

More Breaking News

- Robinhood Appointed Trustee for Trump Accounts, Stock Rises

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

- AZI Stock Slips as Investors Eye Key Developments

- Microbot Medical Eyes Expansion with Key Milestones in 2026

Always Room to Grow

There will never be a point when you’ve totally nailed it as a trader and there’s nothing left to learn.

Whether I’m teaching, reading the feed in my Trading Challenge chat room, or making a video lesson, I’m always learning something new.

I even learn from my mistakes, like my biggest loss in months…

I still need a little therapy about it, so let me tell you what went wrong…

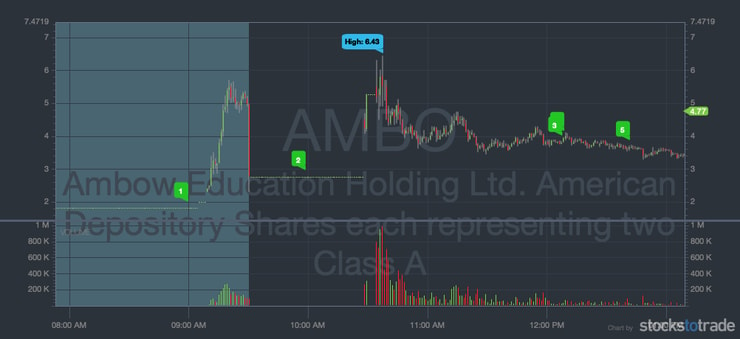

Ambow Education Holding Ltd (NYSEAMERICAN: AMBO) was up … Then, for whatever reason, there was a huge crash and halt. Just like that, I lost over $4,000.

I got out of the trade. I’m much more responsible about cutting losses than I’ve been about making hair appointments…

The stock actually spiked again — I could’ve been profitable on the trade. But the thing is, you never know.

I took the loss and moved on — and I actually ended up being profitable for the day.*

The lesson here? You can get crushed in a heartbeat when you’re trading these huge percent gainers. Be ready to cut losses quickly, and don’t get greedy.

Remember: great trading isn’t about nailing it every time. If you’re always going for home runs, you could end up striking out — a lot.

It’s all about those singles! Small wins add up over time.

Ready to Keep Growing?

Nothing lasts forever. You know what they say — hair today, gone tomorrow.

As a trader, all you can do is keep learning and be prepared when opportunities come along.

If you’re serious about becoming a self-sufficient trader, consider joining my Trading Challenge. This is exactly where my top students started, and where many new traders are finding their way in the market.

What’ll you get? Webinars. The greatest chat room community ever. And so much more…

Big things have small beginnings. Focus on a little growth every day … it adds up over time. My hair is all the proof you need!

Do you understand that big things have small beginnings? If you get it, leave a comment … or retweet or favorite my infamous hair post!

Leave a reply