Right now, it’s more important than ever to trade like a sniper.

We’ve been in this hot coronavirus market for weeks now … It’s creating a ton of volatility. There are big swings in the overall market and individual stocks.

But if you’re struggling right now, you’re not alone…

That’s why I created my “Volatility Survival Guide” — to help you navigate this crazy market. Plus, you’ll learn how to better use StocksToTrade and how to trade through future volatility. Take advantage of this NO-COST resource today.

So what does this volatility mean for traders like you?

When there’s a hot sector there are so many plays and opportunities. But there won’t necessarily be plays every day. So, what should you look for in a trade? How can you adapt your trading?

Let’s go over some of my recent trades and look at some adjustments I’m making…

… and how you can learn to trade like a sniper…

Table of Contents

Putting the Pieces Together

You have to put the pieces together for every single trade. Breaking news can mean trading opportunities … But, it’s not just about breaking news.

There are other factors to consider before trading blindly — a news catalyst, volume, hype, the right patterns…

I use the Sykes Sliding Scale. Learn how to use this tool to help plan trades by studying my “Trader Checklist Part Deux” guide.

Let’s review some of my recent trades so you can see how I put multiple factors together to trade like a sniper…

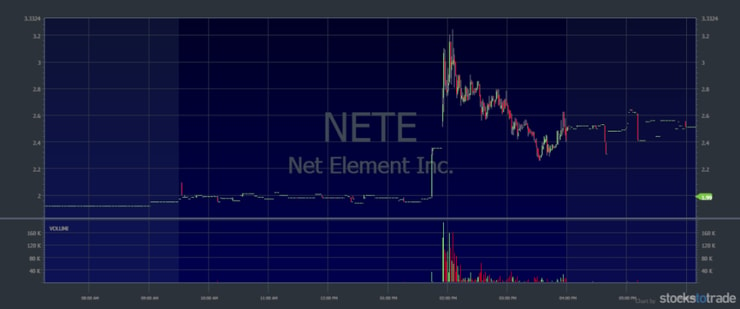

Net Element, Inc. (NASDAQ: NETE)

On April 27, I was in and out of NETE quickly for a $640 profit.**

Net Element is a former supernova. It was running on news that it was launching mobile ordering and delivery for restaurants. It actually got halted, so even though it was spiking, it was a little tough to trade.

I didn’t see it before the halt — I saw it after the spike. Then I saw the news and bought it right after it the halt was lifted. It actually hit the $2.80s before I got in. I got in on a little dip at $2.62 with 2,000 shares. And I got out at $2.94.

It was moving fast … I got out too soon, but I made my 10% and didn’t get greedy.

The key here is that I waited like a sniper.

I buy these speculative runners after they spike. I get in on a dip off the high and hope the stock will hit that high again. Notice this stock is in the right sector — and it’s a former supernova with volume.

(**My results are NOT typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

But what about the stocks that don’t go back to their highs?

Remember to Follow Rule #1: Cut Losses Quickly

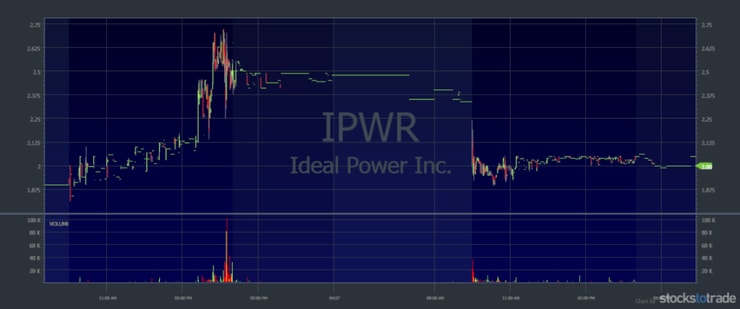

On April 24, Ideal Power, Inc. (NASDAQ: IPWR) was spiking after a tweet about the company making ventilator parts.

I bought 4,000 shares at $2.35 thinking there’d be a press release over the weekend. My plan was to hold for a gap up on Monday. I’m glad I sold half at $2.50 Friday after hours to lock in some gains since IPWR wasn’t continuing up.

On Monday, there was no press release and no gap up. So, I sold the rest of my shares at $2.11 and ended up with a loss of $180.

When stocks don’t continue to make new highs or do what you expect, cut losses quickly. It’s rule #1. It prevents small losses from turning into a disaster. You don’t even have to wait until you have a loss. You can get out for a small profit if you don’t like the price action.

I probably should have sold my entire position after hours. But when it didn’t do what I expected on Monday morning, I cut losses quickly and kept my loss small.

Here’s another trade I want to review…

AgEagle Aerial Systems, Inc. (NASDAQ: UAVS)

On April 27, I traded UAVS. There was news about United Parcel Service, Inc. (NYSE: UPS) and CVS Health Corporation (NYSE: CVS) using drones to deliver prescriptions in Florida…

UAVS wasn’t even mentioned in the press release — it was a sympathy play. When one stock in a sector runs, so can other stocks in the same sector. It was also a coronavirus-related play. Drone delivery makes sense right now as more people are staying home.

The company also announced a conference call on April 30 to provide a corporate update. So maybe people were buying it, anticipating good news. This is a “buy the rumor, sell the news” kinda play.

I bought the dip with 7,000 shares at 79 cents and sold at 83 cents. UAVS reached its previous highs, but when it didn’t break out, I sold.

UAVS was also a recent runner. I can’t stress enough the importance of remembering recent runners and former supernovas…

On April 15, UVAS went from around 30 cents up to about $1.50. It came down pretty quickly too. Not something you want to chase. But recognize it’s a former supernova and that it can run again.

Sign up for my Supernova Alerts. This no-cost program can help you learn more about the pattern that’s helped me make over $5 million in trading profits.**

(**My results are NOT typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

Throughout my 20+ years of trading, I’ve had to…

Adapt to Market Changes

I’ve been around through bull and bear markets. Right now, the coronavirus industry and tech advances around it are hot. But the volatile markets mean every day is different.

If I see big percent gainers with the potential to run, I might be more aggressive. If the market’s cooling off, I don’t trade or I trade more conservatively.

I think that’s the great thing about trading. You can adapt your position sizes and risks based on the opportunities and the market conditions.

Some students were saying there wasn’t a lot of volume in NETE. But you have to look at when the news came out. Yeah, the stock was dead before the news, but a lot of volume came in once it was released.

You have to be ready to react to news and recognize opportunities … The market’s constantly changing. It’s like a moving target. You gotta keep up.

Fast forward to the first week of May and more hot plays. The week of May 4, I made $24,177.50.**

I’ve even shorted a few stocks recently. (I know, it’s shocking.) But I’m adapting and trying new things. And I’m very quick to exit since there have been so many short squeezes lately.

(**My results are NOT typical. I’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

Here’s one of my best trades of the week…

SolarWindow Technologies, Inc. (OTCPK: WNDW)

I bought this stock similar to my other trades … It was in a dip off its highs. I was hoping it would retest the highs or breakout. I got a perfect breakout and I sold into strength.

I had 7,500 shares from an average of $2.20 and I sold at $2.57 for a profit of $2,775.** Here’s the chart:

So how’d I know it may retest the highs or run further? Again, it’s a former supernova and it had news. It didn’t have as much volume as I like, so I took a smaller position.

You can see how I adjust based on the specific trade, the setup, the news, and the overall market.

So, how do you recognize these opportunities? You study your butt off, prepare, and always…

More Breaking News

- Arrow Electronics Exceeds Q4 Forecasts, Signals Strong Market Position

- UiPath Hits Milestone in AI Automation: Potential Market Surge

- Rigetti Computing’s Ambitious Plans Propel Stock Surge

- Battalion Oil Stock Surges Amid New Gas-Treating Agreement

Remember Former Runners

When the news about the drone deliveries came out, people wondered how I knew which stock to buy. I looked at other companies in the sector. But I chose UAVS because it was a recent runner.

It wasn’t mentioned in the news, but I know that former runners can run again…

You have to combine breaking news with mindset and strategy. You can’t just trade based on breaking news.

It comes down to preparation and education. Can you add it all up to be quicker than other traders?

The longer you’re in the markets and the more you study, the better prepared you’ll be. You also need the right tools to help you learn…

How to Trade Penny Stocks Like a Sniper

Trading like a sniper means putting multiple factors together — like breaking news, volume, and a chart pattern. Then you strike at the right time to get in and out of the trade quickly.

You look for support and resistance. You aim to get the best entry close to key areas that are holding … or buy a breakout when a stock breaks through resistance.

What isn’t trading like a sniper? Chasing stocks that are spiking. You also need to understand which stocks have the potential to spike. Get my “Spikeability” DVD and study up.

Pay attention to areas of resistance on the chart when planning your exit. Trade according to your plan and move on. Learn the process, then repeat again and again.

You only fire when everything lines up. Conserve your energy for the best setups and trades. Aim small, miss small, and…

Use the Best Tools

Trading is like a battlefield. And if you’re in battle, you want the best weapons on hand. In trading, that means the best tools.

I use StocksToTrade every day. It helps me spot news and social media buzz. It’s amazing that students still ask me where I see these news releases. I helped design the platform and its 40+ built-in scans specifically for the low-priced stocks I like to trade.

Try StocksToTrade with a 14-day trial for $7. Also, check out the StocksToTrade YouTube channel. There are tons of FREE video lessons to help you learn how to get the most out of the platform. You should learn how to use the weapons you take into battle.

I know too many traders who go in unprepared. I don’t want that for you. I didn’t trade any of my plays perfectly — I never do.

Do NOT get overly greedy in trading, remember that a few hundred per day, and eventually a few thousand per day, adds up nicely over time and keeps the real job away! #stayhumble #singlesnothomeruns #KnowledgeIsPower

— Timothy Sykes (@timothysykes) May 4, 2020

When You Trade Like a Sniper, Singles Add Up

My gains are bigger than my losses — that adds up over time.

Some people message me saying, “Tim, so I’m supposed to work hard and study hard. But I’m not guaranteed profits and it’s going to take up a lot of my time … You’re not really selling me the lifestyle.”

I’m being real.

Wanna be my next top student? You gotta study. And you have it so much easier than I did when I started. I had to learn the hard way through trial and error.

This is why I teach — to make it easier for you. You can learn from my mistakes.

Apply for my Trading Challenge if you’re truly dedicated. Only Challenge students get access to live weekly webinars with me and top students like Tim Grittani, Mark Croock, and Micheal Goode.

Yes, it takes time. But most people get it after three, four, or five years. It depends on the market, personality, and dedication.

If you stick with it, eventually you’ll learn…

How to Recognize the Best Plays

When there’s a hot market or sector, you can learn from so many plays. When there’s no hot sector, you might learn from random moves.

The recent moves aren’t random. They’re related to the coronavirus. Despite the lockdown, some sectors and companies are hot…

Like drone delivery, food delivery, and parts for ventilators. Not to mention the vaccine and masks plays we saw a month or so ago.

Recognizing hot sectors and recent runners can really help you. It’s crazy to me how many people don’t remember recent runners. They just forget to watch them.

Waitr Holdings, Inc. (NASDAQ: WTRH) was one of the biggest food delivery plays in March. Nearly six weeks later, it spiked again on May 4.

Even when you can recognize these plays, you’ll still miss some. Grittani and I still miss plays. Nobody’s perfect.

But the more you study recent runners … the more you understand hot sectors, the better prepared you can be to put it all together … and trade like a sniper.

Trading Like a Sniper: The Bottom Line

Wanna trade like a sniper? Do your research. Study. Learn to recognize and remember former supernovas. It gets easier with time and experience.

Right now, we’re seeing crazy volatility in the markets, so I’m adapting. I adjust my position sizes and trade conservative when things are slower. I’m more aggressive when I spot the setups that fit my strategy. I’ve even gone short a few times.

But no matter the trade, I make sure it all lines up. Never trade on just one indicator. Make a checklist — use the Sykes Sliding Scale.

Nail down the process.

This is why I show you my trade details, not just total profits or losses. I want to be real with you about what it takes to be a self-sufficient trader.

Do you want to learn more about how to trade like a sniper? Let me know in the comments … I love to hear from my readers!

Leave a reply