If someone gives you hot stock picks, how do you know if it’s any good?

First: NEVER blindly follow anyone’s stock picks or trade alerts.

No exceptions. I hear from WAY too many people who have lost colossal amounts of money because they didn’t follow this rule. Don’t be one of them!

So what’s a trader to do? Build a process to find your own stock picks. That way, you never have to rely on anyone else. I send out alerts on my trades so my students can learn my process.

You must build your foundation of stock market knowledge and research skills, then put it to work. (Just like my Trading Challenge students learn to do.)

Let’s break down how you can work to find your own stock picks, step by step. We’ll start with some basics on stock picks and then dig deeper from there.

Table of Contents

- 1 What Is a Stock Pick?

- 2 How To Find Your Own Stock Picks

- 2.1 Stock Picks Tips: #1 Run Technical Analysis

- 2.2 Stock Picks Tips: #2 Find Stocks in Uptrends

- 2.3 Stock Picks Tips: #3 Use Stock Chart Patterns

- 2.4 Stock Picks Tips: #4 Look at Current Events

- 2.5 Stock Picks Tips: #5 Trade Volatile and High-Volume Stocks

- 2.6 Stock Picks Tips: #6 Prep Ahead of Time

- 2.7 Stock Picks Tips: #7 Use a Great Stock Market Scanner

- 2.8 Stock Picks Tips: #8 Use a Good Broker

- 2.9 Stock Picks Tips: #9 Never Stop Learning

- 3 How Do I Know When a Stock Will Go Up?

- 4 What Is a Stock Watchlist and How To Create One

- 5 Timothy Sykes’ Top Stock Picks To Watch for 2024

- 5.1 MicroAlgo Inc (NASDAQ: MLGO) — The Volatile Chinese AI Penny Stock

- 5.2 Safety Shot Inc (NASDAQ: SHOT) — The Potential Short if You Like Pain and Stress Dip Buy Biotech Stock

- 5.3 RedHill Biopharma Ltd (NASDAQ: RDHL) — The 300% XGPT Biotech Stock Winner

- 5.4 Altamira Therapeutics Ltd (NASDAQ: CYTO) — The True Penny Stock XGPT Winner

- 5.5 Minim Inc (NASDAQ: MINM) — The Penny Stock That Went From Nasdaq Delisting to Supernova

- 6 Where Can I Get Good Stock Advice?

- 7 Stock Picks: The Bottom Line

What Is a Stock Pick?

Stock picks are where traders find stocks or trades that meet their criteria. If you’re day trading, you’re looking for stocks making big gains.

It’s even better when big gainers have high volume. If stocks run on low volume, liquidity can be an issue. So you may manage to buy into the stock, but good luck getting out with low volume.

With my stock picks, I look for a solid news catalyst driving the momentum. Traders need a reason to jump into a play. This could be anything from a new product or service to a partnership opportunity. And traders love to see government contract wins!

If a stock’s running for no reason, it’s hard to make a plan around when to enter and exit your trade. You won’t know why you’re in it in the first place!

What Smart Traders Look for in Promising Stocks

Most traders look for stock picks with the potential for spikes. But something has to drive the price action. Here are some examples…

- Buyers flooding into a stock due to a catalyst

- A stock breaking above its all-time highs on high trading volume

- Big-name investors buying into the stock

- A big government contract or legislative news

The key is to look for anything that could create strong demand and push the price higher. For example, when Elon Musk tweets about a stock, it can create a tidal wave of buying or selling within seconds.

How To Find Your Own Stock Picks

Some traders are too lazy to learn how to pick stocks. That’s ridiculous!

If you want to follow someone else’s picks, that’s your choice. But consider the lag time between when a ‘guru’ makes a trade and when the notification hits your inbox. The penny stocks I love to trade move too fast for anyone to follow my alerts.

Why do I send them? To help my students learn the process.

Develop your method for finding your top stock picks. If your goal is to be a self-sufficient trader, this is the route you want to follow. Here’s my nine-step plan to help you learn how to do it…

Stock Picks Tips: #1 Run Technical Analysis

Technical analysis measures a stock’s momentum. You use technical indicators to support your theory about a stock’s price action.

It can help to combine that with some basic fundamental analysis. Look at the company’s profitability, business model, leadership … all the basics behind its business.

It’s important to choose a great platform to pick stocks. Your platform should allow you to choose from various technical indicators. Every trader has favorites. And the more experienced you get, the simpler it’ll be. You don’t want to overdo it. A handful is great.

One of the best platforms with the most important technical indicators is StocksToTrade. I helped create it, and I continue to invest in it. And I do that to make life easier for traders like us. But don’t just take my word for it — check it out yourself!

More Breaking News

- Vizsla Silver Corp. Sees Stock Flux Amid Strategic Movements

- Exponent Stock Boosted by Strong Q4 Performance and Dividend Hike

- BigBear.ai Partners with Maqta Technologies, Enhancing AI Solutions in Port Operations

- FMC Plans Debt Reduction and Strategic Growth Initiatives for 2026

Stock Picks Tips: #2 Find Stocks in Uptrends

Most traders start out going long. Why short sell when you’re getting your foot in the trading door? It’s way too risky.

And if you’re an optimist, you may like the feeling of going long. You’re putting your money where your faith is. At least for the time being. Remember, you’re a day trader. Never marry a penny stock.

When stocks are on the uptrend, they consistently make higher highs and higher lows. You want to get in at a good price and let the trend do the work for you. Especially when you’re new to trading. Work with the trend, not against it.

Stock Picks Tips: #3 Use Stock Chart Patterns

So you have your favorite technical indicators and a great stock scanner ready to go. Great! Now it’s time to learn the next step — identifying chart patterns.

Chart patterns tell the stories of stocks. You can see the past and present, and make your best guess about future action.

The best patterns should increase the odds of entering a trade right before it’s ready to take off. Here are two examples…

The Supernova

I LOVE this pattern.

A supernova happens when a company generates hype, whether it’s media coverage, an announcement, or even just a promotion.

As the hype builds, the stock can see massive volatility and an increase in trading volume as traders rush on board. These prices can run like a freight train — but it’s up to you to decide whether to ride it.

Supernova events frequently end in collapse, so trade carefully. Aim for singles!

Learn more about supernovas in this video:

The Stair Stepper

The stair stepper is a traditional uptrend. It’s where a stock rises then pauses, rises then pauses, again and again. It makes higher highs and higher lows — just like climbing a staircase.

This pattern can be a relatively low-stress way to play a stock. You can see the price move in your favor. Or maybe it stays in range to its recent high. It can be a great pattern for newbies to learn.

Stock Picks Tips: #4 Look at Current Events

If you’re interested in finding stocks with hype and rapid movement, you need to stay on top of news and current events.

Look at earnings updates, analyst reports, conference calls, SEC filings — anything that could excite the market into pushing stock prices around.

Stock Picks Tips: #5 Trade Volatile and High-Volume Stocks

Besides monitoring volatility, you also need to keep an eye on trading volume. Dig for stocks that trade enough each day to allow you to pick up shares at the price you want. They should also have enough volume for the market to accept your shares at a good price when it’s time to get out.

Stock Picks Tips: #6 Prep Ahead of Time

You want to know what’s going on in the markets at large before you focus on a specific sector. You have to stay on top of the news. Foreign, domestic, all of it!

When you want to know what’s going on with penny stocks, there’s nothing like StocksToTrade’s Breaking News Chat. It can help save you time in finding the hottest news for penny stocks.

Catalysts are huge for day traders. These could be earnings releases, partnership updates, new product releases, new contracts, or FDA approval news.

When you’ve narrowed your stock picks, you’ll want to dig deeper. How has the chart behaved in the past? You might even take a peek at the company financials. Is the business profitable, or is it an all-hype play?

You MUST prepare. Know the stocks you’re watching, and research them ahead of time. Get your trading plan together.

Even so, you’ll want to run a good scan or two to see what else might be moving on volume and breaking news. Sometimes a stellar breakout will surprise you.

Stock Picks Tips: #7 Use a Great Stock Market Scanner

If you’re ready to start finding your own stock picks, the right trading software can help make it easier.

No surprise I recommend StocksToTrade. It’s where you can scan the market for increased volume and big movers. It’s a killer platform that I use every day — I even helped with its design!

StocksToTrade can help you cut the time it takes to find a handful of your best trading opportunities daily.

This comprehensive software is for traders of all experience levels. And it has all the tools you need in one place — charts, scanners, indicators, news feeds, and much more.

Stock Picks Tips: #8 Use a Good Broker

There are a ton of brokers out there, but you have to make sure you pick the right one for your needs.

If you’re experienced in the markets, you’re probably set up with a good broker, so you can probably skip this part.

If you’re a newbie, do your research before you pick one. Broker fees and services change all the time.

Stock Picks Tips: #9 Never Stop Learning

If you follow me, you know I emphasize this a LOT.

When I started out, there was so little information to learn from. I had to learn how to trade and find stocks picks the hard way — but you don’t have to.

Right now, you have access to my massive vault of blog posts and YouTube video lessons. Check everything out. Where’s a good place to start? Get my free online penny stocks guide.

Trading Challenge

If you’re serious about learning to find your own stock picks, apply for my Trading Challenge. It’s where I mentor upcoming traders who are ready to work for their goals and dreams.

Through the Challenge, you get access to all my resources, trades, commentaries, webinars, and more. Plus, you get the chance to learn from my top students.

I can’t trade for you. And beware of anyone who says, “Just follow my stock picks.” That’s a scammer! Remember the old adage: It’s better to teach someone to fish than to do their fishing for them.

That’s what the Trading Challenge can provide. Are you up for it?

How Do I Know When a Stock Will Go Up?

History doesn’t repeat — but it often rhymes. Most of the stocks I trade are former runners. If a stock ran before, people expect it could run again. It becomes a self-fulfilling prophecy.

Stocks don’t usually go up for no reason. And if they do, but it doesn’t last. Make sure you’re trading a stock with a great catalyst.

It takes time and patience to learn what a great catalyst looks like. You have to watch and observe what makes stocks move. And just when you think you know the answer, the market changes. That’s what I love about trading … It keeps you on your toes!

What Is a Stock Watchlist and How To Create One

A stock watchlist is a short list of stocks you think will be in play in the days or weeks ahead. It can change from day to day. Sometimes you get lucky and see multi-day runners.

If you’re in a hot market, you might wind up with dozens of stocks on your watchlist. You have to narrow them down to a handful. Be picky. Choose the best. You have to be able to keep a close eye on all your picks.

Once you know which technical indicators to look for, you can run a stock scanner. This can be the night before the trading day or the morning of. It all depends on your strategies.

Using a Stock Watchlist to Find Your Own Stock Picks

It’s great to subscribe to watchlists from successful traders. I put out a few of them myself. But you have to learn to make them on your own.

Sign up for my no-cost weekly watchlist here.

I send watchlists out so you can learn from my process and how I think. If you want to be a pro trader, you have to build your own strategies and trading plans.

If you blindly follow someone else’s watchlist, you won’t understand why you’re taking a trade. Use them as a guide, not a crutch.

Timothy Sykes’ Top Stock Picks To Watch for 2024

My top stocks to watch for 2024 are:

- NASDAQ: MLGO — MicroAlgo Inc — The Volatile Chinese AI Penny Stock

- NASDAQ: SHOT — Safety Shot Inc — The Potential Short if You Like Pain and Stress Dip Buy Biotech Stock

- NASDAQ: RDHL — RedHill Biopharma Ltd — The 300% XGPT Biotech Stock Winner

- NASDAQ: CYTO — Altamira Therapeutics Ltd — The True Penny Stock XGPT Winner

- NASDAQ: MINM — Minim Inc — The Penny Stock That Went From Nasdaq Delisting to Supernova

Remember that these are my picks, based on my experience. I want you to use them to learn how I think about the markets. But I also want you to stand on your own two feet. Learn which stocks work for you and why.

There’s no guarantee I’ll trade any of these stocks. I’m watching them to see if they match my preferred setups — only then will I trade them.

The best traders watch more than they trade — that’s what I’m trying to model here.

MicroAlgo Inc (NASDAQ: MLGO) — The Volatile Chinese AI Penny Stock

My first stock to watch is MicroAlgo Inc (NASDAQ: MLGO).

This is an extremely volatile stock.

The chart history shows that. In September the price launched 150% in less than 24 hours.

Past spikers can spike again …

The big news on everyone’s lips right now is the company’s recent announcement to establish a postgraduate training facility. On December 6, it confirmed the cooperation of Shenzhen University and the Haikou Comprehensive Free Trade Zone Management Committee.

MLGO is in the technology industry, and that makes it highly vulnerable to the bullish momentum caused by 2023’s AI boom.

MLGO quickly spiked 540% due to the news.

And you’ll notice, the spike didn’t last long. Prices quickly fell 75% on December 7.

We have to play the most popular patterns and then get out before things turn ugly.

These are volatile penny stocks. The spikes won’t last forever, but we can take advantage of the price action if we understand the movement.

Due to the extreme sell-off, I’m currently watching for a price bounce. It’s part of my 7-step framework. Specifically #5.

For an example, take a look at the chart below. It’s a trade I made in 2020. There’s an extreme bounce after an extreme sell-off.

Yes, these patterns still work years later, they’re based on human psychology …

But every stock is a little unique. Like a snowflake.

Don’t expect MLGO to follow DECN’s pattern to a T.

This is an inexact science. But with enough experience, the patterns become more clear.

Wait for the perfect opportunity on MLGO.

If you’re worried about the volatility, join the live stream and follow along.

Safety Shot Inc (NASDAQ: SHOT) — The Potential Short if You Like Pain and Stress Dip Buy Biotech Stock

My second stock to watch is Safety Shot Inc (NASDAQ: SHOT).

For new traders that stumble upon penny stocks, a popular strategy is to short the crappiest spikers.

I’ll admit, I used to be a short seller myself. This strategy used to work.

But in the mid-2010s, something changed …

The crappy spikes started to run for days and weeks. Short seller accounts got blown up left and right. That’s when I switched to a long-biased strategy. We encountered something called the ‘short squeeze’.

If you’re not aware of this potent catalyst, watch my video below:

Shorts keep trying to guess the top on SHOT.

But if they had any market experience, they’d realize they’re shorting a red-hot biotech stock that has an arsenal of news catalysts. Most recently, on October 4, the company announced it sold out of its product ‘Safety Shot’ soon after its release on Amazon.com.

It’s a crappy stock. And the price will likely crash back down eventually. But right now …

- It’s on a multi-month run

- It’s in a hot sector

- There’s bullish news

- The price is consolidating

This stock has the potential to squeeze past recent highs especially if shorts keep trying to drag it down.

Make sure to trade with a plan. Identify key support and resistance, and craft a strategy around those levels.

SHOT is a ticking time bomb, but we still have to play it smart.

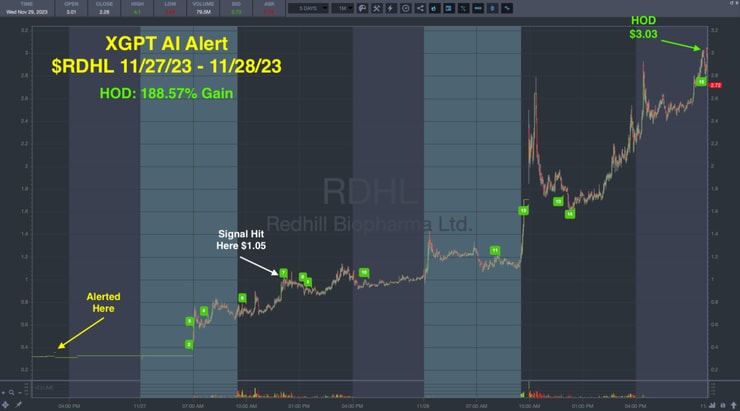

RedHill Biopharma Ltd (NASDAQ: RDHL) — The 300% XGPT Biotech Stock Winner

My third stock to watch is RedHill Biopharma Ltd (NASDAQ: RDHL).

Artificial intelligence is here to stay.

There was some backlash at first. A predictable resistance to change. But the reality is that AI can make all of our lives better. IF we take advantage in the right ways.

And for small-account traders, the opportunities are bigger than ever!

For example: RDHL spiked 950% after the company announced a 5-year exclusive U.S. market grant from the FDA.

An FDA grant for a penny stock is like striking gold. That’s why RDHL spiked so high. And it might not be done.

Now, imagine the potential if you had eyes on this before the price spiked.

I did.

I’ve been in the market for over two decades and I have over $7.5 million in trading profits. In that time, I’ve learned which stocks are most likely to spike and why.

I’ve spent the last 15 years teaching other people what I learned. And I currently have over 30 millionaire students.

But this process can take time to learn. At least, it used to …

I’m always looking for ways to teach students more efficiently. And 2023 gave me the best study tool to date.

I uploaded all of my trading experience into an AI bot that I call XGPT. And in the first few days of it being operational, it alerted RDHL before the spike even started.

Take a look at the chart below …

And RDHL is just one example of an XGPT win.

Here’s how we use AI to capitalize in this market.

There are more trade opportunities right around the corner.

Altamira Therapeutics Ltd (NASDAQ: CYTO) — The True Penny Stock XGPT Winner

My fourth stock to watch is Altamira Therapeutics Ltd (NASDAQ: CYTO).

Technically, a penny stock is any ticker trading below $5.

With that said, we often find that true penny stocks spike higher because the price starts lower. For some simple math, take a look at the examples below. For the same dollar change, the lower starting price shows a bigger percent change.

$3 to $6 is a 100% change.

$0.30 to $3.30 is a 1,000% change.

CYTO is a true penny stock on a multi-day run that started on November 17. The company announced a sale of 51% subsidy ownership to a Swiss private equity investor. CYTO was to receive about $2.3 million from the exchange.

Then on November 29, the company announced it had regained Nasdaq compliance concerning the minimum stockholders’ equity requirement. This was a direct result of the 51% ownership sale that occurred earlier in the month.

And in the afternoon on November 29, our XGPT bot alerted a trade at the end of the day. Take a look at the chart below …

Currently, prices have dipped off of the highs. But they’ve managed to consolidate and bounce off of the $0.30 level.

It is possible that support becomes a perfect launch pad…

Minim Inc (NASDAQ: MINM) — The Penny Stock That Went From Nasdaq Delisting to Supernova

My fifth stock to watch is Minim Inc (NASDAQ: MINM).

I’ve already made money on this stock.

On November 30 I traded it for a $1,452 profit (starting stake was $10,465). And I’m ready for any more bullish volatility.

Here’s what happened:

Stocks that trade on the Nasdaq exchange have to meet certain criteria. I already mentioned the minimum stockholders’ equity requirement. Another is the mandatory listing price of $1 or higher.

A stock whose price sinks below $1 for 30 consecutive days risks delisting.

On November 20, MINM announced the company received an SEC notice of possible delisting.

But ten days later, on November 30 the price spiked 1,000%.

When there's a giant runner EVERY DAY it's the height of all stupidity to try to explain them away as if they are black swans, but us longs will just enjoy plays like $BDRX $VVOS $MINM $RDHL whenever they pop up. IT'S SUPERNOVA SEASON…ARE YOU PREPARED TO CAPITALIZE ON THEM?

— Timothy Sykes (@timothysykes) November 30, 2023

Allegedly, the company isn’t aware why the price would spike so high. They released a statement about it that same day.

The company might not know anything. And if so, this is likely a short squeeze.

Think about it: Bearish news came out on November 20. Greedy shorts piled in and hoped the price would tank.

On November 30, a little bullish momentum ignited this supernova.

It’s a scary situation for short sellers. But it’s highly lucrative for long-biased traders. And the price just bounced off $2.50.

Support and resistance tell us the price consolidation could hint at a future spike.

Where Can I Get Good Stock Advice?

The sky’s the limit. It’s the age of the internet, and there’s tons of information out there. I’ve put out thousands of videos over the course of my teaching and trading career. That’s what happens when you’ve been around for a couple of decades and love what you do!

I suggest you start with my PennyStocking DVDs over on Profit.ly. They provide step-by-step guides to my penny stock trading strategies.

Stock Picks: The Bottom Line

Picking your own stocks is the smartest way to trade, but you must know what you’re doing.

Take some time to observe veteran traders. Understand why they think the way they do. Then use them as a launchpad for building your theories and strategies.

Be disciplined and do the work every day. Most importantly, keep learning and developing your skills. When you’re ready, apply for the Trading Challenge.

How do you go about finding stock picks? I want to hear from you. Comment below!

Leave a reply