Today I want to share four important penny stock power words with you. These are words that can potentially have a HUGE impact on a stock’s price action. Especially if you find them in the right way AND when other indicators fall into place.

To explain, let me take you back in time a couple of months…

On August 26, I did one of my weekly Trading Challenge webinars. Why talk about a webinar from August 26? Because what happened can help you become a better trader.

On that day, I took two trades on Tautachrome Inc. (OTCPK: TTCM) based on four power words. (See the trades below.) Of course, Trading Challenge students asked…

“Tim, how did you know?”

Here’s the answer…

Table of Contents

It Was in an SEC Filing

During the webinar, more than one student wondered how I knew TTCM would keep going. I didn’t. But I’d seen the SEC filing. And what it said was enough for me to be a little more speculative. I’ve had some of my biggest winners in the past based on SEC filings.

Nothing is guaranteed, but the SEC filing had the penny stock power words in it. (Keep reading to see a screenshot with the power words.)

It could’ve turned out to be a ‘buy the rumor, sell the news’ situation. People knew about the news, but they didn’t know whether it would be a big win because of the news.

Before I get to the filing, some students asked…

Where Did You Find the SEC Filing?

02:47 PM Tahj55 → timothysykes: “May be a dumb question but where are you finding the SEC filing and whats making you read it before the stock starts spiking? are you getting alerted through STT when it comes out?”

I don’t normally look for SEC filings. StocksToTrade Breaking News found the stock. That’s another reason why StocksToTrade Breaking News is so useful. They don’t just alert press releases. They also alert SEC filings.

(Quick disclaimer: I proudly helped design and develop StocksToTrade and I’m an investor.)

If you’re not using the Breaking News Chat add-on, get it here. If you already use the Breaking News tool…

All You Have to Do Is Read

It blows my mind when people rip on trading or penny stocks. And it blows my mind when they rip on plays like TTCM. This is what I’ve been seeing for 20 years. (New to penny stocks? Start with my FREE penny stock guide.)

It was good for students to see a patience play — where it wasn’t just one breakout or a morning spike. It wasn’t over in a couple of minutes like so many of my trades.

Trading Challenge students watched the stock trade while I gave commentary. And it gave me the opportunity to reel them in from focusing on random stocks or patterns. Why? Because of the…

4 Important Penny Stock Power Words

The power words (or similar words) in an SEC filing can create a big spike. Again, it’s not guaranteed. There are always multiple indicators. But as you continue your trading journey — look out for these four important power words in SEC filings…

More Breaking News

- URG’s Steady Climb: Optimism or Omen?

- SoFi Expands Financial Horizons with New Services

- DNN Stocks on the Rise: What’s Next?

Press Release to Follow

Crazy, right? Those four words — “press release to follow” — are a hint of upcoming news. A lot of traders won’t see the SEC filing, but they’ll see the press release after the fact. THAT is a perfect example of the informational inefficiency I love. It creates a huge opportunity.

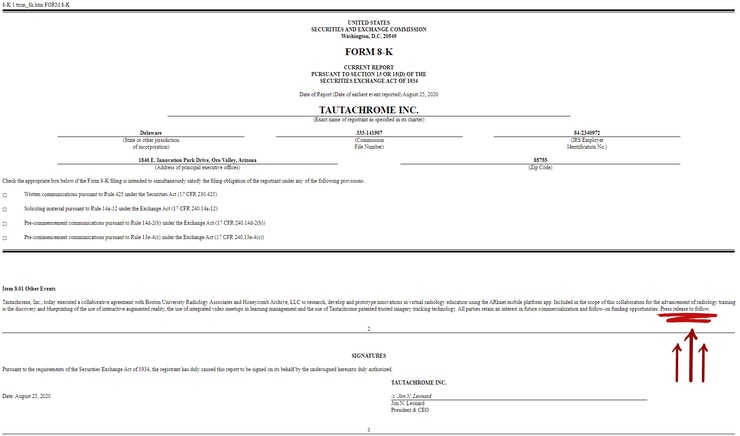

Here’s a screenshot of the SEC filing. I’ve underlined the penny stock power words in red to make them easy to find…

The SEC filing said, “Press release to follow.” That’s as clear as it gets. So look for those words — especially in an 8K filing. But remember, even though the SEC filing said press release to follow, it didn’t say when. It didn’t guarantee a press release the same day or even the next day.

So I was looking at other indicators, too. The filing with the power words was just the icing on the cake. What other indicators made TTCM the only stock to watch that afternoon?

Every Trade Has Multiple Indicators

Keep reading to see my full trade commentary and explanation of my two TTCM trades on August 26. Keep in mind I took this trade based on the power words in the SEC filing AND because…

- TTCM is a former runner.

- Augmented reality tech was hot at the time.

- The SEC filing also teased a deal with Boston University. (Virtual learning has been hot during the pandemic.)

- It was a big OTC first green day with big volume.

- It was breaking out of a multi-month cup and handle pattern

Let’s take a look at the trade…

Tautachrome Inc. (OTCPK: TTCM) August 26, 2020

You’ve seen the SEC filing, so you know the catalyst. First, look at the TTCM two-year chart to get an idea of how the stock traded in the past. It’s important to look at charts in different time frames.

I was familiar with TTCM because I traded it during the big run in July 2019. And I’ve traded it several more times in 2019 and 2020. (See all my TTCM trades here.) In other words, I know its history and the chart.

Pay attention, this is important…

To Prepare for the Future, Study the Past

Too many people disregard this, but it’s key. TTCM has a history of multi-day runs and overnight gap ups. It also has a history of one-day spikes. I didn’t know which it would be this time around. But I knew the potential.

Watch this video to see what I mean.

This Pattern Repeats Over and Over … Can You See It?

Pay particular attention at the 5:40 mark where I talk about TTCM back in 2019…

Like Tim Bohen and I say in the video, we expect these stocks to fail eventually. They aren’t investments — they’re trading vehicles. It’s crucial you understand the difference between trading and investing.

That leads to another very important point…

Follow Your Trade Plan

The first TTCM trade I took on August 26 hit my goal of 10%–20%. Rather than overstay my welcome going into the midday lull, I took the single for a 14.55% win.*

(*Please note: My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Here’s the August 26 TTCM intraday chart with my trades…

Notice I got out of the first trade when I saw a wall of sellers at $0.013ish. I tried to give it more time but decided to lock in profits heading into midday. But I kept watching TTCM — waiting for the press release.

The second trade has a few parts to it. They demonstrate perfectly how important it is to…

Find Your Comfort Level

Again, the second trade happened during the webinar where I explained it in real time. (Trading Challenge students get access to all archived webinars. Apply for the Trading Challenge here.)

The gist of it is that I rebought TTCM late in the day as volume picked up and it was closing strong. There was still no press release, but one was expected.

It was a multi-week, multi-month breakout and the overall markets were hitting new highs. But rather than hold my entire position, I locked in profits. I sold half when it hit a wall of sellers even as it hit new highs.

That brings up another frequently asked question…

What Is a Wall of Sellers?

This is what a wall of sellers looks like on Level 2…

As you can see from the screenshot, there was a wall of sellers at $0.0149. (See the ask side of the bid/ask box.) I wanted to see it make a clean breakout. We got the day breakout of $0.0144.

But you also have to see how stocks behave at round numbers. In this case, $0.015. That wall of sellers is part of the reason I sold half my position.

Safe trading allowed me to lock in profits and be a little more aggressive with the rest of my position.

Then, I further reduced my position when TTCM was struggling around $0.017. That allowed me to hold overnight. Let’s do the math…

My overnight position was very small — only around $1,650. That included unrealized profits of roughly $480. On the overall trade, I’d already locked in roughly $1660 in profit with my two sells.

It was literally a no-lose situation at that point. By trading conservatively, even an unlikely gap down to zero would result in a scratch trade.

The next morning there was no big gap up. I sold at the open — again at $0.017 to lock in a total profit of $2,145.*

Final Thoughts On TTCM and Penny Stock Power Words

It’s important to understand that even though I was patient, this trade was NOT a hold and hope scenario. I still traded with my rules and used my experience to navigate the trade.

If It Closes Too Strong, Don’t Chase

A lot of people want trading to be an exact science. It’s not. One of the reasons I wanted to write this post is to point out that it’s a moving target.

Before I bought TTCM, I was watching in anticipation of the news. I wasn’t prepared to buy if it closed too strong, because I don’t like to chase. It’s OK to miss a trade. Learn from it and be ready the next time.

At the same time, I didn’t want to buy if TTCM panicked too much. Because then I’d wonder if the news was already out. It’s kinda, “Wait a minute, maybe everyone already knows the news.” If it turned into panic selling, then I would be buying into a wall of sellers.

This is why it’s crucial for you to…

Be Meticulous

As I explained in my webinar, people who buy on press releases aren’t being meticulous. For me, I want to see what the press release says and how the market reacts.

So as the stock traded sideways heading into power hour, I was watching, but I wasn’t quite ready to buy. I wanted to see…

- How would the stock close?

- Would the company issue a press release that day?

- Was the press release already priced into the stock?

This question came up when I was explaining the power words in the SEC filing…

02:37 PM Simonfuture2 → timothysykes: “would you rather that PR to be before the market close or after? or do you not care when, you are just waiting to see how the price reacts after the press release?”

My answer was simple: I don’t care if it comes before or after the close. I’d rather the press release be good.

When the Setup Is Right, Take It

In the end, the setup was too good to pass up. That doesn’t mean I’m always right — I’m not. I lose roughly 25% of the time. But I was willing to take the trade based on all the indicators and then let it play out.

Had I been wrong I would have simply followed rule #1 and cut losses quickly.

5 MORE Important Power Words…

That about wraps up what happened with TTCM. But if you’re not already in the Trading Challenge, it’s only the beginning.

The thing that separates the Trading Challenge from my other educational resources is…

Trading Challenge Students Get Webinars

Every week, Trading Challenge students get two to four live webinars. But they also get access to thousands of hours of archived trading webinars. And for many newer students, the webinar on August 26 was a real eye-opener.

Trading Challenge Student Testimonials

My goal is to be the mentor to you that I never had. When a play like TTCM comes up during a live webinar, it ties everything together. Below are just a few of the dozens of comments after the webinar on August 26.

4:00PM Schwarz_S13 → timothysykes: “Thanks Tim, first webinar with you, thanks for the lessons and questions answered.”

4:00PM JuMO → timothysykes: “Amazing webinar. Had to only listen to half of it as I was driving in my car, but still totally worth it.”

4:00PM WiFiMike: “First webinar in the challenge and this was incredible. The learning material has been a wealth of knowledge. This tied so much of it together.”

4:00PM Tony815 → timothysykes: “im not even trading $TTCM but just watching you and hearing your commentary is awesome learning so much!”

4:00PM weber: “Just amazing and gives me so much hope and motivation to study more.”

4:00PM beingmick: “$TTCM awesome birthday gift for me!”

4:00PM Jpsmith1219: “YESS!!!!!!!!! AMAZING!!!!!”

4:00PM gjbailey36: “Holding 10K $TTCM overnight….WOW! Thanks Tim!!!!”

4:00PM millerruth23 → timothysykes: “Thanks, man, awesome webinar!”

4:00PM RPhTrader → timothysykes: “Cheers! Thanks Tim!”

4:00PM johnnyma75 → timothysykes: “Thank you, what a day!!!”

4:00PM Windwalzer → timothysykes: “Thank you for the great education on a great trade.”

4:01PM Jenna → timothysykes: “Thank you so much Tim! Awesome teachings.”

4:01PM TheBeastMarket → timothysykes: “That was so awesome to see that price action and understand it. Thanks.”

4:01PM lorena_gerardo83: “d*** im so happy i join the challenge!! freaking awesome webinar!! congrats to everyone that banked!!”

4:01PM soultrain → timothysykes: “Didnt get a play on this stock but saw the great price action. good luck everybody overnight.”

Next Steps

This post only scratches the surface. During the webinar I went deep, explaining my thought process in detail. Would you like to watch the webinar to see how it all unfolded? Trading Challenge students can view it here.

If you’re not a Trading Challenge student … now’s the time to apply. 2020 has been AMAZING. Now is the time to learn so you’re ready for the next hot market. I can’t predict when it will happen — hot markets come and go.

But I do know this…

You MUST be prepared when you enter the market. Preparation is key. Apply to join the Trading Challenge today. Then immerse yourself in the archived webinars. Do it!

What do you think of the penny stock power words described in this post? Comment below, I love to hear from all my readers!

Leave a reply