Talk about two great ‘problems’ to have … First, I’m having serious trouble keeping up with these $1 million trading profits posts.* I’ve written a few of them recently…

But trust me, I’ll never get tired of making announcements like this.

I’m proud to introduce Jack S. as my latest Trading Challenge student to pass the million-dollar profit mark!* He’s currently up over $1.2 million in profits as of early March 2021.*

Jack’s only 23 and still in grad school, but he’s already joining a noble lineage of seven-figure Trading Challenge students*…

In January 2021, several of my students including Mike ‘Huddie’ Hudson, Matthew Monaco, and Kyle Williams all crossed $1 million in trading profits within days of each other.* They’ve all been studying and trading for years — the hot market gave them the opportunity to grow their accounts exponentially.*

My second ‘problem?’ I don’t know what to call Jack. It’s getting confusing since I already have another millionaire student named Jack — Jack Kellogg. He’s currently up over $5.8 million in profits as of early March.*

Because I’m clever, I’ve been calling the newer millionaire “Jack #2”*…

Despite referring to him like he’s a movie sequel, Jack’s story deserves top billing. It’s as funny as it is informative and inspiring. So read, enjoy, and get motivated to study hard!

Also, don’t miss my brand-new video interview where I talk with Jack about his trading career and $1 million trading profits*…

(*Please note that the trading results that Jack #2, Jack Kellogg, Kyle, Huddie, and Matthew report are not typical. Most traders lose money. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

Table of Contents

$1 Million Trading Profits: It Didn’t Happen Overnight*

It makes for an attention-grabbing statement: Jack passed $1 million in trading profits while still in grad school.*

Maybe you’re thinking, ‘How hard could it be?’

If that’s your mindset, here’s my answer…

Harder than you think.

Please don't think my top https://t.co/occ8wKmlgm students & I have it easy in the beginning, it's a struggle to learn proper discipline, watch https://t.co/48IZn9qIGR & https://t.co/odGz3PB5Um & see how we all began, the key is learning the patterns so you can be FULLY prepared!

— Timothy Sykes (@timothysykes) February 24, 2021

Jack’s youth might make this milestone seem effortless, but he’s actually been studying and trading for years.

He also blew up his account — multiple times. He started trading with $2K … But he lost it and “had to restart a couple of times.”

More recently, he had an $80K blow-up. It wasn’t on a single trade but during a six-month period where he was having “a problem with my trading habits and behaviors.”

He talks about his losses in the video I posted above … Keep reading for a closer look at one of his bigger losses in recent memory.

I want traders to understand that this journey hasn’t been easy for Jack, but he stuck with it … Now, after years of hard work, he’s a millionaire.*

Let’s take a look at his full story so you can understand the kind of hard work that went into making it all happen.

This Hilarious DM Started It All

It’s my goal to always be completely transparent with you … So I’ve gotta say, I didn’t have high hopes about Jack from the get-go.

Jack initially found me on Instagram during his 2014–2015 junior year of high school.

I used to post about flashy cars all the time. I’m proud to say that I’ve grown a lot since then.

Nonetheless, a lot of students found me that way — including Jack. He says, “Like anybody, I was hooked on the Ferrari. It’s the car that I’m going to hopefully purchase one day. If you have a Ferrari, I will gladly listen to your message.”

Jack was inspired to reach out … And his initial contact was super sketchy.

True story: my first contact with Jack was through a DM where he sent me a blurry selfie and the message “Please teach me! I’m on vacation and just woke up. I have about 30 minutes free.” It’s pretty hilarious to look at now. Check it out in this post:

View this post on Instagram

No, I wasn’t getting ‘highly motivated student’ vibes. But despite appearances, Jack was actually very serious about trading.

Getting Serious About the Penny Stock Niche

Jack had the desire, but he wasn’t ready to get started with my Trading Challenge yet — mentally or financially. So he worked on building his ‘knowledge account’ as he finished up high school.

Most high school seniors contract a disease called senioritis and slack off. Not Jack.

He spent all his free time studying the stock market. He already knew that there was great power in the stock market.

But as he puts it, seeing my posts about supernovas “took my knowledge to a whole new level of possibilities … Small-cap stocks are just a totally different realm of the stock market, which is awesome.”

Want a primer on how to spot supernova plays? Check out this video:

More Breaking News

- Datadog Sees Price Target Shifts Amid Market Changes

- Bitfarms Plans for U.S. Redomiciliation and Debt Repayment Spark Investor Interest

- Exponent Stock Boosted by Strong Q4 Performance and Dividend Hike

- SunOpta’s Acquisition Boosts Stock by 32% Amid Key Industry Moves

The Trading Challenge and the Trek to $1 Million Trading Profits*

Jack officially joined my Trading Challenge in 2017. At this point, he was ready to apply himself.

He dug into all of the resources available, including the chat room and my DVDs…

His favorite resource by far is the webinars, which he says are even better now than when he started. That’s because there are so many more now — the Trading Challenge features webinars not just by me, but by several of my top students.

He says, “What’s cool is that, although there are some commonalities among strategies used, they are also big differences in trading techniques. If there is one thing to learn about trading, it is that there are a million and one ways to make money and manage risk.”

He also loves StocksToTrade: “I have actually used that software since the beginning. It’s just so convenient having everything in one program. Plus I love the way the charts look.”

(Quick disclaimer: I helped design and develop StocksToTrade and am an investor.)

The Strategy That Led to Jack’s $1 Million Trading Profits*

Jack has mainly been a short seller over the years. His go-to strategy? Waiting for momentum to shift in a stock.

As he shares, “There are many different variations of this…

“Sometimes it comes down to an intraday breakdown … Other times it comes down to so many buyers flooding into a stock that it gets to the point of ‘who’s left to buy.’

“But I absolutely love waiting for breakdowns and then positioning myself where the original buyers will sell their positions and push the stock down.”

How does that strategy actually play out in the market? Here are some examples…

A Big Win*…

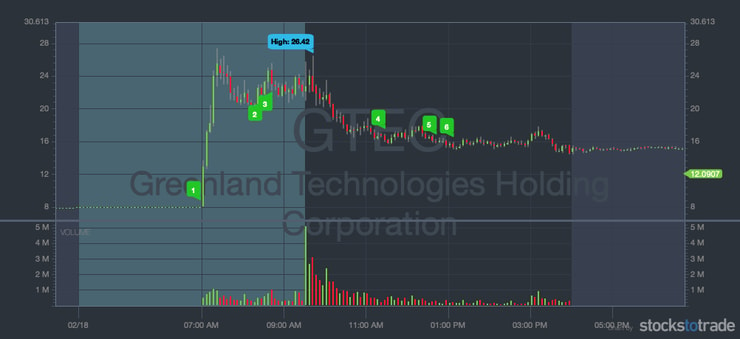

To illustrate Jack’s strategy, consider his recent $50K+ trade short selling Greenland Technologies Holding Corp. (NASDAQ: GTEC)*…

GTEC is a great example of a breakdown. As Jack says, “Oftentimes, we will see these big overexaggerated moves in the premarket that are not completely warranted.

“They appear to be incredibly strong stocks, but by the time the market opens, there’s insufficient demand in the stock to keep it that high. And it spends all day filtering out people who chased the stock up.”

Here’s the chart on the day Jack traded…

GTEC held true to Jack’s thesis, and he had a big win.*

Staggering Losses…

It doesn’t always work according to plan, though.

I already mentioned Jack’s biggest loss, but I also want to share a more recent loss to demonstrate that traders make mistakes even after they pass the million-dollar profit mark.

Recently, Jack had a nearly $10K loss on Greenpro Capital Corp (NASDAQ: GRNQ).

While he mainly goes short, he’s been trying to go long recently, because there have been so many breakouts.

He shares, “GRNQ had been on my watch for a solid few weeks before I initially took the trade. It faked me out a couple of times, but this time, I truly believed it was all coming together … This was the breakout that we’ve been seeing in so many other charts. Unfortunately, that was not the case.”

I’d consider this a good loss because Jack learned something from it.

He says, “This is why we have risk management. Although $10,000 is a pretty large loss, especially for an overnight position, it was the absolute worst-case scenario in my plan.

“The next market open, I cut the loss and moved on because I was wrong. Had I held for another day or two I would be looking at anywhere from a $20K–$40K loss.”

I love that Jack keeps learning from his wins and losses. Check out this recent tweet:

@timothysykes Had my worst day (which y'all will hear about in the interview) and couple of my best days in February. February's gone, now its time to focus on March🤠 #neext pic.twitter.com/JnSYD51Odg

— Jack Daniel (@jackdan_no7) March 1, 2021

Jack Two’s $1 Million Profits Milestone* … What Happens Next?

Time and time again this has happened…

A student passes $1 million in trading profits.* It’s a happy occasion … But it doesn’t really change much for them.

When I asked Jack how he celebrated the milestone, he kind of went blank … Then he admitted he’d gone out to dinner and gotten “two apps.”

Way to go crazy, Jack! Hope you enjoyed living it up with a salad and an eggplant appetizer…

If anything, this big milestone is an opportunity for Jack to get down to the serious business of being a trader.

He says, “I am absolutely relieved to be here and have hit this mark. My goals going forward mostly consist of getting rid of all the trades that waste my time.

“I often find myself in names and patterns that don’t meet any sort of criteria that gives me ‘my edge’. Funnily, that’s where all my biggest losses come from.

“It’s funny to think that we can make more money by simply doing less. We can try to nail every move, and we will most times end up missing all of them.”

That’s what I call the right mindset! Trading is NOT a 9-to-5 job, so why treat it like that?

Jack has more financial freedom now, and he’s using it to his advantage to focus on the best plays.*

Jack’s Tips for New Traders

Following his $1 million trading profits milestone, what does Jack have to say to new traders?*

To paraphrase, stick with it. But for the long answer, Jack says:

“Trading is a game of persistence. There are going to be many good days and bad days, and a lot of the success is attributed to keeping everything under control during the bad days.

“This can be done by always using a firm risk management system. There’s a reason many great traders say ‘cut losses quickly.’

“When you’re just starting out, cutting your losses quickly and only allowing for planned risk is what keeps you in the game. If you have made a killing and you have less than three years experience under your belt, you’d better be wiring some money out.”

He also suggests being humble: “I also notice a bunch of mistakes happen when my account gets too big … I start to get sloppy.”

Jack’s $1 Million Trading Profits Milestone* … How Inspired Are You?

I love sharing stories like this. Jack’s story is incredible — he’s accomplished so much at such a young age. I’m so proud of his $1 million trading profits milestone!*

I’m proud to have him as a student, and proud to have recently made him a Trading Challenge chat room moderator.

But it didn’t happen overnight, and it wasn’t always easy. Despite his $1 million in trading profits, he’s also had some big losses — including a five-figure account blow-up.

Through thick and thin, he sticks with the process — he’s in it for the long haul.

What about you … How are you motivated by Jack’s story? Are you motivated to study? Consider applying for my Trading Challenge.

Would you have stuck with trading after an $80K account blow-up? Leave a comment and let me know … Plus, congratulate ‘Jack #2’ on his incredible milestone!

Leave a reply