Everyone wants to be a millionaire, right? I get DMs and emails all the time from people saying they want to be my next millionaire student. But most people don’t realize how much work it takes to make millions. They look for the easy button.

Last week, I passed the $1 million annual trading profit milestone for the first time in 20 years of trading.* Only a few weeks earlier, I passed $6 million in career trading profits.* (I trade with a small account to teach.)

Most people have the wrong mindset. If you’re just starting, you shouldn’t focus on how much money you can make. But it doesn’t end once you become profitable. If you reach the level of mastery where you can make six-figures in a day like Jack Kellogg, it’s very similar.*

(Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Keep reading to find out my take on how to make millions. First…

Table of Contents

- 1 Proud to Make More Food Bank Donations

- 2 Trading Mentor: Questions From Students

- 2.1 “How many screens do you watch? I’m finding it hard to follow multiple stocks…”

- 2.2 “Can you explain why the volume during the panic on TSNP, ENZC, and ZNOG looks the same?”

- 2.3 “How long do you expect these OTC opportunities to last?”

- 2.4 “When holding an overnight position, do you send your order right before the market open or after?”

- 2.5 Special Announcement: Jack Kellogg Webinar

- 3 Trade Review: How I Passed the $1 Million Annual Profit Milestone

- 4 How to Make Millions? One Trade at a Time

- 5 Millionaire Mentor Market Wrap

- 6 Educational Resources

Proud to Make More Food Bank Donations

Last week was a solid week of trading. It started hot — and I’ll review my $1 million profit* milestone trades later. But what makes me more proud is that I can donate another $73,000 to food banks to help people in need.

Whew, what a day, my 3rd consecutive $20k+ day, but I was too conservative on my $TSNP $RSCF buys…the good news is the $66k I've made in trading profits THIS WEEK will ALL get donated to food banks to help families in need & now I've made $1.046 million in 2020 trading profits!

— Timothy Sykes (@timothysykes) December 2, 2020

Want to help us increase our donations? Check out the new Karmagawa merch here. Our new line is sustainable — much of it made from recycled plastic.

Great News on Yemen Donations

Working with Partners Relief & Development, Karmagawa has helped thousands of people in Yemen. Keep an eye out for a dedicated post. It’s crazy what’s going on there but, as you’ll see, we’ve made a real impact.

Now, let’s talk trading…

Trading Mentor: Questions From Students

This week I picked four questions from my latest Trading Challenge webinar. Want your trading questions answered? Every week, Trading Challenge students get two to four live webinars. You can even ask different mentors the same questions to see how we think.

The first question is from Profit.ly user okcstocks…

“How many screens do you watch? I’m finding it hard to follow multiple stocks…”

I have one laptop that’s missing five keys. Letters are literally falling off of my keyboard, and I’m still doing fine. So don’t believe the crap about not being able to watch all the plays.

You CAN watch multiple stocks, you just need to train yourself. That said, you don’t need to be in a bunch of trades at once. For me, one or two positions at a time is enough. I don’t like trying to manage too many trades.

The next question is from Profit.ly user jothamd…

“Can you explain why the volume during the panic on TSNP, ENZC, and ZNOG looks the same?”

I don’t know. Maybe stop losses, promoters, or dip buyers? I can guess, but who cares? It happens over and over again. It’s like a magic pattern. It’s the one pattern I teach, love, cherish, and prepare for.

Think about it like this…

You don’t have to be the chef who knows all the ingredients. Instead, be the consumer who recognizes all the ingredients. Be able to see when they’re mixed together perfectly and served on a silver platter. Then, be ready with fork in hand.

How do you prepare? There are over 700 video lessons on Profit.ly about buying dips and panics. Watch every single one multiple times. And take notes.

The final two questions are from Profit.ly user Tsionmare44…

“How long do you expect these OTC opportunities to last?”

I don’t know, I’ve been doing this for 20 years. If it ends tomorrow, fantastic. If it goes another 20 years fantastic. Take it one trade at a time. That’s how to make millions.

Don’t try to anticipate or guess. Don’t try to make an OTC wish list…

“Dear OTC Santa Claus, I would like one panic per day, every day, for the next 20 years…”

There is no OTC Santa Claus. Instead of trying to predict, guess, or wish…

Why not just react? Think about taking what the market gives you and being happy with it.

Wait for your patterns. If you don’t know your patterns, you shouldn’t be trading. So first, find which patterns work best for you. To do that you have to know the patterns, and then you have to try them.

Final question for this edition…

“When holding an overnight position, do you send your order right before the market open or after?”

It depends. You have to think about multiple indicators. For example…

- What’s the stock?

- Am I shorting it or longing it?

- Is it a first green day OTC play?

- Is it a first red day play?

- What’s the news catalyst, if any?

- Is it a hot sector?

- What’s the float?

- What’s my position size?

All those things matter. I never just say, “Overnight position, let me put in my sell order at the same time.” I’m never lazy when it comes to trading. You shouldn’t be either. If you really want to learn how to make millions, be meticulous.

You have to think about all the different things that influence these stocks. THAT should determine whether you trade them. And it determines how conservative or aggressive you should be.

A lot of the confusion comes down to a lack of preparation. You need to prepare more. Many of you reading this are just beginning. This question is a good example of why we have so many DVDs, video lessons, and webinars. It’s so you can study. It’s so you can learn to think about multiple indicators before risking your hard-earned money.

Speaking of webinars…

Special Announcement: Jack Kellogg Webinar

On December 18, millionaire trader Jack Kellogg will share his trading wisdom. He’ll answer questions, review trades, and inspire you to study hard. Jack passed the $1 million career milestone in November. But he topped it off by hitting $1 million for the year after an incredible $120K day last week.* I can’t wait, it’s gonna be epic.

Please congratulate @Jackaroo_Trades on his $120,000+ profit day today, his biggest day ever, even while he’s sick in bed…let’s all wish him well & tell him to get a good nights sleep to be ready for all the big time opportunities on $TSNP & $ENZC $VRYYF $FNMA tomorrow too! pic.twitter.com/AAYqdy9q8d

— Timothy Sykes (@timothysykes) December 2, 2020

Want to participate in Jack’s webinar? Apply for the Trading Challenge today.

Now let’s review a milestone trade…

Trade Review: How I Passed the $1 Million Annual Profit Milestone

After I review the trades that took me over $1 million in annual profits, I’ll get to the important lesson in this post. But let me give you a hint…

There’s nothing special about me or my top students. This TIME is special. The reason I talk about the money is not to brag. It’s to show you the potential.

Let’s check out the trades…

Tesoro Enterprises, Inc. (OTCPK: TSNP)

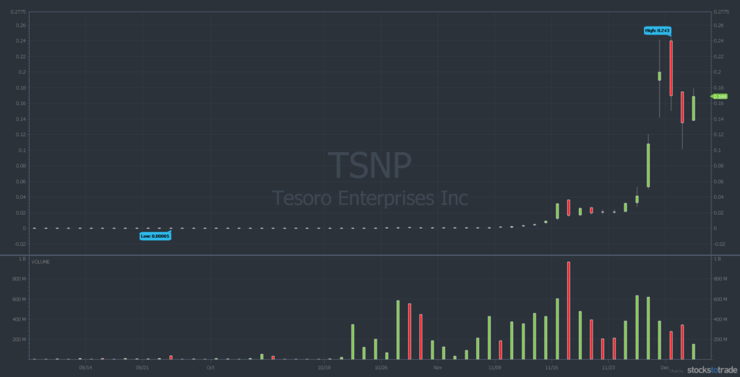

TSNP ran from sub-penny to 24 cents a share in roughly two weeks. To put that in perspective, that’s more than a 2,500% increase. That’s the penny stock potential I hope you understand. (New to penny stocks? Start with my FREE penny stock guide.)

Here’s the TSNP three-month chart:

Want to know how to make millions? Learn to trade stocks with this kind of volatility and price action. I’m not saying it’s gonna be easy. But the chart shows the potential. Just don’t think these low-priced junkers are investments. (They’re not.) They’re trading vehicles.

First Green Day and Morning Panic Pattern Perfection

The TSNP price action was about as good as it gets. And my trades are some of the best examples of the first green day and morning panic patterns this year.

Check out the TSNP chart from November 27–December 2 showing my alerts:

You can see the market was only open half-day on November 27 due to the Thanksgiving holiday. Notice my buy alert near the close. What you can’t see are my position updates. (See the full trade commentary with position updates here.) I added shares and then sized down into the weekend to be safe.

Top Tip: What to Do When a Stock Proves Itself

TSNP had an OUTSTANDING 80% gap up on November 30. I sold near the open and made $16,159 on the trade.

Some people asked why I was even long over the weekend. Because the stock proved itself all day. I underestimated it not once, but three times on November 27. It had a morning spike, consolidation, and an intraday panic. Three times it did better than I thought it would. And THAT gave me the confidence to hold overnight.

The Trade That Took Me Over $1 Million in Annual Profits

But the first green day gap up didn’t get me to $1 million for the year.* It was buying the dip on the morning panic a few minutes later that took me over the top. On that trade I made $5,070, surpassing $1 million in annual trading profits for the first time in my career.*

One more thing to notice about that chart … The next day TSNP had a near-perfect double top and another classic morning panic. I bought the dip on that one for another $15,712 win.* TSNP was just amazing last week.

Watch this video for more details about my thought process on the TSNP trades…

Crossing the $1 Million Profit Milestone for 2020 Today

Pay particular attention to what I say at the three-minute mark. It brings me back to the most important lesson for today…

How to Make Millions? One Trade at a Time

At the start of 2020, I had no idea how much I’d make. Even halfway through the year when it was shaping up to be one of my best, I still didn’t know. Pay attention, because this is key…

If you want to make millions, you MUST learn to take it one trade at a time. And your goal shouldn’t be to make the most money with each trade. It should be to trade well.

It's NOT just about making the most $ every day, it's about taking advantage of what the market/life offers you. Some days you don't even have to trade, go outside, go study, go workout…don't become a slave to $, instead use $ to earn your freedom & live a more rewarding life!

— Timothy Sykes (@timothysykes) December 4, 2020

If you asked any one of my top students how they feel about making a lot of money, they’d say the same thing. And if you asked them how they’re trading, they wouldn’t be completely satisfied. Even on their best days…

For example, Matthew Monaco had his first $20K day last week.* We talked at the end of the day, and he was disappointed because he missed a lot of opportunities. If you asked Kyle Williams, Roland, or Huddie…

They’d say the same thing. They all want to be better traders. And to do that, they take it one trade at a time.

Millionaire Mentor Market Wrap

Hopefully, you get that there’s no secret answer to how to make millions. It’s hard work. To do it as a trader, you have to grind. You have to learn from every trade — one trade at a time. And to stay in the game long enough, that means trading small and cutting losses quickly.

And as much as I say study hard every day, penny stock trading is NOT rocket science, I've taught some VERY stubborn, degenerate, ignorant people over the year & by year 4-5-6 they understand EVERYTHING so go hard with learning in the beginning then it gets much easier over time!

— Timothy Sykes (@timothysykes) December 4, 2020

Study every day. At first, it will seem hard. But it gets easier over time. You don’t need an unlimited amount of knowledge. But you do need to approach trading with the mindset of constant improvement. Experience matters. So start now.

What can you do today, tomorrow, next week…

To set yourself up for one, two, or three years from now?

Educational Resources

If you haven’t studied my “How To Make Millions” guide, this is the perfect opportunity. There hasn’t been a market like 2020 in decades. Who knows how long it will last? But one thing is sure: if you’re not at least learning from this market, you’re missing opportunities.

Get “How To Make Millions” Here

Everyone asks how to make millions. So let me ask YOU a question. How bad do you want to make millions? Leave a comment below, I love to hear from all my readers!

Leave a reply