Mike “Huddie” Hudson is on fire this year!

He’s now up over $500K in verified profits.* That’s a milestone many new traders strive for, but too many give up or blow up before they have a chance of reaching it.

Huddie turned that dream into a reality after joining my Trading Challenge a few years ago. And what I respect even more about him? He’s committed to helping new traders.

It’s time for a long-overdue update on how Huddie’s doing. Like many of my other top traders, the recent hot market has been important for Huddie’s growth as a trader. He’s learned a lot of new lessons and is now more consistent than ever.*

But what makes me even more proud? How Mike Huddie gives back to the trading community. He wants to help other traders in their journeys.

Read on to find out how Huddie made it to where he is today. His journey is like a lot of my other top students. He set goals and worked hard to achieve them.

And the best part? He’s just getting started.

(*Huddie’s trading results are not typical. Individual results will vary. Most traders lose money. My top students have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Table of Contents

My $500K Student: Who Is Mike Huddie?*

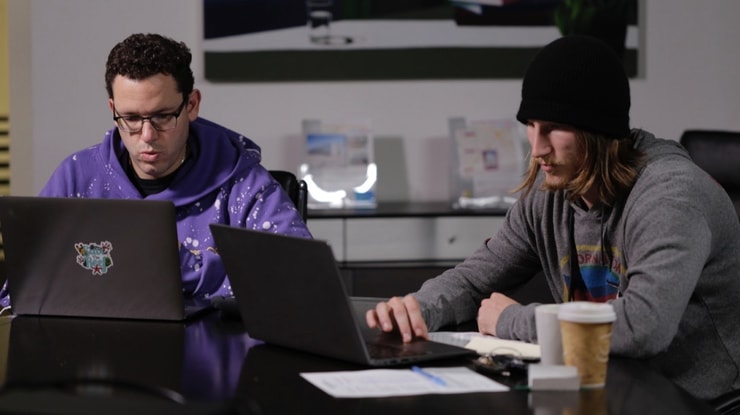

I always hate meeting up with Huddie. He makes me fully aware of my inability to grow hair. Seriously, Huddie grows more hair in a week than I’ve grown in my entire lifetime.

In fact, I think of his hair like I think of his trading profits … Every time I see him, there just seems to be more of it.*

Huddie’s been my student for five years now. In 2018, Huddie found exponential growth in his trading. (Check out his profit chart here.) Now, during these two years, Huddie made over $500K. And 2020 is his best trading year so far.*

Let’s talk about how Huddie used this hot market to his advantage…

How Mike Huddie Banked in This Hot Market*

Remember, trading success doesn’t happen by luck. It happens when preparation meets opportunity, and it’s safe to say Huddie was prepared for the wild 2020 market.

In fact, Huddie made over $60K in June alone, thanks to the hot market.*

Now, I don’t generally praise short sellers. I think shorting is risky and it’s just not my bread and butter. That said, I think Huddie does it well.

And here’s something you have to remember about the wild 2020 market … Most of the companies that made 1,000% moves or more aren’t in play anymore.

A lot of them were pumps. Insiders and promoters can use newbie traders to inflate a company’s stock price. And while the price is high, they sell and get out of their positions.

I like to trade pumps on the way up…

But some traders play these stocks on both sides — long and short. Like Mike Huddie. He trades both sides of these stocks, but he has a heavier short bias.

The reason that Huddie did so well during the hot market (and is still doing well) is because he read those pumps like a book. He knew how to spot the right longs and find where the stock should start tanking.

Since there were so many runners over the summer, Huddie buckled down and banked on his preparation.*

How Mike Huddie Traded $8K in Profits Overnight*

Now, I’ll say that I think Huddie’s a little more advanced in the way he looks at losses.

My #1 rule is to cut losses quickly. It’s the most important rule I’ve ever made.

Remember, I had to learn big trading mistakes the hard way. There were no penny stock mentors when I got into the markets 20+ years ago. And I’ll never forget the day when I lost over $500K on a single trade…

That was mostly because I didn’t cut my losses quickly. Read more about it in my free book, “An American Hedge Fund.”

Huddie treats his losses a little more like Tim Grittani, who now cuts his losses intelligently. Grittani’s now a better trader than me. That makes me proud as a teacher.

And as a teacher, it’s my job to pass on the basics you need to become successful and consistent, like cutting losses quickly. As you get to the level of my top students, like Huddie and Grittani, you can evolve. You can better understand how to cut losses intelligently as you find consistency.

So what does cutting losses intelligently have to do with Huddie’s $8K overnight profit?* That approach was the basis for it.

Watch his free webinar and find out exactly how he did it:

How Huddie Traded $8K* In Profits Overnight

How to Get Huddie’s Weekly Webinars

As I said, I’m proud of Huddie for giving back to the trading community — it’s a common theme among many of my top students.

They want to help other traders find consistency. It’s why I think we have the best trading community. My top students aren’t greedy. They don’t want to keep what they’ve learned to themselves. A lot of them find different ways to pay it forward. Here’s how Matthew Monaco, Jack Kellogg, and Kyle Williams help the community.

As for Huddie … he’s joined the SteadyTrade Team with my good friend Tim Bohen. Their goal is to teach traders how to trade.

Currently, the SteadyTrade team puts out over 10 webinars per week to help traders find consistency. Huddie does an episode every single Friday.

I love seeing this. And at the end of the day, this is the type of content I want all my students to study.

Whether you’re one of my students or not, joining the SteadyTrade Team is a great way to add to your skillset and continue to learn.

The Trading Setups That Made Huddie $500K*

Lately, Mike Huddie’s been busy…

But we did talk a bit about the setups that have made him over $500K in profits in his trading career.* And he shared how he’s trading now.

Top traders grow and evolve. Whether that means they find new setups or improve consistent setups, it doesn’t matter. They just keep going.

These days, a lot of Huddie’s trades come from the short side, but he dabbles in long setups too.

When Huddie and I chatted, a lot of his trades were short-biased. One trade we discussed that exemplifies his strategy well is CytoDyn Inc (OTCQB: CYDY).

Here’s the chart:

A lot of my top students reported banking on this ticker. In fact, Grittani reports making over $200K when he longed this stock.

But Huddie actually shorted this one, making nearly $30K in profits.*

He told me that this is a similar setup he sees on listed stocks — the first red day setup. It’s basically the opposite of the first green day.

Want to learn more about first red and green days? Get my 30-Day Bootcamp. It’s how you can build a solid trading foundation in 30 easy-to-digest trading lessons. How fast or slow you go is up to you. Learn more here.

Mike Huddie’s a great example of a trader who’s self-sufficient and knows what works best for his strategy. He’s gotten great at spotting these patterns and knowing exactly what they should do. If they don’t work like he wants them to, he gets out fast.

How You Can Find Your Setups

It’s hard to find the right setup as a new trader. There are so many, and so many potential ways to play them.

But it’s important to find the setups and patterns that work for you. That’s why I got into teaching. I don’t trade just one pattern. It’s important that my students learn from several different patterns. That’s how they learn what’s out there and start to test what works for them.

If you’re struggling to find the right setup, you need to start studying ASAP.

None of my top students made all their profits on one trade … They’re students who understand the power of consistency and aim for singles.

Over time, their strategies, commitment, and dedication pay off for them. They work hard to find — and maintain — trading consistency.

It’s why I make so many video lessons and DVDs…

I want to teach my students as many patterns as possible to help them learn. No big surprise, most of my top students studied my video lessons for hours on end until they found what clicked for them.

Trading well comes down to studying. Take it from Huddie, who’s now five years into his journey, nailing hot markets, and giving back to his trading community.* I’m so proud of Huddie!

Conclusion

I think it’s safe to say that Mike Huddie is doing well for himself.

I never doubted that Huddie would be a great trader … just like I know all my students have the potential to be great traders.

And there’s a reason they’re in my Challenge. They showed me they have the dedication it takes. Remember, I only select the students who I think have earned their spot in the Trading Challenge.

I only want to work with students who I know are willing to put in the time and dedicated to learning. And I don’t have time for people who question my teaching process or want ‘hot stock picks.’

Think you have what it takes to be one of Challenge students? Apply now.

How does Mike Huddie inspire you? Let me know in the comments below!

Leave a reply