Is green investing the future of the market? Nobody knows for sure, but people are slowly becoming more aware of how their actions and purchases can impact the environment.

Maybe that mindset will spill over into the stock market and how people choose to invest their money.

Let’s think positive and prepare for if and when that day comes…

In this post, I’ll go over what green investing is and how it differs from ethical investing. Plus, I’ll give some green stocks to watch. Let’s do this!

Table of Contents

- 1 What’s Green Investing?

- 2 Green Investing and Ethical Investing: Are They the Same Thing?

- 3 Why Invest in a Green Company?

- 4 Different Green Investment Areas

- 5 How Do I Know a Company’s Really “Green?”

- 6 Top 10 Green Stocks to Watch in 2020

- 6.1 Waste Management (NYSE: WM)

- 6.2 Enphase Energy, Inc. (NASDAQ: ENPH)

- 6.3 VivoPower International PLC (NASDAQ: VVPR)

- 6.4 SPI Energy Co., Ltd. (NASDAQ: SPI)

- 6.5 Siemens Gamesa Renewable Energy, S.A. (OTCPK: GCTAY)

- 6.6 Fuel Tech, Inc. (NASDAQ: FTEK)

- 6.7 Sunvalley Solar, Inc. (OTCPK: SSOL)

- 6.8 Sunworks, Inc. (NASDAQ: SUNW)

- 6.9 United Natural Foods, Inc. (NYSE: UNFI)

- 6.10 FuelCell Energy, Inc., (NASDAQ: FCEL)

- 7 Are Green Investments the Future?

- 8 Conclusion

What’s Green Investing?

Green investing is a type of socially responsible investing. It’s specific to investing in companies that are environmentally friendly. It can include companies that produce or supply alternative green energy, environmentally friendly products or technology, or that conserve natural resources.

There are also companies that clean up or reduce pollutants in the air, water, or land.

I’ll get into the different green subsectors you could invest in a bit…

Green Investing and Ethical Investing: Are They the Same Thing?

Ethical investing is investing in companies based on morals and ethical principles. Ethical investing can include companies that are making positive social impacts that aren’t necessarily related to the planet or environment.

It doesn’t always take into account any potential profits. It’s more about investing in your community or a cause you believe in.

Why Invest in a Green Company?

Green companies can be involved in leading-edge technology that could change the way we live. Like climate-change stocks — if a company comes up with a solution to climate change, that would be a huge breakthrough.

That might be too big of an idea right now, but as technology advances, anything is possible…

More and more investors are looking for green investment opportunities.

Higher demand for green products and green stocks puts more pressure on companies to develop green products, technologies, and alternative energy.

Another good reason to invest in a green company is that it can just feel good. Putting your money into a company that’s trying to make the world a better place can feel good. And you can potentially gain some profits at the same time.

I choose to donate all my trading profits to charity rather than invest in green stocks.

And since I don’t invest in stocks, I don’t really care what sector the penny stock I’m trading is in or even what its business or product is.

I’m trading chart patterns and price action, not the company.

My goal is to make 10%–20% on a trade, then move on to the next. I don’t get married to the company.

I did that once and it cost me half a million of my own money. Read about my huge loss in my book “An American Hedge Fund.” (Get a no-cost downloadable version here.)

Disclaimer: I’m not an investor and I’m in no way giving you financial advice. All trading and investing is risky. Never risk more than you can afford. Do your due diligence.

Different Green Investment Areas

Within the green stock sector, there are subsectors. You can diversify over the sub-sectors or stick to one that you prefer.

Wind Power

Wind power is a form of green energy. It’s environmentally friendly and doesn’t emit any carbon or emissions.

Companies in this sub-sector could design and build wind turbines, supply the parts and materials, or own and operate wind farms.

Solar Energy

Solar energy is another form of alternative energy. The sector has already seen increased interest this year in the markets. As society moves more to battery-powered and electric vehicles, switching to solar seems like a natural choice to avoid huge electric bills.

It’s also great for the environment. And once you have all the components set up — it’s basically free energy from the sun.

More Breaking News

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

- Kyndryl Holdings Stock Shows Mixed Performance Amid Market Turbulence

- Breaking News: Ondas Navigates Market with Enhanced Strategy

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

Pollution Controls

Pollution control is the process of reducing or eliminating pollution. This can be in the air, water, or land. Some examples of stocks in this sector would be recycling companies or a company with a technology that can reduce emissions from an existing polluter.

Water Stocks

Water’s our most valuable natural resource for obvious reasons. Water stocks would be stocks of companies that collect, deliver, or purify water.

There are a number of water utility companies that are publicly traded. Or you can invest in an ETF to diversify your portfolio.

Organics

Organic means something that’s produced without harsh chemicals or additives, like certain fertilizers or pesticides.

You’re probably thinking of fruits and vegetables … Yes, of course food can be organic, but think bigger…

There are also organic textiles, like cotton, hemp, and bamboo, organic personal products, makeup, vitamin supplements, and other foods, like meat, eggs, and grains.

Green Investment Funds

If you want to have a diversified investment portfolio, consider a green investment fund like green century funds, an ETF, or mutual fund. These funds and ETFs spread out investments over a number of green companies and keep their investors money out of fossil fuel companies.

How Do I Know a Company’s Really “Green?”

Knowing if a company is really green or not will come down to your research and due diligence. A company might advertise itself as a green company, but unless you know the ins and outs of the company and what it does, you’re just taking their word for it.

I never trust any of these shady companies…

When it comes to penny stocks, companies will do whatever it takes to get the stock price up. We’ve seen this over and over again with different hot sectors…

When marijuana stocks were running companies that weren’t related to marijuana would release news that it was getting into marijuana or CBD industry. It was the same thing with bitcoin. Companies were announcing they were getting into cryptocurrency and blockchain.

And we’ve seen it again in the coronavirus market. All kinds of companies releasing news they’re getting into the hand sanitizer business … They’re just desperate to get their stock price up.

It’s buyer beware out there. Do your own research before handing over your hard-earned money.

Top 10 Green Stocks to Watch in 2020

Here I’ll go over some green stocks to watch in 2020. These aren’t recommendations to buy or invest in. Use my stock watchlists for ideas. Don’t follow anyone’s alerts or stock picks. Use them to learn my process so you can become a self-sufficient trader.

And in case you’re wondering how I found these stocks, and all the stocks I trade — I use StocksToTrade.

It has the best stock screener, charting software, and the Breaking News Chat is a game-changer … It brings news on penny stocks right to your subscriber FAST.

(Quick disclaimer: I proudly helped design and develop StocksToTrade and am an investor in it.)

Another tool you should take advantage of is my Sykes Sliding Scale. It’s all the indicators I use to determine if a trade is worth taking. I go over it more in-depth in my DVD “Trader Checklist Part Deux.”

Now, whether you’re into green investing in large-cap stocks or trading small-caps, there’s a ton of green stocks to choose from. Let’s look at some large-cap examples first…

Waste Management (NYSE: WM)

When you think of garbage and waste, it doesn’t exactly sound like green investing. But waste collection companies are also involved in recycling and in some cases turning waste into energy.

Waste Management owns landfill gas-to-energy facilities in the U.S. They also collect and distribute recycling materials to transfer stations and manage the marketing of recyclable materials for third parties.

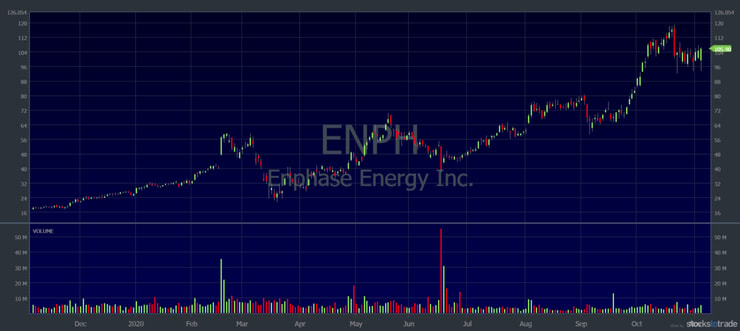

Enphase Energy, Inc. (NASDAQ: ENPH)

ENPH is a solar company. It develops, manufactures, and sells solar solutions for homes. It also develops and sells solar solutions to distributors and installers.

A year ago this stock was trading in the $20 range. The solar sector’s hot. With the recent election, there could be more government funding into green energy solutions. We’ll see how that plays out…

OK, enough with the big boring companies. Let’s get to the penny stocks I know and love…

VivoPower International PLC (NASDAQ: VVPR)

VVPR and its subsidiaries operate solar and critical power services in the U.S., Australia, and the U.K.

The stock was a big runner recently. With a lot of interest in the electric vehicle (EV) sector, battery and solar stocks have been sympathy plays.

Always be careful holding these stocks too long. A couple of days after the stock had its big run to $24 per share, it did an offering. But the stock still has a relatively low float of just under $14 million shares, so it could still run with the right catalyst.

SPI Energy Co., Ltd. (NASDAQ: SPI)

SPI is involved in the engineering and construction side of the solar business. It also develops and owns solar projects and sells electricity to power companies.

The stock had a huge day on September 23 when the stock went from the $3s to a high of $46.67 — in one day!

It’s a low float stock with just under four million shares. That means it’s volatile and can have huge spikes with the right catalyst.

Siemens Gamesa Renewable Energy, S.A. (OTCPK: GCTAY)

GCTAY engineers, designs, builds, and sells wind turbines. It also constructs wind farms. It has two segments of the business — wind turbines and operations, and maintenance.

This company is one of General Electric Company’s (NYSE: GE) biggest rivals.

Fuel Tech, Inc. (NASDAQ: FTEK)

FTEK is in the pollution control sub-sector. It has the technology to reduce nitrous oxide emissions from combustion sources like boilers, incinerators, and furnaces.

The stock has a float of 17 million shares and it released its third-quarter earnings on November 10. It has a history of failed spikes, so if you’re going long, be careful.

Sunvalley Solar, Inc. (OTCPK: SSOL)

Sunvalley Solar is a California-based company that offers solar systems and maintenance to builders and homeowners.

The stock has been in an uptrend this year with an increased interest in the solar industry. Its 52-week high is just under 20 cents. It could be a breakout play if the sector momentum continues and it breaks above resistance.

Sunworks, Inc. (NASDAQ: SUNW)

Sunworks is another California-based solar company that develops and installs solar systems. From small kilowatt systems all the way up to megawatt systems for large projects.

The stock spiked huge when it moved in sympathy to SPI Energy’s big run on September 23.

It also had a big spike on October 7 when it announced $10 million in new contracts. Learn more about contract winners in my most comprehensive DVD guide “How to Make Millions.” (It’s 35 hours of education and all proceeds go to charity — double win!)

This stock is in a hot sector and a former runner, so it’s worth watching.

United Natural Foods, Inc. (NYSE: UNFI)

UNFI is in the organics sub-sector. It offers organic foods and products in the U.S and Canada.

And it’s not just fruits and veggies. It also offers organic juice, eggs, milk, nutritional supplements, and personal care products.

FuelCell Energy, Inc., (NASDAQ: FCEL)

FCEL manufactures, operates, and sells stationary power plants and heat sources. It has a number of different products to service clients in education, healthcare, and industrials.

Over the last few months, the company has taken advantage of the interest in its stock by doing a number of offerings. The company has raised $177.35 million in gross proceeds from the offerings between June and October 2020.

Hopefully, it puts that money to good use … the company’s float is now over 200 million shares. It’s gonna take some big news for this stock to have a big move.

Are Green Investments the Future?

Eco investing could be the future of the market. Tesla Inc’s (NASDAQ: TSLA) recent run shows there’s interest in green technology and electric vehicles.

But I don’t try to predict the next hot sector. In 2020 we’ve seen lots of EV, battery, and solar plays. Could that spill over into other green products, or technologies? I don’t know…

I don’t pretend to know the future. And I don’t try to impose my will on the market.

Yeah, it would be great if more consumers, corporations, and governments would move toward more green and sustainable practices. But the market doesn’t care what you want.

Learn to take what the market gives you.

I don’t go looking for the next hot thing. Instead, I wait for the trades to come to me. I stick to my strategy and patterns. It works for me … I’ve grown my account to $6 million by sticking to my penny stock niche and patterns.* (See all my trades here.)

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade, and individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

Conclusion

The more green products, solutions, and technology we develop, the better it is for everyone.

But you can’t impose your will on the market. Make sure you study and do your research before buying or trading any stock.

Don’t get burned by believing in these companies or buying illiquid stocks. Learn my trading rules.

I teach because I want everyone to have the freedom I do. When you make millions of dollars then you can spend that money on things that matter to you. Whether it’s your family, the environment, or traveling the world.

I started my charity, Karmagawa, so I could give back. If it wasn’t for trading, I wouldn’t have the means to donate so much money to charity.

If you want to learn my trading strategies, apply for my Trading Challenge. You’ll get access to all my video lessons, webinars, DVDs, and my Challenge chat room.

These are the same resources that helped all my millionaire students build their trading education foundation.* Start building yours today.

Are you interested in green investing? Let me know in the comments, I love to hear from you!

Leave a reply