Could EPS be your secret weapon for figuring out the best stocks to trade?

You’ve probably heard the term EPS before, but it’s possible that like many traders out there, you have no idea what it actually means or how to use it.

Knowledge is power when it comes to trading … so understanding EPS and its ramifications could help you gain more insight about stocks and help you determine if a trade is worth your time.

Ready to get acquainted with EPS as part of your fundamental analysis and to help you improve your trading?

Let’s do it. Here, I’ll explain what EPS is, why it matters, and how it can help you make smarter trading decisions.

Table of Contents

- 1 What Is Earnings Per Share (EPS)?

- 2 The Importance of Earnings Per Share

- 3 What Is a Good EPS?

- 4 How to Find Earnings Per Share

- 5 Earnings Per Share Formula

- 6 How to Calculate EPS

- 7 How to Analyze EPS

- 8 Different Types of EPS

- 9 Learn How to Increase Earnings Per Share

- 10 Trading Challenge

- 11 EPS: The Final Word

Earnings per share — EPS for short — is the portion of a company’s profits that are allocated to each outstanding stock share. EPS is expressed as a dollar amount.

If that sounds confusing, don’t worry — once you break it down, earnings per share is actually pretty easy to understand.

Basically, the EPS ratio is a measurement of the net income (the bottom line, after expenses) that a given company, in theory, has available to pay stockholders of its common stock.

Why does earnings per share matter? Here are some clues you can learn from it as part of your stock research…

Determining a company’s trajectory. What’s a company’s EPS history? If it’s trending in a positive way and has been for a while, this could be a positive sign of potential profitability and continued success for the company.

It could also be an indication that the company will have sufficient funds to reinvest some of its profits in future growth. The more a company grows, the more it could potentially profit. This could lead to bigger returns for you if you hold a position.

However, if the EPS is trending negatively and has been over time, this could be a sign that the company is experiencing trouble. It could be the harbinger of a price reduction in the stock in the future … Obviously, that’s not desirable if you’re buying the stock.

Predicting future growth. As a trader, considering the EPS of a company’s stock can help you get a better idea of a company’s potential for delivering strong dividends in the future.

Looking at earnings per share and cross-referencing the company’s history of making changes to its dividends can give you an indication of what you might expect down the road.

Yep, things change. And nope, you can’t predict the future. But patterns repeat themselves over and over in the market. Looking at the past can give you a clue as to what the future might hold.

Valuing a company. The EPS can help you determine the company’s value. It easily divides the profits into tidy little per-share units. It’s neat, clean, and easy to understand.

The number of outstanding shares could change at any given time. So just looking at a company’s overall income alone may not be the best way to tell if you’re jumping into a good trade.

And no, you can never know if you’ll profit from a trade. But the EPS offers you another way to look at the company’s overall wellness. Every bit of information you get counts.

What Is a Good EPS?

It’s hard to assign a specific amount to a “good” EPS because there are a number of factors you need to consider.

In general, if a company has a high EPS, it’s considered a good sign. But keep reading, because there’s more to it than just that…

It’s not just about the number … it’s about the implications of the number. Here are some of the things a higher EPS can tell you:

Potential for higher dividends. A high EPS can be a good indication that the company will offer sizable dividends for investors.

Not sure what a dividend is? It’s the distribution of the company’s earnings to its shareholders.

Typically, the dividends are quoted on a per-share basis. For example, there might be a dividend of 25 cents per share. Or there might be a percent-basis dividend, such as a 15% dividend yield.

Dividends are a nice perk for long-term shareholders. They’re usually offered by bigger companies that have slower, steadier growth. Some traders and investors use dividends to increase their position, which can help increase their dividends over time.

That’s not how I trade. I prefer trading low-priced stocks. With dividends, we’re talking longer-term prospects … That’s not how to grow your account fast.

So why am I telling you about all of this? Because to find success in any sort of activity in the stock market — from short-term day trading to long-term investing — you need to be educated.

Even though my success came from trading penny stocks, that doesn’t mean it’s the right choice for you. My goal as a teacher is to educate you so that you can become a self-sufficient trader. A big part of that is introducing you to all sorts of stock market strategies, tools, and techniques.

Wanna learn more about dividends? Check out this post.

Commitment to growth. A high EPS can be a good sign that the company will be able to reinvest the funds back into the business. That’s a good thing because it can help create more company growth.

If the company is committed to promoting further growth, it could result in higher profits over time. This could make the stock a good contender for a long-term position if you follow the traditional ‘buy low, sell high’ stock market model.

Of course, there are many other factors to consider, such as the stock price, your account size, and so on. But by incorporating this in your research, you can begin to narrow down stock picks according to your account size and portfolio.

How can you figure out the EPS of a given ticker? You’ll need the EPS formula. There are actually two basic ones.

Don’t worry if these formulas don’t make sense yet. Just read them first, and I’ll explain in a lot more detail, including how to find these numbers to perform the calculation.

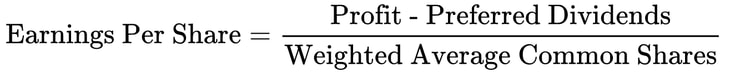

Formula One:

- Net Income / Total Number of Shares Outstanding = Earnings Per Share

More Breaking News

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Valterra Platinum Strengthens Position with Impressive Earnings Surge

- Bitcoin Crash Sparks Sharp Decline in Cryptocurrency Stocks

- Novo Nordisk’s Shares Surge as FDA Targets Illegal Drug Marketing

Formula Two:

- Net Income / Weighted Average of Shares Outstanding = Earnings Per Share

Both of these formulas can be used to compute EPS.

This might lead to a good question: which one should I use?

Well, the first one is easier, making it quicker to calculate. However, a lot of traders prefer the second one because it accounts for more fluctuations.

Since the weighted average number can help account for changes in the number of shares outstanding, it can give you a more realistic picture of what’s going on with the company.

How to Calculate EPS

Before you can use the formulas above, you’ll need to figure out the different parts of the equation. Here’s everything you need to know.

Start by figuring out the number of shares outstanding.

What’s shares outstanding? This figure includes all shares currently held between shareholders plus shares held by investors. It also includes shares held by company insiders, like employees and partners.

To find this number, you need to check out the company’s balance sheet. On it, you’ll see a section dedicated to shareholders’ equity. Usually, it’s toward the bottom of the document, but every document will be a little different.

You’ll see line items for preferred stock, common stock, and sometimes treasury stock. These line items will each include the shares outstanding.

Add together the shares outstanding for the preferred and common stock, and if applicable, subtract the amount listed under treasury stock. Just like that, you’ve calculated the shares outstanding. Boom. Pat yourself on the back.

Sometimes unique events can throw off the number of shares outstanding. For instance, if a stock splits or if more shares are issued for any reason, it could skew the number.

For this reason, calculating the weighted average of shares outstanding can sometimes give you a more accurate idea of the shares overstanding over a period of time.

Weighing the shares outstanding isn’t hard, it just involves a little middle-school-level math.

Sum Up to Compute the Weighted Average Number

To figure out the weighted average number of shares outstanding, take the number of outstanding shares, then multiply the time of the reporting period during which those shares were active (for instance, six months of the year would be 0.5).

Then, add up the different sums, and you’ll have the weighted average number.

For example: 2,000 shares outstanding (2,000) times the first six months (0.5) of the year = 1,000

- 2,500 shares outstanding (2,500) times the second six months (0.5) of the year = 1,250

- Weighted average: 2,250

By doing this, you’re capturing the average, giving you a more realistic look at the number of shares outstanding and compensating for events that could skew the number.

Now that you’ve figured out the necessary numbers, let me give you a simple example of how the formula comes together.

Say that you’ve figured out that Company X had a total income of $10 million during a fiscal year while maintaining a weighted average of 20 million shares.

To calculate their EPS for that time period, you’d divide the net income by the number of shares. That’s it!

So your calculation might look like this: $10 million divided by 20 million shares = $0.50 EPS.

How to Analyze EPS

Now that you’ve figured out the EPS … what can or should you do with that information?

Don’t just take an EPS calculation at face value. Be a good detective — turn it around and look at it from a variety of angles. Here are some things to consider to help you analyze EPS…

Often, when referring to the EPS, you’re actually referring to the basic EPS. No, that doesn’t mean it loves pumpkin spice lattes and reality TV … it just means it’s a simplified figure.

Here’s what you need to know about the basic EPS: it doesn’t take into account things like stock options and warrants.

These can have a diluting effect by increasing the total number of shares outstanding. So it could throw off the number, giving you an EPS calculation that tells an incomplete story.

To get a more complete view of a company, you may want to look at the diluted EPS, too.

The diluted EPS takes into account the factors mentioned above like additional securities (stock options, warrants, etc).

This can help you get a more realistic view of what could happen if these additional securities were exercised … and therefore what might be a more accurate EPS calculation.

EPS Excluding Extraordinary Items

Every now and again, an anomalous event or action will factor into a company’s earnings or shares outstanding that could throw off the calculation.

For instance, say that the company had a huge, once-in-a-lifetime contract. This is great for earnings, but you wouldn’t be able to count on it every year or quarter. But the same could go for a big, one-time loss.

Things like this could seriously throw off the EPS, so if possible, you want to account for them when calculating the EPS.

Look at the stock’s news, chart, and earnings reports. See what happened throughout the year and if there are any events that could throw off the reporting.

Say that you do find something, like a one-time $65 million contract. In this case, you’d want to subtract the extraordinary item from the net income before going through with the EPS calculation.

EPS From Continuing Operations

In the day-to-day course of business, things happen. For instance, say that a company has five factories, and during the course of the year they close one location. You may find it helpful to calculate the EPS for just the locations that will continue.

In this case, you’d subtract or add extra or lesser items from the net income before performing the EPS calculation.

EPS and Capital

A lot of traders ignore the money necessary on a company’s part to generate the net income or earnings in the EPS calculation.

For example, say that Company Y and Company X both have the same EPS number. Does that mean that they’re equal? Nope.

They might not be operating with the same amount of equity. One company could have much better margins, meaning that their ability to generate income is greater. This is part of why the EPS is just one tool for traders — like any other figure, you should fact-check and examine it.

Also: don’t always just trust what companies say. Look at the earnings reports and analyze the statements yourself. Don’t rely on just one source.

Always do your own research. I mean, duh. It’s a good trader habit to adopt now and maintain for life. Yes, it will take a little time, but if you discover something that can help keep you from losing money, it’s well worth the effort.

EPS and Dividends

EPS doesn’t instantly translate into bigger dividends. While it might seem that it makes sense that the higher the EPS, the bigger the dividend … it doesn’t always work that way.

Part of the earnings could be paid out as a dividend, but that’s up to the company. However, if a company has a good track record of increasing the dividends, it could be a sign that this trend will continue.

So if you’re curious, take a look at the company’s history of dividend payouts. This could inform you how its dividends will increase (or not) in the future.

EPS and Price-to-Earnings

The “E” in EPS and P/E ratio both refer to earnings … and both give you a deeper look at what the company has to offer.

The P/E ratio is calculated by dividing the share price by the EPS. This can help you get a better sense of the company in relation to the market’s expectations. It shows the price you’ve got to pay relative to the current earnings.

When a stock splits, the total number of shares increases. This affects the EPS because it affects the total number of shares outstanding, which changes a major part of the formula. So the EPS is affected in direct relation to how many more shares were added.

No need to panic, though. Since the company’s value and profit don’t change, the P/E ratio doesn’t change.

So if you’re researching a company’s earnings and you see a dramatic and sudden drop in the EPS amount, a stock split could explain it.

Be sure to back this up by researching that the company did indeed add a large number of shares. Then use the weighted average formula for calculating the most accurate EPS ratio.

Different Types of EPS

Basic versus diluted aren’t the only types of EPS calculations that you should consider. If you want a real gold star, look at EPS based on different time periods.

The trailing EPS, current EPS, and forward EPS are all different calculations that help you to consider the past, present, and future in your research.

Trailing EPS

This is a company’s EPS calculated based on a time period that’s already passed. Usually, it’s most relevant to look at the most recent year on the books.

The past can inform the future. While many factors can change a company’s EPS over time, looking at its trailing EPS does offer some advantages.

For one thing, it’s based on cold, hard, factual data. It’s calculated using actual numbers from the company’s earnings and history. This means that it gives you a realistic look at how the company has performed in the past.

Current EPS

The current EPS is a mix of data and a little conjecture that amounts to a projection of the EPS for the current year. You calculate the data for the time that’s already transpired in the fiscal year, combined with projections for the remainder of the year.

Because it does mix actual data with the projected part, the current EPS gives you a pretty good idea of how the EPS might shape up for the year.

However, remember that this is NOT a factual number, and things can change. It’s worth considering as part of your research, but don’t let the current EPS be the final deciding factor.

Forward EPS

Is a stock’s future bright? That’s what a forward EPS wants to know. This version of the EPS is an estimate for the future, based on either company or analyst-generated estimates.

The forward EPS is interesting to look at, but it’s important to remember that it’s based on projections, not facts. So while it’s not a waste of time to consider the forward EPS, don’t use it as your sole source of deciding whether to buy or sell.

How can EPS increase? There are a few key ways.

One obvious way is an increase in the company’s revenue. However, this could happen in behind-the-scenes ways, too, like lowered costs (also called margin expansion).

Another way is via share buybacks, where the company effectively lowers the number of available shares without changing its profits. When the lower share amount is plugged into the EPS calculation, it increases the total amount.

Trading Challenge

An educated trader is much more likely to make smart decisions in the stock market.

If you’re ready to invest in your trading education, consider joining my Trading Challenge. This challenge isn’t just for any wannabe trader … You have to apply to be accepted.

I’m looking for students and budding traders who are interested in developing their expertise and improving their trading mindset.

I only want to work with people who are fully committed to achieving success in day trading … you’ve gotta be willing to study and work hard.

My Trading Challenge was created based on my personal experience in the stock market over the past two decades (and counting).

I’ve got a massive library of videos, webinars, and live trading webcasts … You can easily see every trade I make. You can get a solid overview of how to trade penny stocks in this book by my student Jamil: “The Complete Penny Stock Course.”

I don’t want to just teach you patterns … I want you to understand them so that you can become a self-sufficient trader who can adapt to any market and spot opportunities.

Could you be my next superstar student? Apply for my Trading Challenge today.

EPS: The Final Word

You can’t do enough research. But you can definitely do too little.

The more you know about a stock, the better and more informed your trading decisions will be.

Learning about the earnings per share ratio won’t rock the very earth you trade on. But it’s a piece of the puzzle. Every bit of extra information you can put together on a company can help strengthen the case for (or against) a trade.

Calculating a company’s EPS can give you valuable insight into a company’s overall health. It can also be helpful in giving you more information about a stock’s past and potential future.

Bottom line: Incorporating EPS calculations in your repertoire can help you make more calculated and tactical decisions in your trades. And considering a company’s EPS in your stock research can help you become a stronger trader.

I want to hear what you think! Leave a comment and let me know.

Leave a reply