Some traders think day trading scalping is a road to quick gains…

But what is this strategy? Well, day trading is when you buy and sell a security within the same trading day…

So when you buy and sell a security within a few seconds or minutes? That’s day trading scalping.

In this post, I’ll cover day trading scalping in detail. I’ll get into the pros and cons, the different ways traders use it, and some potential scalping strategies for beginners.

Even if you don’t plan on using this strategy, it’s a good idea to learn as much as you can about different trading methods. You never know what will work for you or where you’ll find your edge. Plus, it’s always smart to know how other traders may approach the markets.

Never underestimate the power of your education.

I found my niche in momentum penny stocks. Maybe day trading scalping will be a method that works for you…

Table of Contents

- 1 What Is Day Trading Scalping?

- 2 What Are the Types of Scalping?

- 3 Scalping vs. Swing Trading

- 4 Day Trading Scalping: Pros and Cons

- 5 3 Day Trading Scalping Strategies for Beginners

- 6 How Do You Choose Stocks for a Day Trading Scalping Strategy?

- 7 Know When to Scalp and When Not to Scalp

- 8 Is Scalping in Day Trading Profitable?

- 9 Frequently Asked Questions About Day Trading Scalping

- 10 What Is Forex Scalping?

- 11 Is Scalping Better Than Day Trading?

- 12 How Is Scalping Different From Other Strategies?

- 13 How Many Trades Do Scalpers Make in a Day?

- 14 Is Day Trading Scalping Illegal?

- 15 Day Trading Scalping: The Bottom Line

What Is Day Trading Scalping?

Scalping is a trading strategy focused on profiting from small price fluctuations. Traders who scalp are known as scalpers. And scalpers usually hold positions only held for minutes or even seconds.

The goal with this strategy is to make lots of small profits.

It’s more about quantity than quality. Scalpers can trade over 100 times in a day and see minimal returns. They often use leverage to boost their profits, since they’re only trading on small price fluctuations.

Day trading scalping requires precision. One bad entry or exit can result in a big loss and wipe out all previous gains. A scalper has to keep a tight stop loss and cut losses quickly whenever a trade goes against them.

What Are the Types of Scalping?

There are three common types of scalping. One way focuses on the spread, and the other two take a more traditional trading approach. Let’s cover each briefly…

First, there’s market-making. These traders try to use a stock’s spread and post a bid and an offer for it. You’d only use this strategy with stocks that don’t fluctuate much. And it’s tough because you’re competing with market makers. I don’t recommend beginners try this.

Another way of scalping is to buy lots of shares of a stock and wait for a small move. If the stock moves a few cents, you get out and prepare for the next trade. This can be risky if you aren’t in a highly liquid stock. If your order doesn’t fill quickly, your winning trade might turn into a loser.

For the third type of scalping, you’d generally have a plan that has a 1:1 risk/reward ratio and exit the trade when one of the exit signals is generated.

My opinion? A 1:1 risk to reward is garbage. At that point, you might as well go to a casino. I trade volatile penny stocks, which most people consider risky — but I usually have a 3:1 or better risk/reward.

Check out my student Jamil’s book, “The Complete Penny Stock Course.” He gets into risk management and risk/reward setups. This book answers SO many frequently asked questions about penny stock trading. Read it!

Scalping vs. Swing Trading

In swing trading, you hold a position anywhere from a few days to a few months … The timing is in between day trading and long-term investing. Swing traders use both technical and fundamental analysis to prepare for trades.

Scalpers rarely use fundamental analysis. They use price action confirmations and technical indicators to time their trades.

As a day trader, I fall somewhere in the middle. I usually hold positions longer than a few seconds, but I rarely hold them overnight or longer.

And I trade the patterns I know because history tends to repeat. Even though trading’s not an exact science, my strategies work for me and have for 20+ years. I’m now up over $7.1 million in trading profits.*

You have the opportunity to learn from me and my top students. I want to teach any trader who’s dedicated my rules and process. I didn’t have a mentor when I was starting out, so I want to be the teacher I never had.

If you’re serious about trading, apply for my Trading Challenge. If my team and I accept you, you’ll get access to thousands of video lessons, live webinars, and arguably the best trading chat room around!

Day Trading Scalping: Pros and Cons

Let’s take a look at the pros and cons of day trading scalping.

The biggest advantages to scalping are potentially lower risk and the opportunity to profit in a bear or bull market.

When I say there’s a lower risk, I mean only if you stick to your plan. Scalping won’t likely result in a huge loss if you’re in and out of a stock quickly. And you probably won’t end up a hopeless bag holder either.

The same goes for the upside. A scalping trade candidate usually won’t rise too high in a short time … So you might miss out on the upside. That’s one of the biggest disadvantages.

Also, fees can add up quickly if you aren’t careful. With commission-free trading, you don’t have to worry as much about this, but you still need to watch out. If there’s a $5-per-trade fee and you’re only making $5 per winning trade … there goes your profit.

3 Day Trading Scalping Strategies for Beginners

Here are three day trading scalping strategies…

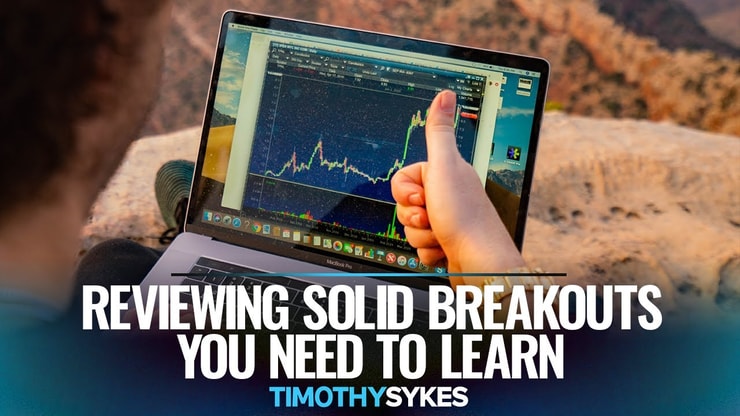

1. Trading Breakouts

I look for breakouts all the time in my trading. Breakouts can be useful for scalping, too.

When a stock’s trading on high volume and breaks the high of the day, it shows buyers are in control. That can push it even higher — and scalpers can get in and out quickly.

This indicator doesn’t work every time. You have to be prepared for losing trades. It’s part of the process. That’s why I expect the worst out of every penny stock company — and I’m never disappointed.

2. Stochastic Oscillator Scalping

The stochastic oscillator is an indicator used to pinpoint trend reversals.

The lower level of the stochastic oscillator is the oversold area, and the upper level is the overbought area. When both lines cross in the lower level, it prompts a buy signal. When both lines cross in the upper level, that’s a short sell signal.

Scalpers use the stochastic oscillator in many ways. As always, do your due diligence before risking hard-earned cash on this day trading scalping strategy. Never risk more than you’re willing to lose.

More Breaking News

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

- Red Cat Holdings Poised for Growth as Drone Orders Surge

- Novo Nordisk’s Shares Surge as FDA Targets Illegal Drug Marketing

3. Scalp at Support and Resistance

Support and resistance are key levels in technical analysis. No matter what type of trader you are, you must understand support and resistance.

A support level is a price that the stock tends to stay above. If a falling stock hits a certain point two or three times without going any lower, that’s the support level.

Resistance is the opposite. It’s the point where a stock has had a hard time breaking through in the past.

Scalping at support and resistance is kind of the opposite of buying breakouts. Buyers pile in at the low end when a stock reaches a support level. And they short sell once a stock has reached the resistance level.

This technique has been around for as long as I can remember. It’s a staple of trading strategies. Scalpers use it to take advantage of the quick moves that tend to happen at those key levels.

How Do You Choose Stocks for a Day Trading Scalping Strategy?

Choosing which stocks to trade can be one of the most challenging parts of scalping. It comes down to the type of scalping you’re doing and how much volatility you’re comfortable with.

I think it’s best to find the most volatile stocks and learn how to take advantage of their big moves. Some volatile stocks can move 10%–20% in a matter of seconds. That’s a nice move, especially for a scalper.

What’s the best way to find the most volatile stocks? Use a stock screener.

StocksToTrade is my go-to stock screener.** It was designed by traders, for traders, so it has everything I need … amazing charts, customizable scans, and much more. Learn more about StocksToTrade and start your 14-day trial here.

Know When to Scalp and When Not to Scalp

So how do you know when to scalp and when to not? That’s the million-dollar question.

Practice is the best way to improve your overall trading. With experience, you’ll get a feel for when to trade, whether you’re scalping or using a different strategy … But only if you’re practicing the right way.

If you’re trading random stocks and following chat room ‘tips,’ you’ll never become a top trader. You have to follow the rules, keep a trading journal, study the past, and do your daily research to learn to think for yourself.

Is Scalping in Day Trading Profitable?

Sure day trading scalping can potentially be profitable, but like any trading, it’s not easy.

Most traders lose, and I’d argue that the vast majority of scalpers lose. That’s because they need a win/loss ratio better than 50% to be profitable.

When you day trade momentum penny stocks the way I do, you only need your winning trades to be greater dollar gains than your losing trades. Risk management is key.

Frequently Asked Questions About Day Trading Scalping

Let’s look at a few common questions…

What Is Forex Scalping?

Forex scalping is when you trade currencies in the forex market and only hold the position for a few seconds or minutes. The goal is to make small gains from quick in-and-out positions. Forex scalpers exchange currencies many times in a single day.

Is Scalping Better Than Day Trading?

It depends on the trader. Some traders prefer scalping or swing trading over day trading. I find there’s much more opportunity in day trading. I like the risk-to-reward ratio better.

How Is Scalping Different From Other Strategies?

The big difference is that scalping relies on small gains from quick buy-and-sell tactics. In other trading strategies, you hold positions longer and aim to make greater profits from each trade.

How Many Trades Do Scalpers Make in a Day?

Scalpers make anywhere from a few trades to over 100 trades in a day. It all depends on the day and how many opportunities there are. The volume of trades is one of the most important factors in scalping — a higher volume of trades means a higher profit.

Is Day Trading Scalping Illegal?

No. There’s nothing illegal about day trading scalping. There’s another form of scalping that’s a crime, but scalping in the stock market is completely legal.

Day Trading Scalping: The Bottom Line

Day trading scalping is a strategy focused on profiting from small price fluctuations. Scalping is more about the number of trades than the quality.

Scalping can be a profitable strategy if you stick to your plan — but it can be risky. One big loss can wipe out all your small gains.

Experience is the key to knowing when to scalp. Make sure you’re following the rules, studying, and keeping a trading journal so you can learn the patterns. That’s how you become a smarter trader.

What do you think? How might scalping be a part of your day trading strategy? Leave your thoughts in the comments!

Disclaimers

*Tim Sykes’ trading results are not typical and do not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit.

**Tim Sykes has a minority ownership stake in StockstoTrade.com.

Leave a reply