Challenge Student Lessons: Key Takeaways

- How my student went from total newbie in 2019 to where he is now (this is awesome!)…

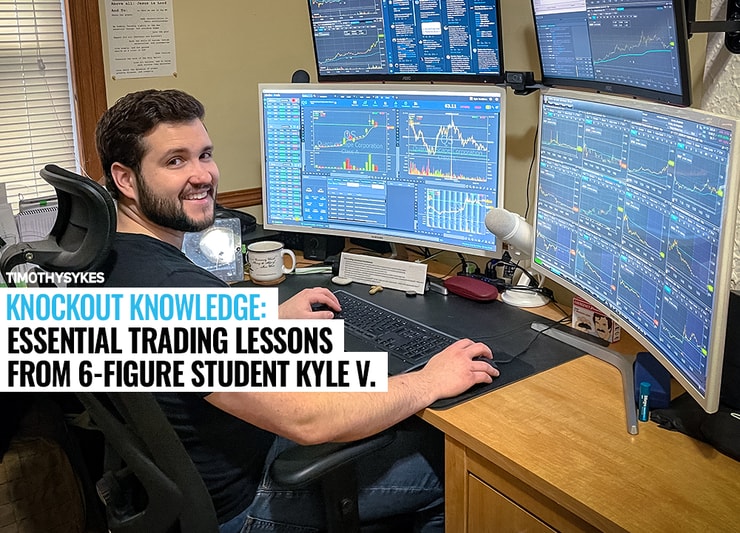

- The tools he uses — see his Trading Challenge resources and more…

- Key lessons he’s learned over the course of his journey…

Ready to unlock your full trading potential? Click here.

How much can a trader achieve in a year?

Let’s look at Trading Challenge student Kyle V. He started my Trading Challenge in December of 2019 with pretty much zero experience. By December 2020, he was up over $70,000.* As for year two? Read on to find out!

Kyle’s story is exceptional. He’s learned a lot since he started and has some incredible lessons to share…

Table of Contents

- 1 Motivated to Study Hard

- 2 Kyle’s Key Lessons For New Traders

- 2.1 Lesson 1: You Choose How Much You Lose

- 2.2 Lesson 2: Don’t Just Track Data — Track Yourself

- 2.3 Lesson 3: Focus on Progress, Not Profits

- 2.4 Lesson 4: Focus on Just a Few Setups

- 2.5 Lesson 5: Don’t Predict, React

- 2.6 Lesson 6: It Takes Time

- 2.7 Lesson 7: Follow the Framework!

- 2.8 Lesson 8: Time of Day Matters

- 3 Learn. Trade. Repeat.

Motivated to Study Hard

I shared Kyle’s trading story in this post, but to briefly review…

Before Kyle joined the Trading Challenge, he had little stock market or penny stock knowledge.

He’d dabbled in bitcoin (BTC) in 2017 and traded a few random tickers on Robinhood…

But for all intents and purposes, he was a total newbie. He didn’t even know basic trading terminology…

But he knew he wanted to learn how to trade, and he knew that I’d be the right teacher for him.

He’d done his research on potential mentors. He appreciated my transparency, charity focus, and the fact that I’d been in the penny stock game for decades. Kyle also liked that I had students like Tim Grittani and Jack Kellogg who not only found success but stayed active in my Challenge community.*

He says, “I came in knowing two things … 1) If they can do it, I can do it. And 2) this is going to be hard work and unrewarding for a long time. But if I study hard and stay dedicated, it will be worth it in the end.”

By the way, I recently wrote an update on Kyle’s trading journey — don’t miss it.

About a year into his trading journey, Kyle wrote a document detailing what he’d learned. He’s shared it with several other Trading Challenge students … It’s taken on cult classic status in my chat room!

Kyle agreed to let me give you a peek…

Kyle’s Key Lessons For New Traders

As of August of 2021, Kyle’s up over $237,000 in trading profits. In fact, he reports that he recently paid off his student loans with his trading proceeds.*

How can you learn from him? Here are just a few of Kyle’s key lessons for new traders. Read, learn, and get inspired.

Lesson 1: You Choose How Much You Lose

Kyle says, “It is up to you if you want to lose a lot of money at the beginning or just a little bit because you control your position size and your overtrading.”

Early on, Kyle recognized his first six months would be the most dangerous time of his trading career — because there was a lot he didn’t know.

This meant a huge potential for loss. He didn’t want to demoralize himself before he got his footing.

Knowing this, he maintained discipline, avoided overtrading, and kept his position sizes small. The result? The most his account was ever down in those early days was $250.

Once he did hit his stride, he got more confident about sizing up.

I love this lesson…

First, it ties right back to my #1 rule: CUT LOSSES QUICKLY!

Second, it’s such a simple lesson but so few traders actually get it. Bravo, Kyle!

Lesson 2: Don’t Just Track Data — Track Yourself

A ton of my top students credit tracking data with helping them figure out what setups worked for them. Tim Grittani, Stephen Johnson, and Evan are just a few examples…

Kyle thinks there’s a lot of value in tracking data — but not just about your trades. He says, “The most important thing to ‘track’ at the start is yourself. You are unique, and your trading style will be unique. You have to find your edge.”

His theory? You can’t control the market — but you can control yourself.

In the beginning, you don’t yet know enough about the market to benefit from large amounts of data. You won’t understand what it all means.

But focusing on yourself can help you put protections in place. And that you can avoid bad trading habits and emotionally driven decisions.

So pay attention. Here’s a great place to start tracking:

- Your emotions

- Your trading habits

- Where you feel stuck or confused

- The types of plays you consistently enter at the right time

- The reasons you sell too soon or too late

More Breaking News

- Dingdong Sells China Operations to Meituan Subsidiary, Retains Global Presence

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

- Marathon Digital’s Divergent Strategy Brings Market Challenges

- Clear Channel Outdoor’s Strategic Move: Major Acquisition Unfolds

Lesson 3: Focus on Progress, Not Profits

Kyle got a piece of advice early on in his trading career: “Don’t focus on having green days — focus on consistent disciplined trading. Keep working your process, and the profits will come later.”

It made him feel totally exposed. He knew instantly that he needed to shift his mindset away from the ‘gotta be green’ mentality that destroys traders.

For Kyle, focusing solely on profits is a losing strategy.

When the trade is winning, traders take profits too fast. When the trade fails, they revenge-trade or try to fight it. It’s all motivated to close green, and the result is small wins and HUGE losses.

Lesson 4: Focus on Just a Few Setups

It’s tempting to try all the setups and trade everything. Don’t do it.

Kyle says, “It can be overwhelming at the beginning feeling like you are constantly missing all the plays, but you are better off to pick just a couple of tickers and watch them closely, and then work on really nailing entering plays at the right time.”

You need to learn how patterns develop and set up. In hindsight, it’s easy to see, but it takes practice and lots of studying to really understand.

That’s why I post all of my trades publicly — so my students can study and learn from them!

Kyle thinks this is one of the reasons why people love Tim Grittani’s “Trading Tickers” so much. A lot of the DVD is live trade recordings with commentary.

It took a while for Kyle to follow his own advice. It wasn’t until June 2020 that he resolved to trade less and wait for his best setups. He focused on OTC panic dip buys only for that month — and he saw a noticeable uptick in his profits.*

Lesson 5: Don’t Predict, React

‘Don’t predict, react’ is a concept that traders often misunderstand.

Yes, learning patterns and technical analysis are methods for figuring out what might happen.

However, to trade based on what might happen is a mistake.

Instead, Kyle notes, traders should “react to price action that indicates your research and trade plan were correct. And you take the loss and move on quickly if new information reveals a change.”

You want to wait for actual evidence that the stock’s moving in the direction you want before executing. It’s not about catching the exact bottom or top, but capturing the meat of the move.

The more you watch the market, the more you’ll recognize the patterns. And the faster you’ll be able to react when opportunities are there.

Lesson 6: It Takes Time

According to Kyle, part of why learning to trade takes time is that several factors need to come together.

When you first start trading, you probably aren’t making many — maybe not any — profits. So you don’t have much confidence or conviction.

That makes it hard to trade with discipline and stick to a plan. And that often leads inexperienced traders to trade emotionally.

He says that he learned from Grittani that trading is about two things: strong conviction and clear risk that you stick to.

The hard part? Trusting the process while you study and learn the rules.

They might not make sense at first, but you follow them until they do. Kyle says, “If you stick to your plan and focus on your edge (the best setups for you), you won’t have to trade scared.

“If you make a good plan and stick to it, you know exactly how much you might lose on a trade and can protect yourself. This will help you to consistently profit, even small amounts, which will build your confidence even through losses where you traded your plan.”

Lesson 7: Follow the Framework!

I put out all of my DVDs, webinars, and videos for a reason — I want my students to be prepared when opportunities come along.

Kyle says that my P.R.E.P.A.R.E. framework is a great place for new traders to start, and suggests typing out running tickers through the scoring process until you really internalize the factors.

He says, “I spent the first months making a morning watchlist in Excel where I made a column for each category and typed out my research to get in the habit of looking at all of the factors when checking out a ticker.”

Lesson 8: Time of Day Matters

At the beginning of his trading journey, Kyle tried to force trades in the premarket because it was the time that worked best for him.

But he quickly learned that the market didn’t really care about his schedule. So he adjusted.

He says, “The best times of day to really learn are at the open and between 2:30–4 p.m. … One of the best trading decisions I made was to work my schedule to be available in the first and last hours of the day in particular.”

Just because certain times of day might be better doesn’t mean you can’t study and prepare at other times. But according to Kyle, freeing up the market open and close can speed up your learning.

Learn. Trade. Repeat.

One of the things I appreciate most about Kyle is his adaptability and willingness to keep learning.

It’s clear he’s a responsible and disciplined trader. But beyond that, he’s committed to continuing to improve. By organizing his thoughts and lessons learned, he’s paving the way for future growth for himself — and inspiring others in the trading community.

Are you inspired by Kyle’s lessons? Why not keep a trading journal and keep track of your own lessons learned? You might surprise yourself with what you learn about yourself and your trading over time…

Take your trading discipline and strategies to the next level now. Apply for the Trading Challenge today!

What’s your favorite lesson from this post? Leave a comment below … I love hearing what you have to say!

Disclaimers

*Please note that any reported trading results are not typical and do not reflect the experience of the majority of individuals using our products. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable.

Leave a reply