A lot of traders got excited about solar penny stocks in early 2023…

President Biden was just taking office. And his aggressive plans to fight climate change fueled sky-high spikes in solar and renewable energy stocks.

Now, more and more states are moving toward green energy…

In April, California Gov. Gavin Newsom announced state restrictions on oil extraction and that the state will ban fracking by 2024. Other states could follow suit…

And that could mean big moves for solar penny stocks and renewable energy stocks.

Read on to find out why I think you should watch solar penny stocks for potential trades and the top brokers to use. And of course, I’ll share my top solar penny stocks to watch in 2024…

Let’s go!

Table of Contents

- 1 What Are Solar Penny Stocks?

- 2 Why Should You Consider Trading Solar Penny Stocks?

- 3 List of 11 Solar Penny Stocks to Watch in 2024

- 4 Other Alternative Energy Stocks to Watch in 2024

- 5 Solar Penny Stocks: The Bottom Line

- 6 Frequently Asked Questions About Solar Penny Stocks

What Are Solar Penny Stocks?

Solar penny stocks are stocks of solar companies that trade under $5 per share.

They can trade on the major exchanges like the Nasdaq and NYSE or on the OTC markets.

Solar penny stock companies are usually small, unknown companies. They can range in business from solar panel installers to manufacturers. It can even include companies that provide solar panel parts and supplies to the solar industry.

Penny stocks aren’t like typical large-cap stocks that move slowly over time. And that’s exactly why I like them…

They can have huge price swings. That can mean the potential for huge profits. But it also makes them dangerous…

Yet I’ve still managed to grow my small account to over $7.6 million in profits over my 20+ years trading this niche.

Want to know how I do it? Start with my FREE guide to trading penny stocks here.

Then, when you’re ready, apply for my Trading Challenge.

Why Should You Consider Trading Solar Penny Stocks?

Solar penny stocks could have a bright future. They can spike if there’s new funding or initiatives on a federal level. Even rumors of big news for the industry can spike these stocks.

Solar penny stocks can be super volatile. I love volatility because it allows me to make quick trades. My goal is to take the meat of the move, then move on to the next opportunity.

There’s power in volatility. But it’s a double-edged sword. It’s great on the way up. But it can cut deep on the way down. That’s why I have trading rules.

My #1 rule is to always cut losses quickly.

I don’t allow a small mistake to turn into a huge disaster. When a stock goes against me, I never hold and hope.

For a stock to have the volatility I want to take advantage of, it needs high volume and ideally a catalyst. Major news or hype about a future event can get more traders interested in the stock. And more demand can mean bigger upward moves.

Solar penny stocks can offer those opportunities. But you can’t just blindly buy any solar stock. You need to prepare. That means having a watchlist, a trading plan, and the right trading mindset.

So before I get to the list of top solar penny stocks to watch, remember that this is a watchlist. These picks are not a recommendation to buy.

Use this list to prepare for the right news catalyst, pattern, and strategy that works best for you. That way you’ll be ready to strike when the right opportunity presents itself.

Ok, let’s get to it…

List of 11 Solar Penny Stocks to Watch in 2024

Here’s my list of 11 solar and alternative energy stocks to watch in 2024…

Solar Penny Stocks Under $1

Solar Integrated Roofing Corporation (OTCPK: SIRC)

SIRC is a solar and roofing installation company.

I’ve traded this stock a few times over the years. (See all my SIRC trades here.) It’s a former supernova, so it has the potential to spike again with the right catalyst.

Fernhill Corporation (OTCPK: FERN)

FERN is a tech-holding company with broad interests. It acquires companies in fintech, crypto, artificial intelligence, and alternative energy like solar and battery storage.

This one’s worth watching to see if it follows my 7-step framework. I go over the pattern in detail in my “Pennystocking Framework” DVD. It’s a $797 value, but you get it as a bonus when you get into my 30-Day Bootcamp. ( Learn all about my Bootcamp in this video.)

SunHydrogen, Inc. (OTCPK: HYSR)

SunHydrogen, Inc. uses technology to generate renewable hydrogen using sunlight and water.

This solar stock trades high volume. That makes it a good one to watch when the sector heats up.

Ascent Solar Technologies, Inc. (OTCPK: ASTI)

ASTI designs and manufactures things like portable solar chargers and thin-film blankets.

Like most solar penny stocks, it has a beaten-down chart after having a huge run in early 2021.

The company recently announced it filed its 2020 financial results with the SEC. That makes this OTC stock a little less sketchy than some others. It’s had big moves in the past. Watch it for your patterns when the right opportunity presents itself.

Learn how to read earnings reports here. And find out how to read SEC filings here.

SinglePoint Inc. (OTCPK: SING)

SinglePoint Inc. is involved in many areas of solar, healthy living, and horticulture. From solar installation to air purification, and even hydroponic, health, and lifestyle supplies.

Frankly, it’s hard to keep up with what business some of these sketchy penny stocks are in. That’s why I trade penny stock patterns and price action. I don’t believe in any of these companies.

I traded this one in 2021 when it went supernova. (See all my SING trades here.)

This company has done a few reverse stock splits over the years, so it has a relatively low float. Most of these sketchy stocks have hundreds of millions or even billions of shares.

It could really spike with the right catalyst and high volume.

Principal Solar, Inc. (OTCPK: PSWW)

Principal Solar Inc. is listed as a solar stock but the company is interested in the entire renewable energy sector.

It even formed a subsidiary and entered into a partnership with eTruck Transportation.

“The Company today also announced that it had achieved its first major electric vehicle investment milestone, delivering a US$1.1 million tranche of funds into its subsidiary partnership with eTruck Transportation, thereby fulfilling its initial financial obligations under the terms of the partnership agreement.”

This stock could move on solar news or news in the electric vehicle (EV) sector.

Solar Penny Stocks in Canada

Aurora Solar Technologies Inc. (OTCPK: AACTF)

AACTF is a Canadian solar company. The company offers control systems and energy production measurement systems for solar panel manufacturers.

As of this writing, it’s trading near its all-time lows. But it had a first green day after announcing it raised over $3.5 million through a private placement.

Like all these stocks, it could get hot with the right catalyst.

Solar Alliance Energy Inc. (OTCPK: SAENF)

Solar Alliance Energy Inc. is a Canadian solar company but offers services and installation in a few southeast states in the U.S. It also installs EV chargers.

This stock trades very low volume. So I don’t recommend you trade it unless the company announces news that brings in high volume.

I once lost $500,000 of my own money from investing in an illiquid penny stock. Trust me, it’s not worth it. Get the whole story in my no-cost book “An American Hedge Fund.”

Other Alternative Energy Stocks to Watch in 2024

Here are a few other clean energy stocks and renewable energy penny stocks that could have potential.

VivoPower International PLC (NASDAQ: VVPR)

This is a solar-energy company.

The price spiked 580% after the company announced on April 2 that its subsidiary, Tembo E-LV would merge with Cactus Acquisition Corp. Limited (NASDAQ: CCTS).

CCTS is a shell corporation that exists for the sole purpose of merging with a private company, thereby taking it public.

Every VVPR share held on the date of the merge will be eligible for 5 Tembo shares. And the news didn’t stop there:

- April 3: VVPR announces a $5 million share buyback program.

- April 8: VVPR announces $10 million in private placement for Tembo from Emirati Investment.

The price dipped after the 580% spike. But don’t be upset at the missed opportunity. Always remember that past spikers can spike again.

Now that VVPR has shown us its ability to spike after an obvious catalyst, there’s a decent chance we’ll see another spike in the future.

Plus, StocksToTrade shows that VVPR’s float is only 1.3 million shares. Here’s why that matters: When a stock has a float below 10 million shares, it’s considered a low float stock. The low supply helps the stock spike higher when demand increases — like when the company announces bullish news.

The price is still consolidating around $4 right now. There’s a chance that it bounces off of that level. But I’d rather see it announce more news to bring back momentum.

KULR Technology Group Inc (AMEX: KULR)

KULR’s run started on March 14 after the company announced a new contract worth more than $865,000 with Nanoracks for the development of an advanced space battery.

But that’s not all …

On March 26 it announced a contract with Lockheed Martin Corporation (NYSE: LMT) to improve missile construction.

The total spike from March to April measures 540%.

Prices just dipped due to a dreary earnings report on April 15. But it’s just as well — I don’t want to buy shares of an overextended stock.

Now that the price dipped a bit, it’s easier to identify strong support to build a position off of.

Take a look at the chart thus far, I included a screenshot below.

For new traders, this can look confusing. Try reading the chart left to right as if the price was trading in real time. Every candle represents 30 minutes:

Support and resistance levels are a BIG part of our trading process.

The levels help traders choose when to buy and when to sell. And it’s especially important when the trade doesn’t go as planned.

Nothing is a 100% guarantee in the stock market. Anything can happen at any time.

Support and resistance levels help us identify a failed trade with enough time to get out.

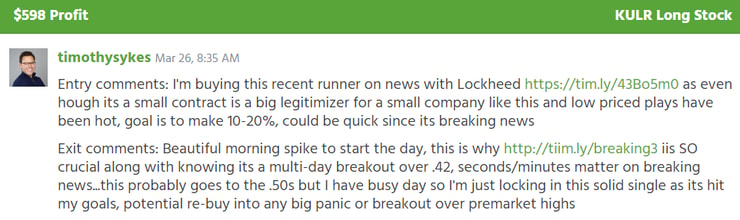

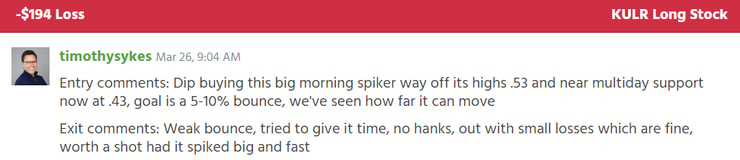

Since KULR began its spike on March 14, I traded it twice.

Once for a profit, with a starting stake of $3,400:

Once for a loss, with a starting stake of $21,925:

Thanks to support and resistance I can keep my losses smaller than my gains.

Watch me and my students trade LIVE!

KULR is still in play. I’m waiting for my next trade opportunity.

FuelCell Energy Inc (NASDAQ: FCEL)

This is a HUGE former runner.

FCEL spiked 1,300% between November 2020 and February 2021. Take a look at the chart below (every candle represents one trading day):

More recently, on April 8 the company announced it expanded an existing agreement with ExxonMobil Technology and Engineering to develop CO2 capturing technology that simultaneously creates electricity. It’s called carbonate fuel cell technology.

And on April 11 FCEL announced that its technology will also be used by the Sacramento sewer system to help create electricity from biogas.

Thus far, the news hasn’t inspired any volatile price action. But past spikers can spike again … And considering the abundance of bullish catalysts, it’s only a matter of time until the momentum picks up again.

Wait for the confirmation of volatility.

I don’t want to buy and hold shares of this stock. That’s a waste of time and capital. Instead, we wait for the stock to show us momentum. Then we trade the best setup.

More Breaking News

- SunOpta’s Acquisition Boosts Stock by 32% Amid Key Industry Moves

- Under Armour Battles Data Breach Amid Revenue Challenges

- Oracle’s Expansion Plans and Market Response Fuel Stock Momentum

- Vizsla Silver Corp. Sees Stock Flux Amid Strategic Movements

What Are the Top Online Brokers for Solar Penny Stocks?

You should be able to trade listed solar penny stocks by using any of the major brokerages.

But if you want to trade solar penny stocks listed on the OTC markets, you need a broker that allows that. For instance, Robinhood doesn’t allow access to OTCs.

Certain brokerages also don’t allow short selling. So if that’s part of your strategy, do your research first.

I use E-Trade and Interactive Brokers. That doesn’t mean they’re the best. They just suck the least for my trading needs and work for me and my style of trading.

You have to find out what works best for you based on your strategies and trading style.

For more on brokers, check out this post.

Solar Penny Stocks: The Bottom Line

Right now, solar penny stocks are in the dark. They need volume and an exciting catalyst to bring them back onto the limelight.

That could be news of funding or initiatives for the green energy sector. Or it could be news of reduced oil production.

I don’t try to predict what news or laws might impact the market. Instead, I wait for the market to react to any major news before I plan my trades.

Want to learn the strategies I use to trade solar penny stocks? Apply for my Trading Challenge today. Fair warning: I don’t accept everyone.

I only want the most dedicated students willing to learn the right process and mindset to become self-sufficient traders.

All my 10+ millionaire students have gone through my Trading Challenge. Students get access to thousands of video lessons, all my DVDs, plus weekly live trading and Q&A webinars.

Want access to all these amazing educational resources? Apply today.

Which solar penny stocks are on your watchlist? Let me know in the comments … I love to hear from all my readers!

Frequently Asked Questions About Solar Penny Stocks

Want to know more about trading solar penny stocks? Here are some FAQs about solar penny stocks and the brokers to trade them…

Is Robinhood Good For Penny Stock Trading?

Robinhood doesn’t allow access to OTC stocks. Some of the most volatile penny stocks trade on the OTC markets. So if you want to trade penny stocks make sure you do your research on brokers. Find one that works for you, your trading style, and your strategy.

What Are the Most Profitable Penny Stocks?

There are certain indicators I look for before I make any trade. Every day I use StocksToTrade to scan for big percent gainers with high volume, and, ideally, a catalyst. I don’t trade stocks based on the company’s product or technology. And I never trade illiquid stocks.

Can I Find Solar Penny Stocks on Robinhood?

Most penny stocks are listed on the OTC markets. Robinhood doesn’t allow its users to trade most OTCs. You could use Robinhood to find and trade the few solar penny stocks listed on the major exchanges like the Nasdaq and NYSE.

What Are the Top Solar Companies to Invest In?

I don’t invest in solar or any other companies. My strategy is to day trade volatile penny stocks. My goal is to take advantage of stocks moving on news and hype. I take the meat of the move, then I move on to the next opportunity.

Leave a reply