There’s a lot of interest in renewable energy stocks these days…

The electric vehicle sector has been one of the hottest sectors in recent years. This has had some spillover effects for the best renewable energy stocks.

There’s a big catalyst in President Biden’s $100 billion plan to “reenergize America’s power infrastructure.” It’s supposed to lead to at least one million new renewable energy and energy efficiency jobs per year.

This has brought even more attention to the best renewable energy stocks.

But it’s not just good news that moves stocks. Every big oil spill means good PR for renewable energy.

To me, that’s a good thing. We need to stop having incidents like the 4,000-ton oil spill that happened in Mauritius in 2020.

New @karmagawa fundraiser to help #Mauritius in their oil spill cleanup efforts as there's countless wildlife/marine life & coral reef dying every minute & locals are trying as hard as they can, but need help! 100% of funds raised will be donated & I'm also donating $25,000 too! https://t.co/3QmksX31X2

— Timothy Sykes (@timothysykes) August 9, 2020

This donation was part of a $1.6 million donation made by my charity Karmagawa. I’m proud to have helped wildlife and coral reefs with this donation. But you know what would have been better? Not having to deal with oil spills in the first place…

That’s one argument for trading renewable energy companies’ stocks. And the market’s taking notice.

Table of Contents

- 1 Is Renewable Energy a Good Investment?

- 2 7 Renewable Energy Stocks to Watch

- 2.1 1. VivoPower International PLC (NASDAQ: VVPR) — The Subsidiary Spin-Off Green Energy Stock

- 2.2 2. KULR Technology Group Inc (AMEX: KULR) — The Contract Winner Lithium-Ion Battery Penny Stock

- 2.3 3. FuelCell Energy Inc (NASDAQ: FCEL) — The EV Battery Stock With the Exxon Deal

- 2.4 4. Plug Power Inc (NASDAQ: PLUG) — The Hydrogen Stock That Might Not Survive 2024

- 2.5 5. Mullen Automotive Inc. (NASDAQ: MULN) — My Troll Meme Stock Pick for the Bagholders Out There

- 2.6 6. Nikola Corporation (NASDAQ: NKLA) — The Hydrogen Fuel Cell EV Stock

- 2.7 7. American Battery Technology Co. (NASDAQ: ABAT) — The EV Battery Penny Stock Spiker

- 3 Renewable Energy Stocks Under $5

- 4 Renewable Energy Penny Stocks

- 5 Conclusion

- 6 Renewable Energy Penny Stocks Watch List 2024 FAQs

- 6.1 How do I trade renewable energy stocks?

- 6.2 What are the best energy stocks to trade?

- 6.3 Can you get rich quickly with penny stocks?

- 6.4 Are energy penny stocks in oil and gas or renewables?

- 6.5 Are energy penny stocks volatile?

- 6.6 What investment opportunities exist in green penny stocks?

- 6.7 How do dividends and revenues factor in?

- 6.8 Can I trade these stocks on OTC markets?

- 6.9 How are these stocks countering fossil fuels?

- 6.10 What types of firms are listed in this category?

- 6.11 What does the financial media say about renewable penny stocks?

- 6.12 What should you consider for portfolio addition?

- 6.13 How can sales performance impact stock value?

- 6.14 What role do partnerships play in renewable penny stocks?

Is Renewable Energy a Good Investment?

People ask me how to invest in renewable energy stocks often when they see how much effort I put into charity.

And many are interested in green investing. This kind of socially responsible investing targets environmentally friendly companies. Investing in renewable energy stocks can be part of this strategy.

But here’s the deal — I don’t invest in renewable energy stocks or any stocks…

I trade stocks, usually for just minutes.

For 20+ years, I’ve used the same patterns. I share everything I do. Here are few ways to start for no cost:

- My penny stock guide is a great start for newbies.

- My “30 Trading Videos in 30 Days” YouTube playlist takes you through trading basics.

- And my YouTube channel has over 1,400 videos on patterns, interviews, and more.

- Follow my Facebook page to keep up with all the content I post there.

Following my patterns and rules is how I’ve made $7.6 million in my 20+ years of trading.

Top Renewable Energy Stocks

The stocks I target in the renewable sector look like the stocks on my other watchlists…

They’re stocks with solid news catalysts and a history of running. And they’re low float, so heightened demand can really move their prices.

They can be pumps, so I limit my risk accordingly. I never believe in these sketchy stocks. I watch the price action and react to it.

I don’t believe in there being ‘best stocks’ for renewable energy or any other sector. And that doesn’t limit me. It opens me up to any stock that has a chart I like.

7 Renewable Energy Stocks to Watch

My top renewable energy stock picks are:

- NASDAQ: VVPR — VivoPower International PLC — The Subsidiary Spin-Off Green Energy Stock

- AMEX: KULR — KULR Technology Group Inc — The Contract Winner Lithium-Ion Battery Penny Stock

- NASDAQ: FCEL — FuelCell Energy Inc — The EV Battery Stock With the Exxon Deal

- NASDAQ: PLUG — Plug Power Inc — The Hydrogen Stock That Might Not Survive 2024

- NASDAQ: MULN — Mullen Automotive Inc. — My Troll Meme Stock Pick for the Bagholders Out There

- NASDAQ: NKLA — Nikola Corporation — The Hydrogen Fuel Cell EV Stock

- NASDAQ: ABAT — American Battery Technology Co. — The EV Battery Penny Stock Spiker

I don’t trade random stocks. That yields random results. You must put thought into the stocks you trade. That means building watchlists to help you learn about the stocks on your scans.

See more of how I build my watchlists and sign up for my NO-COST weekly watchlist here.

Remember — I’m not telling you which renewable energy stocks to buy. I’m showing you my process so you can build your own watchlist. And here I’m sharing why I’m watching each stock. Do your research!

1. VivoPower International PLC (NASDAQ: VVPR) — The Subsidiary Spin-Off Green Energy Stock

My first renewable energy penny stock pick is VivoPower International PLC (NASDAQ: VVPR).

This is a solar-energy company.

The price spiked 580%* after the company announced on April 2 that its subsidiary, Tembo E-LV would merge with Cactus Acquisition Corp. Limited (NASDAQ: CCTS).

CCTS is a shell corporation that exists for the sole purpose of merging with a private company, thereby taking it public.

Every VVPR share held on the date of the merge will be eligible for 5 Tembo shares. And the news didn’t stop there:

- April 3: VVPR announces a $5 million share buyback program.

- April 8: VVPR announces $10 million in private placement for Tembo from Emirati Investment.

The price dipped after the 580% spike. But don’t be upset at the missed opportunity. Always remember that past spikers can spike again.

Now that VVPR has shown us its ability to spike after an obvious catalyst, there’s a decent chance we’ll see another spike in the future.

Plus, StocksToTrade shows that VVPR’s float is only 1.3 million shares. Here’s why that matters: When a stock has a float below 10 million shares, it’s considered a low float stock. The low supply helps the stock spike higher when demand increases — like when the company announces bullish news.

The price is still consolidating around $4 right now. There’s a chance that it bounces off of that level. But I’d rather see it announce more news to bring back momentum.

More Breaking News

- Spotify’s Royalty Growth and Stock Upgrade Create Buzz

- Bitfarms Plans for U.S. Redomiciliation and Debt Repayment Spark Investor Interest

- Vizsla Silver Shows Resilience Amid Unsteady Market

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

2. KULR Technology Group Inc (AMEX: KULR) — The Contract Winner Lithium-Ion Battery Penny Stock

My second renewable energy penny stock pick is KULR Technology Group Inc (AMEX: KULR).

This run started on March 14 after the company announced a new contract worth more than $865,000 with Nanoracks for the development of an advanced space battery.

But that’s not all …

On March 26 it announced a contract with Lockheed Martin Corporation (NYSE: LMT) to improve missile construction.

The total spike from March to April measures 540%.*

Prices just dipped due to a dreary earnings report on April 15. But it’s just as well — I don’t want to buy shares of an overextended stock.

Now that the price dipped a bit, it’s easier to identify strong support to build a position off of.

Take a look at the chart thus far, I included a screenshot below.

For new traders, this can look confusing. Try reading the chart left to right as if the price was trading in real time. Every candle represents 30 minutes:

Support and resistance levels are a BIG part of our trading process.

The levels help traders choose when to buy and when to sell. And it’s especially important when the trade doesn’t go as planned.

Nothing is a 100% guarantee in the stock market. Anything can happen at any time.

Support and resistance levels help us identify a failed trade with enough time to get out.

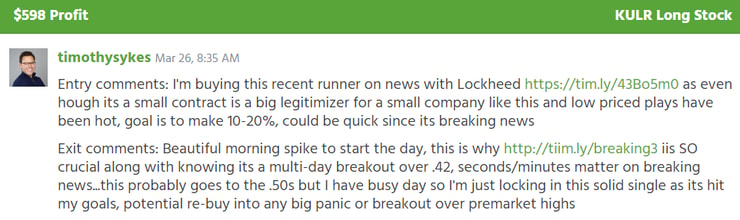

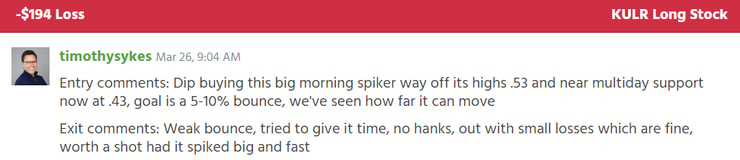

Since KULR began its spike on March 14, I traded it twice.

Once for a profit, with a starting stake of $3,400:

Once for a loss, with a starting stake of $21,925:

Thanks to support and resistance I can keep my losses smaller than my gains.

Watch me and my students trade LIVE!

KULR is still in play. I’m waiting for my next trade opportunity.

3. FuelCell Energy Inc (NASDAQ: FCEL) — The EV Battery Stock With the Exxon Deal

My third renewable energy penny stock pick is FuelCell Energy Inc (NASDAQ: FCEL).

This is a HUGE former runner.

FCEL spiked 1,300%* between November 2020 and February 2021. Take a look at the chart below (every candle represents one trading day):

More recently, on April 8 the company announced it expanded an existing agreement with ExxonMobil Technology and Engineering to develop CO2 capturing technology that simultaneously creates electricity. It’s called carbonate fuel cell technology.

And on April 11 FCEL announced that its technology will also be used by the Sacramento sewer system to help create electricity from biogas.

Thus far, the news hasn’t inspired any volatile price action. But past spikers can spike again … And considering the abundance of bullish catalysts, it’s only a matter of time until the momentum picks up again.

Wait for the confirmation of volatility.

I don’t want to buy and hold shares of this stock. That’s a waste of time and capital. Instead, we wait for the stock to show us momentum. Then we trade the best setup.

4. Plug Power Inc (NASDAQ: PLUG) — The Hydrogen Stock That Might Not Survive 2024

My fourth renewable energy penny stock pick is Plug Power Inc (NASDAQ: PLUG).

This is another big spiker from 2020 and 2021.

In January 2021 alone, the price gapped up 140%* in less than two weeks. It’s an incredible feat for a stock that was already on a run and was trading above $30 per share.

But alas, the momentum was unsustainable. Like most of the trash companies in our niche, the bull spike was attributable mostly to hype and speculation.

From 2021 until now, the stock lost 95% of its value. It’s back in penny stock territory.

And things aren’t looking good in the short term:

- In November 2023 the company announced concerns about its funding and cash levels over the next 12 months.

- There’s currently a class-action lawsuit investigating “false and misleading statements” the company may have made.

There’s a real concern that this company could delist from the Nasdaq.

I’m interested in the price action because it’s a former runner and because we’ve seen bankrupt stocks turn into huge short squeezes before.

Greedy short sellers see a bankrupt stock like PLUG trading around $3 and they think that they can ride it lower. It’s a decent thesis. The company is garbage.

But if there are too many short sellers in a stock, any bullish momentum could cause some to panic and get out. Short sellers have to buy-to-cover to exit. And the added bullish momentum could cause other short sellers to panic.

Soon enough, we’ve got a crappy stock squeezing +100% even +1,000% just due to short sellers blowing up.

I’m waiting to see if a scenario like this plays out.

5. Mullen Automotive Inc. (NASDAQ: MULN) — My Troll Meme Stock Pick for the Bagholders Out There

My fifth renewable energy penny stock pick is Mullen Automotive Inc. (NASDAQ: MULN).

There are likely still bagholders that bought MULN shares at the top of the 2020 spike.

The price tried to push higher several times but traders sold into the momentum.

There’s a chart of the spike below. Understand, the shares never traded at $400,000. The chart shows the high price level because of share dilutions and contractions that have happened since then.

Every candle represents one trading day:

Don’t hold shares of these volatile stocks.

We’re here to trade high-probability patterns that accompany these spikes.

MULN helps to manufacture electric vehicles and energy solutions. And its history of spiking makes it a top watch for future green-energy trade opportunities.

That is, if the bagholders ever give it some breathing room …

6. Nikola Corporation (NASDAQ: NKLA) — The Hydrogen Fuel Cell EV Stock

My sixth renewable energy penny stock pick is Nikola Corporation (NASDAQ: NKLA).

NKLA designs and manufactures battery-electric as well as hydrogen-electric vehicles.

On March 21 NKLA announced its first Hyla refueling station in Southern California was open for business. The resulting spike measured 80%.

On April 11 we learned of rumors surrounding potential fraud and misconduct at NKLA. The price fell dramatically as a result. But it’s not over for NKLA.

It seems this company is doing real business. And in the world of penny stocks, that’s a big vote of confidence. Plus, it’s always possible that any updates on possible fraud will inspire future volatility.

The $1 level is acting as major resistance on this stock. I’d wait to see if the share price can reach that level before I plan a trade.

7. American Battery Technology Co. (NASDAQ: ABAT) — The EV Battery Penny Stock Spiker

My seventh renewable energy penny stock pick is American Battery Technology Co. (NASDAQ: ABAT).

This company works in lithium battery recycling. Lithium batteries are a necessary component for most EVs.

From December 2020 to January 2021, the stock spiked 2,500%.* Back then, the ticker symbol was ABML. On September 20, 2023 the company uplisted from the OTC markets to the Nasdaq, changing its ticker to ABAT.

The uplisting is a bullish catalyst on its own. But there are more catalysts at work here:

- On April 3 the company announced a $20 million tax credit.

- On April 4 the company announced another tax credit, this one worth $40 million.

There wasn’t much volatile price action as a result. But I’m glad to see that it’s trying!

As a former runner, It’s only a matter of time until one of these catalysts inspires another buying spree.

*Past performance does not indicate future results

Renewable Energy Stocks Under $5

The allure of hot sector penny stocks is undeniable. These stocks present a unique blend of opportunity and volatility. Renewable energy is booming, making green energy stocks a magnet for investors looking for the next big breakthrough. The gains here can be proportionately greater than those from more established stocks, mainly because even minor positive developments can send their prices soaring.

However, it’s crucial to approach these opportunities with a clear strategy and an understanding of the risks involved. The volatility of penny stocks, combined with the speculative nature of biotech ventures, means that while the potential for rapid gains is significant, the risk of losses is equally high. Conduct thorough research, looking beyond the hype. And never invest in these stocks — only trade them.

Remember, the key to success in trading renewable energy stocks under $5 is not just about jumping on every opportunity but being selective and strategic. It’s about leveraging the explosive potential of the renewable energy sector while managing risk meticulously. By focusing on companies with the potential to lead in their niche, traders can capitalize on the disproportionate gains that these penny stocks offer, all while keeping their investment strategy tight and cutting losses quickly.

Renewable Energy Penny Stocks

Many renewable energy stocks follow penny stock patterns. So what happens when you combine the two?

For the renewable energy penny stocks I’ve been watching, it’s meant even more volatility. That’s a good thing.

If you’re not drooling at the prospect, watch my no-cost “Volatility Survival Guide.” I’ll show you how volatility can make for great trades, regardless of the direction. Sign up for the four-video course here.

Conclusion

What are the best renewable energy stocks?

There’s no good answer for this, but hopefully, this watchlist gives you some ideas of what to look for. Learn from it, then create your own watchlist.

It’s anyone’s guess whether renewable energy stocks will recover their momentum in 2024. But if they do, you want to be ready.

This means studying as much you can and learning what setups work best for you. You can’t control the market, but you can control your response to it. And I have a ton of free and low-cost resources to help you get up to speed.

ENJOY TONS OF FREE RESOURCES TO HELP YOU LEARN: https://t.co/KON0UFjulH & https://t.co/ZB6EtRjpli & https://t.co/LZD2YySd0U & https://t.co/SKdarBd9IK & https://t.co/6oLl0jlfuv only the lazy ignore them & then lie saying they're not 100% free, welcome to the idiocy in this niche!

— Timothy Sykes (@timothysykes) June 18, 2020

After you learn the basics, my Trading Challenge can help you hone your skills. I don’t accept everyone. But if you’re willing to work hard at becoming a better trader, I hope you get in touch.

We’re in a rare market these days. Renewable energy stocks have been on fire, along with other sectors.

Our work is preparing for what the market throws our way next.

What do you think about renewable energy stocks? Have you traded any of the stocks I’ve put on here? Let me know in the comments — I love hearing from you!

Renewable Energy Penny Stocks Watch List 2024 FAQs

How do I trade renewable energy stocks?

You trade renewable energy stocks just like any stocks — keep a close eye on their news and react to chart movements. Always do your due diligence and study the stock’s history and chart to ensure you make the right trades.

What are the best energy stocks to trade?

There’s really no “best” energy stock to trade because circumstances change and prices move. However, you can keep a watchlist of your preferred energy companies and monitor each of them closely. When you see a good setup it might be a good time to trade.

Can you get rich quickly with penny stocks?

You can get rich with penny stocks, but not necessarily quickly. Penny stock trading is a great way to build your trading account, knowledge, and experience — all things you need to become a successful and smart trader.

Are energy penny stocks in oil and gas or renewables?

Energy penny stocks can be in both oil and gas as well as renewables. However, with the global focus shifting towards combating climate change, renewable energy stocks are gaining more attention. From my trading experience, I’ve found that renewables often offer more long-term growth potential.

Are energy penny stocks volatile?

Yes, energy penny stocks can be highly volatile. This volatility can offer significant returns but also comes with increased risks. It’s crucial to have a solid trading plan and stick to it. I’ve been right about 70% of the time in my trades, and it’s all about managing risks effectively.

What investment opportunities exist in green penny stocks?

Green penny stocks present an investment opportunity for those interested in diversifying their portfolio. You can take various positions in companies focused on sustainable energy. ETFs specifically tailored for green energy are also available.

How do dividends and revenues factor in?

For the most part, green penny stocks do not offer dividends due to their focus on growth. However, their revenues can indicate the performance of these companies. It’s important to consult an author specializing in the green energy sector for the most reliable details.

Can I trade these stocks on OTC markets?

Yes, many renewable energy penny stocks are OTC (Over-The-Counter) traded. Before making any investment, check the exchange where the stock is traded and be mindful of the disclaimer usually associated with OTC stocks. A financial fund that focuses on OTC green energy stocks might be an opportunity for investment.

How are these stocks countering fossil fuels?

Renewable energy companies are making strides to reduce dependency on fossil fuels. They create infrastructure for renewable energy, which can be a great addition to your investment portfolio. The global focus is shifting toward sustainability, creating a chance for these stocks to excel.

What types of firms are listed in this category?

Different types of firms are included, offering various services related to renewable energy. From waste management systems to energy storage assets, the range is diverse. Some even forge partnerships with established companies to expand their services and scale their operations.

What does the financial media say about renewable penny stocks?

Reputed media outlets like CNN cover these stocks and their performance. It’s advisable to keep track of the news for any significant reasons that could impact these stocks. Always pay attention to the interests discussed in such articles to better understand the landscape.

What should you consider for portfolio addition?

Before making an addition to your portfolio, consider the company’s value compared to its revenues. It’s also important to assess the money invested in infrastructure and applications for renewable energy. Diversification through ETFs is also an option.

How can sales performance impact stock value?

Sales figures and revenue generation play a significant role in determining the stock’s value. In the renewable energy sector, revenues mostly come from applications like energy storage, solar installations, and waste management services.

What role do partnerships play in renewable penny stocks?

Partnerships are crucial for these companies to expand their assets and services. Strategic alliances can substantially increase sales and improve the overall performance of the stock in the market. Such details are often covered by financial media.

Leave a reply