Stocks are nothing more than pieces of paper — whether physical or virtual. They represent real money, but on their face, they’re just contracts.

You probably know that I don’t like risk. When I play the stock market, I want the greatest rewards at the lowest risk. I suggest that you take the same position.

When it comes to stock futures, my principles remain the same. But what are stock futures? And how to trade stock futures?

Table of Contents

What Are Stock Futures?

Stock futures investing are different from traditional stocks in that they take place in the — you guessed it! — future. Trading stock futures means agreeing on a price for a stock, whether to buy or sell, and putting an expiration date on it.

On or before the expiration date, you must execute the trade. Unlike options, you don’t get to back out and decide not to participate. You’re locked in.

That might sound scary, but it can work out great if you’re willing to read the charts and make educated guesses about a stock’s future price. With stock futures, you can short, too, if you want to protect against losses.

Stock Market Futures Versus Traditional Stocks

Traditional stock trading takes place in real time. In other words, you buy and sell your shares immediately.

You might know that I’m a huge fan of penny stocks. They’re great for building incremental wealth without assuming a ton of risk. I might buy a penny stock at 10 a.m. and sell it by 10:37 a.m. I often hold onto them for longer, but that’s how fast the traditional stock market can move.

Futures trading is another animal.

- You’re estimating the price at which a stock will be traded on the market on a future date.

- You then agree to buy or sell that stock on an agreed-upon price.

- You can take a long or short position, just like you can with traditional stocks.

Unlike options, futures trades often don’t make it to the expiration date. The trader might exercise his or her rights long before to take advantage of the market.

U.S. Stock Futures

You can trade stock futures on the major U.S. stock exchanges just like you would do with traditional stocks. The most US futures common options include the following:

Each of these US stock futures behave differently, however, so you have to study them carefully before you start trading stock futures. If you’re not educated about the companies you’re watching or the industries they’re in, you might blow your estimation and lose lots of cash.

I say that because many people think they can act on a futures tip, invest all their money in a futures contract, and get instantly rich. It rarely happens that way — in fact, you’re more likely to lose everything you have.

What Are Single Stock Futures and Stock Index Futures?

The term single stock futures sounds a little misleading, so let me explain. All it means is that there’s a contract between two people: the buyer and the seller.

The buyer, for instance, agrees to buy 100 shares of a specific stock at an agreed-upon date for $10 per share. The seller agrees to deliver said stock by that date to complete the contract.

These are extremely liquid, so you don’t usually see the contracts reach expiry. And it’s possible to use leverage for stock futures, but I don’t recommend it. When you use leverage, you borrow someone else’s money on a gamble, and that can put you in a precarious financial situation.

Several of the major trading indexes allow for single stock futures trading:

- Dow 30

- S&P 500

- Nasdaq

- SmallCap 2000

- S&P 500 VIX

Stock index futures are a little different. Instead of contracting to buy or sell shares of a single stock, you’re hedging your bets on an entire market, such as the Dow Jones Industrial Average. You make a contract with someone else based on how the entire index will perform.

World Stock Market Futures

Stock futures are interesting because they’re highly dependent upon global stock market performance. Keep in mind that trading hours are limited in the United States. While we’re sleeping, people in other parts of the world are trading.

That’s why CNN might broadcast a serious hit to certain stocks when the market first opens in the morning. Something has happened on the other side of the world that influences the U.S. stock market.

Lots of traders prefer to trade stock futures in foreign markets. For one thing, there’s a lot of new growth overseas, which means high volume and high liquidity. They’re a little like penny stocks in that they’re just getting their sea legs, so there are lots of opportunities to cash out.

Also, in many areas of the world, earnings growth happens faster than in the U.S. It’s something to think about if you’re interested in trading stock futures.

More Breaking News

- Valterra Platinum Strengthens Position with Impressive Earnings Surge

- Exponent Stock Boosted by Strong Q4 Performance and Dividend Hike

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

Asian Stock Futures

You hear me talk a lot about price volatility in the stock market. Outside New York trading hours, lots of things can happen, and volatile shifts in the market can take place without our even knowing it.

Unless, of course, you’re following markets outside the U.S.

The Asian stock market futures has drawn significant interest from U.S. traders thanks to its many emerging markets and companies. Some people say you can predict the U.S. market opening by paying attention to the Asian stock futures market, but that’s not always the case. It’s just good to be informed.

Specifically, you can trade futures on the Tokyo Stock Exchange. It’s a bit of a ripple effect. The TSE can impact the London Stock Market, which then impacts what happens to the U.S. markets.

European Stock Futures

The same goes for European stock futures. You can enjoy more volatility in these markets than in other parts of the world, which might give you an advantage.

However, keep in mind that you can also pay attention to foreign stock markets without actually trading internationally. Instead, you can use the information gleaned from their performance to guess how the market will open in the U.S.

It’s not foolproof. Nothing about investing is. But once you learn to read patterns in the market, you can make increasingly accurate predictions.

How to Buy and Sell Stock Futures

One major difference between trading traditional stocks and trading stock futures is that the latter is happening around the clock.

I’ll get into premarket stock futures here in a minute, but for now, it’s important to understand that you’re not just trading between 9:30 a.m. and 4 p.m.

At least, not if you’re smart.

Let’s look at the best practices for buying and selling world stock futures.

How Do Stock Futures Work?

Let’s be clear: Stock futures are high-risk investments. High volatility and the inability to escape the contract can result in losing even more than the initial investment.

With that out of the way, let’s look at what are stock futures and how stock futures work.

You can take either a long or a short position. If you go long, you’re expecting the price of the stock to increase. If you go short, you’re expecting it to decrease.

Upon execution of the contract, you pay a margin — typically between 10 and 20 percent of the total price — and set an expiration date.

Here’s why these contracts usually never make it to expiry. A buyer who’s using a long position watches the stock price creep up. He’s not sure where it will go from there, so he executes the contract to take the profit.

He could have held out for a greater profit. Or, if the stock went south, he could have lost his investment.

The longer you hold out, the more risk you take on. Additionally, if a stock starts to tank and you don’t execute fast enough, your broker can issue a margin call. This means that you have to pay your broker to bring your account back up to the maintenance level.

The Importance of a Commodity Pool

Now that we’ve covered single stock futures, let’s talk about the communal aspect of stock futures market. A commodity pool is essentially a group of investors who trade futures together. Each shares in profits (or losses) based on how the stock performs.

The pool has a manager who must be licensed and registered in the United States.

The great thing about a pool is that everyone’s purchasing power increases exponentially. You can trade in much higher dollar amounts than you could on your own. Furthermore, you’re limited to losing your investment. In other words, you can’t go in the hole.

If you’re interested in trading commodities futures, a commodity pool is a great way to protect your cash.

Pre-market Stock Futures

As with all aspects of trading, there are risks and benefits of pre market trading. Generally, pre-market trading begins at around 8 a.m., though some of the larger companies see trading activity as early as 4 a.m. Eastern time.

The important thing to remember with stock futures is that you want to know what the market is doing around the world. You also want to see what news might have broken since the market closed and might therefore influence stock prices.

During pre-market hours, there’s very little volatility. You also won’t find much volume at this time because so few people are active.

However, I’ve had some good luck with pre-market trading. Other people say their brokers don’t allow it, so I recommend finding one that does.

If you’re trading futures and you have a sense about a stock’s activity pre-market, don’t be afraid to act on it. Better to take your profits now than risk future losses.

Tips For Successful Stock Market Futures Traders

If you want to do well in the stock futures market, you have to pay careful attention to market volatility and volume. Those are the two metrics I track more than any other because I want to make sure I don’t get stuck in a losing position.

Here are my best tips for stock market futures traders. If you’re thinking about getting involved with this type of investing, I hope you’ll join my Trading Challenge and work toward building your wealth.

Exercise Caution When Selling Short

Short-selling is a pretty big risk in any type of investment, but especially when it comes to stock futures. You’re betting on a losing game, which can seriously impact your bottom line.

Here’s the deal: If you’re going long, you can lose 100 percent of your investment. That sucks, but it’s not the end of the world.

If you go short, though, there’s absolutely no limit to the amount of money you can lose. Let that sink in for a moment.

This is especially true when you’re investing in stock futures. Anything can happen from the time you execute the contract and the time you complete the transaction. If the share rises 1,000 percent, you’re in the hole for the difference.

Use Mental Stops

I’m a big fan of mental stops, and I use them often. It’s a great way to control your own trades without putting yourself at greater risk.

A mental stop is just what it sounds like. You don’t manually set a point at which you want to sell your shares. Instead, you have a general idea of your goal in a specific position, and you execute a purchase or sale when the stock price reaches that point.

Since stock futures can last for months, you don’t want to allow a computer to think for you. Instead, you want to watch the market closely and decide for yourself when it’s time to end the transaction.

Don’t Trade Large Positions

I’m a pennystocker by trade, so you know I’m a fan of trading small positions. I’ll never risk more than 20 percent of my total account on a single play because I know it puts me at substantial risk.

Again, this is even more important when trading stock futures. Since you’re betting on a stock’s trajectory over time, you don’t want to put yourself in a position where you’re out thousands of dollars (or more).

Trading small positions allows you to get the hang of trading stock futures without risking your financial future. Plus, it allows you to make more plays with different stocks, which means you’ll learn faster and get more insight into the trading game.

Depending on your risk tolerance, you might only risk 1 or 2 percent of your account total on a futures play. There’s nothing wrong with that.

Track Stock Futures Volume

A better idea is to focus a small amount of money on a high-volume stock. Volume is an indicator of how often a stock price fluctuates.

In many cases, high-volume stocks represent great picks. It means there’s high demand for the stock and that lots of players are involved. High volume generally correlates with high liquidity.

In the futures market, you want high volume because you want to know that, even if a stock begins moving in opposition to your forecast, it can still bounce back. And it probably will. However, you also have to do your research.

What news has been released about the company? Is the catalyst for the high volume temporary or long-term? What do the financial reports say?

Understand Hedging

One of the main attractants of stock futures is that they allow you to hedge for reduced risk. Since you can execute the contract at any time, you can mitigate risk and pull out of the deal if you sense that your forecast was wrong.

There’s a delicate balance between hedging and panicking, which is why I tell my Trading Challenge students to study long and hard. If you don’t know what you’re doing, you can miss out on profits because you have an itchy finger.

Regardless, hedging against potential losses can help you exercise more control over your wealth.

Consider the Calendar Spread

Now we’re getting to the good stuff.

A calendar spread occurs when you take both a long and short position on a stock at the same strike price, but with the expiration dates occuring in different months. Essentially, you’re betting that you can profit from a stock price’s imminent volatility.

It’s a complicated way to trade — and it can blow up in your face if you’re not intimately familiar with the calendar spread technique and the shares you’re buying and selling. It’s best for traders with bullish long-term strategies for specific stocks, and again, don’t use more than a few percent of your account on a single play.

Get Enrolled in a Trading Course or Find an Experienced Mentor

Does all this sound complicated? That’s because it is.

I’ve been day trading actively for two decades now and I’ve profited nearly $5 million in that time.** However, I still take losses and make mistakes.

That’s why it’s so essential to enroll in a trading course. Learning from people who have the experience and expertise to guide you through your first trading years can make a huge difference in your success or failure.

I’ve seen lots of amateur traders lose everything they have because they don’t understand the market or its inherent risks. They think they can follow a “hot” stock pick sent to them via email and get rich. Sorry. It doesn’t work that way.

Why Should You Apply for the Trading Challenge?

Speaking of trading courses, you might not have heard about the Trading Challenge. It’s my way to help aspiring traders find their sea legs and get started in the market.

More importantly, it’s my goal to help make as many self-sufficient traders as possible.

I started trading back in high school and college not because I wanted to “get rich,” but because I wanted freedom. The goal to “get rich” is too amorphous to provide much motivation, so you need a dream in your mind before you even start trading.

From there, I can guide you toward the laptop lifestyle you covet.

Frequently Asked Questions

There are a couple questions I get asked over and over about stock futures, so I’m going to answer them here. That way, I can reference them at later dates and point people in the right direction.

How Much Money Is Required to Trade in Stock Futures?

You can’t trade stock futures unless you have at least $10,000 to put into a trading account. And that’s the bare minimum.

In some cases, you’ll need $20,000 or even $30,000 to get started.

You’ll find brokers that will allow you to open an account with as little as $500, but that’s not really worth the effort. You can’t execute trades with that little cash in your account.

This is largely due to the fact that brokers require you to maintain a minimum margin. If you fall below that minimum, your broker will require you to make up the difference.

Do Chart Patterns Work Equally Well in Stock and Futures Markets?

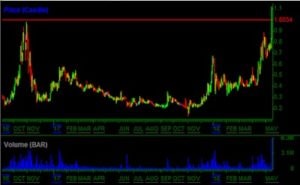

How to read stock futures? Reading charts doesn’t come naturally to many people. It can take years to get used to reading them. However, it’s essential, even if you’re more interested in stock futures than, say, pennystocking.

Charts provide you with a ton of information about a stock’s history and behavior. You can use that information to predict future performance, but you also need to rely on fundamentals.

Sure, chart patterns matter when you’re trading stock futures, but market indicators matter just as much. Recent news, financial stability, and other factors should play into your decision to take a long or short position on any given stock.

The Bottom Line

Stock futures are popular among a wide variety of traders who enjoy playing the long game. They might invest in commodities pools or go it alone, but they love making an educated guess about a stock’s future performance.

I’m more inclined to day trade penny stocks, but that doesn’t mean you shouldn’t explore other types of investments.

If you’re ready to get your feet wet in the stock market, apply for my Trading Challenge. I’m actively looking for my next millionaire student success story. Maybe it will be you.

Leave a reply