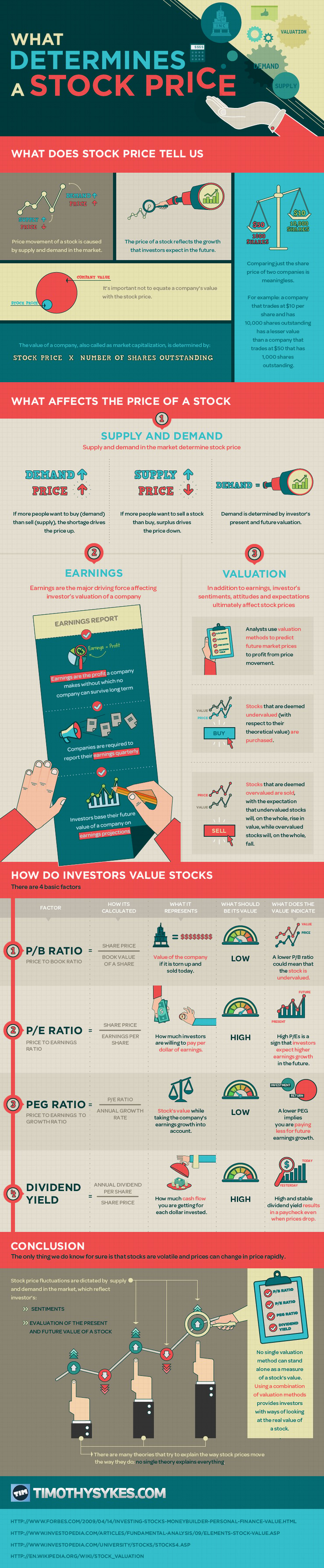

Do you know what determines a stock price? There are a lot of complex formulas that affect a stock price, but in essence…

Price movement of a stock is caused by supply and demand in the market. If more people want to buy than sell then the price goes up, the inverse is true if more people want to sell a stock than buy, as surplus drives the price down.

Price movement can even be moved by people emotions.

To help you understand what determines a stock price, what affects it and defines it, I decided to create an infographic that breaks it all down.

Click on the image below to see a larger view…

Conclusion

The one thing we do know for sure is that stocks are volatile and prices can change rapidly. Always remember stock price fluctuations are dictated by supply and demand in the market, which reflect investor’s sentiments and evaluation of the present and future value of a stock.

There are many theories that try to explain the way stock prices move the way they do but no single theory explains everything.

Leave a reply