I think trading high-volume penny stocks is the best way to grow a small account.

And I should know … I started over 20 years ago with just over $12,000. Today, I’ve made over $7.2 million in profits.* Yep, all from trading penny stocks.

I’ve watched my top students take my lessons, build their own strategies, and grow their accounts, too.

And now, some of those students trade better than me. Frankly, I love that. It means I’m doing my job as a teacher well.

This is an incredible time to learn how to trade. You can even start with a small account. There are so many high-volume penny stocks with crazy spikes…

But as fast as the prices run up, they can crash. So you have to know how to trade smart and safe.

Today, I’ll share a few of my strategies with you. But first, let’s answer this basic question…

Table of Contents

- 1 What Are High-Volume Penny Stocks?

- 2 How to Find High-Volume Penny Stocks

- 3 How to Choose High-Volume Penny Stocks to Trade

- 4 2021 High-Volume Penny Stocks Watchlist

- 5 Why You Should Start Trading High-Volume Penny Stocks

- 6 2 High-Volume Penny Stocks Under $1

- 7 3 Low Float High-Volume Penny Stocks

- 8 Trading Challenge

- 9 Frequently Asked Questions About High-Volume Penny Stocks

- 10 How Do You Find High-Volume Penny Stocks?

- 11 Is Trading Penny Stocks Profitable?

- 12 Can You Get Rich Trading High-Volume Penny Stocks?

- 13 Conclusion

What Are High-Volume Penny Stocks?

A penny stock is any stock that trades under $5. Some penny stocks list on the big exchanges like the New York Stock Exchange (NYSE) or Nasdaq.

Are penny stocks sketchy? Oh yeah. Some don’t even qualify for the big exchanges. Instead, they trade over the counter on the OTC markets.

High volume happens when a catalyst drives a flurry of new buyers into the stock. That can be a new contract, press release, a rumored buyout, etc.

Then there are the stock pumps. Promoters and pumpers lure buyers into stocks by touting them as the next Microsoft or Netflix.

All this action can mean traders and investors jump to buy.

When you see the volume picking up to 200,000, 500,000, or even one million shares — that’s a sign something’s up.

I look for a volume of at least one million shares. I want to see the daily volume at least two or three times the daily average.

Dollar volume matters too. One million shares of 1 cent stock is only $10,000. I never want my order to be more than 1% of the overall volume.

I know this seems like a lot. Don’t worry — we’ll dig into some details soon.

How to Find High-Volume Penny Stocks

No secret here, I use StocksToTrade every day.**

I think it’s the best platform for finding penny stock opportunities. It’s designed by traders for traders. Nothing else even compares.

I used to scan hundreds of emails, message boards, and news sites every day for the hottest plays.

Today, StocksToTrade does a LOT of the heavy lifting for me.

Scan for the top percent gainers and sort by volume. This will show you the hottest plays and put the high-volume penny stocks at the top of the list.

If you’re not using it, I think you should be. Start today for only $7.

How to Choose High-Volume Penny Stocks to Trade

The thing I love about the stock market is that there are always opportunities. You just have to do your research and pick the right ones. Some stocks go full-on supernova and others fizzle out.

So how can you tell which stocks will run?

You can’t predict — you have to learn to react. That’s why I teach a process … Buy only when you find the right setups. And cut losses quickly if the trade goes south.

I know which patterns fit my strategy. And I build a watchlist every single day. (Sign up for my NO-COST watchlist here.)

I want every one of my students to be self-sufficient. But I know it’s not easy in the beginning…

Repetition is key. It’s easy to see the best plays in hindsight. But it takes time to learn to recognize them in the heat of the moment.

And you need the right tools to trade these stocks. So we need to talk about something essential…

Order Processing

You need a broker to process your trade orders for you. And you need to use the right broker for your strategy.

As with most things in life, I think you get what you pay for. Commission-free brokerages like Robinhood don’t allow you to trade all penny stocks. And slower systems struggle to keep up with high volume.

No broker’s perfect.

Even the brokers I use have issues sometimes. Here’s a great example … I made this video after all my technology failed me on the same day:

Technical issues can happen to anyone. That’s why it’s important to manage your position and risk.

The great thing about high-volume penny stocks is that you don’t need to capture the whole move. Getting a small piece here and there can add up in the long run.

The goal is to take small, consistent gains and cut losses quickly when you’re wrong.

Liquidity

High volume means the stock is liquid. Illiquid stocks have low volume. It’s difficult to trade illiquid stocks.

Here’s an example: if you buy 1,000 shares and the volume is only 20,000, that’s 5% of the volume. Your order could move the price. And it’ll be difficult to sell those shares.

So stick to high-volume stocks. You’ll have far less trouble getting your orders filled if the stock is liquid.

Low-volume stocks aren’t worth the risk.

Always take volume into account when scanning for stocks. It’s good to be early to the party — but you don’t want to be first.

2021 High-Volume Penny Stocks Watchlist

By the time I finish writing this post, the next hot stock has already spiked and crashed, and the market’s on to the next play. The hottest high-volume penny stocks change constantly.

That’s why you must actively maintain your watchlists and focus on the hottest stocks.

That changes by the week, day, and even hour. Now, let’s make sense of all this with some examples. But keep in mind that these stocks are for teaching purposes only. I’ll never tell you when to buy or sell a stock. I’m here to help you learn how to become a self-sufficient trader.

More Breaking News

- PHUN’s Strategic Moves: Riding the AI and Event Management Wave

- Bitfarms’ Strategic Moves – What Do They Mean for Investors?

- Best Buy Faces Hurdles: Dockworker Strikes Loom Large Over Holiday Season Sales

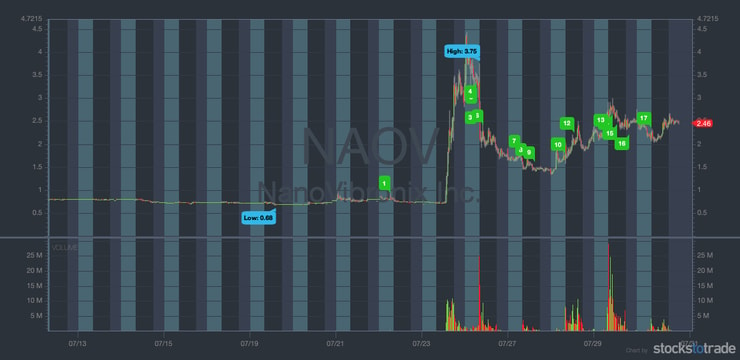

NanoVibronix, Inc. (NASDAQ: NAOV)

NanoVibronix, Inc. focuses on the production of noninvasive biological response-activating devices that help with wound healing. Lately, this stock has been grinding up because of positive news flow.

Here’s the chart…

The stock was trending sideways for a while then suddenly started shooting up. Why?

That’s what you need to figure out as a trader so you can prepare for the next stock that follows a similar trend in price action.

In this case, the stock had positive news that acted as a catalyst and pushed the stock higher. But the news catalyst wasn’t the reason the stock kept climbing after its initial jump. It kept climbing because of the surge in volume.

Now that this stock is on traders’ radars, watch for a break of the previous highs followed by another surge in volume.

IMV Inc. (NASDAQ: IMV)

IMV Inc. is a biopharmaceutical company that develops vaccines and immunotherapies that help fight infection and disease. This sector can be volatile, and this stock’s a great example of just that.

Here’s the chart…

You can see that the price action in this stock looks almost identical to the volume. That’s important to spot early on in your trading journey.

I’m not saying every time the volume’s high the stock will shoot up or fall when the volume decreases. But it’s a common trend in penny stock land. Keep an eye out for that as you study patterns.

Why You Should Start Trading High-Volume Penny Stocks

To me, high-volume penny stocks are the best. No matter what the overall market’s doing, there are always opportunities to grow your account by trading them.

And you don’t need a massive chunk of money to get started. Remember, I started with just over $12,000.* Trading Challenge student turned multi-millionaire trader Tim Grittani started with just $1,500.* Crazy right? Grittani’s been trading for about a decade and I’ve been trading for over two decades.

Keep it all in perspective.

There’s so much potential in high-volume penny stocks, but it takes hard work, discipline, and resilience. How bad do YOU want it?

Now, let’s get back to some examples of high-volume penny stocks…

2 High-Volume Penny Stocks Under $1

Most penny stocks under $1 trade on the OTC markets. That’s not a bad thing though.

I actually prefer the OTC markets. These stocks don’t trade after hours and the action tends to be less choppy than listed stocks.

1. Majic Wheels Corp. (OTCPK: MJWL)

Majic Wheels Corp. is a developmental stage company. They manage waste through junk removal, trash hauling, recycling, construction cleanup, and more.

In May, the company announced plans to acquire the Calfin Global Crypto Exchange. Then on June 30, the company completed the acquisition. When the announcement hit in May, the stock saw a large increase in price action and volume.

Take a look at the chart…

This is a great example of a ‘buy the rumor sell the news’ event. MJWL hit a high of $0.265 right around the time that the company completed its acquisition and started fading soon after.

I’ve been watching it for intraday panics and increased volume. Don’t assume this stock is dead just yet. If there’s an increase in volume, who knows what will happen.

2. DarkPulse, Inc. (OTCPK: DPLS)

DarkPulse is a tech security company in the oil and gas industry. Its technology is designed to monitor infrastructures and keep them secure.

Here’s the six-month chart for DPLS. Pay attention to the surge in price action and volume that started back in early June…

The initial spike in mid-June was an amazing first green day opportunity. And that wasn’t the end. It had another huge run in early July that pushed the stock to 20 cents.

The stock’s held up fairly well since then. I’m watching for breakouts that could push the stock into another multi-day run.

3 Low Float High-Volume Penny Stocks

Low float high-volume penny stocks can make BIG moves in a short time. If you’re prepared, you can trade the action. But you must build your knowledge account first…

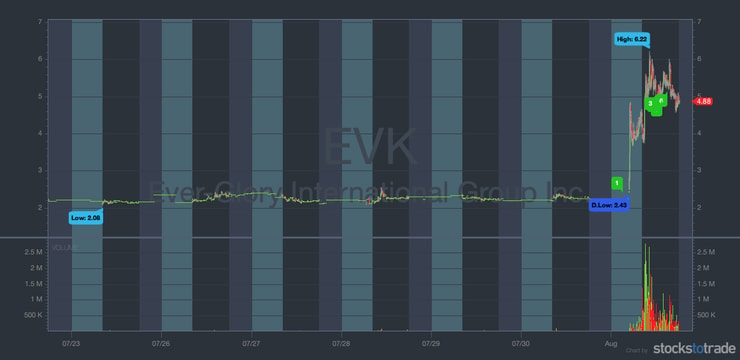

1. Ever-Glory International Group, Inc. (NASDAQ: EVK)

This retail company has a supply chain that focuses on casual wear, outerwear, and sportswear.

Even though retail companies don’t seem like the hottest stocks around, they’ve been on a tear this year. EVK is one of the recent runners.

Check out the chart…

This stock traded sideways for days with nearly no volume … then boom! It shot up like a rocket. Just like the other examples, the initial spike happened because of a news catalyst and the stock continued upward because of the surge in volume.

Again, it’s crucial to find stocks with positive news catalysts. Those stocks draw in buyers and have the potential to continue higher.

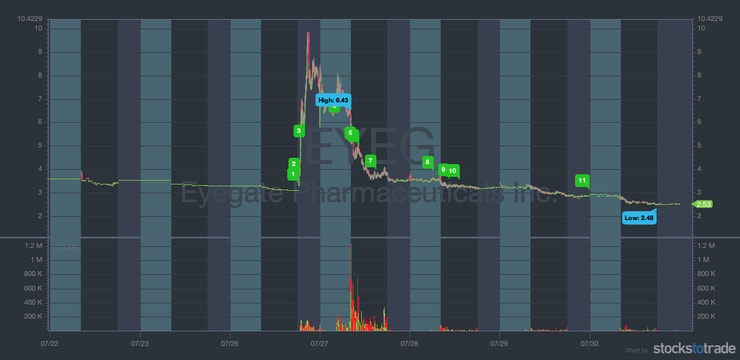

2. Eyegate Pharmaceuticals, Inc. (NASDAQ: EYEG)

Eyegate Pharmaceuticals develops drug delivery systems for treating different eye diseases. This stock has run many times in the past few years, so whenever it has positive news, it tends to draw lots of trader attention.

Check out the chart…

Here, we see that the stock spiked and fell in a matter of two days. These are the types of plays that you need to be careful of as a day trader.

However, if you’re prepared, you might be able to play stocks like this on the long side and the short side. I’m not a big fan of short selling — it’s extremely risky in today’s market. But if you’re meticulous and prepared, go ahead.

3. NeuroMetrix, Inc. (NASDAQ: NURO)

NeuroMetrix, Inc. is a healthcare company that addresses chronic health concerns like sleep disorders, chronic pain, and diabetes.

This stock isn’t technically a penny stock anymore. It’s now trading for about $15 a share, but it was trading for under $5 a share just a few weeks ago. I couldn’t resist sharing it with you because it is such a great example of what can happen to low float stocks with high volume.

Here’s the two-month chart…

This is what can happen to low float stocks with positive news flow and high volume. The stock went all the way from under $3 to a high of nearly $40 in just a couple of days.

Trading Challenge

You can’t learn all of my techniques and strategies by just reading my blog posts and watching my youtube videos. If you want to learn all of them, you need to join my Trading Challenge.

In my Trading Challenge, you’ll gain access to thousands of video lessons, live webinars, arguably the best trading chat room around, and more. However, I don’t let just anyone join my Trading Challenge. I only want dedicated students. That’s why my team interviews everyone who applies for the Challenge to make sure they are joining for the right reasons.

If you’re willing to work harder than you ever have, click here and apply to join the Trading Challenge today…

Frequently Asked Questions About High-Volume Penny Stocks

How Do You Find High-Volume Penny Stocks?

Using a stock screener is the quickest and most efficient way to find high-volume penny stocks. I use StocksToTrade to scan for the highest volume stocks each day so I can build my watchlist.

Is Trading Penny Stocks Profitable?

It can be. It’s why I teach my rules and strategies. I want people to understand the potential in penny stocks. I’ve seen penny stocks jump over 1,000% in a single day. That’s a huge opportunity for trading, and you only need to aim to take part of the move. Singles add up!

Can You Get Rich Trading High-Volume Penny Stocks?

Sure, you could get rich trading high-volume penny stocks … But don’t think it’s easy or that it will happen fast. Most traders lose. And even if you learn all the smart rules and strategies, there’s no guarantee. Welcome to the markets. Switch your mindset and focus on building your knowledge account first.

Conclusion

High-volume penny stocks can be a great way to grow your account. But know what you’re getting into with this niche.

Start with one pattern. Learn how to adapt to the market. This market changes and shifts constantly. I miss plays all the time — and that’s OK. What’s key is that I stick to my rules and stay prepared to take advantage of the opportunities in any market.

Find what works best for you and stick with it.

Your education is key. So do what my top students do and study every day. Try paper trading to gain experience and get comfortable with the price action and movement.

What’s your experience with high-volume penny stocks? Do you have a plan to trade them? Let me know, leave a comment below.

Disclaimer

*While Tim Sykes has enjoyed remarkable success trading stocks over the years, his primary income derives from the sale of financial education products and subscription services offered by various businesses and websites in which he has an ownership stake. I’ve also hired Tim Grittani to help in my education business

This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit.

**Tim Sykes has a minority ownership stake in StockstoTrade.com.

Leave a reply