A good till canceled (GTC) order is one of a swing trader’s classic tools.

If you don’t have a stop-loss in place and you’re not watching your positions, you’re asleep at the wheel. You’re worse than traders that hold and hope…

You’re a trader who will take anything you get. And that usually means a loss.

Don’t get me wrong. I’m not telling you to use GTC orders.

Traders often use GTC orders instead of watching the market. That’s generally a bad idea.

I teach my students to work as hard as they can. Trading is a battlefield … not paying attention is the surest way to blow up your account.

You can’t control how millions of other traders are going to behave. You need to control what you can — and be prepared to act quickly when conditions change.

I drill my students on the basics. I want them to recognize chart patterns. I want them to know the history of the stocks on their watchlists.

I want them to understand all the tools at their disposal. That includes GTC orders…

But most importantly, I want them to watch the market.

That’s the best way to improve…

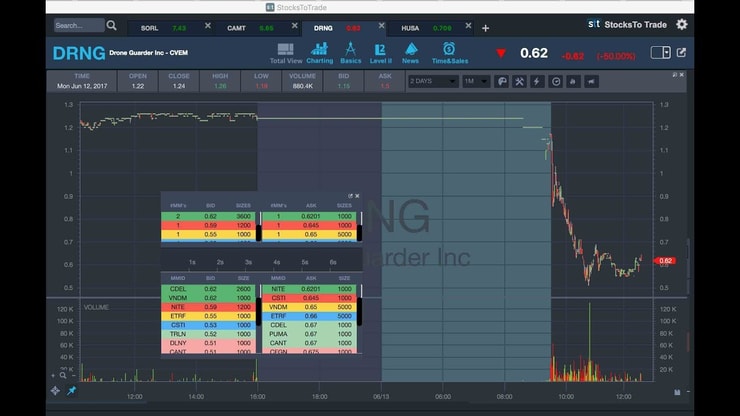

Screen time allows you to see how chart patterns play out in real time, how stocks respond to news. It builds your Level 2 skills … And it gives you more chances to profit.

Learning the meaning of a GTC order isn’t advice for you as a trader … It’s just one more piece of your trading education.

Let’s get to it!

Table of Contents

What Is a Good Till Canceled Order?

There are several types of orders. Let’s look at the main ones…

There are good till canceled (GTC) orders, good till date (GTD) orders, fill-or-kill (FOK) orders … and many more. The main difference is the time in force for the stock order.

A GTC order stays active until you cancel it, meaning it renews each new trading day until you cancel it or it’s filled.

A GTD order expires on a date of the trader’s choosing … typically within a few months, max.

Day orders expire at the end of the trading day.

You should know that both GTC orders and day orders limit their time in force to the trading day, meaning premarket and after-hours trades require GTC or day orders to be placed within these sessions. You’ll typically see ‘GTC EXT’ and ‘DAY EXT’ for those extended-hour trades.

Then there are FOK orders…

A FOK order will either be executed immediately and completely or not at all. They’re a combination of all-or-none and immediate-or-cancel orders. They’re only supposed to last a few seconds.

There’s a good reason for this — but it won’t apply to most of you. FOK orders are mostly used for large stock quantities, like one million shares for example…

Even with ample demand, this order will likely sit on the books for a while. It looks like a wall of sellers to anyone watching Level 2.

The important part to remember is that GTC stock orders can remain in force for 30–90 days, depending on the broker…

On Robinhood, a GTC order typically expires in 90 days. Schwab usually puts a 60-day limit on GTC orders. TD Ameritrade’s GTC orders usually expire in 90 days.

Do your due diligence before you trade!

What Are the Risks of Good Till Canceled Orders?

GTC stop-loss and limit orders expose you to all of the risks of volatility … and none of the rewards.

People like to hate on volatile stocks. But if you approach them the right way, I think they’re great for active traders.

The wrong way would be to wait for your trade to trigger your stop-loss.

If you don’t understand the appeal of volatility, you should check out my NO-COST “Volatility Survival Guide.” It’s a four-video crash course on making the best out of volatility.

It shatters a lot of the illusions that people have about trading … including yours if you use GTC orders to trade.

No stock is safe, but some are safer than others. Blue-chip stocks are known for their steady growth. High-dividend stocks are usually stable enough to ensure regular payouts.

If you trade these stocks, using GTC orders might work for you. I don’t know — I don’t trade these stocks.

I trade penny stocks. They’re how I’ve made $7.1 million in my 20 years of trading.*

Most of the stocks I trade are built on promotion and speculation. Educated penny stock traders don’t trade these stocks because they believe in their products. They trade them because they want to make money…

And that money might come from you if you use GTC orders.

GTC limit orders appear in the order book, which is visible to everyone. And GTC stop orders are supposed to be hidden until they’re triggered…

But market makers see them, and it’s in their interest to execute more trades. Anyway, most traders put their stops in predictable places.

Ever get stopped out, then see your trade hit its target? It stings.

Examples of Good Till Canceled Orders

So I’ve told you what a GTC order is…

And I’ve told you why I don’t use them.

You should know that this isn’t just a Tim quirk. Both the NYSE and Nasdaq stopped accepting GTC orders in 2015 … Although you can still place GTC orders through Ameritrade and every other broker.

The exchanges canceled GTC orders for the reasons I just listed. Traders these days have access to technology that was inconceivable 20 years ago. This access is awesome, but it’s made the market a wilder place.

Information spreads like wildfire. Millions of traders have organized on Reddit and Twitter. A stock’s fortune can change depending on the day…

Say you’re looking at the chart of some promising EV stock. The stock has news, market conditions are good…

You think it might make a nice swing trade. You build a trading plan with a realistic goal and risk. Then you buy in.

You don’t want to watch it too closely, but you want to protect yourself. You set a GTC stop-loss, 3% under where you bought in. Your goal is a small gain of 10%.

Everything checks out so far — your commitment to cutting losses, your greed’s in check, your trading plan’s complete…

What’s wrong with this picture?

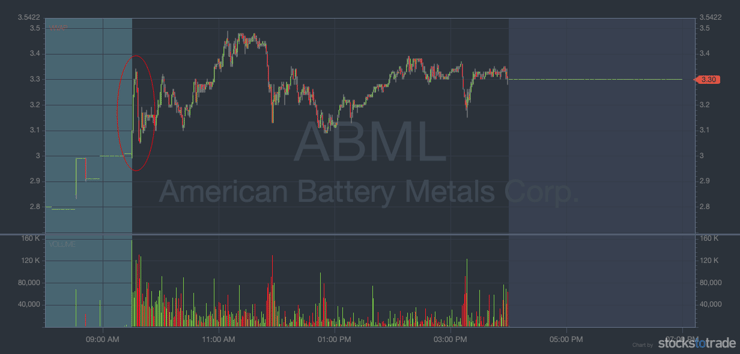

Check out this chart from American Battery Metals Corp. (OTCQB: ABML)’s first green day on January 29.

At the end of the day, it makes a nice move off of the open. But that’s only after some GTC orders get stopped out of the morning panic.

How Can You Trade Using Good Till Canceled Orders?

Alright, I’ve made my case.

If you still want to use GTC orders AND you understand the risks, that’s your call.

There are some decent reasons to use GTC orders. The best one is if they work for YOU.

Let’s say you can’t be present for a trade … or maybe you don’t want to watch the market every day. A GTC stop-loss might be better for you than blindly trusting the market.

I want you to understand everything about the market, not just the way I trade. That’s what I teach in my Trading Challenge…

If swing trading using GTC orders works for you … And you track these trades, and they’re profitable overall … More power to you!

Trading isn’t about following some system and ‘winning.’ It’s about getting what you want out of it.

I am a full fledged travel addict because this world deserves to be FULLY explored! pic.twitter.com/hrsCv4DI2Z

— Timothy Sykes (@timothysykes) September 13, 2018

It’s all about knowing your goals — and putting in the work to reach them.

But dedication is key. That’s one of the first things we look for when screening for the Challenge.

We don’t accept everyone. My students are the hardest workers I know. They show up for all of the webinars our top traders host and my no-BS chat room. When that isn’t enough, they plow through the thousands of webinars in the archive.

Think you have what it takes? Apply to my Trading Challenge here.

GTC Sell Order

A GTC sell order is a stop or limit order that kicks in at a preset price.

If the price is above the stock’s current price, that’s your goal. If you’re cautious like me, it will be a small gain. You want to sell into strength and get your whole order executed.

Some traders use GTC sell orders to hit a goal they think is within easy reach.

If they’re not watching the market, they might miss their goal. So they place a GTC sell order and watch it cook.

Other traders use GTC sell orders on the lower end of the trade. They set stop-loss or stop-limit orders…

I’m critical of these strategies. But they work for some people.

If you’re wondering if they’re good strategies for you, test, track, then consult your trading journal.

GTC Buy Order

Like GTC sell orders, you can place GTC buy orders above or below the stock’s current price.

You can set up a GTC stop or limit buy order to take advantage of a stock’s lower swings…

If you take the GTC element out of the equation, this is one of my favorite ways to trade! Check out my 7-Step PennyStocking Framework…

Panic dip buying is step #5.

You can also set a GTC buy order north of a stock’s current price. Let’s say you identify resistance at $12.40. You want to wait until it breaks the next half-dollar at $12.50…

After that, you think this stock will break out.

There’s nothing wrong with either strategy. I see both of them work regularly.

But when you don’t pay attention, you’re trusting the market to be predictable. I never want you to predict, I want you to react.

More Breaking News

- Bitfarms Plans for U.S. Redomiciliation and Debt Repayment Spark Investor Interest

- Cipher Mining Hikes Price Target Amidst Bold Strategic Moves

- QuantumScape Takes a Big Leap with New Battery Line

- Ondas Leverages Strategic Gains in Defense Sector Expansion

Can You Cancel a GTC Order?

Being able to cancel any stock order is a crucial part of trading.

Not only can you cancel a GTC order — when market conditions change, you should.

Frequently Asked Questions About Good Till Canceled Orders

For those of you who skimmed the article or need a quick refresher…

What Is the Difference Between a Day Order and Good Till Canceled?

A day order expires at the end of the trading day. A good till canceled order will last for a broker-set maximum … or until it’s canceled.

What Is an Immediate or Cancel Order (IOC)?

This is an order that either executes immediately or not at all. It is sometimes combined with an all or none (AON) specification in a fill-or-kill (FOK) order.

What Does Good Till Canceled (GTC) Mean in Stocks?

Good till canceled, good until canceled, good ‘til canceled, GTC … these all mean the same thing. Expiration is the only thing indicated by a GTC order type.

The Bottom Line on Good Till Canceled Orders

Good till canceled orders are a sore subject for me…

I hate seeing traders lose money through a lack of understanding. Then they turn around and blame the market.

The market’s unpredictable. It doesn’t owe you anything. And it’s definitely not a low-risk proposition.

The path to becoming a self-sufficient trader is understanding risk. And GTC orders have more than their share.

Was I too harsh on GTC orders? Do you ever use them in your trades? Let me know in the comments — I love hearing from my readers!

Disclaimer

*These results are not typical. Individual results will vary. Most traders lose money. These top traders have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.

Leave a reply