Dividends are one of the first things investors look at with potential investments. But do penny stocks pay dividends? I’ll get to that in a bit, but first…

How do you think I feel about dividends as a day trader? If you can’t already guess, I’ll let you know later on.

No matter what I think, it’s good to know as much as you can about the market. The more you study the different niches in the stock market, the better chance you’ll have to find yours. Read on to learn about penny stocks and dividends.

Table of Contents

- 1 What Are Dividends?

- 2 Do Penny Stocks Pay Dividends?

- 3 Advantages of Penny Stock Trading

- 4 Risks of Penny Stock Trading

- 5 How to Find Penny Stocks That Pay Dividends

- 6 Top 3 Penny Stocks With Dividends

- 7 Top 3 Stocks That Paid the Highest Dividends in 2020

- 8 Frequently Asked Questions About Penny Stocks That Pay Dividends

- 9 Conclusion

What Are Dividends?

Dividends are a way for a company to distribute its earnings to its shareholders. They’re payments to shareholders as a reward for putting their money into the stock.

Dividends can be paid in a few ways. The two most common are stock dividends and cash dividends.

Cash dividends are just that: the company pays the shareholder in the form of cash. Payment can be by electronic transfer, check, or some other means.

A company might pay stock dividends, giving shareholders additional shares instead of cash. Stock dividends aren’t taxed until the holder sells the shares.

Investors can evaluate a company’s dividend by using the dividend yield, a percentage that measures the dividend in terms of the current share price.

Do Penny Stocks Pay Dividends?

To find dividend-paying stocks, you don’t have to only look at Fortune 500 companies…

Penny stocks aren’t known for their dividends, but some penny stock companies do pay them.

There are dividends in many different sectors. You can find them in electric vehicles, coronavirus, oil, or solar plays. There are also dividends in large-, middle-, and small-cap stocks.

Just like large-cap stocks, penny stocks can pay dividends in a few different ways…

Cash Dividend Penny Stocks

Cash dividend penny stocks are rare. I’m not saying that there aren’t any, but stock dividends are more common in the penny-stock world.

That’s partly because penny stock companies tend not to have solid financials, and they don’t usually have the cash reserves like blue-chip companies do.

No matter what dividend-paying stock you buy, do your due diligence.

Stock Dividend Penny Stocks

Stock dividend penny stocks are more common…

Penny stock companies like to pay stock dividends, because when investors notice a stock has regular stock dividends, buyers may step in and drive the stock price up.

That’s different from larger companies. When large-cap companies pay stock dividends, their stock prices may drop as the additional shares dilute the value of the shares in the market.

It works a little like a reverse split. Learn more about reverse splits here.

Advantages of Penny Stock Trading

I’ll tell you more about the advantages of trading penny stocks shortly. But first, it’s crucial that you know the difference between trading and investing…

Trading is what I do and it’s usually short term. Investing is long term. As a trader, I usually buy and sell stocks within a few minutes or hours. Investors can hold stocks for a lifetime.

Before asking whether penny stocks pay dividends, figure out if you’re looking to trade or invest in penny stocks.

Traders rarely qualify for dividends, because in most cases you have to hold the stock for at least 60 days. That can feel like a lifetime to a day trader!

I don’t really care about dividends. I trade penny stocks to buy low and sell high. I occasionally short sell (not much these days as it’s super overcrowded), which means I’m betting that a stock’s price will go down.

I’ve been trading penny stocks for over 20 years, and I’ve made over $6 million in trading profits.* How did I get here? I put in a lot of time studying this niche and the patterns in it. Now I teach what I’ve learned, and my top students are finding their own success based on my rules and process.*

If you want to join my chat room, where my top students and I mentor traders, consider my Trading Challenge. It can help you on your journey to becoming a consistent trader. Apply to the Challenge here. (Unless you’re lazy and looking for hot stock picks.)

(*These results are not typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Risks of Penny Stock Trading

Don’t get caught up thinking about my trading profits.* I only tell traders about them because I want to motivate them to work hard.

There can be lots of risk with penny stock trading. I’ve seen many traders blow up their accounts and never trade again.

My #1 rule is to cut losses quickly. So to me, it’s not worth it to get a little bit of money back on a dividend but lose your hard-earned cash in the process.

I became a teacher so I can help educate traders and help them stay in the game longer.

The biggest loss of my career was half a million dollars! I broke almost all of my rules in that investment. You can read all about it in my book, “An American Hedge Fund.”

I don’t want that to happen to anyone else. I want to help traders learn the patterns instead of just asking questions like, “Do penny stocks pay dividends?”

How to Find Penny Stocks That Pay Dividends

Stock screeners are great tools to find penny stocks that pay dividends. I use StocksToTrade as my screener.

StocksToTrade is, in my opinion, the best screener for penny stocks. I helped design it to help traders find their trading edge and track low-priced momentum stocks.

StocksToTrade is super customizable. You can apply your own standards and look specifically for the penny stocks you want to trade.

(Quick disclaimer: I proudly helped design and develop StocksToTrade and am an investor in it.)

Top 3 Penny Stocks With Dividends

I told you there are lots of penny stocks that pay dividends. I want to give you a few to keep your eye on…

More Breaking News

- White House, Regulatory Moves Stir Cryptocurrency Market Talks

- Vizsla Silver Shows Resilience Amid Unsteady Market

- BigBear.ai Under Investigation: Stock Faces Turbulent Times

- Datadog Battles Price Target Reductions Amid Growth Hopes

Enel Chile SA (NYSE: ENIC)

Enel Chile is an electric utility company based in Chile. It generates, transmits, and distributes electricity. The current dividend per share is $0.185. That’s a yield of over 6%.

Here’s the six-month chart…

Digirad Corporation (NASDAQ: DRAD)

Digirad Corporation is a holding company that operates with three divisions: healthcare, real estate, and construction. The current dividend is $0.055 a share.

Here’s the YTD chart for Digirad Corporation…

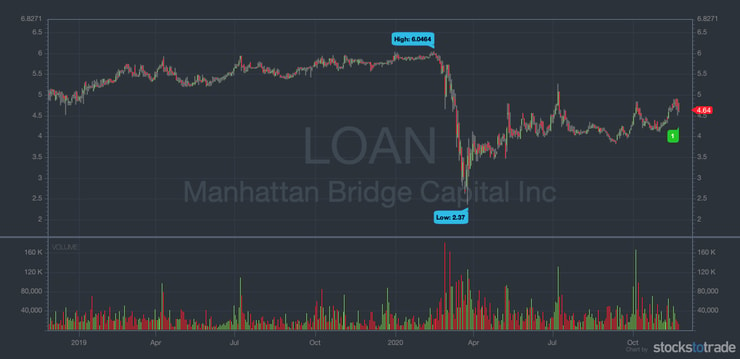

Manhattan Bridge Capital, Inc. (NASDAQ: LOAN)

Manhattan Bridge Capital, Inc., is a real estate company that services and manages first mortgage loan portfolios. The current dividend is $0.11 per share.

Look at the two-year chart…

Top 3 Stocks That Paid the Highest Dividends in 2020

Higher-priced dividend-paying stocks have become a staple for lifetime investors. Their higher-yielding dividends can make your money work for you if you do your research.

Higher-priced stocks with dividends could be safer and more reliable for investors … I mean, if you’re into that kind of thing. Never hurts to know what’s going on in the markets.

Here are some top stocks that pay the highest dividends…

AT&T Inc. (NYSE: T)

AT&T Inc. is a well-known holding company that provides telecommunications, media, and technology services. The company’s current dividend yield is 7.36%.

Here is AT&T’s one-year chart…

Chevron Corporation (NYSE: CVX)

Chevron Corporation is an energy corporation. It’s one of the successor companies of Standard Oil. Chevron’s current dividend yield is at 6.21%.

Take a look at the one-year chart for Chevron…

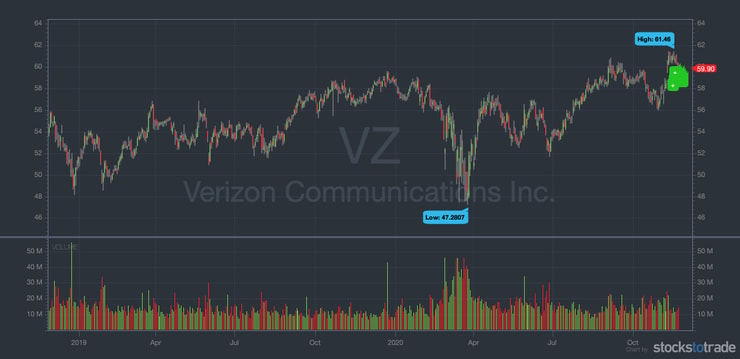

Verizon Communications Inc. (NYSE: VZ)

Verizon Communications Inc. is a competitor of AT&T Inc. The stock has a current dividend yield of 4.4%.

Here’s Verizon’s two-year chart…

Frequently Asked Questions About Penny Stocks That Pay Dividends

Are Penny Stocks Profitable?

It depends. A few rare penny stocks go on to become real companies. But I expect the worst of these junk companies and only day trade the momentum for quick gains. You can lose money on penny stocks. In fact, statistics show most traders do lose ... but that doesn’t mean penny stocks can’t be profitable.

Is It Possible to Make Money Trading Penny Stocks?

The short answer is yes. But you must focus on your education and follow a well-crafted trading plan for every trade. If it weren’t possible I wouldn’t be here today teaching others to be consistent, self-sufficient traders. Don’t expect it to be easy, though. It takes a lot of hard work and dedication.

Does Apple Pay Dividends?

Yes. Apple pays quarterly dividends. The current dividend yield is 0.69%. That’s not as high as some other companies, and definitely not as high as the potential gains you can find trading volatile penny stocks.

Do OTC Stocks Pay Dividends?

Some OTC stocks pay dividends. But if you’re looking to become an educated trader, you have to know that dividends won’t mean much to you once you see the real potential in this niche. And remember, dividends aren’t the only thing that count when buying a stock.

Conclusion

Investors and traders have very different strategies in the stock market. Investors hold for the long term, and traders for the short term.

I’m a day trader. I usually don’t hold stocks longer than overnight or even hours.

I don’t really care about dividends, since I usually don’t hold stocks long enough to qualify for them.

So I wouldn’t look for penny stocks that pay dividends. Instead, I research every stock on my watchlist. There are plenty of things to consider before jumping into a trade. My weekly watchlist is a great place to start. Sign up to get it every week for no cost!

What do you think? Are dividend-paying penny stocks part of your strategy? Let me know in the comments.

Leave a reply