I’ve made nearly $5.8 million trading penny stocks.* Does that make me the best penny stock investor in the world?

No. A thousand times, NO.

It’s not because I haven’t done well in this niche. It’s because the very idea of ‘investing’ in penny stocks is flawed.

If you ask me, there’s no such thing as a ‘successful’ or ‘best’ penny stock investor. Because most penny stocks are doomed to fail … People who choose to invest in them usually fail, too.

In simple terms … Only losers invest in losers! There are no ‘best penny stock investors’ because it’s not a thing.

I don’t invest in penny stocks — I trade penny stocks. That might not sound like a big difference to newbies, but it’s actually huge. It’s a totally different approach.

I don’t teach my students to invest, either. I teach them how to trade penny stocks.

My top students all have their own unique trading techniques, but they also have a few things in common…

None of them are penny stock investors. They’re traders who have taken the time to learn this niche and develop a repeatable and scalable strategy for short-term trading.*

Wanna get into the right mindset for trading penny stocks?

It starts with forgetting everything you know about traditional investing and educating yourself about how this specific niche works.

(*Please note: My trading results, along with the results of my top students are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work, experience, and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Table of Contents

Penny Stocks: A No-Invest Zone

Who is the ‘Warren Buffett of penny stocks?’ Who’s the best penny stock investor?

That’s a trick question. There’s no equivalent.

I don’t mean to imply that there aren’t wildly successful penny stock traders. There are some truly impressive success stories out there.

Consider my top student, Tim Grittani. He’s made over $12 million* trading penny stocks … after starting with a $1,500 account.

He didn’t get rich by finding ‘the next Google’ while it was still an infant penny stock, though.

Grittani studied hard and took the time to learn how penny stocks work. He logged every trade in a trading journal and analyzed his results to find out what was actually making him money.

He refined his techniques, zeroed in on what was working, and scaled up over time.

Now, he’s using the same basic trading techniques he used when his account was small, but his positions are much bigger.

Slow but steady can eventually lead to exponential growth. Small gains add up over time.

Remember to take profits into strength today/this/week/always, we have a truly amazing market right now with tons of opportunities, but it's not a profit until you take it so please lock in profits along the way & do not hold & hope like too many traders do when the momo fades!

— Timothy Sykes (@timothysykes) August 3, 2020

He also understood that most penny stocks are junk companies, so he wasn’t holding positions for weeks or months.

Value Investing vs. Trading

There’s a reason why there’s no best penny stock investor.

A lot of people like to make comparisons to Buffett since he’s largely viewed as one of the all-time greats in the investing world.

He became a billionaire through intelligent investing. His strategy is to find promising companies and put money into them … He focuses on making the best investments possible. When they go up in value, he benefits.

According to “Forbes,” he’s worth over $80 billion.

Some people ask if I’m at this level in the world of penny stocks. It’s flattering that people would think that, but sorry … no.

My approach is nothing like Buffett’s, so there’s no comparison. The way that we work in the stock market is like night and day.

Though interestingly enough, I do have something in common with him that has nothing to do with trading…

Wealth and Personal Development

Did you know that Buffett promised to donate 99% of his wealth to charitable organizations?

It’s part of The Giving Pledge, a program he started with his fellow billionaire Bill Gates. They’re asking other billionaires to give back, too.

I’m no billionaire, but I’m committed to giving back.

I’m honored to have a wide reach on Twitter and Instagram … That brings power. I try to do as much good as I can with this influence.

I actually donate all of my trading profits to charity. There are SO many worthy causes…

For instance, I’m proud to say that thanks to combined efforts between fundraising, Karmagawa, and my trading proceeds, I was able to be part of a $1 million donation to the people of Yemen … read about it in this recent New York Post article.

NEW NY POST ARTICLE ABOUT MY CHARITY'S $1 MILLION DONATION TO YEMEN! https://t.co/lbnDFWy13g Please share on $FB $TWTR everywhere, let's inspire more traders to give back to people in need too! GREAT work @karmagawa community, we did this TOGETHER! #teamwork #charity #helpyemen

— Timothy Sykes (@timothysykes) August 3, 2020

I’m not stopping there. We’ve had fundraisers to help the people of Lebanon after the terrible explosion that recently killed hundreds and hurt thousands…

I donated money to help provide assistance to the oil spill crisis in Mauritius. I started a fundraiser for that, too … We need to protect our planet. If we don’t, eventually we won’t have a world to live in comfortably, much less trade!

And we want to help save elephants from extinction by 2030. You can donate to that cause here.

New @karmagawa fundraiser to help #Mauritius in their oil spill cleanup efforts as there's countless wildlife/marine life & coral reef dying every minute & locals are trying as hard as they can, but need help! 100% of funds raised will be donated & I'm also donating $25,000 too! https://t.co/3QmksX31X2

— Timothy Sykes (@timothysykes) August 9, 2020

I’m nowhere near Buffett’s level of charitable donations, but I’m dedicated to helping make the world a better place through my contributions.

My priorities have shifted during my time in the stock market. Things that used to matter to me like fancy cars don’t matter anymore. Now, I’m motivated by giving back. And I don’t have to be ‘the best penny stock investor’ to make that happen.

Instead, here’s what I know about some of the most hated stocks in the world…

Penny Stocks: Don’t Believe the Hype

I get it. Everyone wants to be a millionaire. I want to help you make your goals a reality, but believing in penny stocks isn’t the way.

Actually, believing in penny stocks could be your downfall.

Most penny stocks will fail.

Some will fail because they’re small companies. Sad but true: that’s just what happens to a lot of small companies.

But many of them are super shady. You can’t trust most of these companies. If anyone tells you that this stock is going “to the moon,” run away fast. That’s probably a promoter who’s being paid to pump the stock.

It makes my blood boil that promoters do this to newbies who don’t know better.

Sure, there are a few penny stocks with success stories. Once in a blue moon, a penny stock succeeds in a big way. But they usually crash and burn.

Don’t be the idiot left holding the bag. Don’t invest in these companies.

I need new traders to know about these promoters and their schemes. So I want to expose these creeps. This is a huge part of why I teach!

More Breaking News

- Stock Reevaluation: Ondas Inc Grapples with Market Challenges Amid Lower Q3 Results

- Cipher Mining Hikes Price Target Amidst Bold Strategic Moves

- QuantumScape Takes a Big Leap with New Battery Line

- Roblox Stock Surges After Strong Financial Performance Reports

Investing in My Students

If I don’t actually invest in these penny stock companies … what do I invest in?

My students.

I focus on trading with a small account, giving commentary, sending watchlists and alerts. That means I’m not set up to prioritize my personal trading.

Instead, I’m prioritizing educating my students and helping them understand this niche.

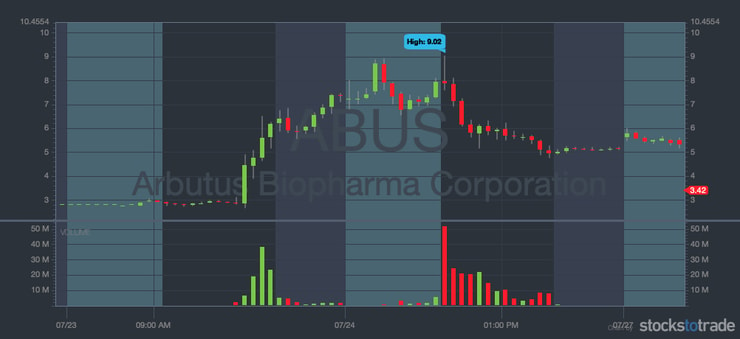

For example, recently I saw Arbutus Biopharma Corporation (NASDAQ: ABUS) pop up on StocksToTrade’s Breaking News chat when it was in the mid-$3s.

I didn’t have to alert it. I could have traded it and put my own trading and potential profits first.

Instead, I took the time to alert the news, even though it meant I didn’t have the time to make the trade. But it was a key teaching lesson for my students.

As you can see since I post every trade publicly on Profit.ly, I’m not right all the time. That’s why I don’t want students to trade based on my alerts … I want them to use my alerts to learn the process so they can make their own trading decisions.

It’s something my top students know well and why they’re not at all concerned with being the ‘best penny stock investors.’

My Top Students: Traders, Not Investors

As my top students show, there’s potential to make money trading penny stocks.* But investing is the wrong approach.

I already mentioned Tim Grittani. You can learn A LOT from him…

But he’s not my only millionaire student.*

My latest millionaire student is Roland Wolf … he started trading with $4K and just passed the $1-million mark.*

He’s getting a lot of attention right now … But he didn’t gain seven-figure status overnight. It took him years to find consistency and work his way up to this awesome milestone.

Here’s another awesome six-figure student to know … Matthew Monaco.*

He traded his way through college. At first, he wasn’t very successful … But when things clicked, they really clicked. Now, not long after his college graduation, he’s up over $300K.

In fact, in August he made nearly $10K in a single day.*

Awesome way to start the week. ~$9700 today @timothysykes $GAXY $8,781$IGEN $850

Check out this panic dip buy. $1,798 (10%) in 3 minutes. BOOM🔥

Straight outta thew 30 Day Bootcamp.

Day 6: Level 2 – Key for OTC

Day 16: Panic Dip BuySign up here: https://t.co/r8tuEcjMWH pic.twitter.com/jUGP5X8e99

— Matthew Monaco 🚀 (@mono_trader) August 10, 2020

Lucky for you, you can learn from him, too. Matt and I collaborated on a 30-Day Bootcamp series for traders … His most recent trades came straight from Days 6 and 16 in the series.

This is why you MUST watch our new https://t.co/5na3WlyHE9 bootcamp, @mono_trader made nearly $10k today on $GAXY $IGEN and I made $5k+ on $GAXY $MARK $LKNCY straight out out of day 6 and day 16 from our course, study up & reap the rewards over time!!! #ilovemyjob #proudteacher https://t.co/fcE0yws3u6

— Timothy Sykes (@timothysykes) August 10, 2020

Focus on Getting Smart, Not Getting Rich

Everyone wants to become rich. But to buy and hold penny stocks, to take an investor’s approach … just doesn’t work.

If you want to make the most of this niche, you first need to change your mindset. Get out of the money mindset and focus on being prepared, looking for opportunities, and letting small gains add up over time.

Next, get educated. If you’re serious about your education, consider applying for my Trading Challenge.

Yeah, I said apply … Not everyone is accepted. I only want students who are willing to work and who will appreciate resources like the chat room community, my webinars, and video lessons.

If you’re not ready for that commitment, at least check out my free resources. There are so many NO-COST resources available, including:

- 30 Trading Videos in 30 Days — this is a great starting point on YouTube.

- “An American Hedge Fund: How I Made $2 Million as a Stock Operator & Created a Hedge Fund” — learn my penny stock story.

- Penny stock guide — new to penny stocks? Start here.

- Weekly Watchlist — start understanding what makes tickers move.

- “The Volatility Survival Guide” — this is a must-watch if you want to understand 2020’s crazy market volatility.

Think Differently About Penny Stocks

I don’t want to be the best penny stock investor. I’m a trader. And I don’t even prioritize my own trading … Yet I’m still a millionaire.*

So I want to show you that you don’t need to aspire to be a great investor of penny stocks.

You need to be who you are and develop a strategy that works for you. That’s gonna take time, effort, and a lot of hard work.

Take what the market gives you by being prepared.

Learn the setups, the patterns that matter, and what to look for.

Can you learn to react rather than anticipate? Think about how you can shift your mindset about penny stocks so that you’re trading, not investing.

What’s your mindset about penny stocks? Leave a comment and let me know if you understand why you don’t need to be the best penny stock investor!

Leave a reply