Winning trades are powerful learning tools if you take advantage of the opportunity. What do I mean by that?

A lot of traders — especially newbies — focus on trying to learn lessons from losses. That’s good. Don’t change that. But winning trades have lessons, too. Sometimes you win in a trade where the setup wasn’t great or your entry or exit was bad. Other times, you just get lucky.

Whatever happens in a trade, there’s a lesson to learn. Why do you think I make video lessons reviewing my trades almost every day? Yes, it’s to teach, but I also learn from reviewing my trades. You should, too.

So next time you trade … win or lose … take some time to learn from it. Because over time, winning trades are about process and discipline. And they happen more when preparation meets opportunity.

Keep reading for more about trading, including a trade review and the lesson of the week. But first, I’m SO happy to share that I’m…

Table of Contents

Taking It Easy in Tulum

I’m in Tulum, Mexico — it’s my first overseas trip in seven months. YES!

I just finished trading for the day, making $2k today during my all day live webinar for https://t.co/EcfUM63rtt students & made $26k+ for the week so now I’m going to enjoy my crazy treehouse here in Tulum! Whatcha think, do you like it? I hope you have a great/safe weekend too! pic.twitter.com/nb67pT9NnT

— Timothy Sykes (@timothysykes) October 2, 2020

Karmagawa and Plastic

This trip to Tulum isn’t just about having fun and enjoying myself. I’m here working with different groups on an upcoming documentary on plastic. We’re really in the planning stages.

As you can imagine, there are challenges around filming during the pandemic. So we’re working with charities and filming locations to get this documentary done. It’s gonna be a process.

Sadly, the plastic problem has gotten much worse during the pandemic. Karmagawa is trying to be part of the solution. All our merch will be sustainable to varying degrees. We’re working with several different factories to see which is the best.

Fashion tends to waste a lot of water and resources. So a lot of our new merch is made with sustainable materials. That includes recycled plastic water bottles. It’s pretty cool. I’ll share more about that soon.

In the meantime…

As the holidays are fast approaching, please give Karmagawa merch as gifts. We donate 100% of the profits. Help us support amazing charities when you order from the Karmagawa shop today.

Let’s get right to…

Trading Mentor: Questions From Students

New Trading Challenge students don’t realize how much I’ve adapted over the years. Winning trades don’t come from hard-headed stubbornness. They come from respecting the process, adapting, and building self-discipline.

Brand new to penny stocks? Check out this FREE penny stock guide.

Also, I highly recommend you take advantage of my recently released 30-Day Bootcamp. It’s getting rave reviews. All the basics for less than $100 … Crazy, but true! Get the 30-Day Bootcamp here.

First question…

“You used to take more swing trades. What changed?”

Right now it’s just a hotter market where things are popping off quicker. You don’t need to do a swing trade to make 10% or more.

A lot of these stocks are doubling, tripling, even quadrupling in a few days. Sometimes in a single day.

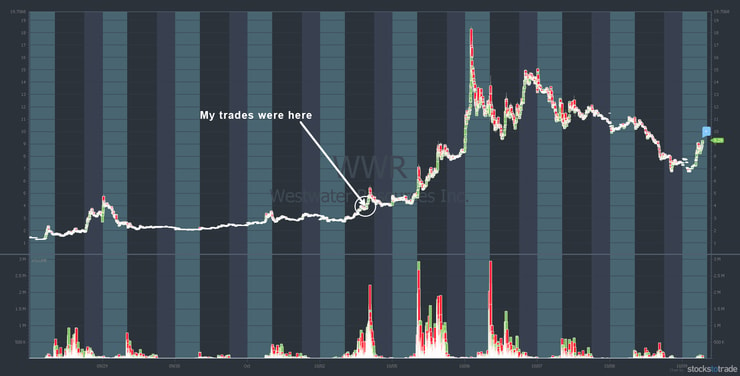

Westwater Resources, Inc. (NASDAQ: WWR) is a good example. On October 2, I was buying it during my all-day trading webinar. I bought it in the $4s and traded it like a coward. I didn’t even want to chase it into the $5s.

Check out the WWR 10-day chart:

As you can see on the chart, two days later WWR hit the $18s. I had trouble with my Wi-Fi and connection to E-Trade, so that influenced how I traded. But I still managed to make a $2,330 profit from these three trades.* The point is, you can make solid profits without holding weeks or months.

(*These results are not typical. Individual results will vary. Most traders lose money. My top students have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Here’s another example…

Ocean Power Technologies, Inc. (NASDAQ: OPTT)

OPTT was a recent Supernova Alerts pick. Check out the OPTT three-month chart:

I alerted subscribers at $1.17 a share on October 5. As you can see, OPTT was trading in the $3.60s two days later. It tripled from my alert.

Again, you don’t need to hold for multiple weeks or months to have solid winning trades. I think it’s actually more dangerous, especially in an unpredictable market.

So swing trading isn’t for me. I’m happy to take singles and be conservative with high-volatility stocks. It’s counterintuitive, but it works for me.

That said, some stocks do take weeks or months. If you want to learn swing trading strategies, Paul Scolardi is the man. Paul has a new newsletter launching soon. You can learn more about that here.

Next question…

More Breaking News

- AppLovin Gains as Analysts Highlight Growth Potential Amid E-commerce Boom

- Bitmine Immersion Technologies Secures Strategic Edge with $14 Billion Crypto Holdings

- Vale S.A. Stock Soars as Goldman Sachs Raises Price Target

- Vizsla Silver Corp US Market Rift: Challenging Times Ahead

“StocksToTrade Breaking News is awesome! But is it risky to rely on one source for big news catalysts?”

It’s not one source. STT Breaking News is not a news wire — it’s a curated tool run by two highly skilled stock market pros. For me, it’s the best way to get penny stock breaking news.

So you’re getting probably over 60 sources all in one place. It’s the most useful, time-saving, and revolutionary tool that I use. Before Breaking News Chat, I’d have to check 50–60 sources. Often, I’d be lazy and only check roughly 20 of them.

For the Breaking News Chat guys, it’s their job. And they’re fantastic at it. I want to stress that they’re former Wall Street traders, not journalists. A lot of journalists don’t make that much money. And when it comes to breaking news about stocks, they don’t do a great job. They don’t care about the timeliness of the news.

Wall Street traders and people with a lot of experience know timeliness matters. The reason I mention the Breaking News guys are former Wall Streeters is because they get it. It was their job as traders to make money from breaking news.

I’m only estimating, but I’d say more than half of my 2020 profits are a result of taking trades based on StocksToTrade Breaking News alerts. (Are you a StocksToTrade user? Get Breaking News Chat here.)

(Quick disclaimer: I helped design and develop StocksToTrade, and I’m an investor in it.)

Here’s an example…

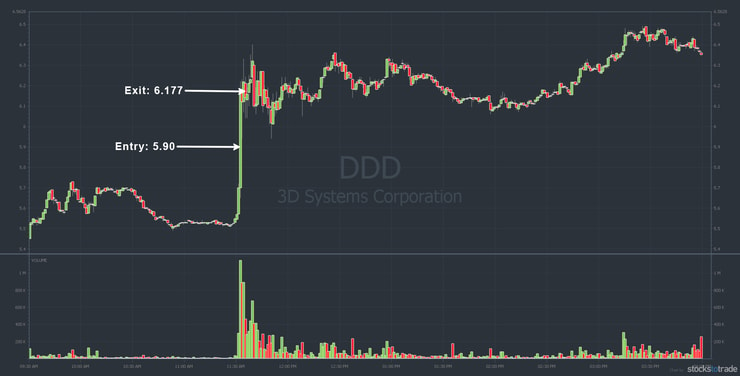

Winning Trade: 3D Systems Corporation (NYSE: DDD)

On October 7, a job posting on the Tesla (NASDAQ: TSLA) website mentioned “growing Additive Manufacturing operations.” In other words, Tesla wants to grow its 3D printing manufacturing. The StocksToTrade Breaking News guys were ahead of the curve.

When the Breaking News team alerted the news catalyst, you had a few minutes before other chat rooms started buying it up.

Check out the DDD chart from October 7 showing my entry and exit:

It didn’t make the biggest move, but it was fast. I bought at $5.90 and sold at $6.177 for $2,216 in profit and a 4.69% win.* Theoretically, I should’ve gone bigger, but my goal was to sell in the $6s, so I played it safe.

Even though it was possible to make 10% on this winning trade, I’m happy. I LOVE Breaking News chat!

Let’s end this with the…

Trading Lesson of the Week

Pay attention…

It’s not about one lesson or one trade. For example, that DDD profit was fantastic. But the day before, I made $5,040 on this trade alerted by the Breaking News guys.* The day before that I made $1,625 on this trade, also alerted in Breaking News Chat.* And on October 1, I made $9,240 on this trade.* Again, it was a StocksToTrade Breaking News alert.

So it’s taking things one trade at a time. You can win or lose on any trade. You have to adapt and optimize to find what works best for you. Develop the right trading mindset for more winning trades…

The Proper Mindset Required For Successful Trading

Everybody wants it to be one trade or one rule. (I trade using ALL these rules.) They want one lesson … one thing. It’s a process. It’s a lot of little winning trades added up.

You’ll also have losses. I’ve had a lot of losses lately. Some of my trades have been a little sloppy. But I follow rule #1 and cut losses quickly. My losses are $100 or $200 while my gains are $500 to $1,000 or more.*

If you have winning trades more often than losing trades and…

… your dollar gains are bigger than your losses…

… it’s statistically impossible not to grow your account.

You only mess that up if you take a big loss or stop focusing on good trades. Random trades can lead you down a risky path. So it’s a matter of process and trading discipline.

Millionaire Mentor Market Wrap

To survive and thrive as a trader, you have to play the long-game. Winning trades might be exciting, but there’s always something you could’ve done better. So learn. Analyze. Study. Every single trade.

And when you lose, let it fuel your work ethic even more.

Midnight motivation: use all your anger/frustration from any losses, mistakes, failures, doubters, haters & self-doubt to fuel your work ethic that needs to be pushed to the limit if you truly want to turn your dreams into reality…and that limit is FAR greater than you realize!

— Timothy Sykes (@timothysykes) October 9, 2020

Remember, it’s a marathon and not a sprint. And realize that you’re capable of achieving far more than you think. I’m not saying it’s easy. It’s not. But if you’re willing to put in the extra time and effort every single day, it adds up. Just like taking singles in trading.

Do you learn from winning trades? If you get it, comment below with “I will learn from EVERY trade.” I love to hear from all my readers!

Leave a reply