Turn Your Losses Around

One of the things I find myself repeating endlessly is something that you all need to hear over and over again to keep you going, especially for my upcoming trading challenge students. EVERY trader…even the greatest…experiences loss and it’s SO important to learn from your losses! If you haven’t lost, you haven’t learned. The hardest part of trading is learning to deal and cope with the losses, learning from them, and turning those lessons into the foundation that can help you achieve major wins.

I’ve called my program for my most dedicated students The Millionaire Trading Challenge because it’s truly a ‘challenge.’ And a challenge is…well, challenging. This isn’t a walk in the park, 90% of traders lose so it’s my job to help people turn their losses around…and if you’re still having a tough time dealing with the losses that will eventually make you the trader you want to be, then maybe the story of one of my newer students, John Papa will restore you to your senses and keep you from throwing in the towel prematurely.

You learn to lose and manage your losses, you’re not failing. You only fail if you can’t accept losses and cut and run when it doesn’t all click right away.

Remember, I only win roughly 70% of the time, but still, I’ve turned thousands into millions, a point I try to hit home to my students on a weekly basis in my live trading webinars here.**

John recently wrote to talk about his struggles during his first six months of trading. During that time, he kept thinking “I’ve finally got this,” but then he would get hit with a big loss and watch his account plummet:

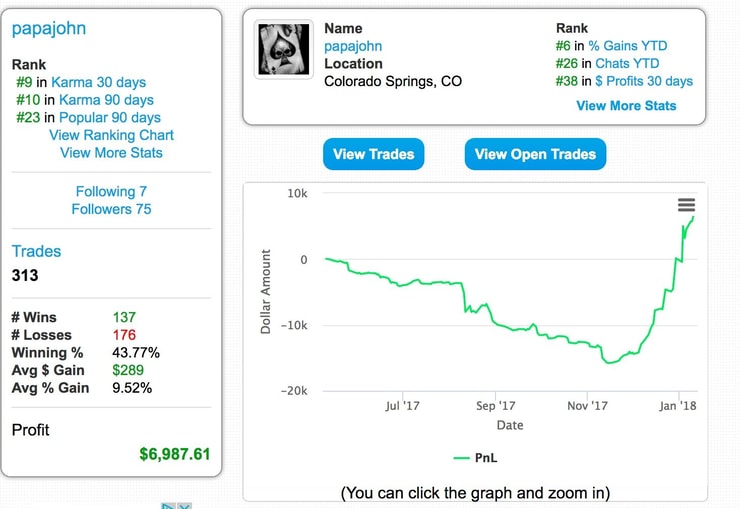

“I lost a bit under $16k after 6 and a half months of trading and was left with just $8000 in my account. Then it finally all clicked together. I’m on a tear in the last 5 weeks. I have had only 3 losing trading days since November 15th (27 total trading days, 24 green), with the worst total loss for a day being $272. In total, I’ve made back $11,179 since November 15th. That’s 140% account growth from my low point and $4,472 away from being breakeven overall. Today was actually my best day ever, with $3,020 profit between two trades. I narrowed down my focus to strictly playing multi-day breakouts and it is working so well. My stats over this time period are exactly where I want them to be, with a 71% win percentage and an average gain of 11%.” (Sykes note: by the time I even got to publishing this guest blog post, John has made another $10,000+ and has now profited $6,000+ overall as his hot streak continues, as you can see here)**

Now that things have finally clicked for John, he was willing to share the 6 key things he’s learned in the ‘struggle’:

Direct from the keyboard of John, pay attention to his persistence and willingness to keep moving forward despite the losses:

#1 Learn to accept failure

This was a hard concept for me but became absolutely essential to my turnaround. In the beginning, I always wanted to be right and that would often lead me to the hold and hope “strategy” when a play would go against me, just so I wouldn’t have to take a loss. Or I would stay in a trade in order to avoid “wasting” a day trade on a losing trade. Both of these behaviors turned potential small losses into even bigger losses. I had to change my mindset to realize that I could have a good losing trade, as long as I followed my plan and more importantly, learned from any mistakes I made.

#2 Manage your risk

‘Cut losses quickly’ is rule number one for a reason. I always struggled with how exactly to do this. At first, I used set percentages as my maximum loss, even though I hardly followed through with cutting a loss when it hit my mental stop level. I eventually switched to risking off of specific levels in the charts, but still didn’t know how to correctly choose those levels, often risking off of midday consolidation levels. Well, when those levels fail it is usually accompanied by quick, massive drawdowns. So even if I knew where I wanted to cut my loss, I often couldn’t get out until much lower, leading to bigger losses than I anticipated.

Then something Roland said at the Traders and Investors Summit in Orlando changed everything for me. He talked about how much he loved Trading Tickers but was mainly going long, so he turned the short plays in Trading Tickers upside down. This was a revelation as Tim Grittani mostly risks his short positions off of the high of day or even the previous day’s highs, these are key technical levels. Now, when I go long I am usually risking off of the low of the day or if there is a big morning spike, risking off of the low point after the pullback from the spike. Since doing this I haven’t had a trade where I have lost more than I was willing to risk when initially entering the trade. The level you risk off of will change with the type of setup you are playing, just make sure you use a key technical level.

More Breaking News

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

- Vale’s Stock Soars Following Significant Price Target Increases

- Vale S.A. Stock Soars as Goldman Sachs Raises Price Target

- Price Predictions Fueled by Company Moves In Market Dynamics

#3 Track every play

I have been doing this from the start but wasn’t tracking everything I needed to be tracking to set myself up for success. The essential part I was missing was tracking the setup for every trade and what time I entered the trade. Once I started tracking my setups, this allowed me to break down my stats for every type of play and find where I excelled and where I was struggling. I thought I would find my edge with morning panic dip buys, and even though I was winning more than 70% of the time, my average loss was four times bigger than my average win. That is not a recipe for success. I also noticed that I had a lot of trades where my notes in the setup column of my spreadsheet said something like “stupid chase of a morning spike.” Actually writing this down helped me eliminate plays like this where I didn’t even have a plan, and focus on finding setups that were working best for me.

#4 Find your edge

This advice is largely taken from Tim Grittani’s journey to becoming a consistently profitable trader. He often talks about how he turned things around by focusing on two specific setups. The actual setups aren’t important, the point is that he found his edge and then cut out everything else and focused on what was working best. This is what I did and the turnaround on my bottom line was incredible. It took me six weeks to make back the $16,000 I had lost over my first six months trading. Before doing this, I was at the point where I could create a watchlist that essentially mirrored Tim’s watchlist, maybe differing by one or two tickers. But I didn’t have a specific plan for each stock, I had more like five possible plans. I would think, “if it has a morning panic I can dip buy,” or “if it has a morning spike I can try to get in on a pullback.” Now my watch lists are very different from Tim’s and I have one exact play I am looking for on each stock on my list. And to be clear, just because I am finding success with the setups I play, that doesn’t mean you need to play the same setups as me. We all have different strengths and weaknesses with varying amounts of risk we can tolerate. This is why tracking your stats is so important, so you can find what will work best for you.**

This follows directly from my previous point. I have narrowed my focus down to solely playing breakouts. Now I have to be patient waiting for the right setups. At one point in time, I had five open brokerage accounts that I was actively trading with. I did this to get around the PDT rule, yet my worst results came right after I opened all the accounts. Now I can go multiple days where there are no plays for me and I am okay with that. Because when there is a play, I can take full advantage of it and really make decent profits if the trade goes as planned.

#6 Never stop learning

Remember that trading is a marathon, not a sprint. I’ve been obsessed with trading and learning how to do this successfully from day one. I could have taken it easy once I was fairly sure I was consistently profitable. But no, that is the exact thing I didn’t want to do. I know that I am finally on the right track and now I am ready to take things to the next level, so I am pushing myself even harder studying video lessons and webinars and re-watching DVDs. If you are not finding success in month 1, or 3, or 6, or 12 just stick with it. Don’t trade too big so you can stay in the game, and keep in mind that you are learning a new profession so it is going to take a tremendous amount of time, hard work and dedication.

I’m SO proud of my student John for his turnaround and please do congratulate him in the comments below! And also, let his profit chart inspire you to never give up on your education as the key is to keep going and if you stay true to your mission and respect this art as a marathon and not a sprint, you will be rewarded:**

Leave a reply