Almost every day I get people asking me “can I trade living where I live?” The ironic thing is they ask me on Instagram and Facebook. The ask me on Twitter or by email. They ask me over the internet.

If you have access to the internet you can do this anywhere in the world. It doesn’t matter if you’re using a smartphone, a laptop, an iPad or tablet. It doesn’t matter if you are using wifi or a landline.

This is one of the most amazing times in history. As long as you have internet access that allows data to come through and you can see the little blinking green and red lights, you can trade. With a penny stock trading app, you can trade from anywhere with a signal.

The crazy thing is we’re only at the beginning of this thing called the internet. The speed of technology is increasing. Strap yourselves in, because the ride is only gonna get more fun from here.

If you get in the game, that is. Don’t sit on the sideline too long. If you’re ready to start trading there’s no better way to gain knowledge than the Trading Challenge.

Table of Contents

- 1 Benefits of Using a Penny Stock Trading App

- 2 What is The Best Penny Stock Trading App?

- 3 What is The Best Free Penny Stock Trading App?

- 4 What is The Best Penny Stock Trading App For Active Traders?

- 5 What is The Best Major Brokerage Platform?

- 6 What is The Best Traditional Brokerage?

- 7 My 5 Best Penny Stock Trading Apps For iPhone

- 8 The Bottom Line

Benefits of Using a Penny Stock Trading App

Let me clarify something first. Not all the apps described in this post are created equal. Not all are designed for trading penny stocks. Some aren’t even ‘trading’ apps. Instead they are tools to help you with trading. You might use them for research, charting, and news.

There are four kinds of apps here: trading apps tied to brokers, stand alone trading platforms, news/research apps, and social trading apps. I haven’t specifically categorized them that way. This post is more of a head’s up about apps you should check out. If they fit your strategy then you can put them to use.

While covering the basics (and my two favorites), this list is not comprehensive. Also, most of the apps mentioned are not specifically penny stock trading apps. Remember, penny stocks are kinda the pariah of the financial world. Few apps have access to everything you need to trade them. Some are better than others. Winter is coming …

Also, any app created by a brokerage gives you access to your account with that specific broker. For example, the Power E*Trade app is exclusive to an E*Trade account. Robinhood has their own app and Schwaab has their own stock trading platform.

What are the benefits of using intentionally designed penny stock trading software?

First, a solid penny stock trading app is like having several apps in one. You get a penny stock news app, a penny stock trading app, and a penny stock screener — all in one place.

If you’re wondering why that’s such a big deal, imagine having to buy several different apps. Then you have to move from app to app to get the real-time information necessary to make a trade. That’s how it was back in the day.

And you could still do it that way. But it’s like strapping on a bunch of extra gear to go for a walk. Not very nice. Trading on one platform, news on another, research and screens on another …

What is The Best Penny Stock Trading App?

I’m not even gonna set you up for this one. Full disclosure: I spent years using multiple websites, services, and trading platforms to trade. I spent years looking for ‘the one.’ I am personally involved with StocksToTrade.

There can be only one…

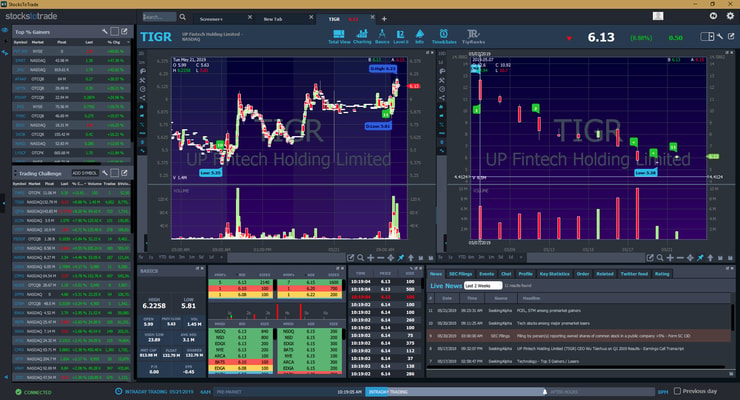

StocksToTrade

StocksToTrade isn’t available as an iPhone app. Maybe someday in the future. But if you’re serious about trading penny stocks it is … by far … the best penny stock trading app out there.

I like to think of it this way:

If you start a business, you have to invest in tools. As a trader, which tools you choose depends on whether you’re in it for the long run or just dipping your toes.

When my Trading Challenge student Jamil came to me with software he’d created — based on my teachings, patterns, and indicators — I was blown away. I realized how much time his penny stock trading software could save. Not only for me, but for my students as well.

We partnered up and spent the next two years building out the first release of StocksToTrade. To my exact specifications. It’s only gotten better. We’re now on version 2.2.1 with new features in development. StocksToTrade is a slick, easy to use, intuitive platform.

StocksToTrade integrates with several brokers, including E*Trade, Interactive Brokers, Ally Invest, and Robinhood. Nice.

Want to give it a spin? Try the StocksToTrade $7 for 7-Days Trial

I think that’s a pretty solid deal. In other professions, if you want to try out the best tools you get like five minutes and then trust your gut. Problem is, marketers are slick and you really don’t know how good the tools are until you use them on the job.

But don’t trust me about STT… go check it out for yourself.

While you’re there, check out StocksToTrade Pro. It’s a training platform featuring twice daily webinars with STT’s lead trainer Tim Bohen. You get an over the shoulder look at Tim’s screen, question and answers, research methods and …

… Tim Bohen hasn’t missed a training webinar in over two years. Solid.

Before you think I’m just gonna pump StocksToTrade I better move on …

What is The Best Free Penny Stock Trading App?

Not quite ready to make an investment in a penny stock trading app or don’t want to pay commissions to a traditional broker? The good news is you can still trade. The bad news is, like so many other things in life, you get what you pay for.

This might sound a little harsh so I’m going to give you some info on everyone’s favorite freebie. But seriously, if you want to do this professionally, do yourself a favor and put some skin in the game.

Robinhood

Robinhood was started by a couple of tech geeks from Stanford. They went off to Wall Street to make their fortunes selling trading software to hedge funds. Then they got their big idea, moved back to California, and started Robinhood.

The goal of Robinhood is to ‘democratize’ the markets. They realized Wall Street firms were paying nothing to trade while the average trader or investor across America paid up to $10 per trade. So they created a brokerage/trading platform where ‘Penny and Bill Merican’ can trade stocks for free.

You might wonder how they make money? They have a premium service called Robinhood Gold. It allows you to trade on margin. They also earn interest from customer cash and stocks. And…

… they get rebates from market makers and trading venues. Not that they are alone in this. But it’s something you should understand about the markets. They get paid to send orders through specific exchanges via the market makers. In other words, they still have their hands in the pie.

As a quick aside, this should concern you. Not Robinhood, but the way stock exchanges work in general. You should understand how the markets work. If you think all is fair in love and on Wall Street … you’re sadly mistaken. I suggest reading “Flash Boys” by Michael Lewis.

My only real issue with Robinhood is order execution. As a day trader of highly volatile stocks, I need fast order execution. With Robinhood sometimes it simply takes too long.

I look at it like this: I pay a commission on a trade and it gets executed. Win or lose the trade happens in a timely manner. But if I choose to go with ‘free’ to save a few pennies, I could end up losing a hell of a lot more due to slow order execution.

It’s called false economy. It’s like buying the cheapest car and then wondering why it fell apart on the Interstate. I realize Robinhood is the choice for some people when they begin their trading journey. Just try to move on as soon as possible. If you are an active trader I’d stay away altogether.

What is The Best Penny Stock Trading App For Active Traders?

I use both Interactive Brokers and E*Trade. In my opinion they’re the best brokers for my trading strategies. They’re both big, stable companies — which I like. While I use them with StocksToTrade, they both offer their own trading apps.

More Breaking News

- Red Cat Holdings Explores Market Expansion Amid Financial Flux

- Domo Explores Strategic Alternatives as Q4 Surprises with Profit

- TeraWulf Poised for Strong Upturn with Strategically Timed Moves on the Stock Front

- UWM Holdings Targets Record Revenue Amid Strategic Moves

E*Trade

E*Trade is a popular broker for penny stock traders. It only requires a $500 deposit to open an account and has decent customer service. They offer a flat rate per trade which is reduced if you make enough trades.

Before I go on… that wasn’t a push to trade more. If anything, I think you should trade less. Take the time to do research and plan your trade. One of the big downfalls of a platform like Robinhood is that people think they can trade more because they have no fees. This usually ends in disaster.

E*Trade has two trading platforms: Power E*Trade and E*Trade. Both are available for iPhone in the App Store. For you Android users, both platforms can be found on Google play.

Interactive Brokers

The Interactive Brokers platform, Trader Work Station, works on Windows, Mac, or Linux computers. Execution is fast and you can trade listed stocks as well as OTC without any problems. They’re pretty good about borrowing shares for short selling. Sometimes it’s difficult if the stock you’re attempting to short is ‘hard to borrow.’

One limitation with Trader Work Station is the lack of Level 2 data. If you don’t know what that means yet, don’t worry. StocksToTrade offers a Level 2 data subscription and since STT now integrates with Interactive brokers — you’re set.

Interactive Brokers requires an initial deposit of $10,000 and has an account minimum of $2,000. Almost forgot, younger traders (age 26 and under) can open an account with a lower initial deposit. Bonus for the youngsters. Oh, to be your age again with modern tools …

Interactive Brokers charges fees per share traded. The amount differs based on your trading volume and is between $0.005 and $0.0005 per share with a maximum value of 0.5% of the position value.

Learn More at interactivebrokers.com

What is The Best Major Brokerage Platform?

TD Ameritrade and Thinkorswim

At one time this was my preferred trading platform. It’s known for offering good customer service, good execution times, and availability of shares to short. There’s no monthly or maintenance fees. Unfortunately, the availability of shares to short fell off a cliff after Thinkorswim was acquired by TD Ameritrade.

Thinkorswim requires $2,000 initial deposit. There’s a mobile app (more below) and you can sync your account across devices. If you’re just about to hit the ‘sell’ button and have to walk out the door, you can close your position via your phone.

What is The Best Traditional Brokerage?

Charles Schwab

Charles Schwab’s proprietary trading platform is called StreetSmart Edge. You can either download a desktop version or access the platform via the web (cloud based). Like most of the other broker apps, StreetSmart Edge lets you do research, place trades, and set-up risk management strategies.

Some of the features include interactive charting, CNBC live stream (in case you don’t get enough talking heads), and ideas for options trading with Schwab’s Idea HubⓇ tool. You can even trade penny stocks with Charles Schwab — they offer a large selection. You’ll pay a commission of $4.95 per trade.

Schwab Mobile is now available for iPhone and Android devices. If you’ve joined the Apple Watch crowd, you can access the mobile app from there. Yes, you can even trade from your Apple Watch. See what I mean when I say we’re just getting started with the internet?

There’s a lot to consider when choosing a broker and trading platform. I’ve had dozens (if not well over 100) broker accounts over the last two decades. One thing has become super clear: don’t skimp on broker fees. I’m not suggesting you should pay more than necessary, but be willing to pay fees to get your orders executed.

If you approach your trading career as “I’m doing everything on the cheap…” you’re already in the wrong frame of mind. Here’s a video I posted on my YouTube channel about how to find the best penny stock brokers.

My 5 Best Penny Stock Trading Apps For iPhone

#5 Stock+Option

Stock+Option bills itself as an all-in-one stock market station. It features advanced options analysis, a portfolio tracker, and live alerts. The app costs $149.99 and you get a lot of functionality for your money. However, quotes can be delayed for 15 minutes.

If you’re going to use this app as an active trader, you’ll want to opt-in for one of the monthly subscriptions. There are 3 subscription options available: Advanced Options Plan, Pro Plan, and Pro Plus. Each subscription gives you different functionality.

Benefits of Stock+Option

One of the big benefits of Stocks+Option is the options data provided. I’m not an options trader, but if I was, I’d want an app that could give me options data. No brainer there…

Download Stock+Option for IOS Here

#4 Yahoo! Finance

This is probably one of the best tools for beginners learning about the markets and trading. Even as you gain experience, this will be a go to place for general information. I still find myself on the Yahoo! Finance site when news stories about stocks on my watchlist pop up.

Benefits of Yahoo! Finance

The most obvious benefit of Yahoo! Finance is that it’s free. There’s a decent mobile app or if you’re on your laptop or desktop you can visit the main site. If you’re not yet using StocksToTrade, Yahoo! Finance is a good place to go to read SEC filings, set up a watchlist, and screen stocks.

Download Yahoo! Finance on IOS

#3 TD Ameritrade Mobile

There are two apps as part of the TD Ameritrade family: TD Ameritrade Mobile and TD Ameritrade Mobile Trader. The latter is also known as Thinkorswim Mobile. When TD Ameritrade took control of Thinkorswim, they kept the Thinkorswim app as a separate platform.

Benefits of TD Ameritrade

TD Ameritrade Mobile is perfect for those who use the main TD Ameritrade website. You get access to the same information about the markets and your portfolios.

TD Ameritrade Mobile Trader (aka Thinkorswim Mobile) lets you trade right from your phone. If you trade futures, foreign currencies, or complex options then this is the version you’ll need.

Perhaps the biggest benefit to using the TD Ameritrade apps is this: both apps are included when you open a TD Ameritrade account. Which means you can try both apps and then stick with the one that suits your strategy. Both are available on iOS and Android.

#2 Bloomberg

There are a couple of Bloomberg mobile apps. One is Bloomberg Business News. The other is Bloomberg Professional. The latter is the app for traders but requires you to have a Bloomberg Terminal account. This is a seriously high-end trading account with a cost of $2,000 per month…

Makes StocksToTrade look like a steal, doesn’t it?

Benefits of Bloomberg

As a pure global business and finance news app that also allows you to track your portfolio, Bloomberg Business News is fine. It gives you a good overview of world markets. Plus, you can set up a watchlist (registration required).

It’s also decent for doing research on companies. The financials tab includes cash flow, balance sheet, and income statement. The key stats tab gives earnings per share, market cap, outstanding shares, and average volume.

Bloomberg does have a paywall after 10 free news articles each month. Most in-depth news sites and apps are going this way. If you’re serious about trading, at some point you’ll probably have to pay for the news you need. At least if you want it all in one easy to access place.

Download Bloomberg: Business News on IOS

#1 Scutify

Scutify is a hybrid financial social network, financial education marketplace (it bills itself as ‘the iTunes of finance’), and trading platform.

Benefits of Scutify

Scutify was on the front side of the financial social network trend. Your ability to interact with other members through ‘scuttles’ is very similar to Facebook or Twitter. Except everyone is talking about the markets. You can post questions or answers, news about trades, status updates, and general chat.

When you look up a stock ticker you get access to the latest scuttles, tweets, news headlines, charting, block trades, and more. And you can follow other members in a similar fashion to other social networks.

If you’ve been reading my posts for a while you know I have a love/hate relationship with chat rooms. You can learn a lot in financial based social media space. You can also get scammed by stock promoters. I’m not suggesting even for a moment that this is happening on the Scutify platform. But you should always do your own research.

Download Scutify on IOS And Android

Bonus: Profitly

I intentionally didn’t include Profitly on this list of mobile penny stock trading apps because it’s different. But since I’ve put Scutify at the top of the list and then mentioned the financial social network aspect, I wanted to mention Profitly.

Profitly is the social trading platform that I’m personally involved with. The thing that makes it different than almost anything out there is that members post their verified trades right on the site.

You’ll see whether a trade is long or short. Whether it’s a stock or FX play, plus entry and exit points. Many traders — myself included — post comments about our trades. It’s brilliant because it provides transparency.

Profitly and StocksToTrade work well together. While StocksToTrade is ideal as a screener, research, and trading platform …

… Profitly is ideal as an education, trading social network, and accountability platform.

There’s a ton of educational material:

- Trade alerts and premium research by Superman Paul Scolardi.

- Premium educational DVDs by me, Tim Grittani, Mark Messier, Tony Pelz, and others.

- Trade analysis plans.

Learn More at Profitly

The Bottom Line

There are a lot of trading apps out there. And more are being developed all the time. By all means feel free to check them out. But don’t get bogged down with “what’s the best app?”

This is the moment where I tell you StocksToTrade is far superior to any of the other apps or platforms and Profitly is the superior trading social network.

I fully admit my bias. But let me tell you why.

I spent years in chat rooms full of stock promoters and scammers. Then there were the 10 or 12 websites I had to have open to research and trade.

Now?

Two is all I need. Yes, I use other sites like Twitter. I still read articles or press releases on Yahoo! Finance sometimes. But I have everything necessary for trading in one place. I use the other sites because I teach and I realize some students are not quite ready to take this seriously.

My question for you: Are you ready to take this seriously?

If you are, join the Trading Challenge.

Aside from the live webinars and DVD courses, you’ll get a year’s Penny Stocking Silver membership on Profitly. There’s a lot of confusion out there and a lot of scammers. You need knowledge, tools, and experience. You in?

Are you a trader? What are your favorite penny stock trading apps and iPhone trading apps? Android user? What are your favorite Android trading apps? Comment below, I love to hear from you!

Leave a reply